GPU mining could eventually be profitable after Ethereum moves to proof of stake

Ethereum is by far Most popular Cryptocurrency for GPU miners. However, there is little time for Ethereum to reach the proof of work state. When integrated with the Beacon Chain later this year, it will move to Proof of Stake.

What about GPU miners? Where does hash power end up? There are many options, but will any of them make a profit after the hash rate has increased significantly?

Ethereum Marge

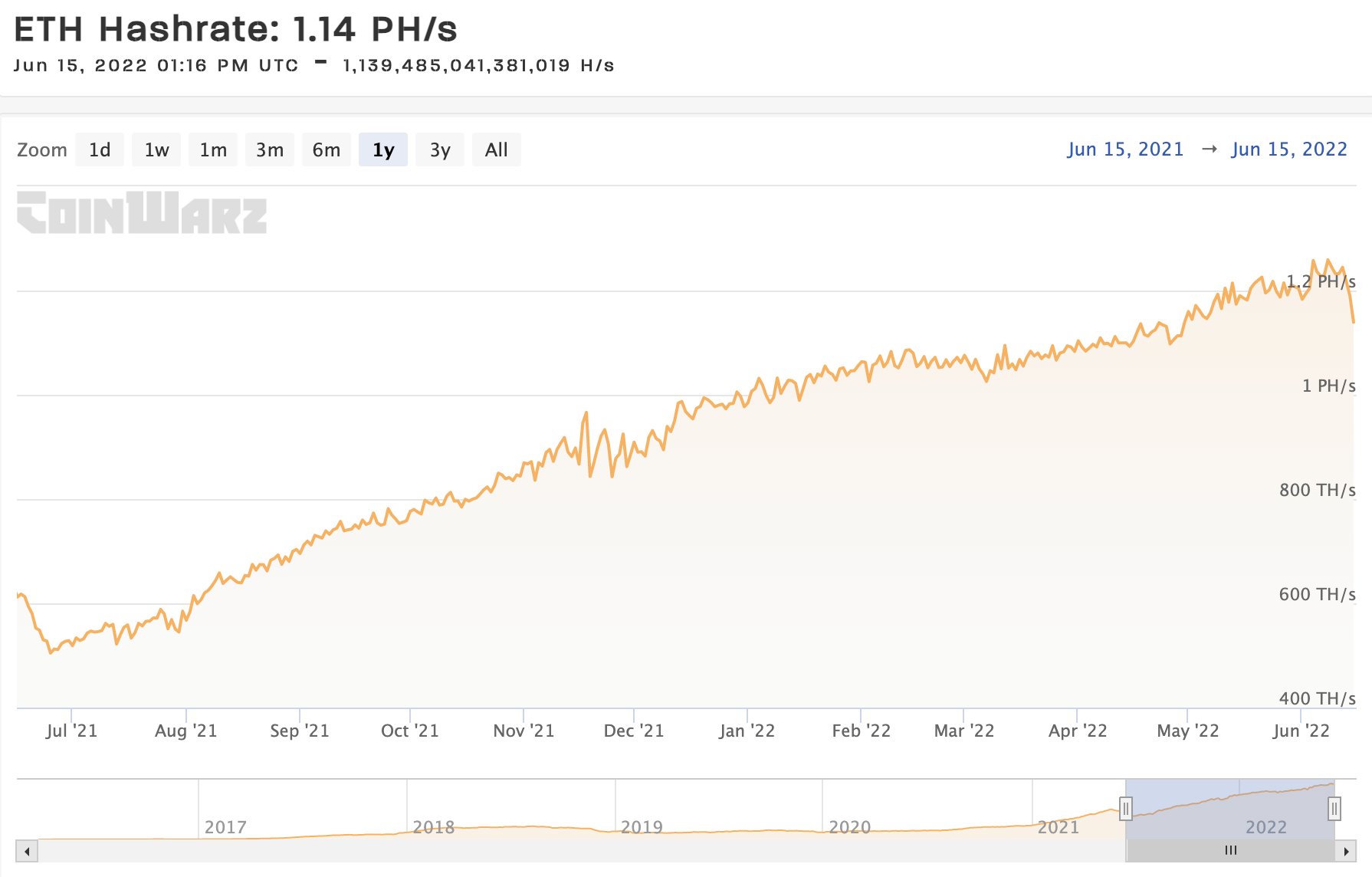

The decline of the crypto market has made even Ethereum mining unprofitable for many miners. However, once Ethereum moves to Proof of Stake, GPU miners will no longer be able to mine Ethereum. As prices fell, energy costs increased, and the merger date approached, the hash rate of the Ethereum network dropped dramatically.

Lowering the hash rate makes mining less difficult and makes the GPU more efficient. Still, the 10% decline is doing nothing to cover other factors that reduce the profitability of the Ethereum mining industry.

This information suggests that the miner is turning off the machine as the returns decrease.Only miners paying less than 0.235kwh using the latest generation GPUs You can make a profit now Ethereum mining. For example, a mining rig made up of AMD Vega 64 cards, one of the most cost-effective GPUs in Brulan in 2021, will require energy costs of less than 0.18kwh to be profitable.

So the question is what the miner is doing with the GPU when he leaves Ethereum.

POW altcoin mined by GPU

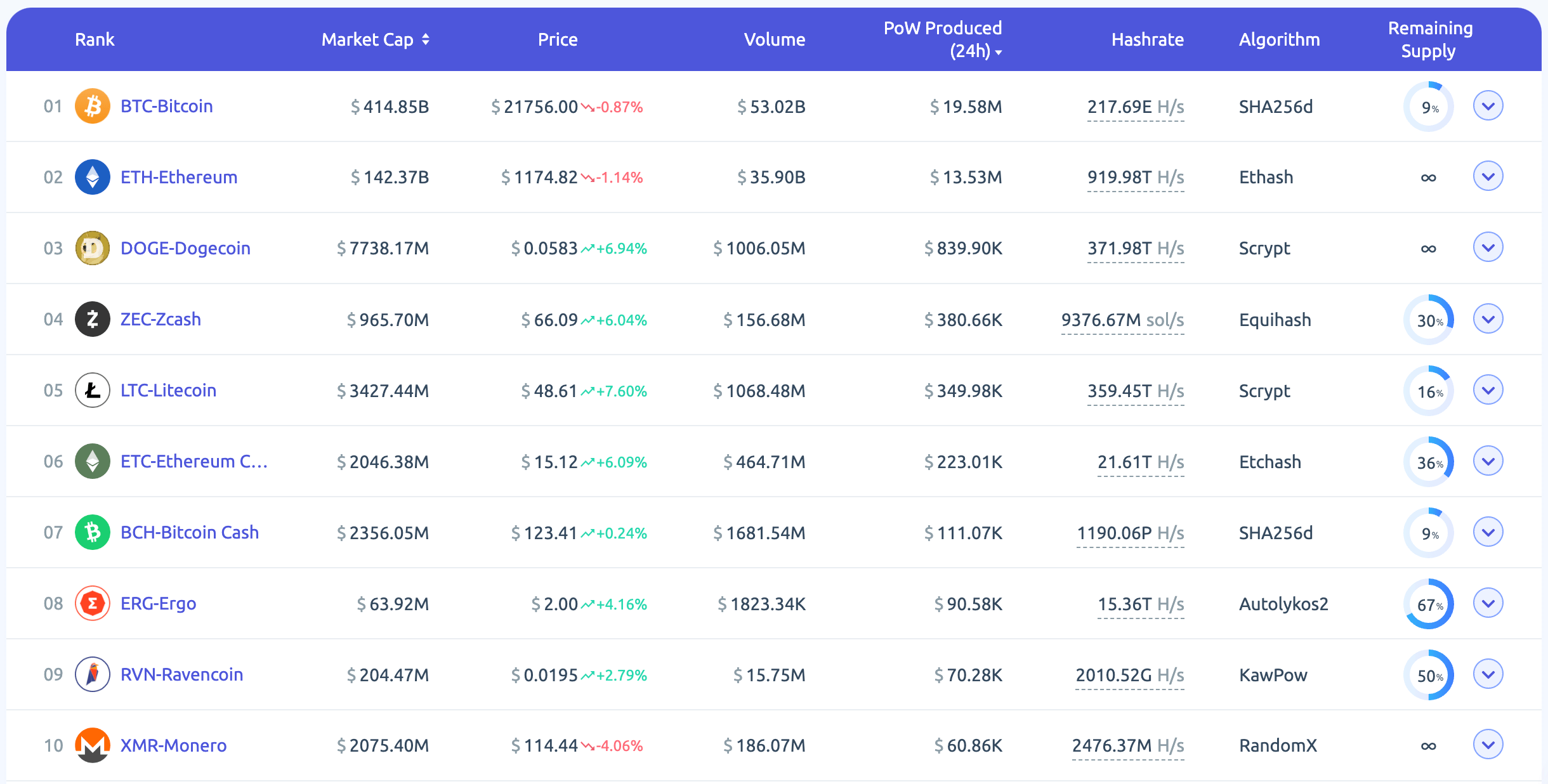

BitPro’s Mark d’Aria Chewy Numbers about the future of other altcoins and GPU mining. He concluded, “There may be a renaissance in GPU mining, and we’ll do this again.” Miners cannot simply switch to another slightly less profitable coin due to the influx of hash power that comes after the Proof of Work is turned off in Ethereum.However, below is a list of top proof-of-work cryptocurrency candidates and their candidates. Hash rate..

- ETH hash rate: 1.14 PH / s

- ERGO hash rate 12.62TH / s

- XMR hash rate: 2.51 GH / s

- ZEC hash rate: 8.53 GH / s

- RVN hash rate: 2.20 TH / s

- ETC hash rate: 18.85 TH / s

To understand how to calculate which of these coins can occupy the mantle of the king of GPU mining, you need to understand the following formula:

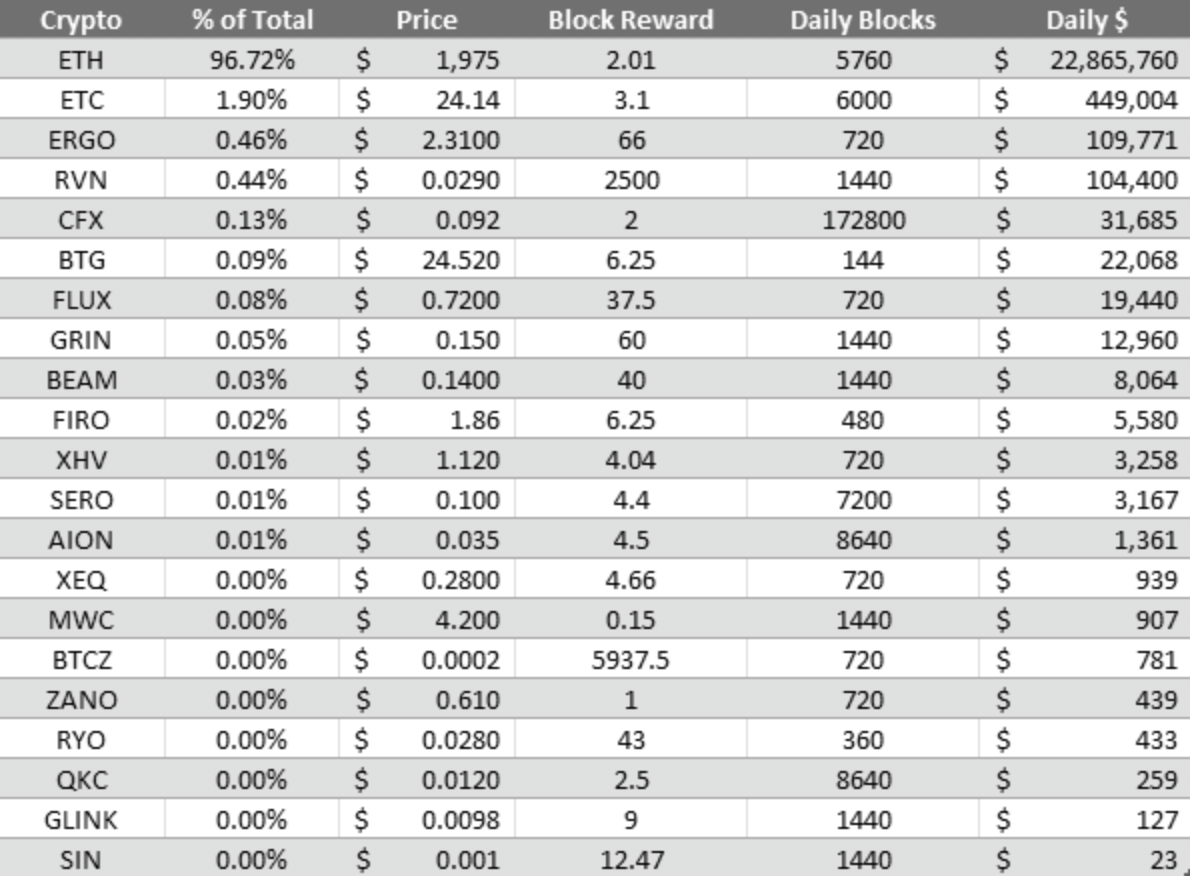

Price per coin x block reward x block per day = total income per day.

d’Aria has created the following table to highlight the daily income of the most popular Proof of Work coins.

Without understanding Total mining income For each coin, you may miss that “the mining calculator does not show the relative hash power and income of the various coins when displaying all these alternatives to ETH”. d’Aria explains what it means in an easy-to-understand manner.

“of [the] An oversimplified base case scenario, nothing changes between present and merge. All crypto prices, total hash powers and block rewards remain the same. On the merge date, all GPUs will be diverted to other coins. Currently, 10 million GPUs are left to split about $ 775,000. Average income per GPU? $0.0775.“”

In addition, in a more positive bullish case, d’Aria calculates that the average GPU revenue will be only $ 0.30 per day, even if all crypto prices double and only half of the miners continue. Did. In the end, he said:

“In reality, there are no good results for miners here on the day of the merger. Miracles need to happen just to keep things as they are. Winter is coming.”

The increase in hash power distributed throughout the current ecosystem cannot realistically lead to profitable GPU mining of cryptocurrencies at today’s prices. However, not everything is lost. CryptoSlate We talked to Stefan Ristic at bitcoinminingsoftware.com, who raised another possibility.

“The post-merger era isn’t easy for miners, but I don’t think it’s that bad. First of all, I think the role of miners is pretty much ignored in such articles. Bitcoin is still there. When it wasn’t tradable, it was the miners who led the hiring … the merger got worse and Ethereum couldn’t rule out the option of falling back to prisoners. “

Still, GPU miners can’t take advantage of merging to secure the future. Ristic has used the history of Bitcoin to predict the increasing adoption of another proof-of-work cryptocurrency.

“Miners are the strength of every PoW cryptocurrency, and when we see millions of miners starting to protect another cryptocurrency, this logically increases their adoption and reflects on their prices. must.”

In support of this paper, Bryan Myint, Senior Director of Advisory for Republic Crypto, said: CryptoSlate“The market addresses the void by devising other ways to implement blockchain consensus and infrastructure support using PoW.”

One such method was proposed by Stephen Ross, Lead Infrastructure Engineer at Republic Crypto. He states: future. “

Profitability after merger

Regardless of math, many people favor post-merging GPU mining. Mining company, Nicehash, suggestion “When Ethereum moves to PoS, mining doesn’t end. There are still many interesting proof-of-work projects that miners can direct their hash power to.” Still, in this article, we’ll look at the total hashing power of the Ethereum network. Little is said about the impact of dropping on a new chain.Nice hash Promotion Ravencoin, Flux, and Ergo as alternatives to Ethereum without considering Dahlia’s mathematics.

d’Aria concludes his article by saying that GPU miners may have to wait for a while until a useful alternative comes up. It’s important to note that BitPro buys and sells GPUs, so it has a vested interest in GPU miners who sell rigs. But mathematics doesn’t lie. GPU mining can be a very difficult time on the merge date. Profitability will undoubtedly drop to unsustainable levels. Still, miners have become a staple of the crypto industry since 2009. Ristic points out a very useful point, stating that the power of miners’ decentralized networks is unmatched.

With Ravencoin’s hash power increased by 500 times, it will become one of the most secure assets in cryptocurrencies. Ravencoin could become the new Ethereum if prices soar in similar multiples. Pay attention to the hash rates of the above currencies as the same is possible with all GPU minable coins. It can be a very bullish signal.