Ethereum’s 2 years peak dominance over Bitcoin has not translated into new ATH

Bitcoin (BTC) may be worth more than Ethereum (ETH), but Glassnode data is available. crypto slateindicating that the peak dominance of ETH has surpassed BTC over the past two years.

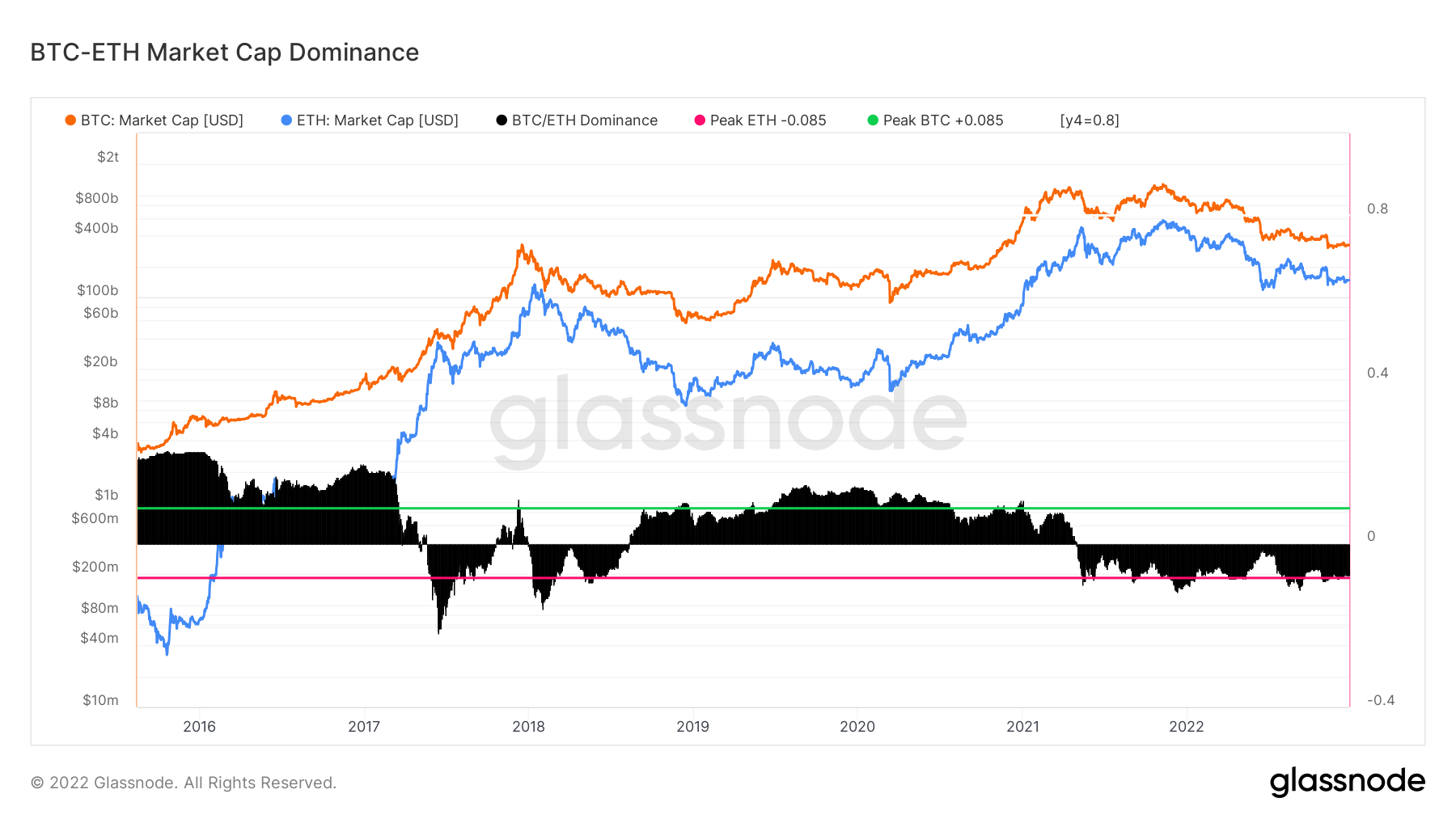

Glassnode’s BTC-ETH Market Dominance metric is an oscillator that tracks the macro performance trends of the top two cryptocurrencies. Market capitalization advantage discounts lost long-dormant coins and provides a model to accurately assess the capital inflows and outflows of an asset. This indicator only considers the market cap of BTC and ETH.

The chart above shows that Ethereum reached its peak of market dominance even before the peak of the asset’s realized market cap, dating back to 2017. Also, ETH returned to dominance in 2018. , maintaining it from late 2021.

BTC peaked during the bear market in late 2018 and early 2021. This indicates that it is a better asset in a risk-off environment.

A risk-off environment describes a bear market situation in which investors let go of risky assets such as stocks and hedge their money with investments in safer assets such as gold and bonds. This may explain why many analysts and investors consider Bitcoin digital gold.

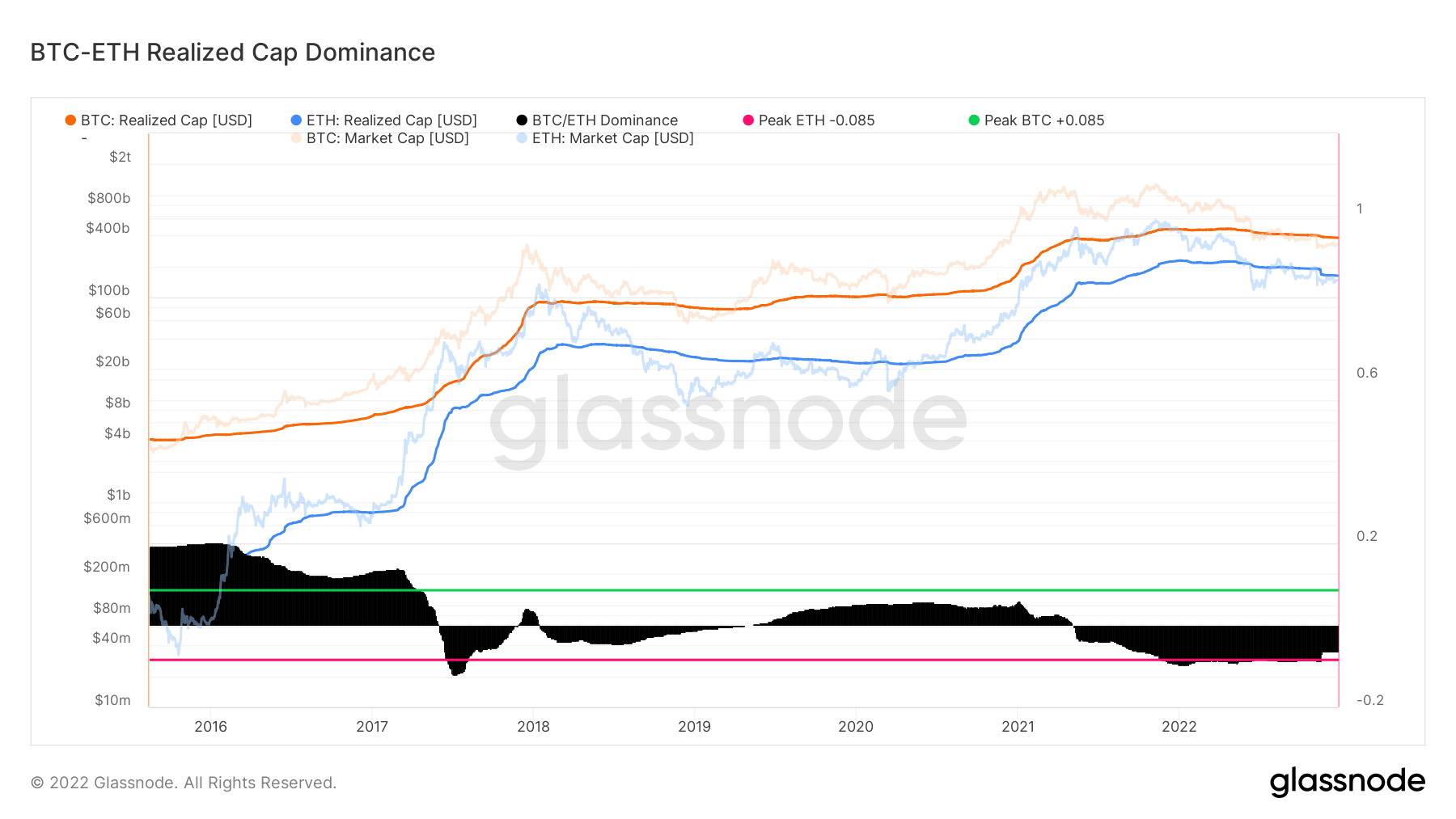

ETH, on the other hand, trades better in a risk-on environment where investors are willing to put their money into risky assets. That’s why it overturned and has maintained its performance to this day. According to the Glassnode chart below, Ethereum’s dominance over BTC in terms of realized market cap peaked above 0.765.

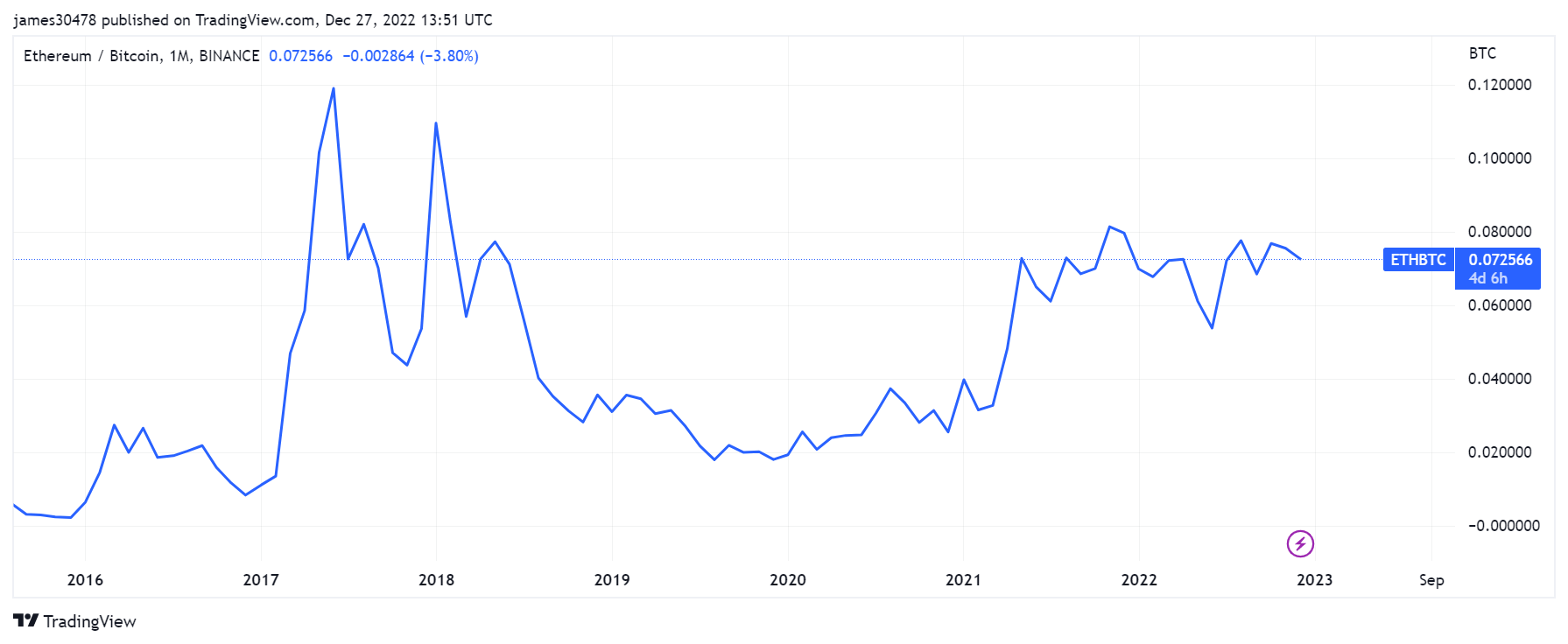

However, ETH’s dominance over the past two years has not translated into better performance of the asset. That dominance he has been steadily declining since 2017, with all other peaks in 2021 and 2022 failing to surpass their previous highs. The reasons behind this decline remain unclear.

However, the success of the Ethereum merge has caused the asset to deflate several times and the issuance rate has dropped significantly. According to multiple reports, the asset may be slowly turning into a store of value based on long-term holders’ beliefs.

BTC has already shown signs that it could outperform ETH in a risk-off environment if the market turns bearish again. It has outperformed Ethereum in the last 60 days.

Several data and market analysts Predict A recession in 2023; this could continue to impact BTC’s strengths of being a safer asset in a risk-off environment.