Global shift away from the US dollar prompts offloading of US treasuries

quick take

- As economic volatility increases around the world, reserve currency concerns are constantly being called into question.

- Reserve currencies tend to last about 100 years. We hear this is the last day of decades of US dollar hegemony.

- We do not expect the dollar to lose its reserve currency position any time soon. But news stories in recent weeks, especially since the invasion of Ukraine, do not bode well for freezing Russia out of the swift system.

- CryptoSlate recently produced a market report on de-dollarization and its impact on Bitcoin.

- US Treasuries are the benchmark for the global economy and are considered the world’s “risk-free” rate. But major countries, especially China and Japan, have started to offload their treasuries.

- China sold almost 18% of its holdings in the last 12 months, while Japan sold 17% of its government bonds over the same period.

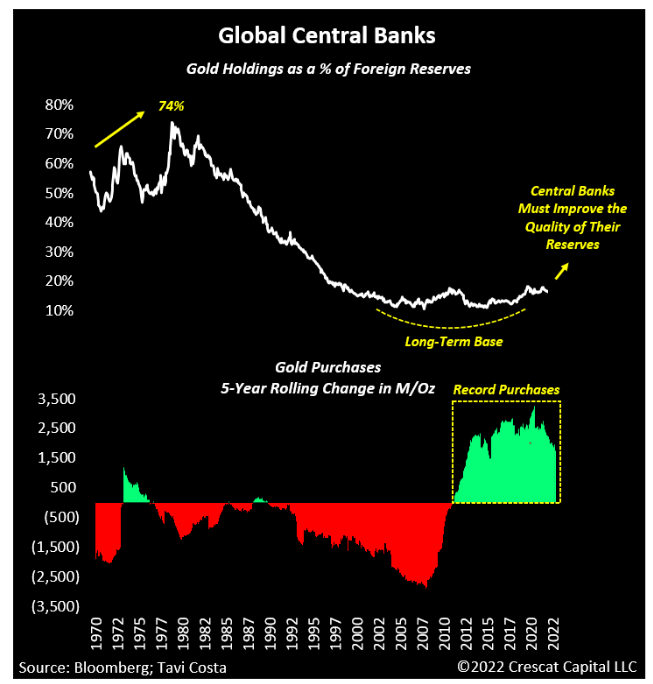

- This coincides with a time when global central banks, mostly in the East, are increasing their holdings of gold in their foreign exchange reserves.

The global shift away from the post-USD has prompted the offloading of US Treasuries, first appearing on CryptoSlate.