FTX, Alameda used Binance as intermediary for their parasitic relationship

In the aftermath of the FTX demise, Bitcoin’s price fell to a 2-year low of $15,000, the exchange’s native token was becoming essentially worthless, and stablecoins across the market fell off the peg. I have a hard time maintaining it.

But the collapse of Sam Bankman-Fried’s empire isn’t over yet. Contagion and secondary effects are yet to be felt and could push the market further into the red.

But what caused the fallout that could have set the crypto industry years ago?

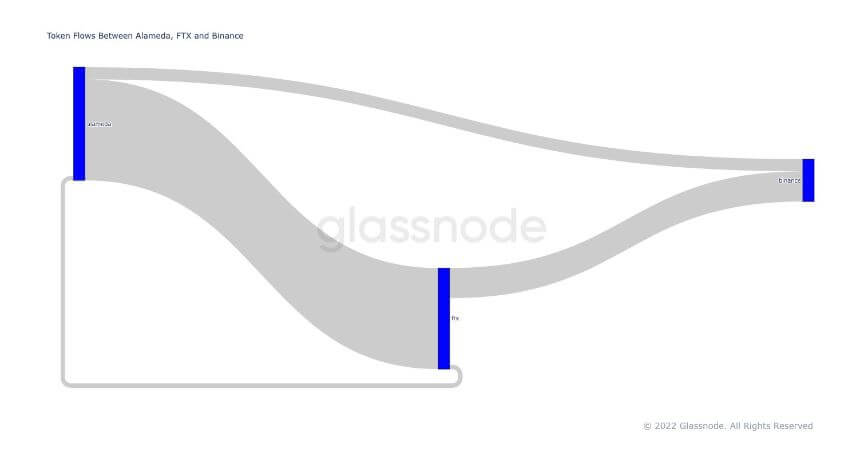

An in-depth analysis of on-chain data by CryptoSlate has revealed the relationship between FTX and Alameda and how the two companies siphoned each other using Binance as an unsuspecting middleman.

Alameda and FTX — two sides of the same coin

Understanding the scope of Alameda and FTX’s relationship requires a deep dive into the token flows of both companies.

The majority of their holdings are in various stablecoins and altcoins, and releasing Bitcoin (BTC) and Ethereum (ETH) from the data makes the two trading methods more clear.

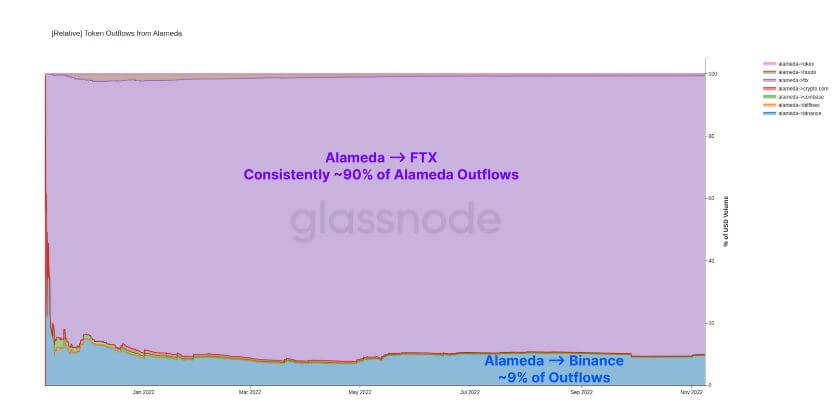

Over the past year, over 90% of tokens from wallets associated with Alameda ended up on FTX, according to data analyzed by CryptoSlate. Around 9% of all outflows from Alameda ended up on Binance.

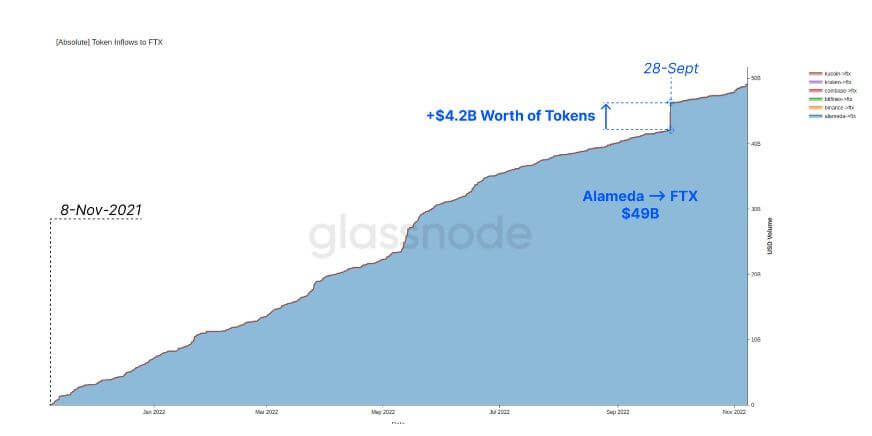

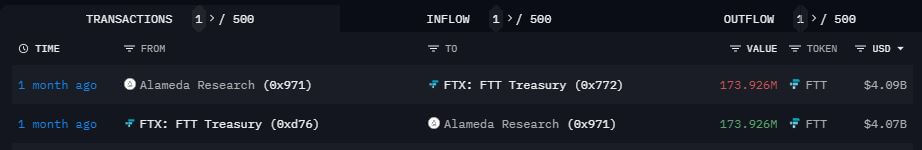

Alameda’s dominance becomes clear when looking at the influx into FTX. Between November 2021 and November 2022, $49 billion worth of various tokens were transferred from Alameda to his FTX. Inflows are increasing month by month and at the end of September 2022 he saw a vertical jump when over $4.2 billion in tokens were sent to his FTX.

Cryptocurrency analytics firm Arkham Intelligence confirmed the inflow in its own report. The company’s scanners show that about $4 billion worth of his FTT is flowing into exchanges.

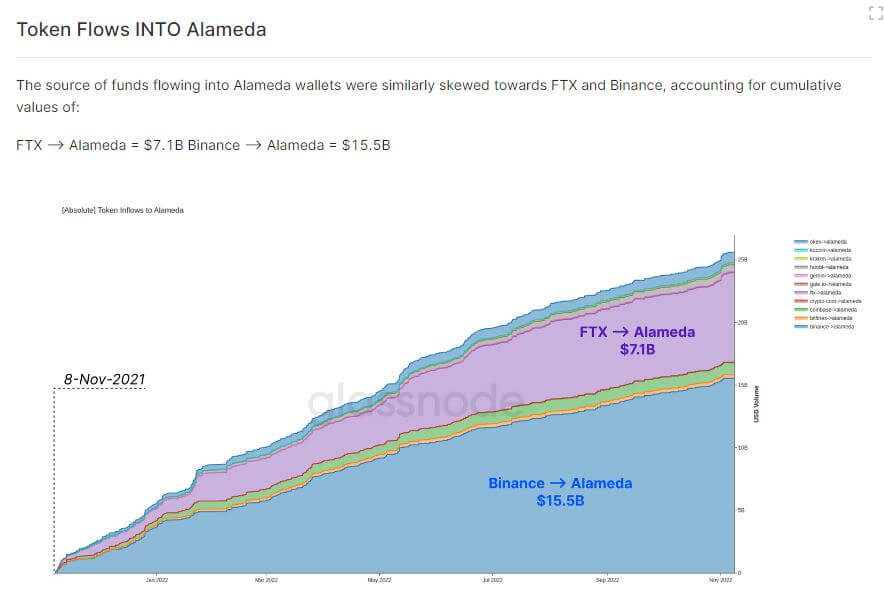

And while most of the money that went out of Alameda ended up going to FTX, the majority of the money that went back to the trading firm appears to have come from Binance. Altcoins and stablecoins have flowed into Alameda. Of the $25 billion, $7.1 billion came from his FTX wallet and over $15.5 billion from his Binance wallet.

The inflow from Binance and FTX Dwarf is the inflow from other exchanges as shown in the graph below.

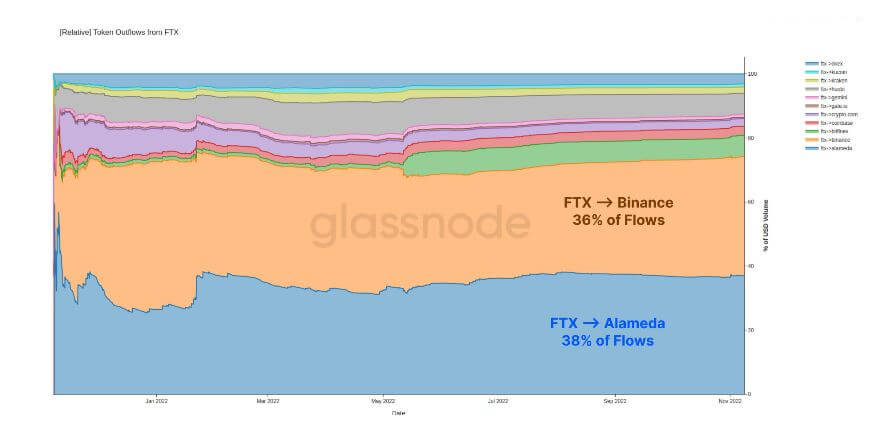

Alameda, FTX and Binance’s trio of wins is even more evident when looking at the outflow from FTX. Since November last year, the outflow from the exchange has been fairly evenly distributed between Binance and Alameda. glass node According to data analyzed by CryptoSlate, around 38% of token outflows from FTX went to Alameda and 36% to Binance wallets. Only 26% of the funds leaving FTX ended up in wallets associated with other companies or exchanges.

finger pointed at the broker

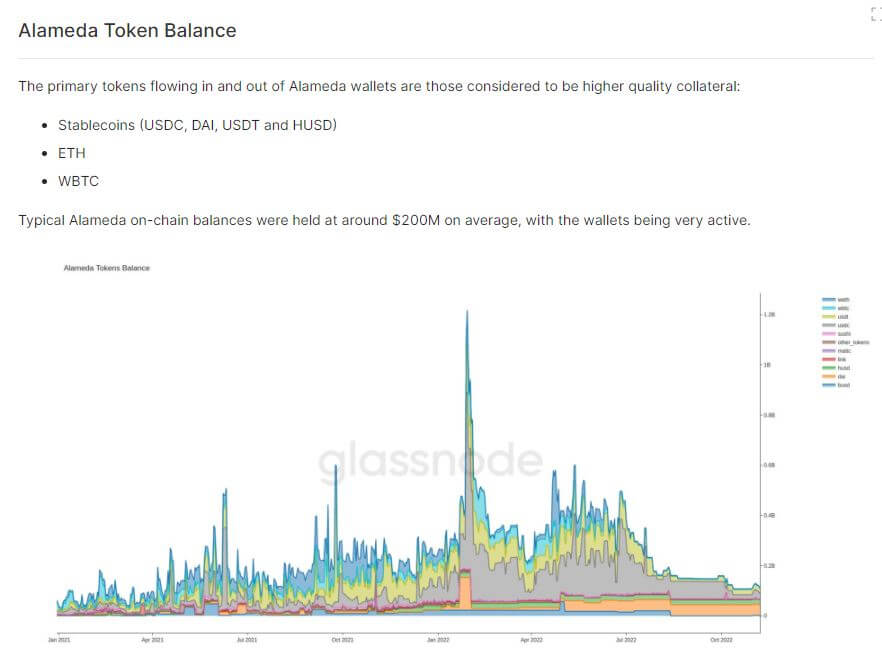

A closer look at the wallets associated with Alameda shows that the company maintained a healthy balance of baskets of different tokens throughout 2021. On average, the company held about $200 million worth of his USDT, USDT, DAI, HUSD, ETH, and WBTC. It is considered a guarantee of high quality.

November’s bull market pushed Alameda’s balance to the ceiling, reaching $1.2 billion in January 2022.

Luna’s collapse in May of this year caused a major dent in Alameda’s balance. Since then, the company has been unable to recover and has seen its balances continue to decline as we enter the fourth quarter.

It is unclear what caused Alameda’s balance to decrease. The industry is ripe with rumors that the company is panicking by selling its reserves to cover the losses it suffered after Luna’s collapse.

For those who don’t believe this was a panic sell, note that Alameda could have sold the reserves to get the funds back into FTX. The company’s current balance sheet problems also make a sale for profit very unlikely.

Further research is needed to understand the full extent of the crisis caused by the Alameda-FTX deal. However, the data analyzed so far points to an undeniable bond between Alameda and FTX. The two bonded through Binance. Binance may have used it as an unsuspecting intermediary for a year on the run.