How low can Bitcoin price go?

Bitcoin (BTC), the flagship digital asset, has had a tough year, dropping 72% from its all-time high and losing more than 50% of its value this year alone.

On several occasions, the value of this asset fell below $20,000. During the bear market, BTC fell below the previous cycle high of $19,750 for the first time ever.

These scenarios have led to the rise of one of the most popular questions in the market: “How far can BTC go?”

First of all, the volatile nature of the cryptocurrency market is so unpredictable that there is no surefire way to determine this. To see just how unpredictable the market is, one need only look at how Ethereum (ETH) price performed after the highly anticipated consolidation. .

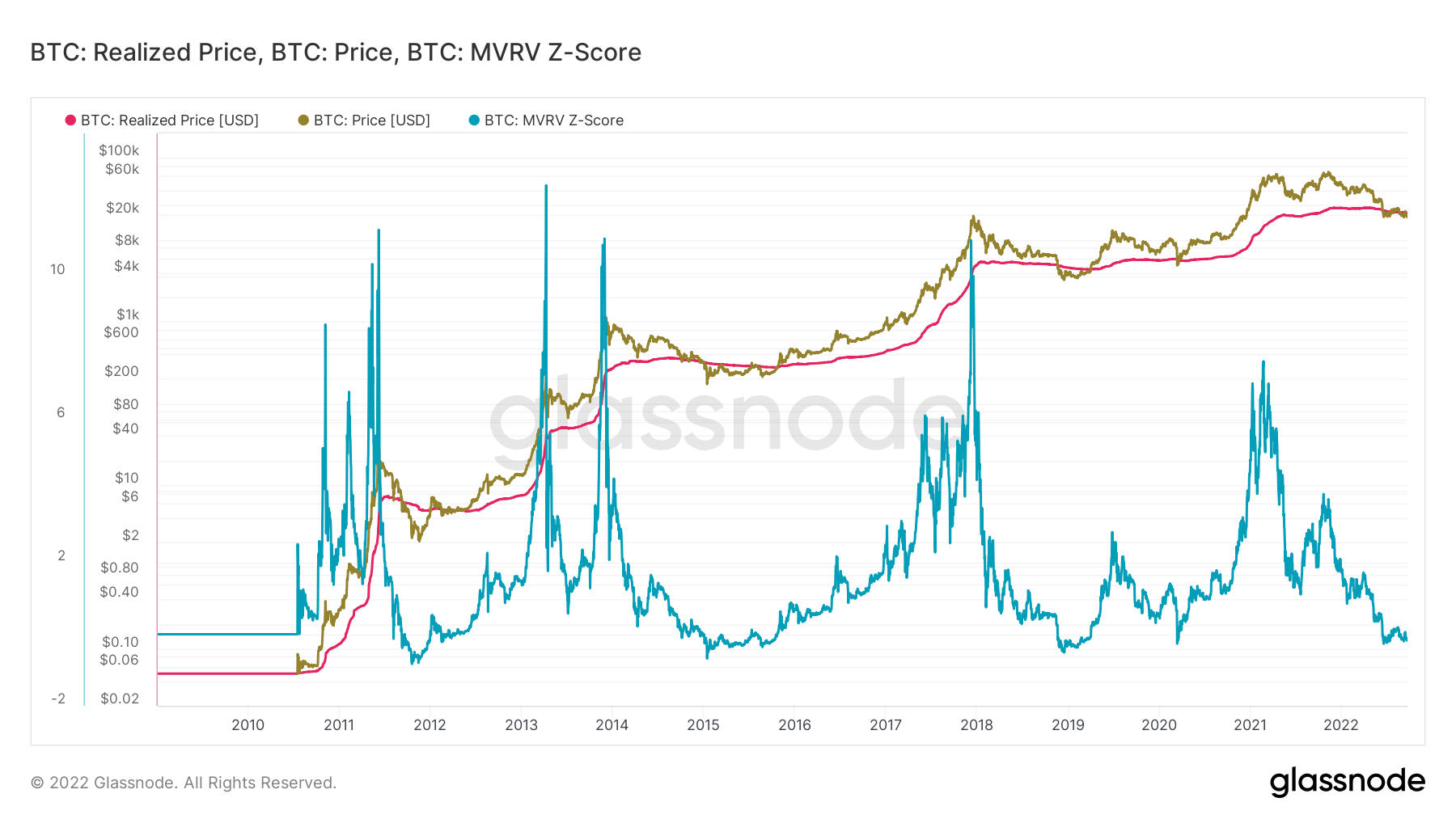

However, certain metrics such as the MVRV Z-score can be used to determine an asset’s price performance.

The MVRV Z-score is based on three metrics: Market Value (MV), Realized Value (RV), and Z-score. The realization score is the price of each bitcoin after it is transferred between wallets, and the Z-score is the deviation test between market value and realization value.

As such, the MVRV Z-score is defined as the ratio of market cap to realized market cap and the standard deviation of all historical market cap data, i.e. (market cap – realized market cap) / std(market cap).

In most cases, the MVRV Z-score can be used to determine if Bitcoin is overvalued or undervalued. Historically, when market value is significantly higher than realized value, it indicates a market top (red zone) and vice versa a market bottom (green zone). The MVRV Z-score shows that BTC is undervalued as the realized price is slightly higher than the market price.

The score is currently in the green zone, which suggests a market bottom and has been there since Terra LUNA collapsed.

As of September 21, with a Z-score of -0.14, which clearly indicates that the market value is less than the realized value. The MVRV at that time was 0.87.

Compared to the previous bear markets of 2020, 2019, 2014 and 2011, the market has been in this zone for 20-300 days and BTC price could stay in this range for another 6 months. It suggests that

On the other hand, the fact that MV indicates that it may have hit a bottom does not mean that BTC cannot fall further. suggests this is no ordinary bear market.

Former BitMEX CEO Arthur Hayes sharp This is in one of his essays. According to him, traders with long Bitcoin positions should watch out for $17,500.

Hayes continued that much of Bitcoin’s price will depend on US dollar liquidity, which has been tightened since November 2021. As the Fed plans to further eliminate liquidity, the taka Faction stance could test Bitcoin’s resilience.