How inflation and debased fiat currencies are pushing investors to Bitcoin

Bitcoin’s reputation as a safe-haven asset has long been debated by the traditional financial world. The lack of centralized control, extreme price volatility and novelty made it difficult to classify as inflation or recession resistant.

But over the past year, during times of uncertainty, investors have continued to choose Bitcoin over fiat currencies.

Inflation leads to Bitcoin

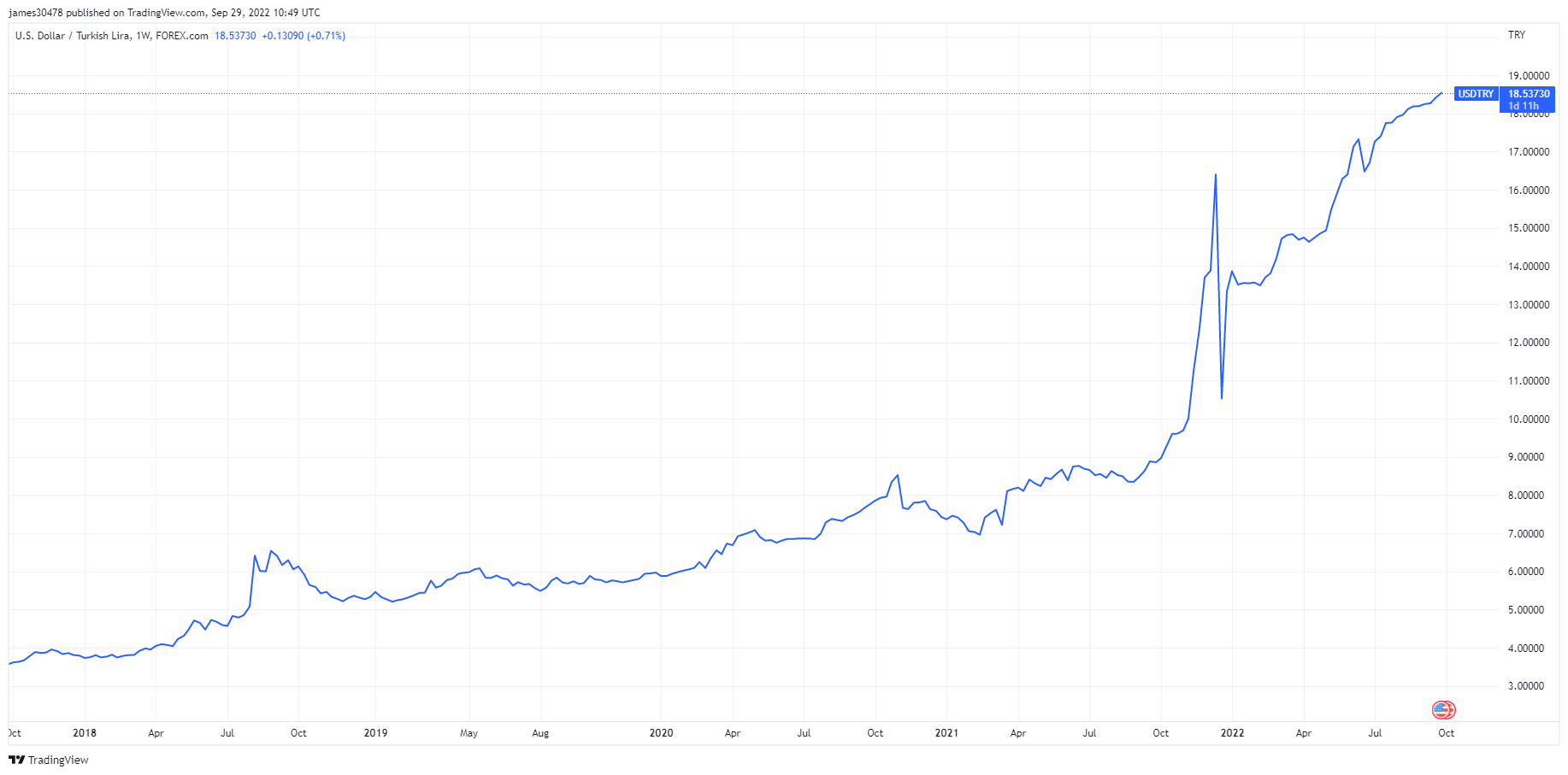

For example, consider the Turkish Lira (TRY).The currency has been steadily depreciating since 2018, and the cumulative inflation rate over the past three years surpass 100%. Since the beginning of the year, the lira has lost 26% of its value against the US dollar (USD). PwC Classified Turkey is a hyperinflationary economy in a September report, which said the deterioration began in 2021 and worsened in mid-summer 2022.

The exchange rate in 2017 was 1 USD per 3.5 TRY, now it is 1 USD per 18 TRY. This has created a huge amount of USD/TRY trading volume, which has been parabolic since the beginning of the year.

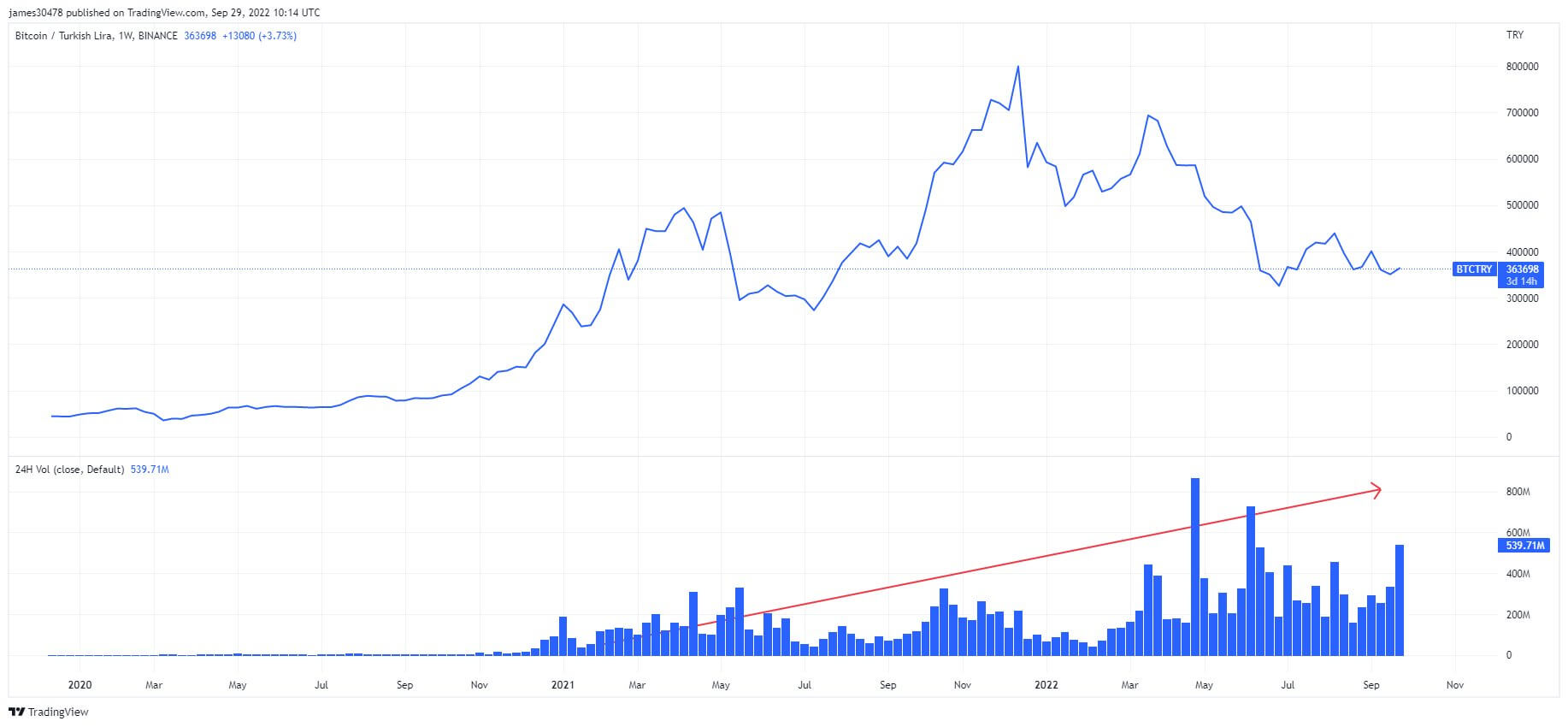

The US dollar is not the only currency that Turks flock to.

BTC/TRY trading volume on centralized exchanges is steadily increasing. According to Binance data, the price of Bitcoin on his TRY jumped to his ATH at the beginning of 2022, and his 24-hour trading volume on the pair peaked in his May of this year.

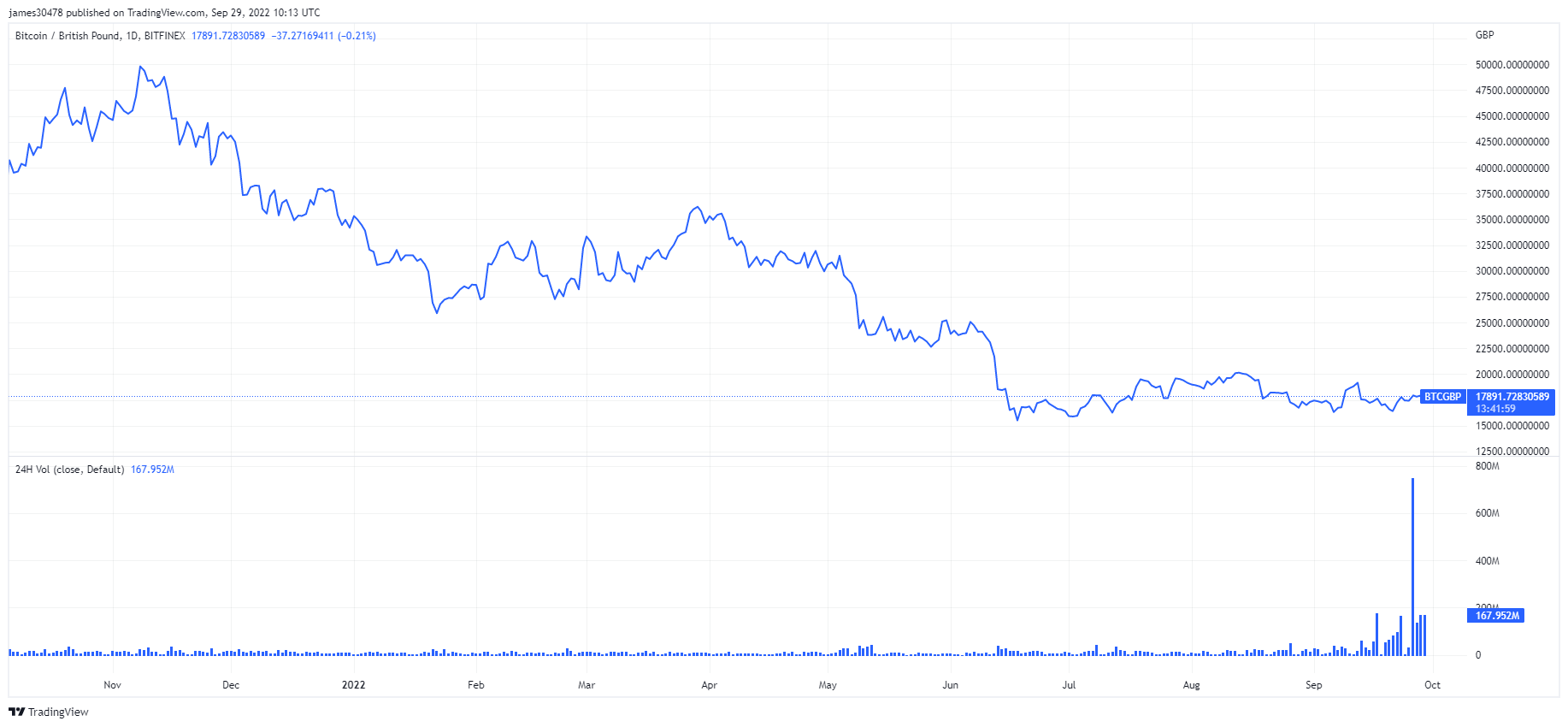

On September 26, 2022, the British pound experienced a flash crash comparable to that recorded on Black Wednesday in 1992, losing 4.3% of its value against the US dollar in a single day. As CryptoSlate has previously covered, the drop is the result of the Bank of England’s emergency intervention in the bond market.

On the same day that the pound hit its worst drop in 30 years, BTC/GBP trading volume hit the ATH, soaring over 1,200% in 24 hours.

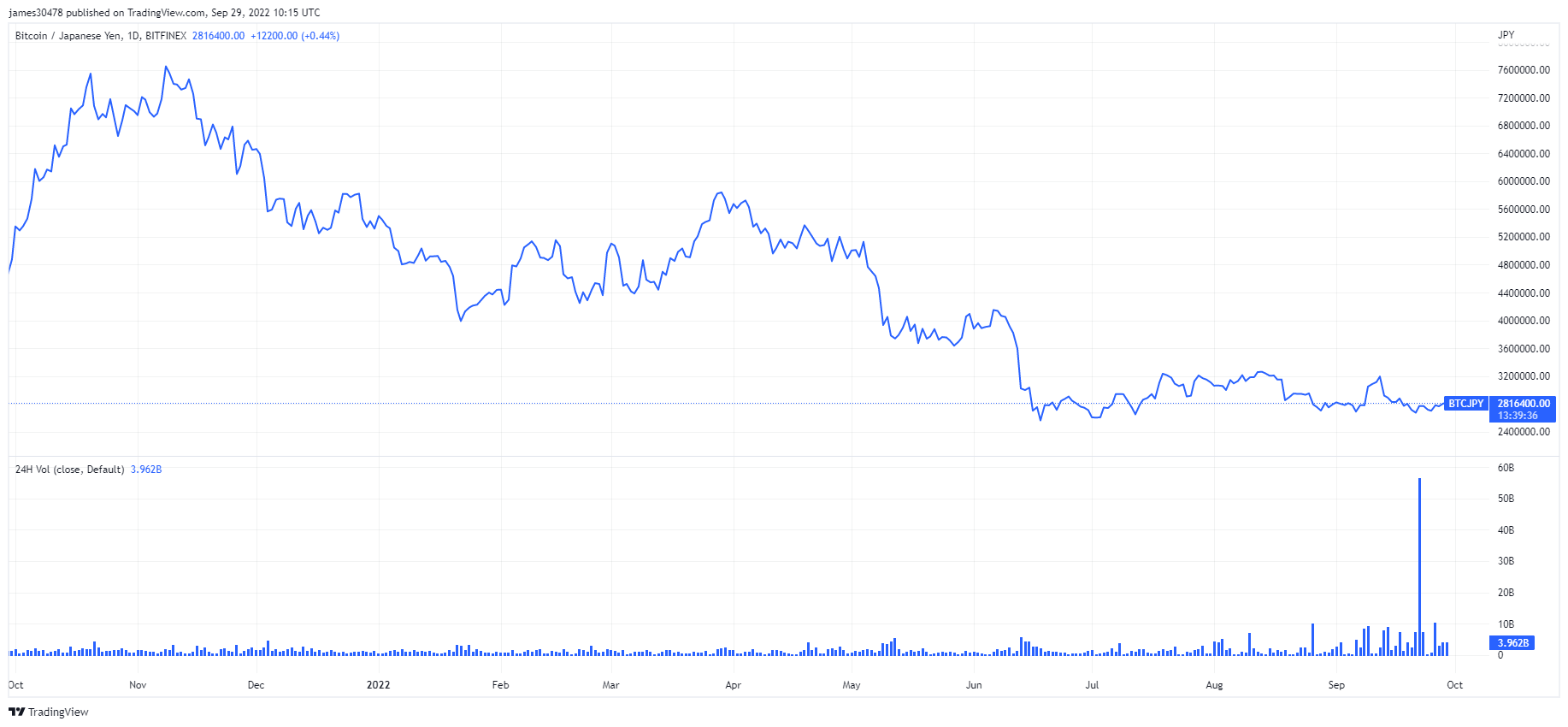

The situation is that the central bank exhaustion About $20 billion or ¥3.6 trillion intervened in the foreign exchange market to support the rapid depreciation of the yen. While this figure shows the government’s total spending on currency interventions for the entire month of September, it is widely believed that all of the $20 billion was spent on a single intervention on September 22nd.

It is now the largest and most significant dollar-selling-yen-buying intervention by the Bank of Japan, surpassing the 2.6 trillion yen record set in 1998. USD this year.

However, the relief was short-lived, with the yen trading at 144 yen to the dollar before the intervention and briefly reaching 140 yen thereafter. The next day, the yen fell to 145 yen to his dollar, rendering the intervention ineffective.

As the yen fell, Japanese investors also flocked to Bitcoin. BTC/JPY volume just peaked at the time of the intervention.

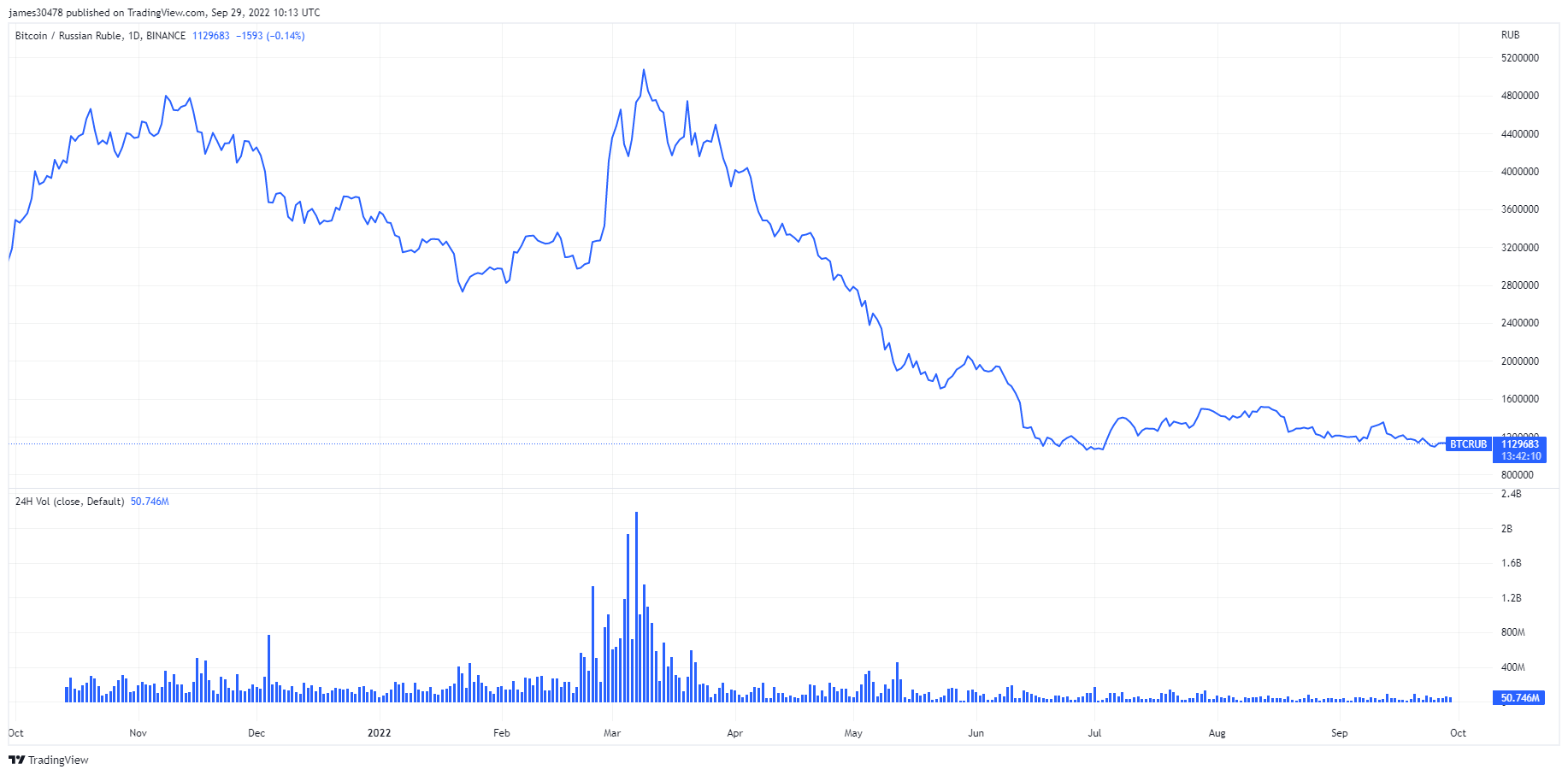

In Russia, BTC/RUB trading volume surged as the ruble fell to historic lows. As Russia launched its invasion of Ukraine and poured its money into Bitcoin, investors in the country turned to the hardest assets available.

The surge in Bitcoin trading volume does not indicate that large-scale adoption is imminent, but it does indicate that Bitcoin is beginning to act as a safe-haven asset. , In the face of inflation and currency depreciation, investors are flocking to Bitcoin en masse.