Ethereum’s rally fueled by speculation on the upcoming Merge

Ethereum’s price rose 40% last month, but the rest of the market is licking the wounds of June’s price crash. Despite its enormous size and network effects, Ethereum’s price has historically struggled to separate from Bitcoin, and has always followed Bitcoin’s rise and fall.

However, this rise has little to do with Bitcoin, which has recovered only 20% from its mid-June low.

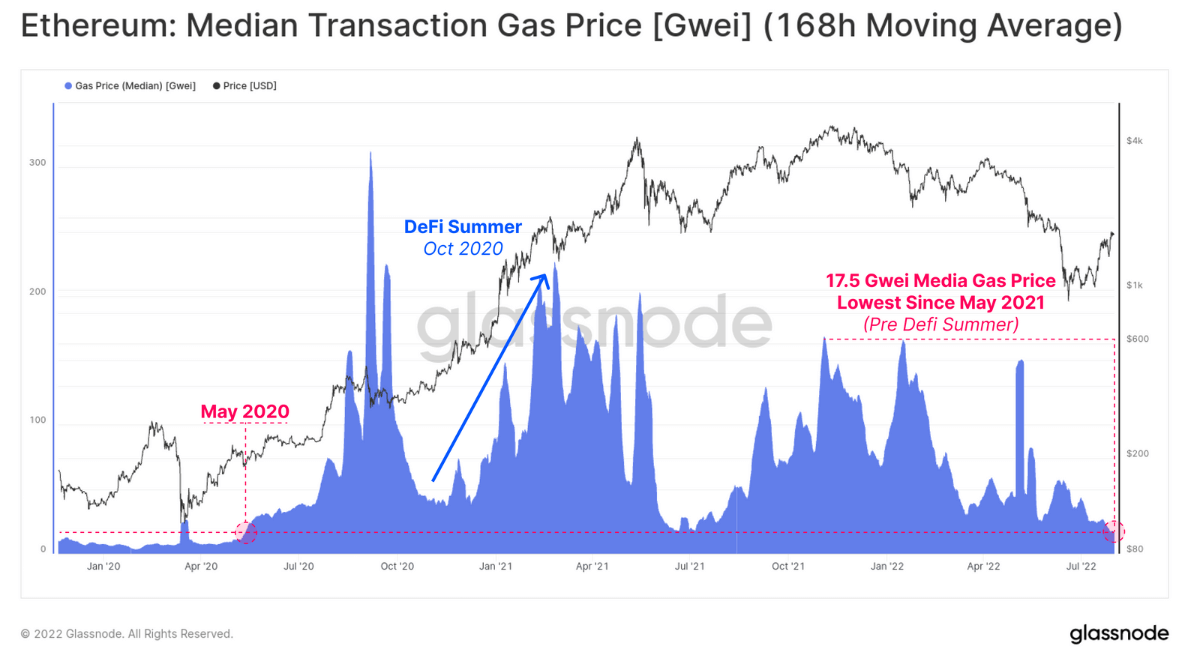

It also has little to do with increased network usage. Ethereum gas prices have fallen significantly this year and are now at 17.5 GWEI, the lowest since May 2021. Less network congestion indicates a decline in user activity on Ethereum, with overall user numbers estimated to reach levels seen. May 2020 — Before the DeFi boom hits in the summer of 2020.

The decline in user activity contrasts with the ETH price spike. This suggests that most of Ethereum’s current rally can be attributed to speculation as traders race to book profits ahead of the upcoming merger.

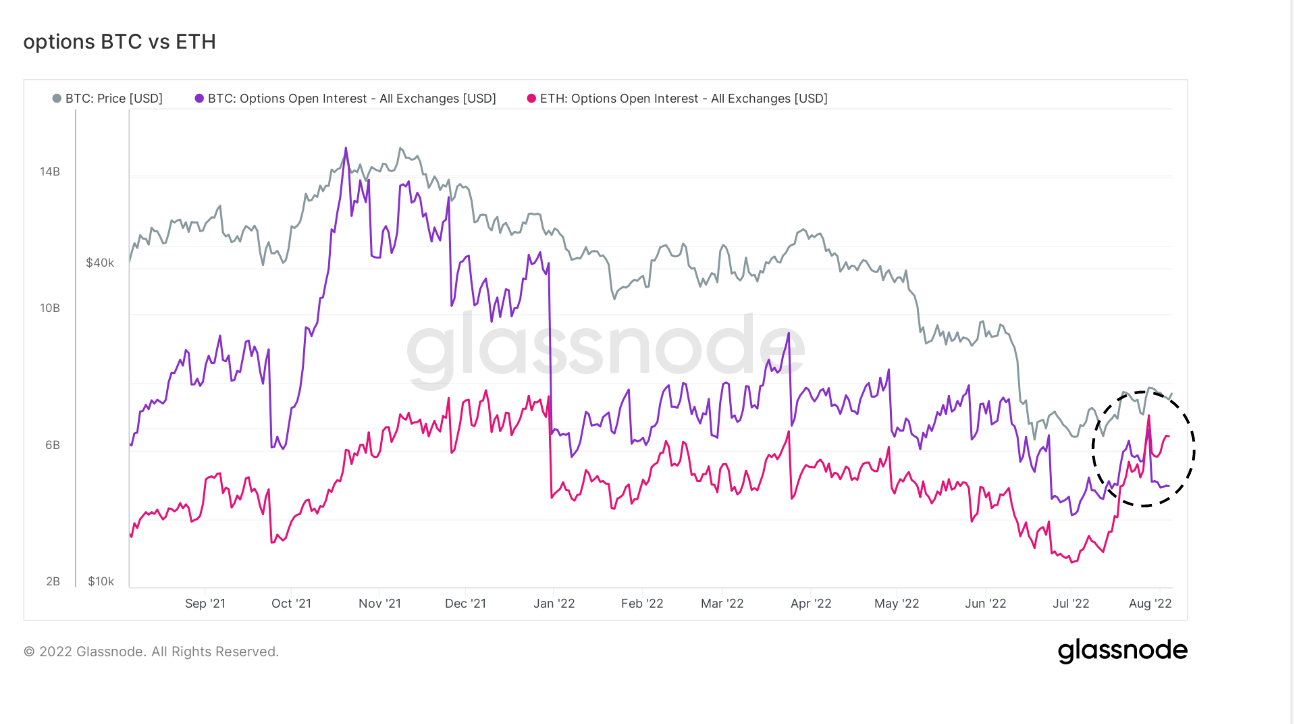

Derivatives also reveal a growing number of traders speculating on Ethereum’s further rise. This is the first time Ethereum’s open interest has surpassed Bitcoin. Bitcoin’s open interest is his $5 billion, while Ethereum’s open interest for the merger scheduled for Sept. 19 is currently at his $6.4 billion.

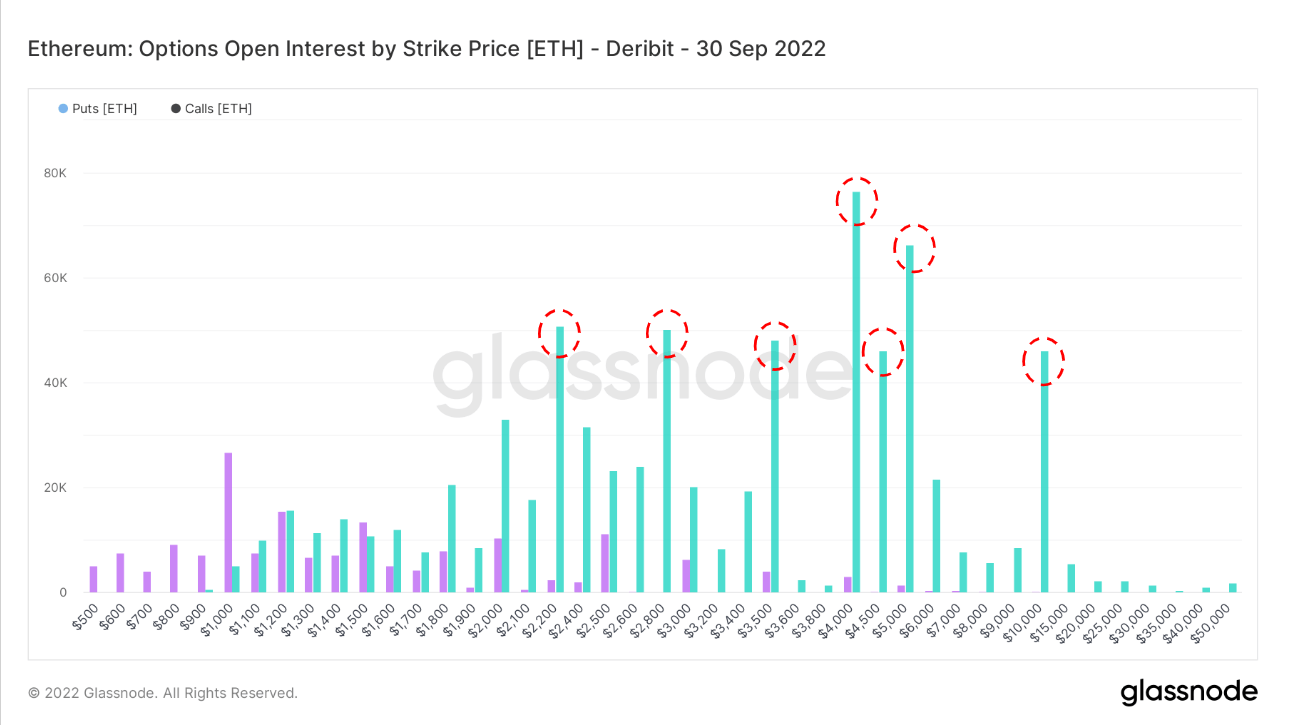

The total open interest of call and put options by strike price favorable call option contract. The majority of Ethereum options are call options concentrated on Sept. 30, with the $4,000 call being the most popular.

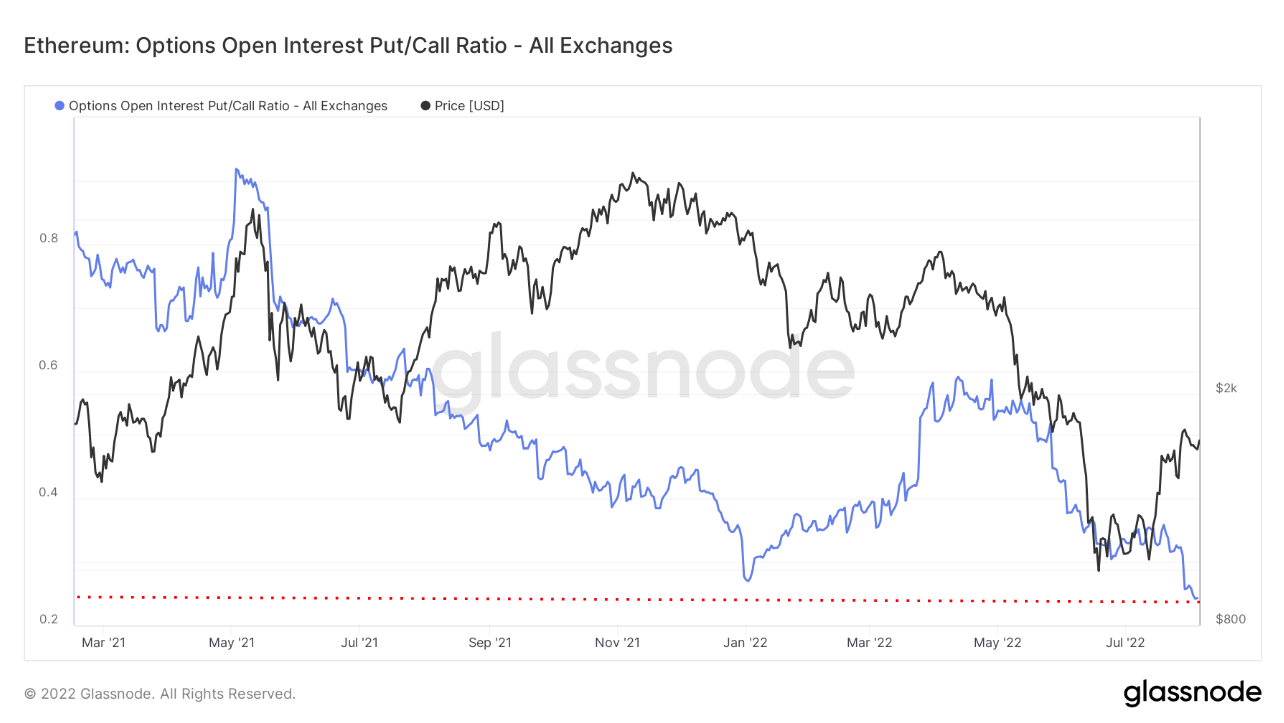

The open interest put/call ratio of options also indicates a speculator’s market. This indicator shows the put volume divided by the call volume of all funds currently allocated in the option contract to determine the overall mood of the market. A rise in the put/call ratio indicates that the trader has speculated that the market is going down and is buying more put he options than he calls options. On the other hand, a decline in the put/call ratio indicates bullish sentiment as more traders are buying calls than puts.

Ethereum put/call ratio is currently lowest It’s never been before, and with the 0.24 showing, a huge number of traders are anticipating a bull market.