How to find opportunities in a bear market

Since April, the cryptocurrency market has been in a serious recession.

Bitcoin is down 70% From the highest price ever Ethereum It’s down 80%.The whole ecosystem like LunaErased, with dozens of altcoins GameFi Tokens have lost almost all their value.

Investors can achieve passive returns in a bull market simply by investing in beta to follow common trends. But in the bear market, it doesn’t work. In this situation, you need to use alpha investment to find investment opportunities.

How to Invest in DeFi in the Bear Market

Find market trends using macro data

DeFi copies almost all traditional financial models, from lending to financial derivatives. The main differences between DeFi and traditional financial projects are the use of smart contracts, more transparent information about chains, and the creation of tokens as incentives.

Therefore, while DeFi has many of the characteristics of traditional finance, it lacks strong regulations and prices fluctuate significantly. DeFi has no real use cases other than making more money with cryptocurrencies. Most people find it difficult to onboard. Therefore, user growth has stagnated after the first boom of interest.

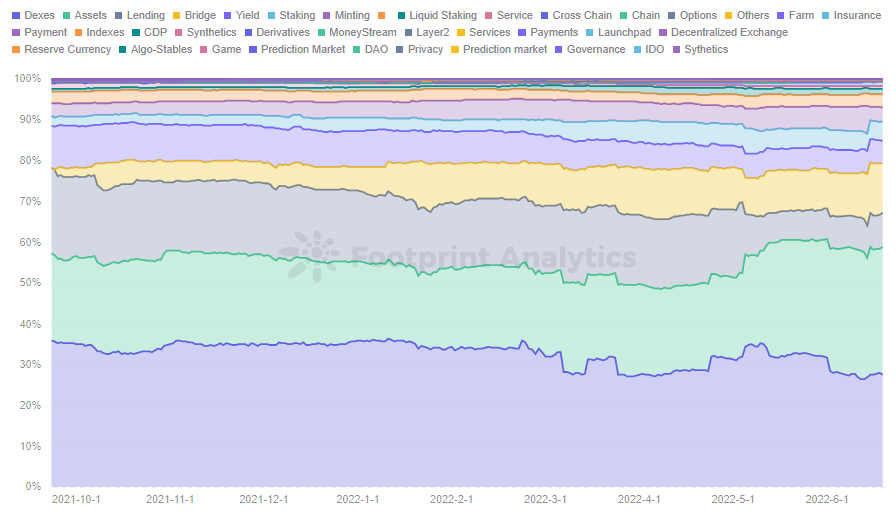

According to the data from Footprint analysisDEX does not remain the top category in DeFi by TVL, its market share has declined 40% to 27%. The lending project was wiped out and dropped from second place. 20% to 8%]. Asset and bridge projects currently occupy 31% and 12% of the market.

1. Use the dollar cost averaging method

The dollar cost averaging method is to allocate the same amount and invest regularly... This is in contrast to timing the market, selling at high prices and trying to buy at low prices.

I don’t know when the token will reach the bottom in the current macro environment. Therefore, it makes sense to incorporate the dollar cost averaging method into projects that are likely to survive in the long run. Steadily investing regular cash is less profitable than making a perfect swing trade, but it is safer.

2. Stablecoin investment

Using stablecoins is a relatively low-risk investment option, as FOMO’s sentiment due to the high volatility of cryptocurrencies makes it difficult to make good decisions, especially in the bare market. There is no shortage of investment in Stablecoin on both the lending platform and the DEX platform, and LPs formed with Stablecoin also protect against permanent losses. Stablecoin has many use cases and low volatility, but it is important to remember that there are risks.

However, after the UST crash, there are concerns about the security of Stablecoin due to the algorithm. The opaque information of centralized Stablecoin also presents certain security issues, and there are concerns about the liquidity risk of over-collateralized Stablecoin.

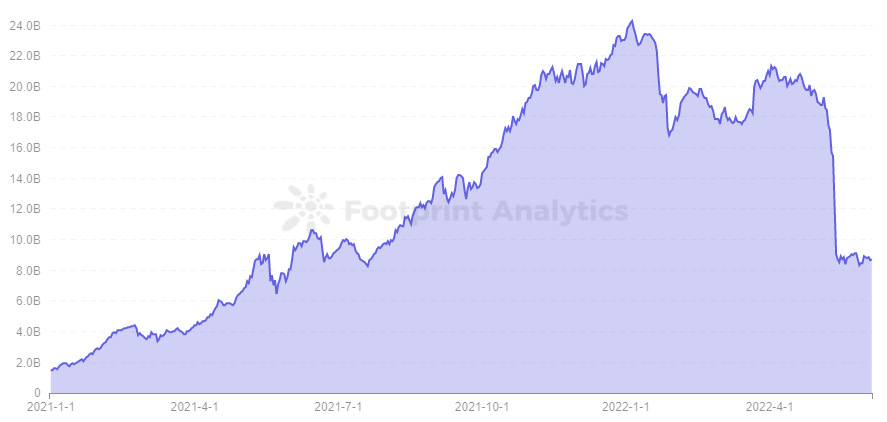

according to Footprint analysisDue to the plunge, the TVL of Curve, DeFi’s largest stablecoin DEX platform, plummeted. This indicates that Stablecoin is not very stable after all, so invest carefully.

How to Invest in GameFi in the Bear Market

Find market trends using macro data

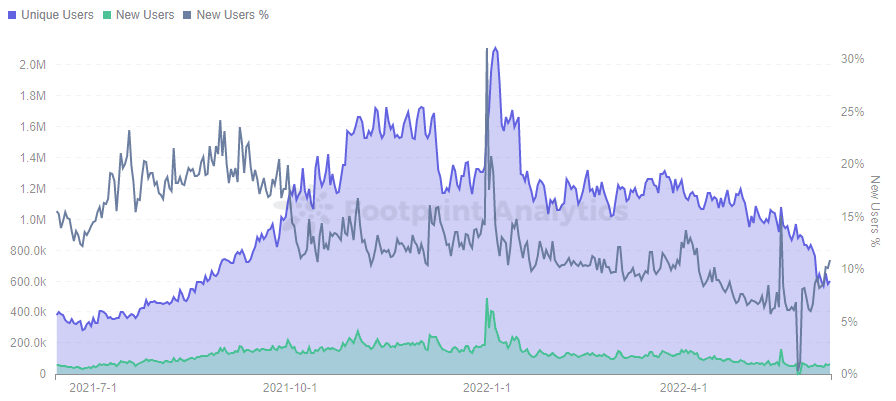

Data from Footprint analysis Shows that unique GameFi users grew to crescendo in late 2021, peaked again in January, and then oscillated downwards. A further significant decline was seen in late May, with new users gradually declining. On June 8th, there were 65,000 new users and 606,000 unique users, only 30% of the peak.

GameFi 1.0 is evolving rapidly and the most common emotion among players is boring. Today’s games are difficult to play, and most projects use only tokens as a reward mechanism to attract many mining and selling players. The project period is basically several months.

It is difficult to choose a project to invest in from many GameFi projects. This is a great way to evaluate your project in terms of project popularity, new player growth, old user retention, and token issuance.

By entering early, you are more likely to return your capital, while at the same time being able to timely pay attention to the dynamics of your project, make decisions, and seize opportunities the night before, depending on the dynamics of your project. increase. Fluctuations in token prices.

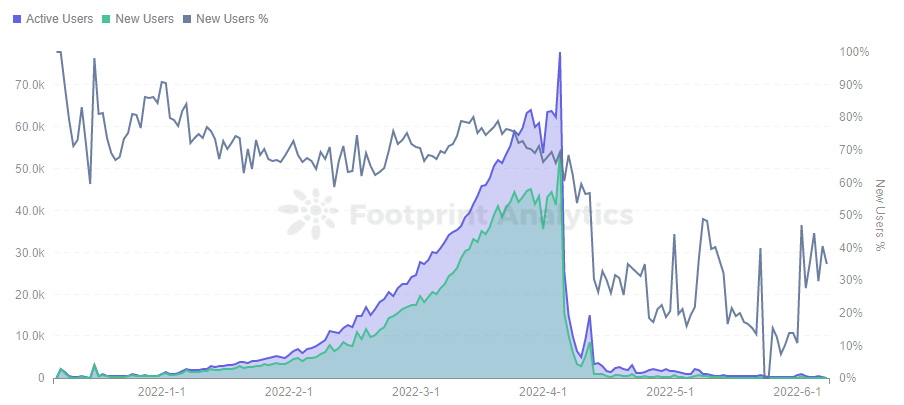

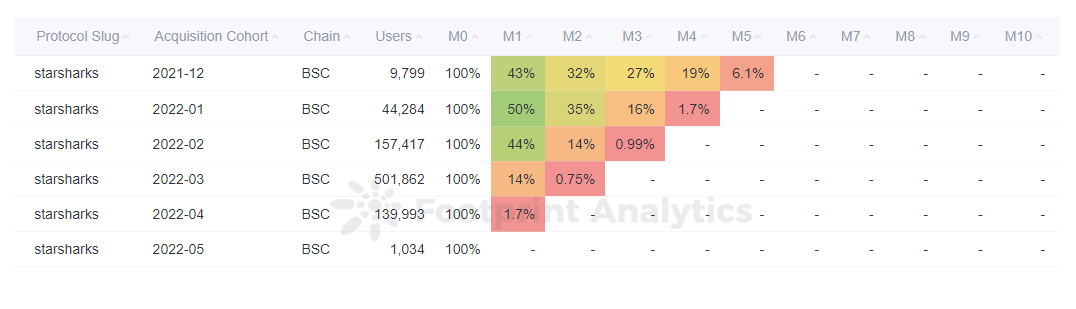

For example, many users StarSharks It was an early model and many users participated in the project.

However, the rapid influx of users caused overuse of tokens, and token inflation caused prices to fall. When the project owner noticed the problem and deleted the rental marketplace, user data also fell off the cliff, unable to attract new users, and the token price fell into a death spiral.

Drop-in StarSharks The retention rate of existing customers is also clear, with only 1.7% of users participating in the game in April continuing. Older users in the previous term have been lost, and only users who joined the company in December last year maintain a retention rate of 6.1%. This is probably because these users used NFTs at a low cost and basically returned sufficient capital. Pure income. Therefore, it is essential to choose the right time to enter.

In addition to paying attention to the macro situation of the entire market, macro management by the project is also important. This is the opposite of decentralization, but effective early management can prevent token prices from skyrocketing or plummeting, allowing your project to grow more permanently. Therefore, users should pay close attention to project dynamics, such as project communication and organizational activities in the community, to understand future directions and take corrective actions before changes occur. Is important.

As a GameFi bottleneck, some traditional developers have moved into the blockchain world, and VC has been working on 3A games for a long time. The most famous of these, Ilbium, has received a lot of attention and has a token price of $ 1,800. peak.

Although the cost of developing a 3A game is high and the duration is long, the beautiful graphics and rich playability of the game attract more players who value their intrinsic value. Whether they can break the Death Spiral spell can wait for this year’s online game performance.

Investing in the bear market should be fixed not only to speculation, but also to finding such valuable games. There is no doubt about the development capabilities of traditional game developers, but the economic model also needs to be paid attention to whether it can be adapted to the blockchain to create games suitable for cryptocurrency users.

- Pay attention to new ways to earn carefully

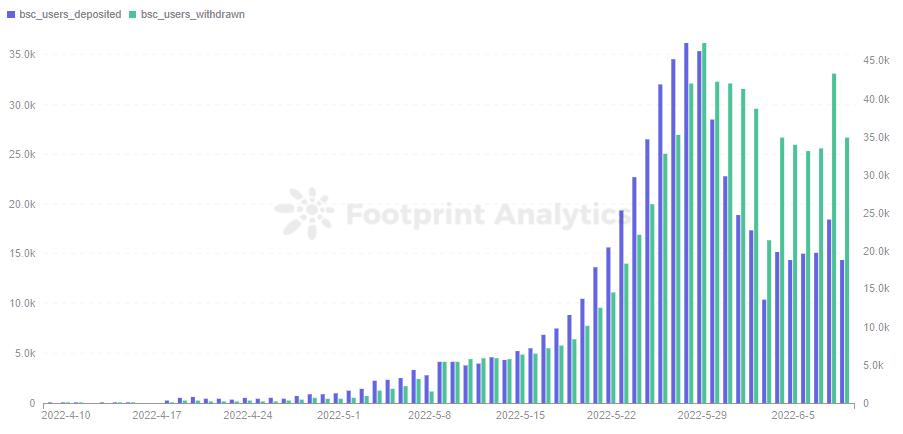

StepN is X-to-earn It was once thought to be a way to put the model at the forefront and get out of the spiral of death.However, due to a series of negative news, StepN from June Withdrawals exceeded BSC chain deposits and tokens were completely dropped.

Regardless of the success of the StepN attempt, the X-to-earn model will be an area of interest in the short term. It is important to look at more and choose carefully, analyze the value benefits of the project itself, and go to the bottom of the early stages of the project to minimize the risk of being trapped.

Overview

Traditional financial investors use insider information to outperform retailers. This still happens in cryptocurrencies, but blockchain data is open and transparent, allowing data researchers to narrow the gap.

Once you understand the macro trends, you need to attend community events to stay informed, research chain data, and make careful decisions, but be quick if you do enough research.

Date and author: June 24, 2022, Simon

Source: Footprint Analysis-Investing in Bear Market Dashboard

This work, Footprint analysis community.

The Footprint Community is a place where data and crypto enthusiasts around the world can gain insights and insights into Web3, Metaverse, DeFi, GameFi, or other areas of the new world of blockchain. Here, lively and diverse voices support each other and move the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform for visualizing blockchain data and discovering insights. Clean up and integrate on-chain data so users of all experience levels can quickly start exploring tokens, projects, and protocols. With over 1000 dashboard templates and a drag-and-drop interface, anyone can create their own customized charts in minutes. Reveal blockchain data and invest smarter with Footprint.