Ethereum leads the charge against Bitcoin, rising 61% since June — Flippening price target at $3,750

Ethereum outperformed Bitcoin ahead of The Merge in September, and the second-largest cryptocurrency by market capitalization is up 61% against Bitcoin since June.

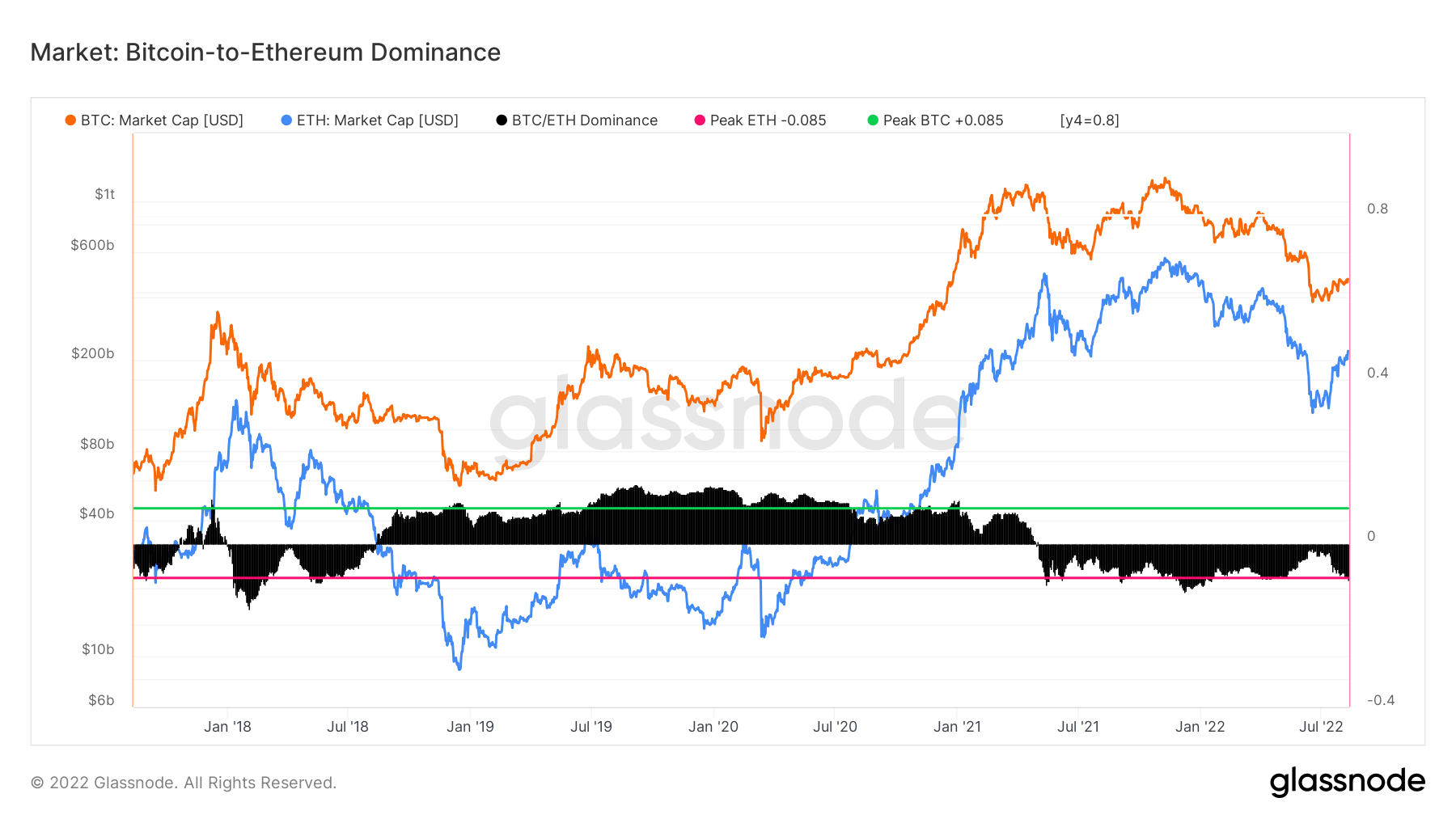

The chart below shows the price of Ethereum against Bitcoin since 2018. Only 12% off from 4 year high.

furi penning

The bullish sentiment may rekindle flipping hopes that Ethereum will surpass Bitcoin in market capitalization.

For this to happen, Ethereum would need to grow another 100% to reach around $3,750. This price target is still 23% below his all-time high of $4,800 set in November 2021.

Ethereum peaked at 0.15 BTC in 2017 and has struggled to regain 0.1 BTC since February 2018. News of the next merge finally turned out to be more than a pipe dream, and it seems to have ignited the market in favor of his contract-enabled blockchain, which is at least smarter than Bitcoin. in the short term.

The following chart plots the price of Ethereum against both the US dollar and Bitcoin. It is clear that Ethereum is currently rising at a faster pace against Bitcoin than against the dollar, demonstrating its strong position in the broader crypto market.

market power

Ethereum’s overall market dominance is also rising compared to Bitcoin. Glassnode’s chart below shows the strength of his overall Ethereum market power, currently at its highest since December 2021.

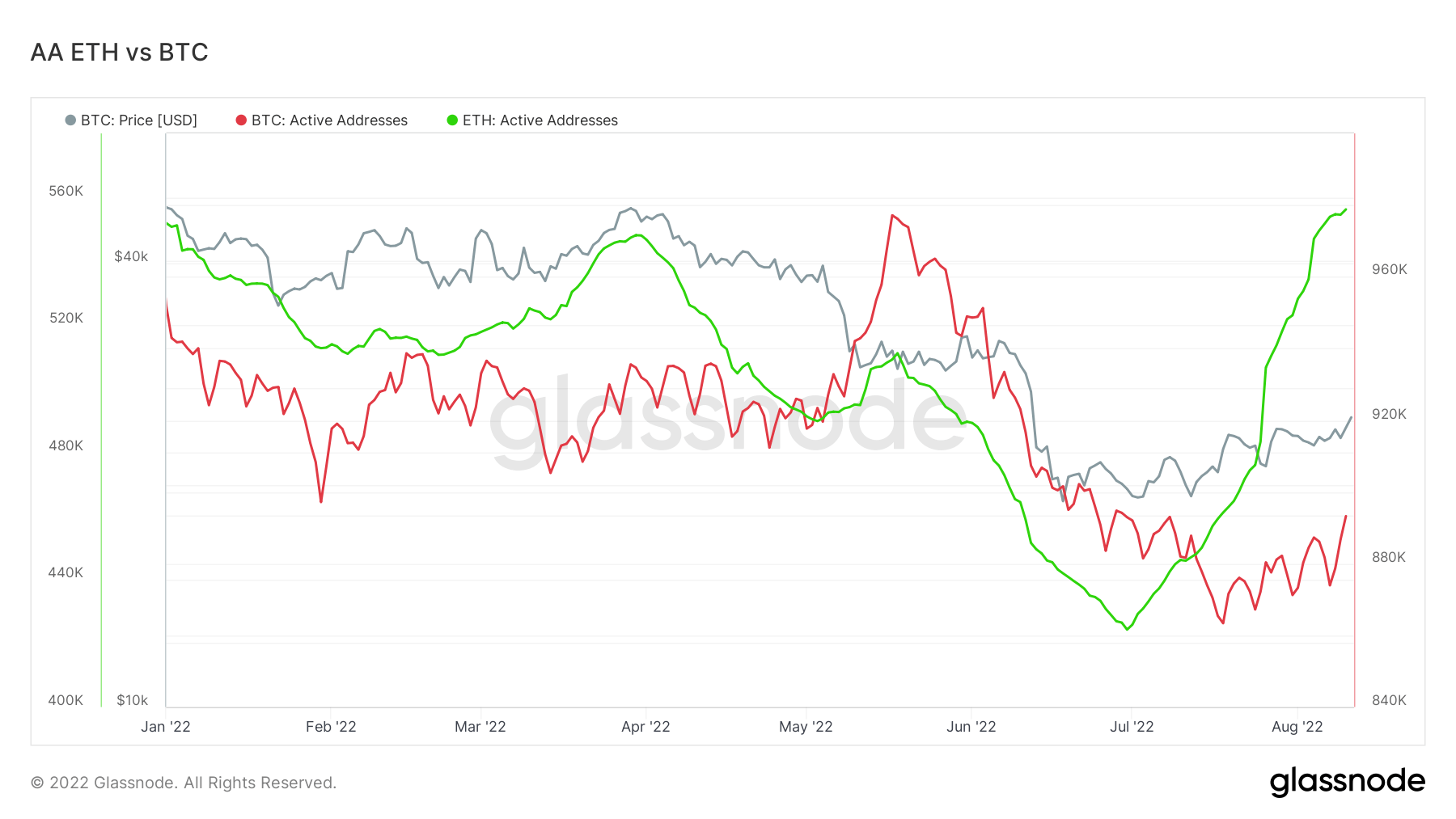

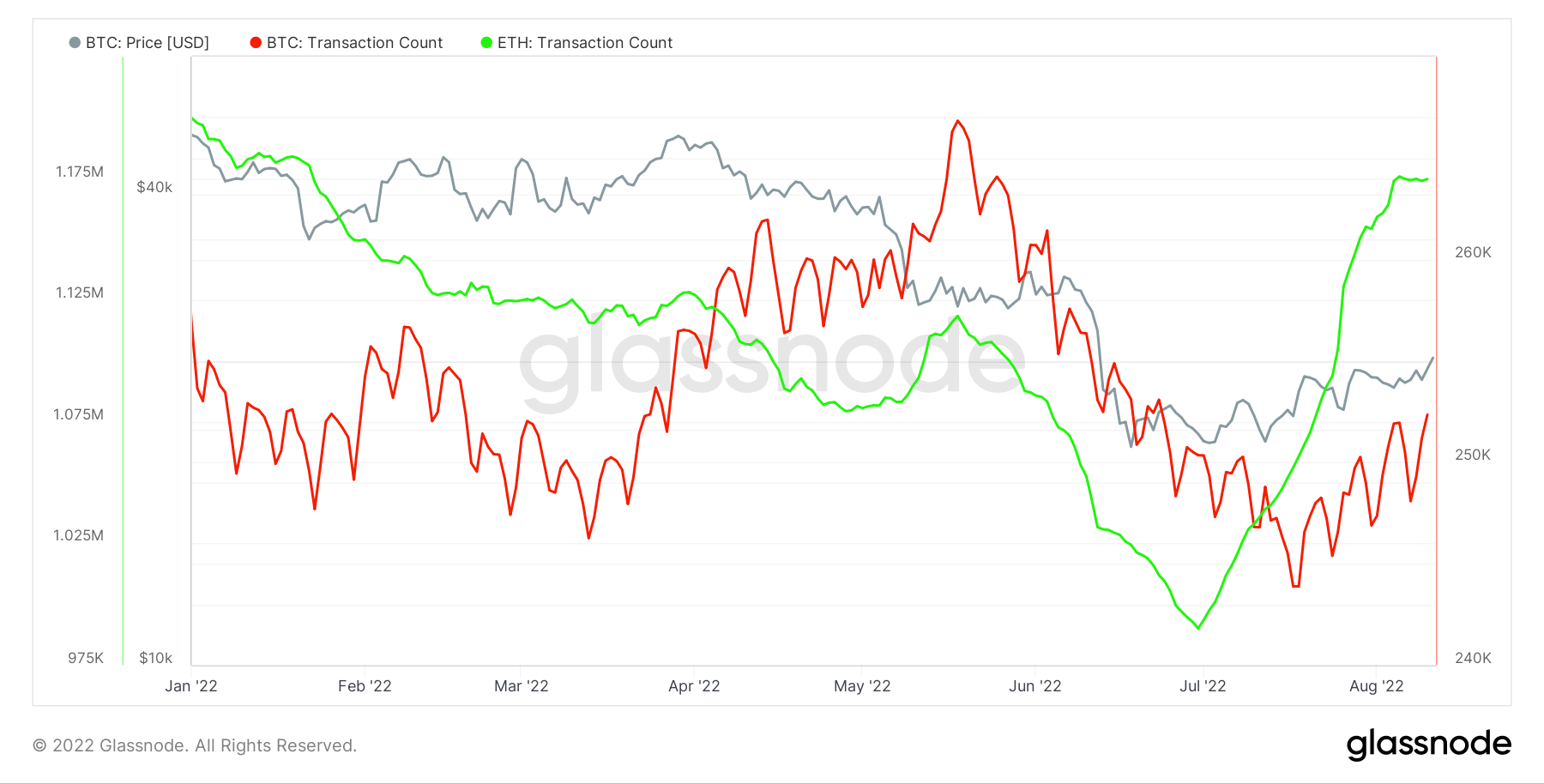

Ethereum also dominates other metrics, such as the number of active addresses and number of transactions. Both metrics began surging around July, and Ethereum now has nearly 100,000 more active addresses for him than rival Bitcoin.

hopium engage

However, major indicators may suggest that Ethereum’s resurgence may be short-lived. But the level of Bitcoin has dropped significantly. This change could indicate that Ethereum’s growing dominance over Bitcoin is being driven by speculation on The Merge rather than by investors looking for long-term hold.

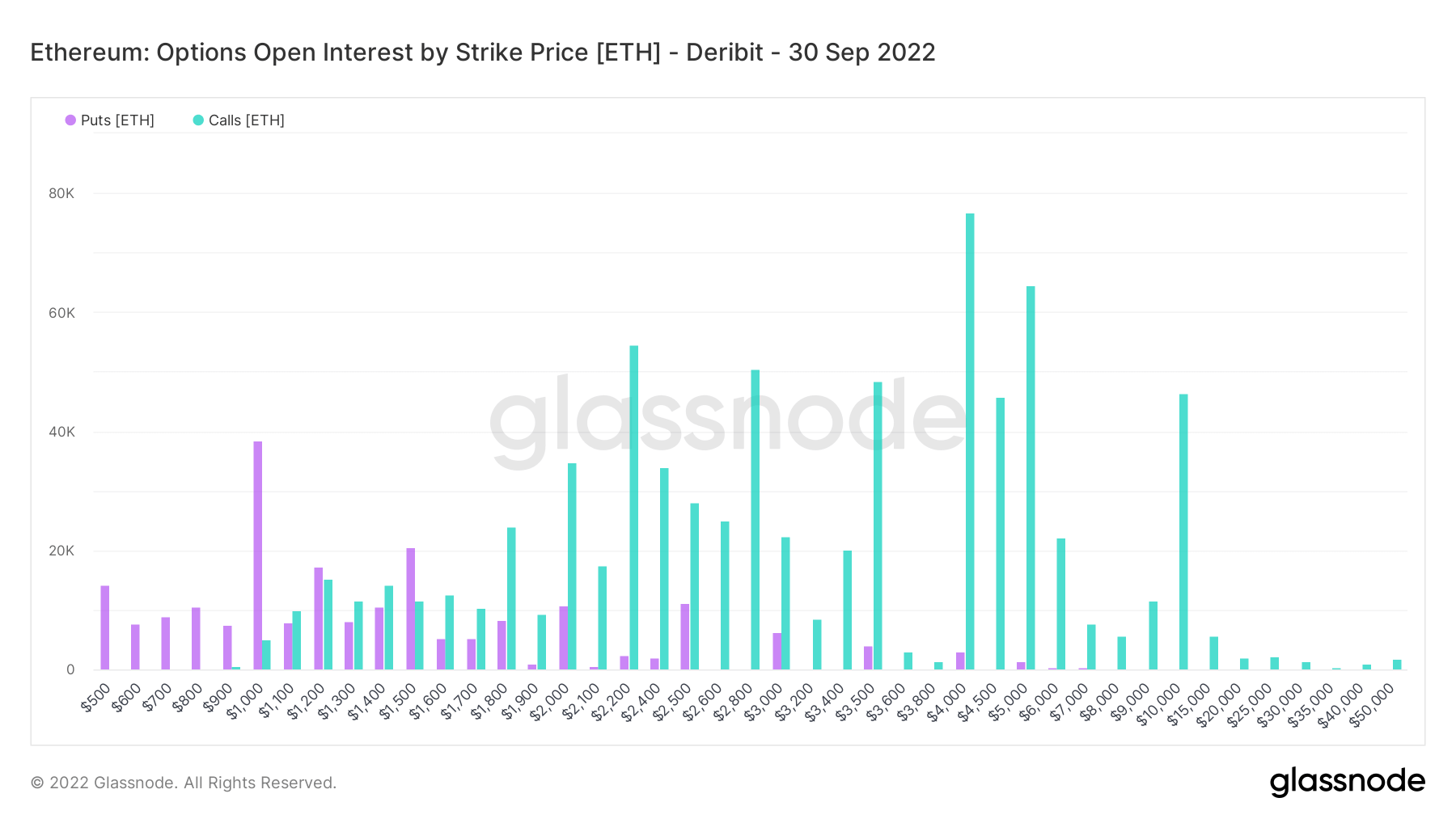

Another chart shows Ethereum option strikes and out-of-the-money calls receiving huge open interest. Massive strike price hits $10,000 in his ETH, up 455% from current price. These calls are likely used as part of a more complex trading strategy, with traders shorting or buying puts at lower strike prices to minimize risk.

In reality, Ethereum has surpassed Bitcoin at the moment. On-chain data such as active addresses show that this affects users interacting with the network, not just his HODLing.

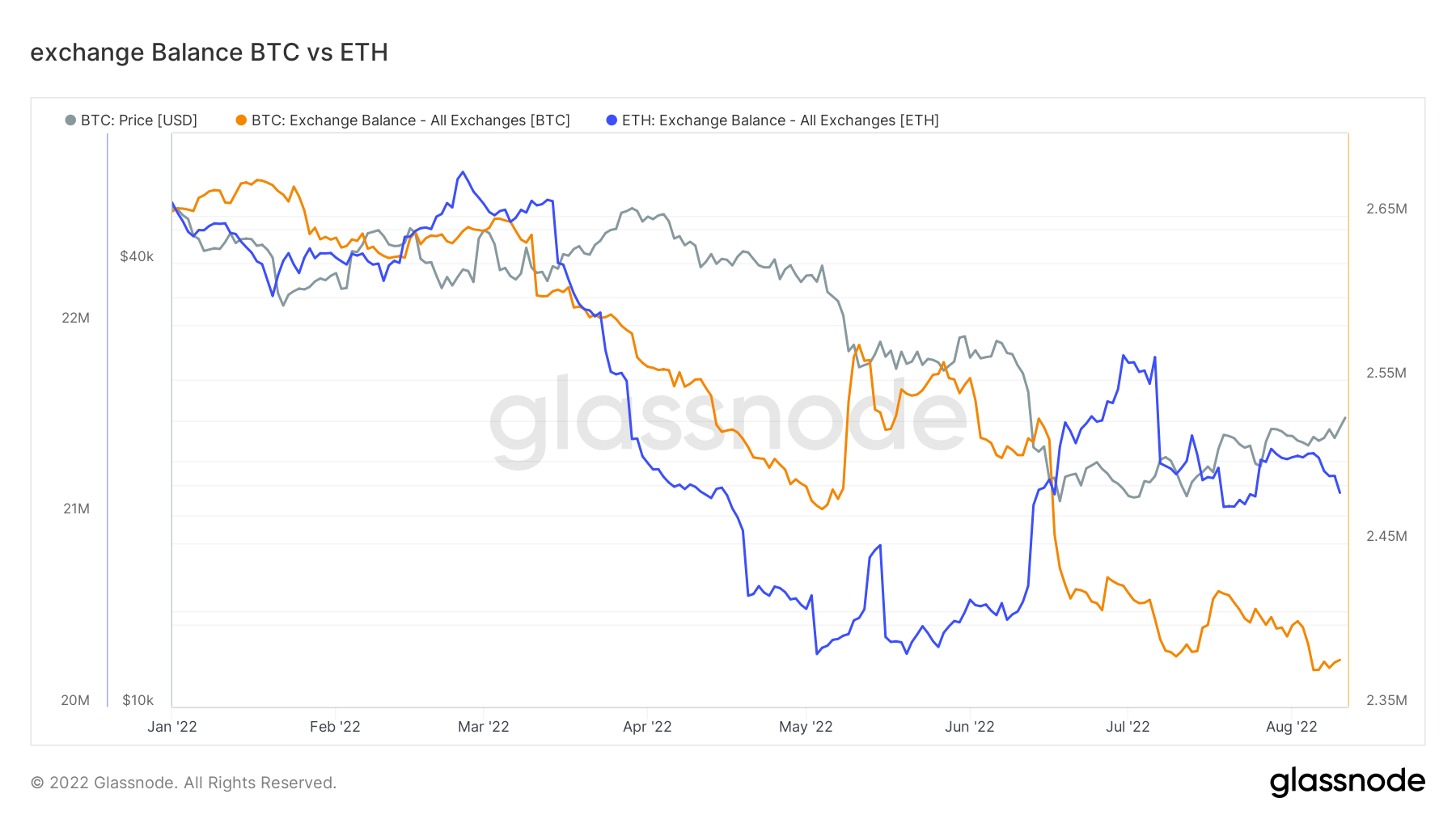

Rising levels of Ethereum on exchanges moderate this sentiment slightly, but an increase in the amount of coins held on exchanges is by no means a perfect indicator of bearish sentiment.

We are just over a month away from The Merge finding out if Ethereum is finally the catalyst to flip Bitcoin.