Ethereum merge might have resulted in 40% loss for Hive Blockchain revenue

Bitcoin (BTC) mining analyst Jalan Mereld estimates that the Ethereum (ETH) merger may have led to a 40% drop in Hive Blockchain’s revenue.

Hive has lost its Ether mining cash cow.

We estimate that the ‘merger’ has reduced revenue by 40%. pic.twitter.com/1vq0U6EUze

— Jalan Mellerud (@JMellerud) December 5, 2022

Mellerud emphasized that the mining company’s ETH business is more profitable than its Bitcoin business. That means a merger event could lead to his 60% loss of operating cash flow.

Hive Pivots to ETC and Bitcoin Mining

The company started mining Ethereum Classic (ETC) to cover its losses. But its main focus is to repurpose Ethereum mining facilities for his BTC mining, increasing capacity from 2.8 EH/s to 3.3 by February 2023.

The miner is now looking to enter the sustainable Bitcoin mining, hashrate index. Examined Finances to see if we can make this move.

Hive’s finances remain strong

The company’s balance sheet is relatively stable, with only $26 million of interest-bearing debt, according to the Hashrate Index. This means that the company does not have to spend as much on debt service and can maintain cash flow that helps with liquidity.

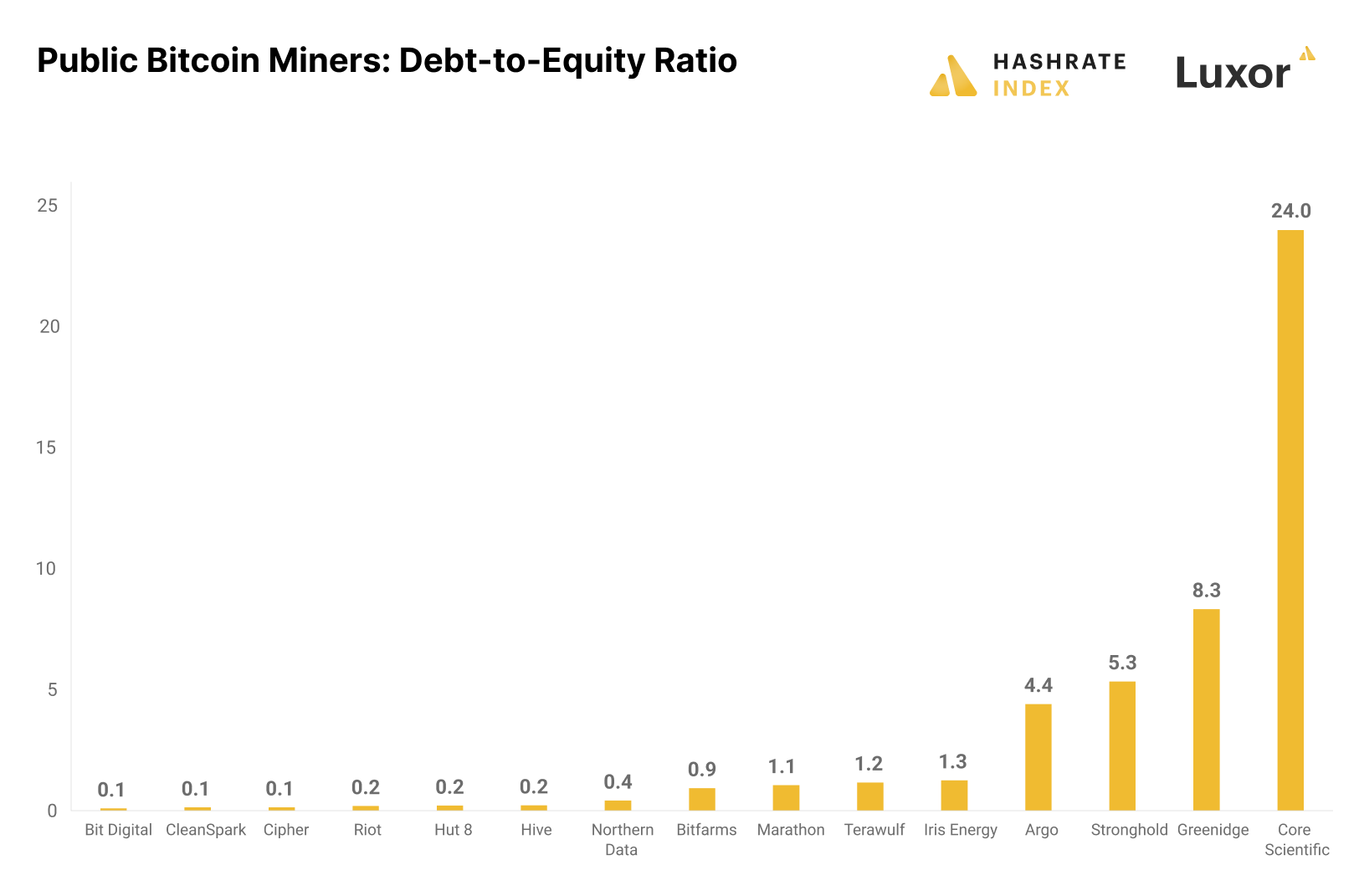

In terms of overall liquidity, the company has one of the lowest debt-to-equity ratios among public miners and a quick ratio of 3 for balance sheet liquidity. Of the top 15 companies by enterprise value, only four other public miners have more liquid balance sheets.

Its liquidity is primarily 3,311 bitcoin holdings and only $8 million in cash. At current value, his BTC holdings in Hive are worth his $57 million, accounting for 88% of liquidity.

The company also boasts relatively high gross margins as its mining operations rely on geothermal and hydroelectric power grids. These grids are not subject to rising energy costs and experience less downtime.

Hashrate Index writes that the company is able to mine more efficiently, producing 5% to 30% more BTC than its competitors, largely due to its consistent supply of hydropower.

In addition, the miner was able to keep administrative costs low compared to competitors such as Marathon.

On the other hand, a significant drop in the value of Bitcoin, combined with high energy costs and rising mining difficulty, has made BTC mining unprofitable for most miners facing high operating costs to pay off their debts. I’m here.