FTX co-CEO blew whistle on exchange; Trump launches NFT collection

The biggest news in the Cryptoverse on December 15th included FTX co-CEO Ryan Salame being revealed as a whistleblower, Donald Trump’s NFT collection, and long-term Bitcoin holders facing losses. include studies that still show bullish sentiment regardless.

CryptoSlate Top Stories

FTX co-CEO Ryan Salame reported to Bahamian regulators on Nov. 9 that the exchange was transferring customer funds to Alameda Research, according to a court hearing on Dec. 14. filing.

Salame told the Bahamas Securities Commission (SCB) that only three people could make such transfers. These people include FTX founder Sam Bankman-Fried, his co-founder Zixiao “Gary” Wang, and his director of engineering Nishad Singh.

Former President Donald Trump unveils his first NFT collection known as Collect Trump Cards.

According to the official website, each NFT is priced at $99 and designed by illustrator Clark Mitchell. Additionally, these playing cards digital trading cards are created on the Polygon blockchain.

All NFTs contain an entry into a “sweepstakes” for a specific prize. ONLY LEGAL RESIDENTS OF THE 50 US STATES AND THE DISTRICT OF COLUMBIA OVER THE AGE OF 18 ARE ELIGIBLE TO ENTER THE OFFICIAL DONALD TRUMP NFT COLLECTION SWEEPSTAKES.

The number of NFTs that can be created during the sweepstakes entry period is limited to 45,000, including 44,000 NFTs that can be purchased during that period.

The New York Department of Financial Services (DFS) release Guidelines requiring banking institutions to seek regulatory approval at least 90 days before offering cryptocurrency-related services.

guidelines release On Dec. 15, DFS Superintendent Adrienne Harris said New York-regulated banks must seek State Department approval before engaging in crypto-related services, even if it is through a third party. said.

under guidelines, Banks must notify the Ministry at least 90 days in advance of commencing the process of providing virtual currency-related services.

In addition, interested banks are required to submit documents covering six broad categories of information related to business planning, risk management, corporate governance, consumer protection, financial, legal and regulatory analysis.

BitGo CEO Mike Belshe revealed in a Twitter space on Dec. 14 that the company rejected Alameda Research’s request to redeem 3,000 wrapped Bitcoins (WBTC) days before bankruptcy.

Belshe said BitGo denied the request after an Alameda representative who contacted his company failed the security verification process.

He added that BitGo was familiar with representatives from all of the companies that own WBTC, and that this Alameda representative was not one the custodian had previously interacted with.

FTX Collapse Costs Crypto Investors Nearly $9 Billion in Realized Losses, According to Chainalysis report.

Chainalysis notes that this loss pales in comparison to Terra’s UST depeg, which caused a $20.5 billion loss. The bankruptcies of crypto companies such as Celsius and Three Arrows Capitals have resulted in $33 billion in realized losses.

According to Chainalysis, weekly realized losses and gains are calculated by taking the value of the assets in the wallet at the time of acquisition minus the value of the portion of the assets transferred out of the wallet at the time the data was recorded.

Transferring assets out of a wallet doesn’t necessarily mean a sale, but it does give insight into how those events impacted investors. This data shows that many investors had already lost significantly more value before his FTX crash.

Big Time has won the prestigious Game of the Year title at the Polkastarter Gaming GAM3 Awards 2022.

Open Loot’s action-adventure game is an open-world RPG with unique blockchain game mechanics. Take a look at the game from his SlateCast episode earlier this year.

After narrowing down the nominations to 32 games from a pool of over 200 web3 games, the awards are complete. Alongside industry judges, there were over 200,000 community votes across 16 categories.

research highlights

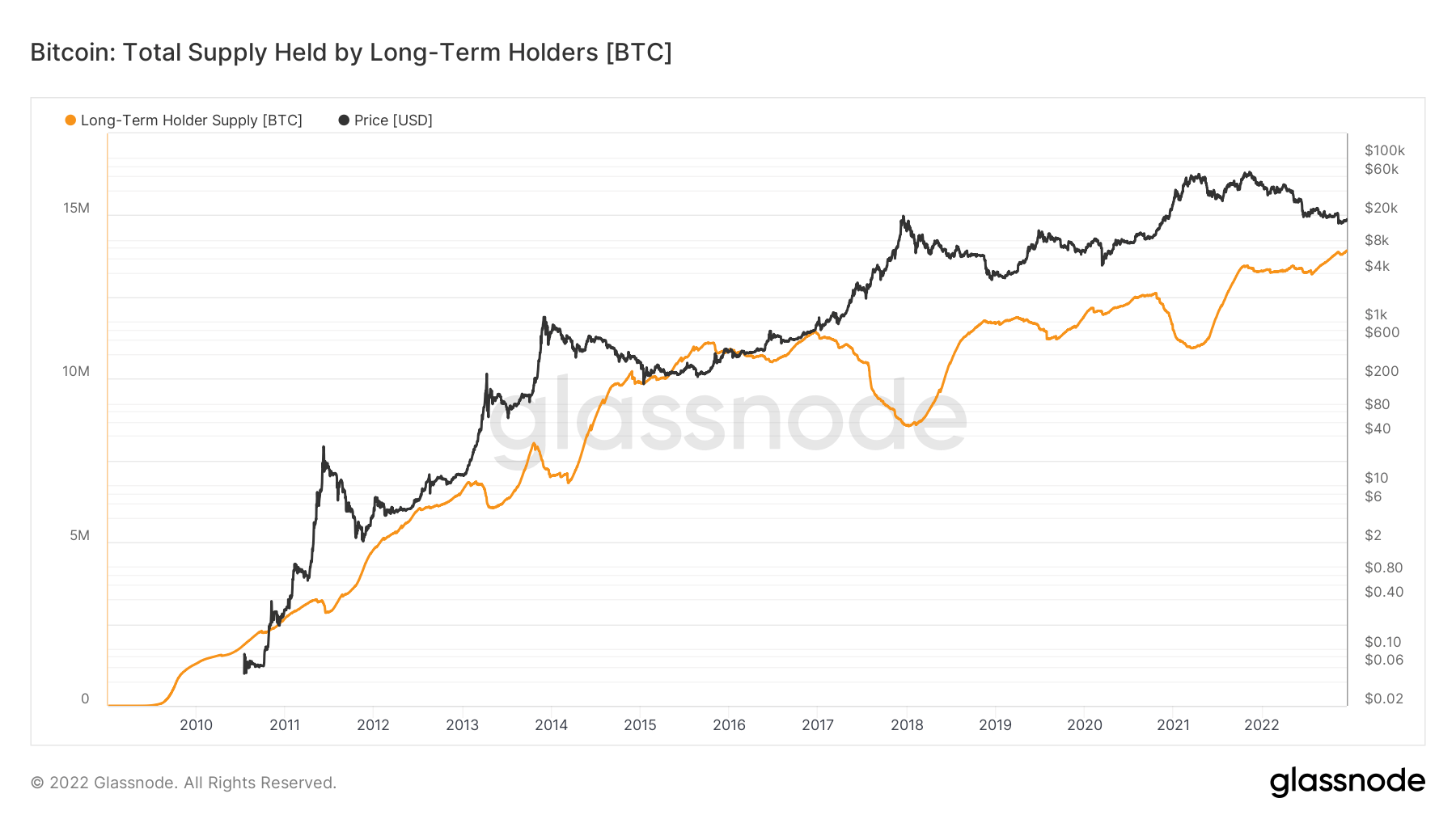

Bitcoin’s (BTC) year-long decline has left several holders suffering unrealized losses, including long-term holders (LTH) who have held the coin for at least six months.

However, CryptoSlate’s analysis of Glassnode data shows that this investor group remains bullish on the flagship digital asset.

According to Glassnode data, the cohort holds a record 13.8 million bitcoins. This group is also considered smart money in the Bitcoin ecosystem as it is usually accumulated in bear markets and sold in bull markets.

For context, long-term holders added about 1 million BTC to their holdings in November. This is because his LUNA crash in May caused prices to drop significantly, allowing traders to accumulate assets. Those who bought bitcoin at the time are now part of this cohort because they have held it for the last six months.

crypto market

Over the past 24 hours, Bitcoin (BTC) has fallen 2.97% to trade at $17,404.71 while Ethereum (ETH) has fallen 3.44% to trade at $1,271.36.

Biggest Gainers (24 hours)

- Safepal (SFP): +9.09%

- CELO: +6.72%

- Hook Protocol (HOOK): +6.42%

Biggest Loser (24h)

- Neutrino US Dollar (USDN): -16.98%

- Telcoin (TEL): -13.6%

- DigiByte (DGB): -12.7%