GameFi sector down, but not out

The Web3 GameFi sector continued to bleed users in June, significantly reducing funding rounds, but some of the popular games have relatively stable token prices and user numbers. In addition, the gaming platform Binary X has reversed that downtrend, creating a rare bear market breakout. Meanwhile, game developer Playful Studios has raised a record amount for the battle game Wildcard.

DeFi Kingdoms and Axie InfinityThese developments show that the industry will never collapse, despite a lot of pain for GameFi developers and investors.

The overall market remains very negative. Last month, according to Footprint Analytics data:

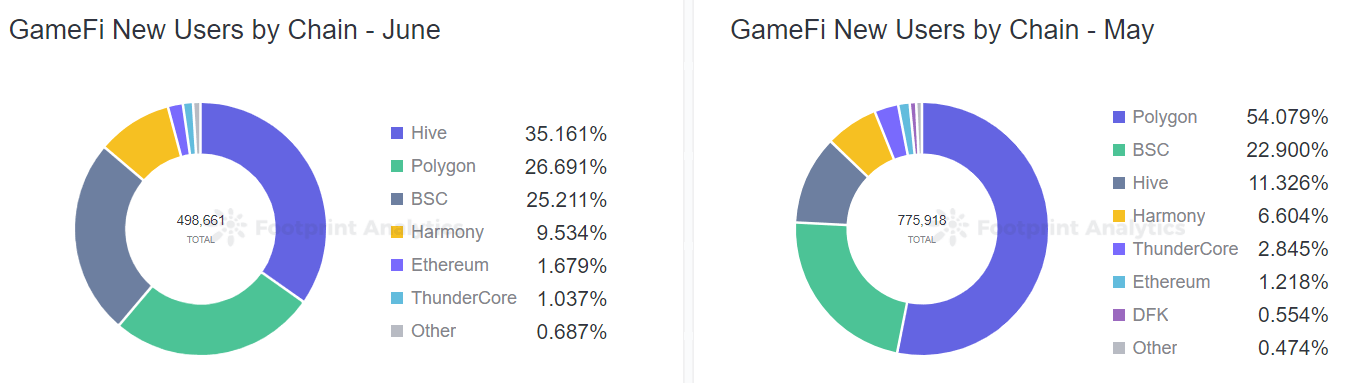

- GameFi Marketplace volume decreased by 30.3% MoM and transaction volume decreased by $ 166 million.

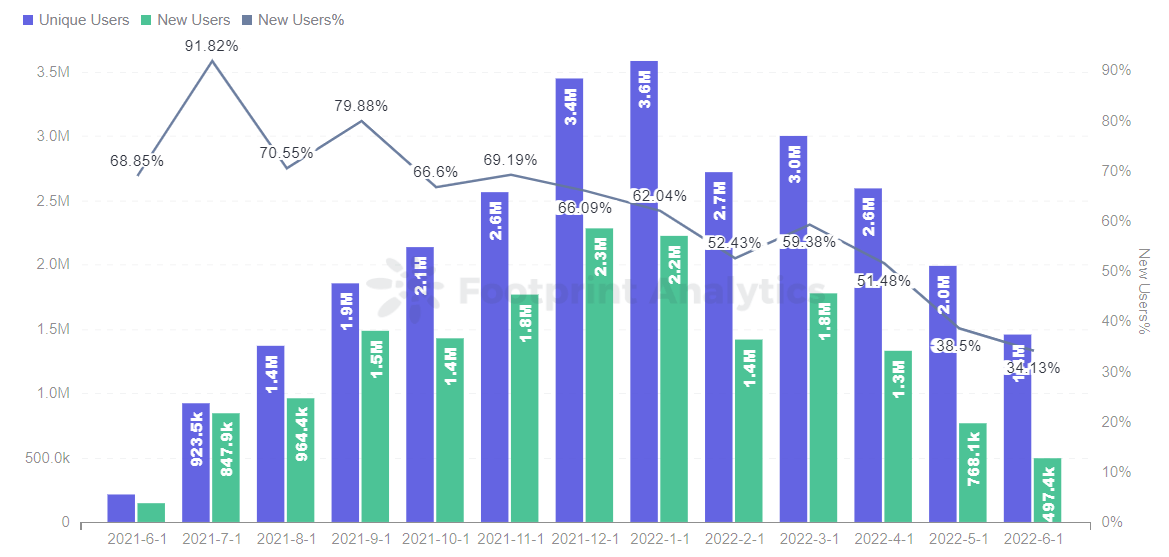

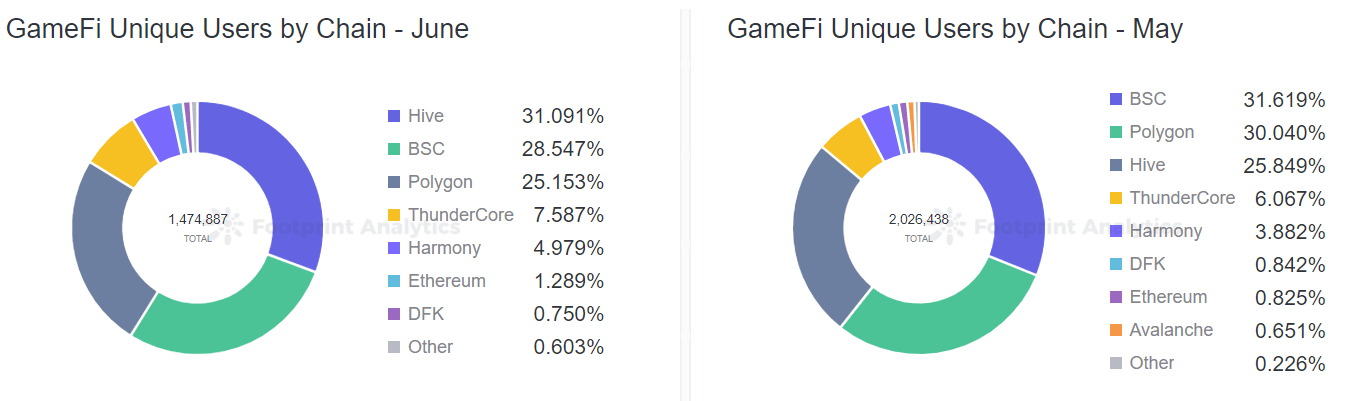

- The total number of GameFi users was 1.46 million, and MoM decreased by 26.9%. The number of new users also gradually decreased by 34.1%.

- VC investment in the GameFi sector fell by 57.7% MoM.

On the other hand, apart from the darkness, so-called “risk” investments like Metaverse Rand and NFT are working relatively well compared to “safe” assets like BTC and ETH. For this topic, Three fictitious BTC / ETH, NFT, and Metaverse land portfolios And it turns out that BTC / ETH (according to some calculations) fell significantly from ATH than the top NFT and Metaverse projects. For the latter two “risk” assets, returns are also significantly higher in bull markets.

Here’s what happened at GameFi in June:

Estimates for the entire GameFi market

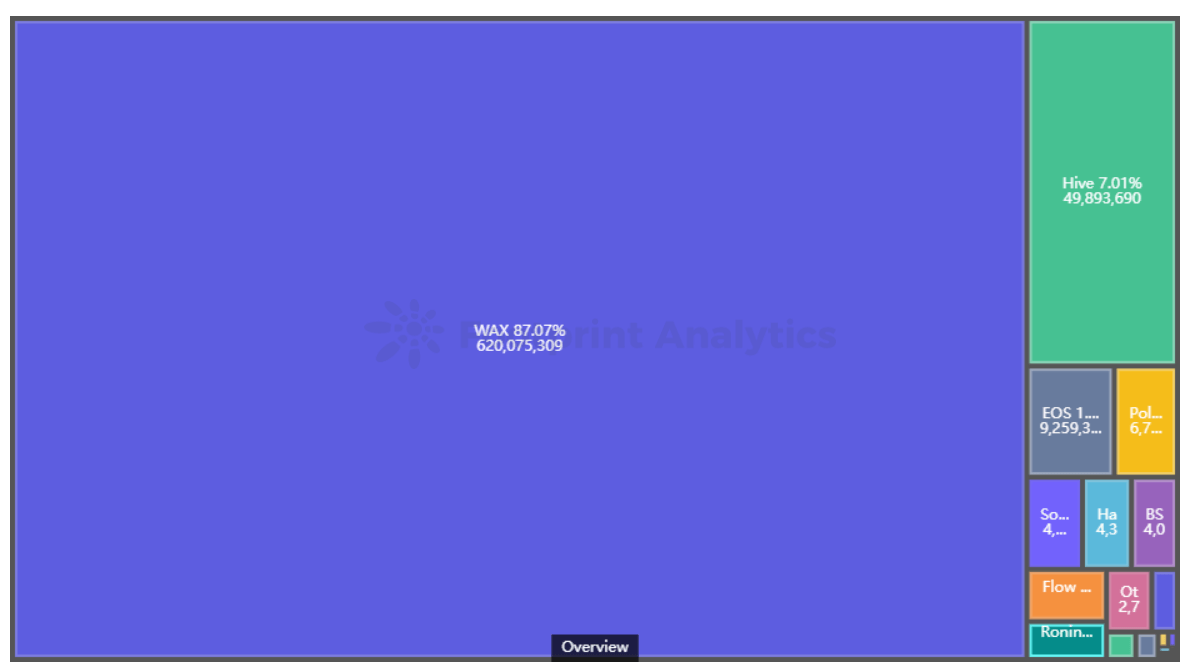

GameFi project count-up is 2.9% MoM, funding is 57.7% MoM

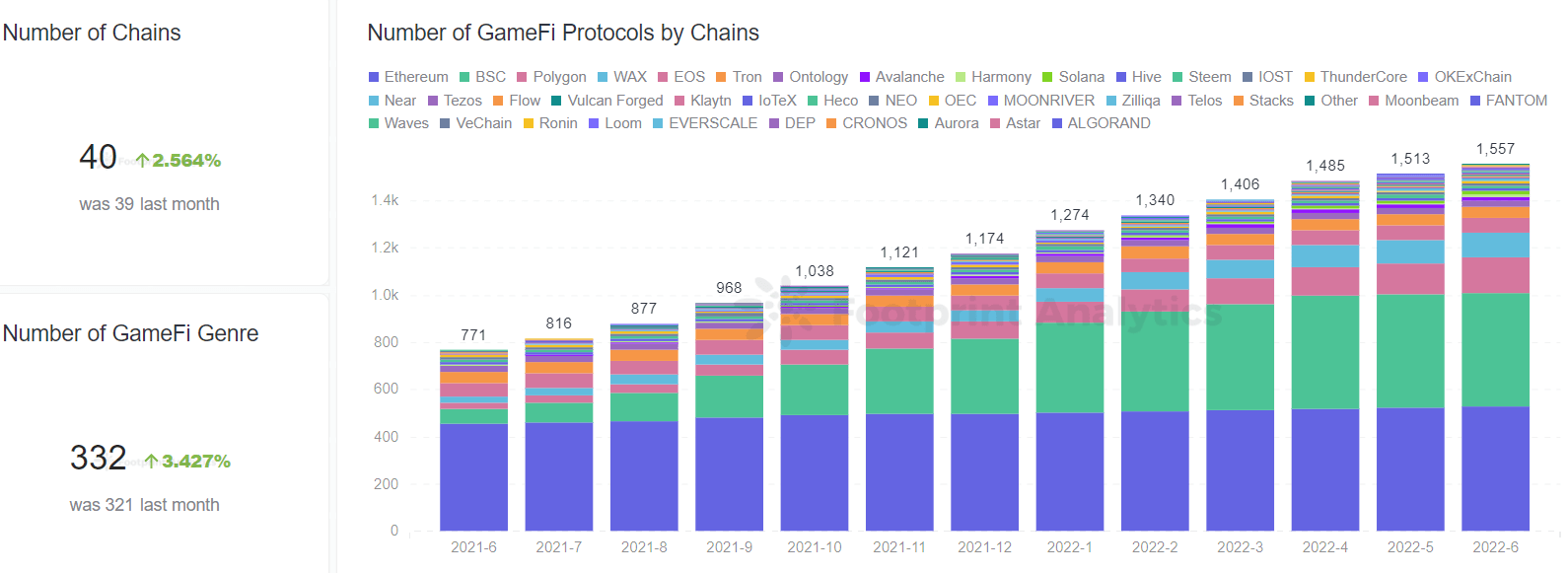

The number of GameFi games was 1,557, with a 2.9% increase in MoM. Newly released GameFi projects include MIND Games, Fishing Lands and Fantom Survivor. Currently, there are few transactions and users.

The market is very afraid, but it does not prevent the emergence of new projects.

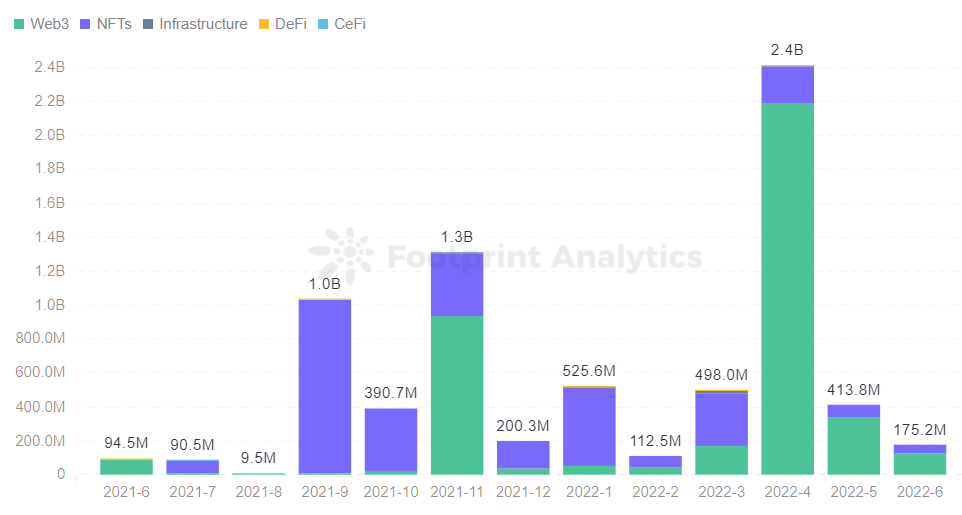

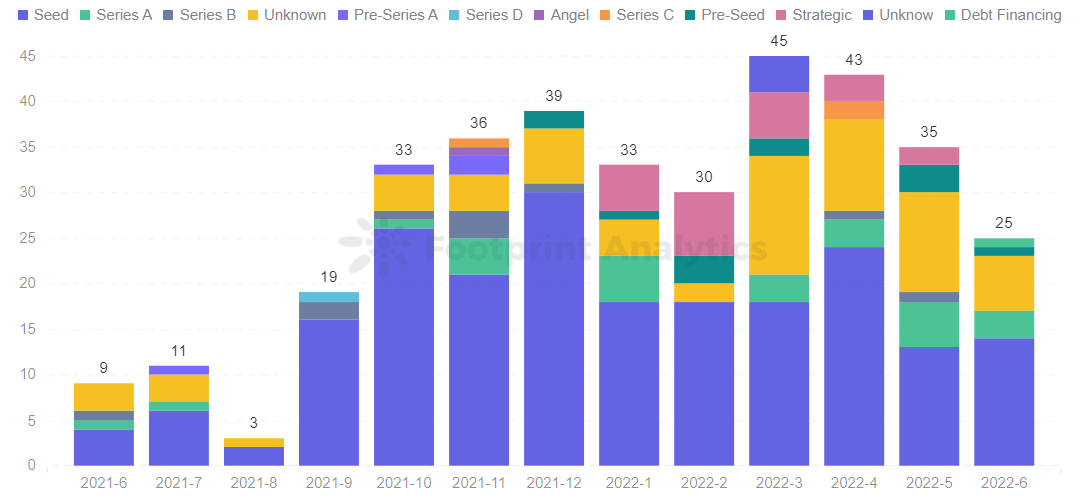

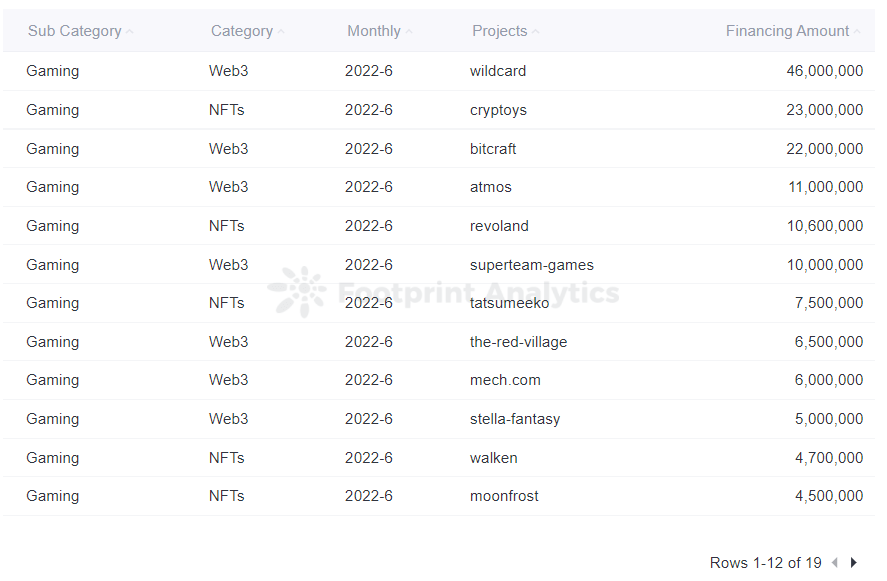

Financing fell by $ 239 million, or 57.7%, from May. There were more seed rounds than any other type when it comes to the number of funding rounds.

Capital flowed primarily into the Web3 and NFT categories. Wildcard, one of the Web3 projects, received $ 46 million and became one of the few dark horses in the bear market. Cryptoys, a digitally collectable NFT toy project, has completed a $ 23 million round led by a16z.

Total GameFi users down 26.9% MoM, volume down from $ 547 million to $ 382 million

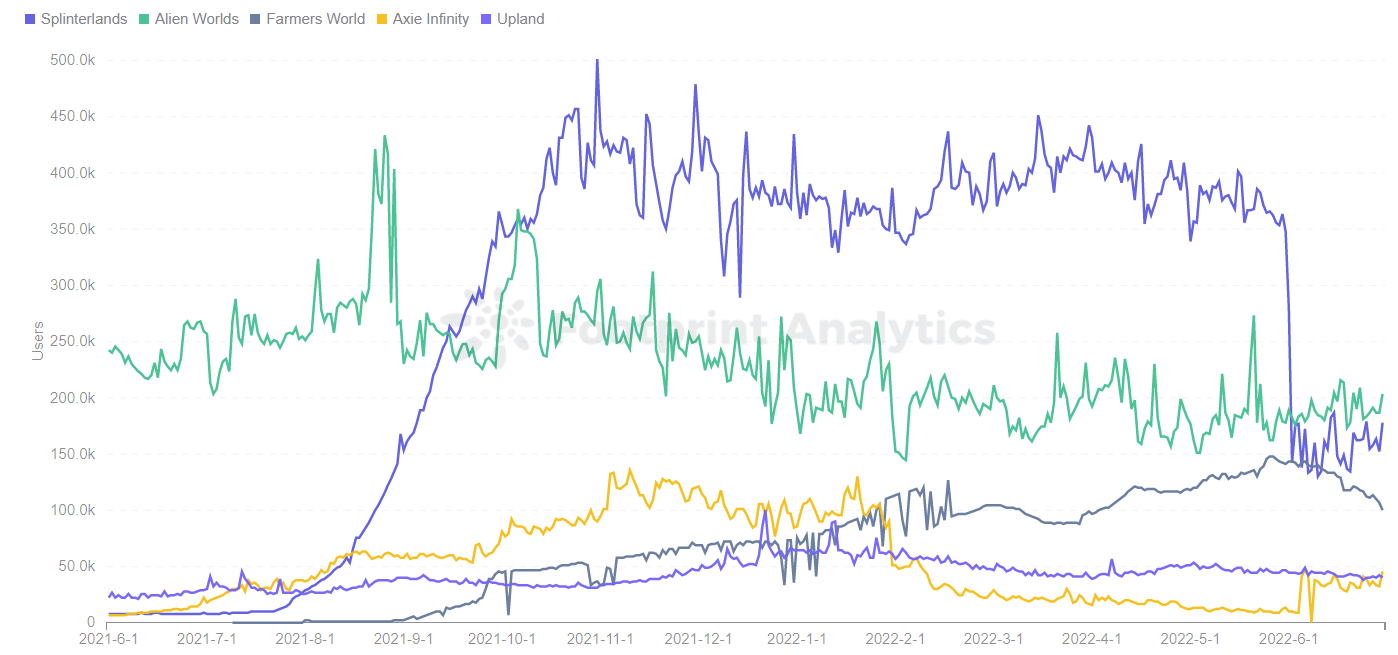

Despite the emergence of more innovative games and projects, the macroeconomic environment and the volatility of the crypto market have reduced the number of active users from a peak of 3.58 million. January To 1.46 million by the end of June. The number of new users has gradually decreased to 500,000. Compared to May, the number of active users decreased by 26.9% and the number of new users decreased by 16.1%.

In addition, the overall trading volume in June decreased from May, down 30.3% from the previous month.

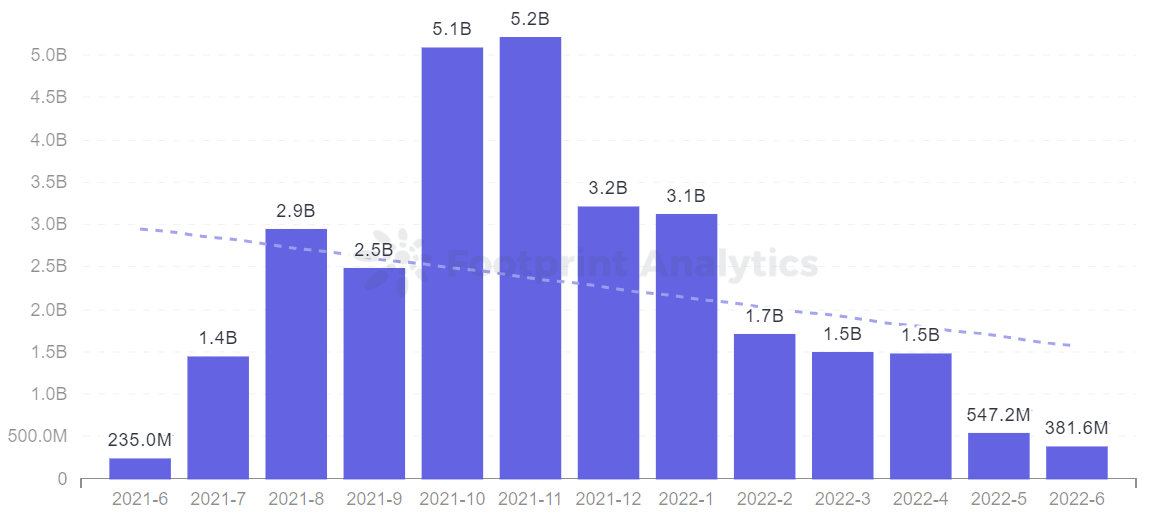

WAX has the most GameFi transactions in all chains, accounting for 87% of the total. This is due to the top two game projects, Farmers World and Alien World. Both maintain a stable number of transactions and users during the bare market.

GameFi project analysis in the bear market

Binary X has quietly revived after entering the stage of death

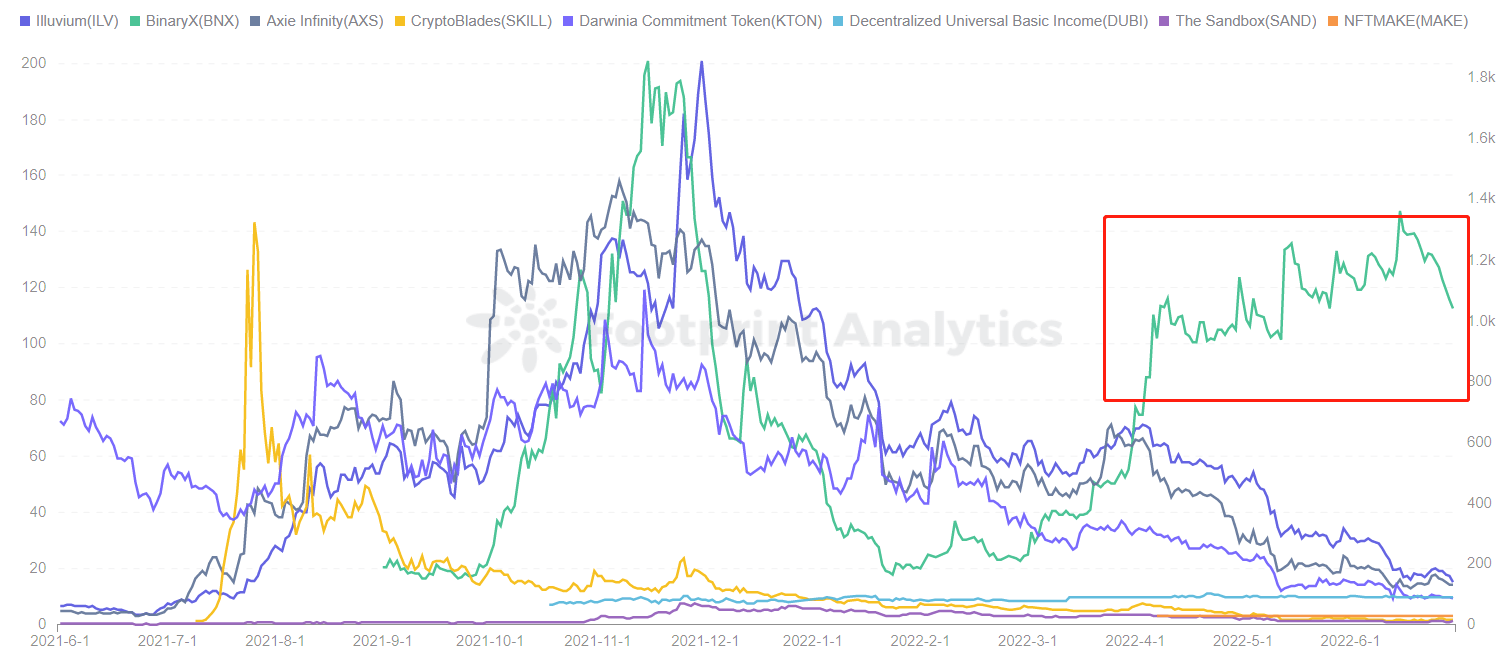

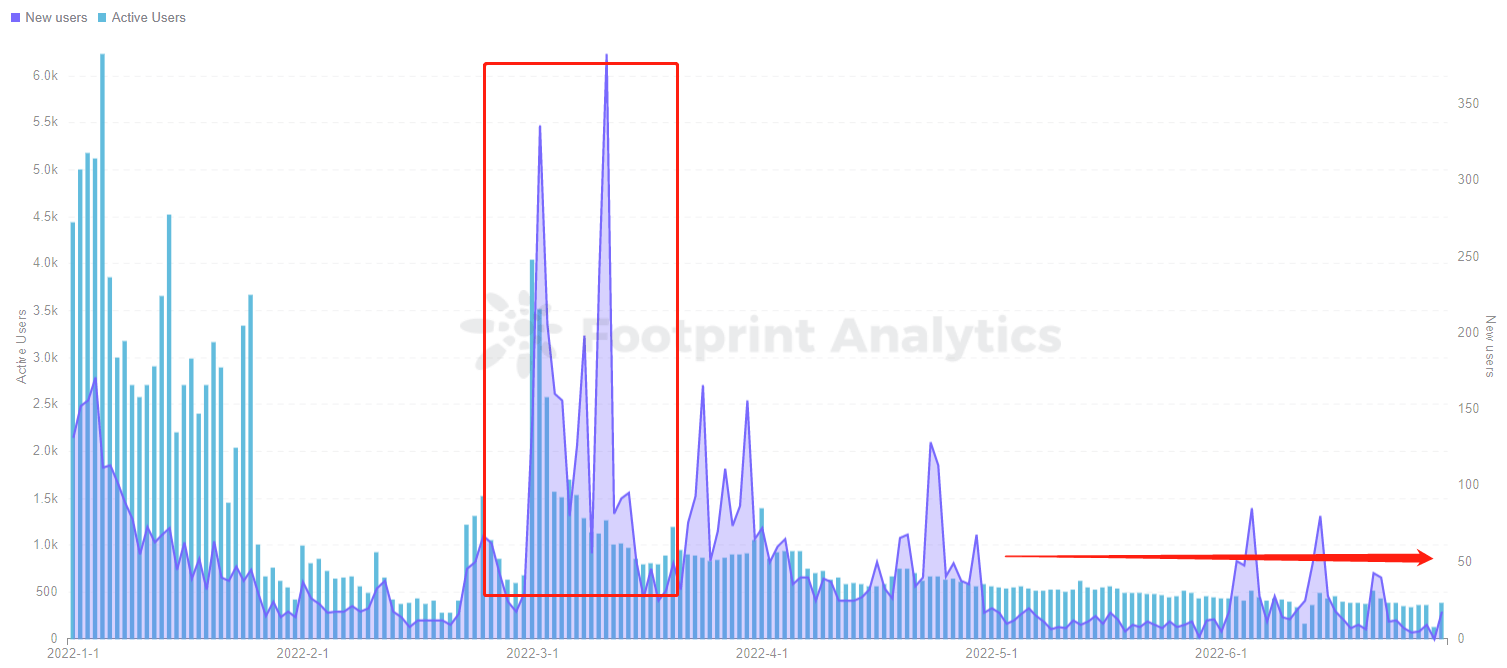

With the bear market in full swing, NFTs and tokens have been devalued as part of ATH in previously profitable projects such as Bomb Crypto, DeFi Kingdoms and StepN. BinaryX was originally a trading protocol that moved to GameFi and launched a successful title called Cyber Dragon, which seemed to be one of many projects.

BinaryX issued the Governance Token BNX for $ 20.62 in September. In November, Binance announced that BNX is participating in the Innovation Board and can be deposited on the platform as a currency for money demand. The currency has no pledge period and holders can buy directly for any number of days to earn income with a 15% APR. As a result, BNX reached a record high of $ 200.71 on November 15, an increase of 873%.

But the good times didn’t last long. The developers of BNX Cyber Dragon have changed their character upgrades several times to make more money in-game. You must use gold to upgrade.

As a result, most players sell their gaming assets and leave the market, resulting in a rapid decline in revenue and difficulty in attracting new users. This reduced BNX from $ 200.71 for ATH on November 15th to $ 17.71 for ATL.

To save the project, BinaryX released Cyber Dragon V2 in March, adding new gameplay and modes. It also includes new casting and upgrade mechanisms for heroes, hoping to add stability to the price.

Notable new GameFi project

On June 14, Playful Studios’ gaming ecosystem, the Wildcard Alliance, announced the end of a $ 46 million Series A round.

The funds were for wildcards, a hybrid multiplayer online battle game. Participants can not only compete with each other for NFTs, but also interact and trade directly with in-game fans and owners.

In the current market environment of significant devaluation of virtual assets, wildcards were able to raise huge amounts of money to support the development of the project.

Overview

The overall market continued to slide alongside the crypto market in June, but individual developments in the GameFi sector show that it may be more resilient than many believe.

June event review

NFT & GameFi

- Stepn returns to the top of the crypto market with a 75% price spike in the last 7 days

- Yuga Labs breaks silence, X2Y2 surpasses OpenSea

- NBA Top Shot Leads with 901.95% Increase in Sales

- Paris Saint-Germain and Jay Chou announce an exclusive series of 10,000 “Tiger Champs” NFTS

- Phantom and Magic Eden partners provide an integrated user experience for Solana NFT collectors

Metaverse and Web3

- Land prices in Metaverse soar 879% since 2019

- Bertelsmann raises $ 500 million for India and focuses on early stage investment in Web3

- LayerThree Ventures Announces $ 30 Million Web3 Cryptographic Fund and Accelerator

- A “Very Ambitious” $ 100 Million Metaverse R & D Hub Is Being Built in Melbourne

- Facebook Pay will be rebranded to MetaPay as Zuckerberg details plans to create a digital wallet for the Metaverse

DeFi and tokens

- Lido moves to a two-phase voting governance model with a traditional voting phase and an opposition phase

- Following BTC price cuts, Bitcoin miners will benefit from a 2.35% difficulty reduction

- Addresses starting with 0x40 paid about 13.4 million stablecoins to repay Aave’s debt

- Layer 2 TVL fell to $ 3.78 billion, down 20.77% in 7 days

- The Largest BTC Whale Purchased 927 BTC This Month

Network and infrastructure

- Arbitram suspends Odyssey as Layer 2 charges exceed Ethereum’s mainnet charges

- Axie Infinity will resume Ronin Bridge months after a $ 625 million exploit

- Ethereum’s energy consumption is expected to decline sharply as mining profitability declines

- Cross-chain bridge Horizon attacker batch forwarded 6012ETH to Tornado Cash

- Tether to perform a full audit by the top 12 companies for transparency of USDT reserves

institution

- Genesis faces “hundreds of millions” in losses as 3AC exposure replaces crypto lenders

- Technology Founder Global Alliance Entrepreneur First Raises $ 158 Million in Series C Financing

- CryptoExchange Unizen receives $ 200 million “capital commitment” from Investment Group GEM

- Crypto.com app now accepts Apple Pay

- Coinbase adds support for on-chain polygons and solana transactions

World wide

- Central Bank of Taiwan Governor is considering a non-interest-bearing CBDC design to prevent statutory deposits from flying

- North Korea maintains its lead in crypto crimes, stealing more than $ 1.5 billion

- Russian Parliament approves tax cuts for issuers of digital assets

- President of the Central African Republic launches crypto initiative following Bitcoin adoption

- New York cryptocurrency Moratorium stops

This work has been contributed by Footprint analysis community By Vinci.

Data Source: Footprint Analysis- June 2022 GameFi Report

The Footprint Community is a place where data and crypto enthusiasts around the world can gain insights and insights into Web3, Metaverse, DeFi, GameFi, or other areas of the new world of blockchain. Here, lively and diverse voices support each other and move the community forward.