ETH falls below $1,500 as over $150M is liquidated in 24 hours

The largest liquidation candlestick in a month wiped out most of Ethereum’s posted gains after the merge.

After the move to the Proof-of-Stake network, ETH reached $1,640 in what many believed was the beginning of a rally. However, due to aggressive liquidations, its price has fallen below $1,500, with ETH at around $1,480 at the time of writing.

Over $60 million in ETH liquidated in less than an hour, putting downward pressure on the rest of the altcoin market. In the last 24 hours, liquidations have brought him over $150 million.

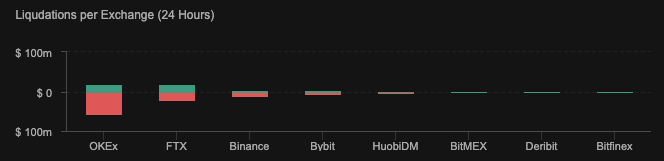

According to data from CoinAnalyze, OKEx has liquidated around $77 million, while FTX has liquidated around $40 million of ETH in the last 24 hours.

The majority of liquidations were longs — about $98.6 million longs were liquidated over the last 24 hours, while only about $48.3 million shorts were liquidated in the market.

Massive losses weren’t limited to Ethereum — other crypto markets were hit as many big coins went into the red. But most losses were no more than a few percent. Ethereum, on the other hand, recorded a price drop of more than 7.5% in a single day.

It is still too early to determine the cause of the large liquidation. Some believe it may have been the result of speculation surrounding the merge. Others believe broader market uncertainty may have caused them.

Traditional markets have seen similarly unexpected crashes in the past few hours, with stocks and indices falling after several days of relative stability. Ongoing volatility is meeting Russian President Vladimir Putin met with Chinese President Xi Jinping.

The two leaders met today in Uzbekistan to discuss “global and regional stability” after Russia’s invasion of Ukraine.