Ethereum’s Shanghai and Capella updates drive $17M inflows: CoinShares

Ethereum (ETH) Shanghai and Capella — Shapella — renewal boosted investor confidence, with $17 million worth of ETH-based investment products in the week of April 17-23, according to CoinShares weekly report. Funds have flowed in.

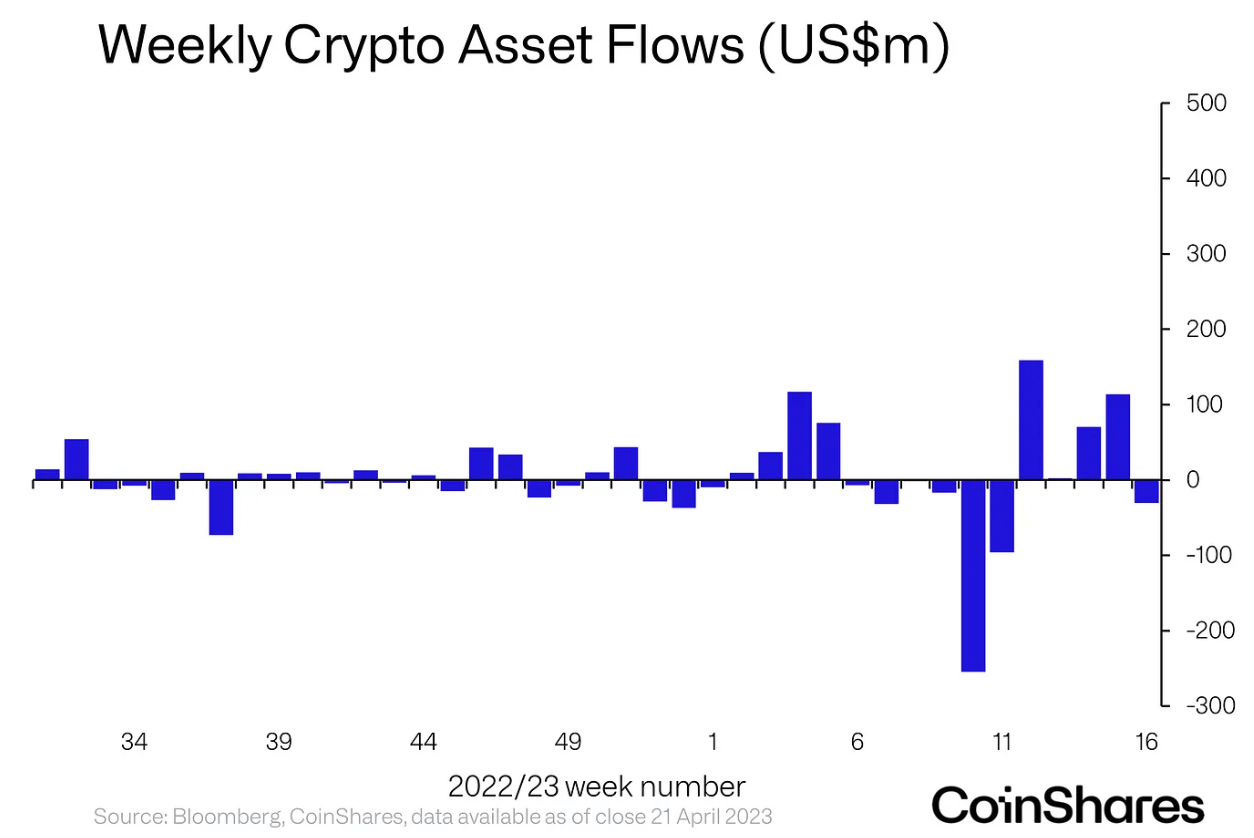

ETH-based products thrived, but the overall crypto investment tools market posted a loss of $30 million last week. report said.

The loss recorded in the week of 17 April was the first hostilities in five weeks. The report noted that outflows began to increase in the week prior to April 14, around the time Bitcoin (BTC) crossed the $30,000 price mark.

ETH’s Shapella upgrade also took place during the same week, with investors betting on BTC during the week of April 10th. I wanted to make a profit.

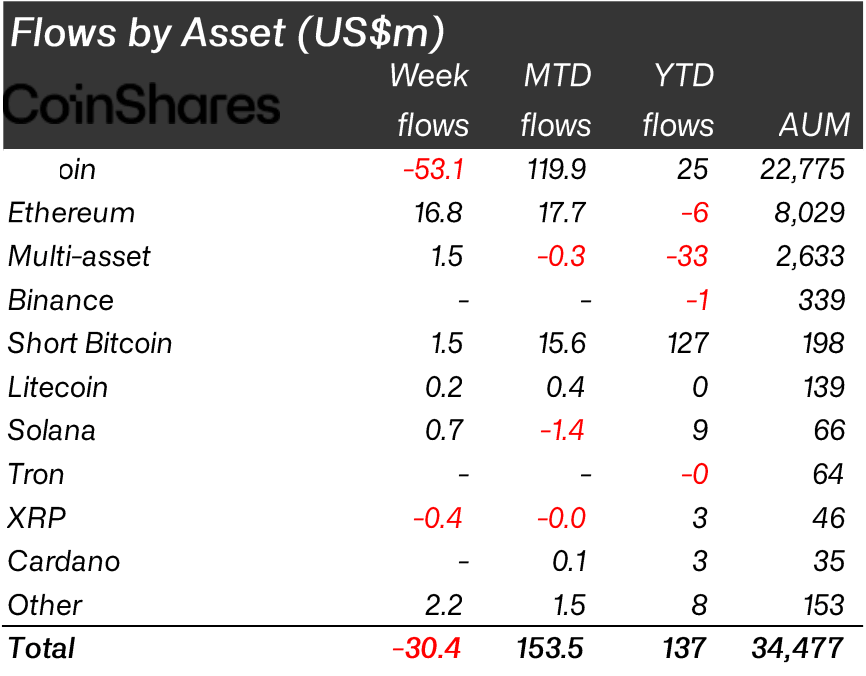

Flow by asset

The spill occurred on April 14th and continued through the week of April 17th. However, profit taking was limited to his BTC, as defined in the report, which recorded a $53.1 million outflow.

Ripple (XRP) was the only other asset contributing to the outflow, losing $400,000 in the week.

ETH led the assets contributing to the inflow with $16.8 million. Short BTC commodities Litecoin (LITE) and Solana (SOL) also registered inflows worth $1.5 million, $200,000 and $700,000 respectively.

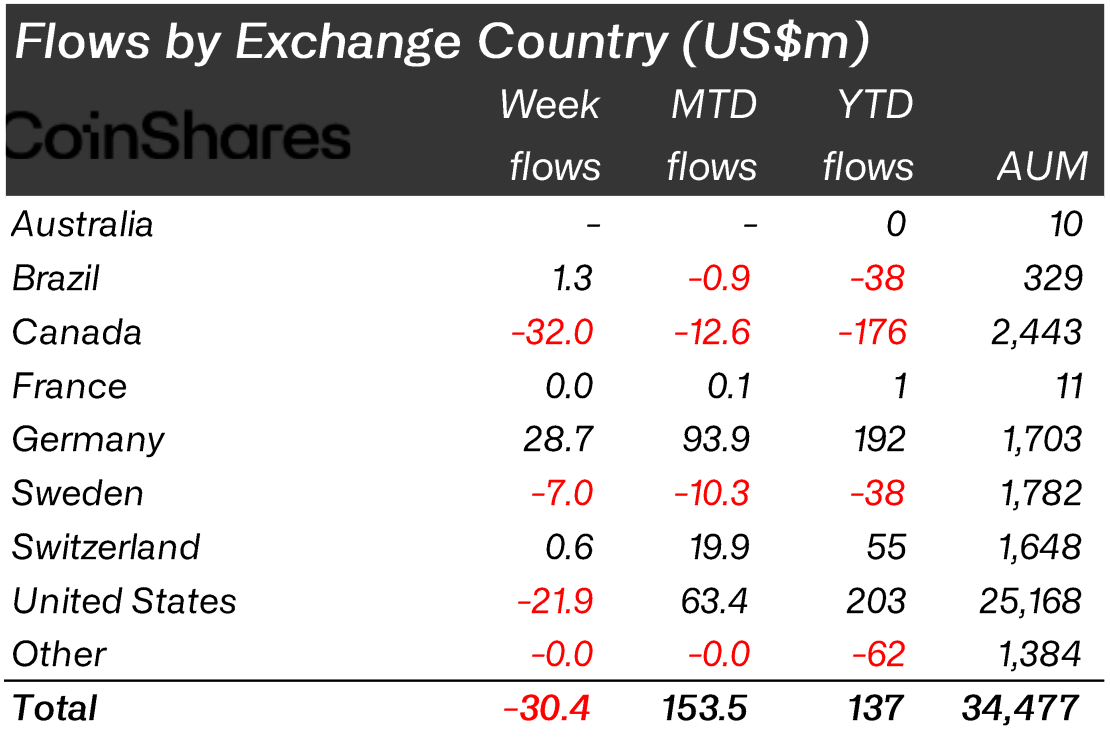

Flow by country

Regionally, North America led the sale of BTC. Canada recorded her $32 million outflow, while the United States recorded an additional $21.9 million. Sweden also donated another $7 million to Flow.

Germany, meanwhile, emerged as a major source of inflows by adding $28.7 million to the market. Brazil and Switzerland also recorded inflows, worth $1.3 million and her $600,000 respectively.

Breaking down the flows by provider, ProShares emerged as the leading provider with the highest outflow valued at $23.4 million. 3iQ and CoinShares XBT recorded further outflows of $20.9 million and $7 million.

CoinShares Physical saw inflows of $15.7 million, bringing total CoinShares inflows to $8.7 million. Twenty-one stocks and objectives also recorded inflows of $2.3 million and $0.9 million respectively.