Huobi, Gate.io, Crypto.com see spikes in flow to FTX

The full outcome of FTX Fallout is still unknown. With FTX, its U.S. subsidiary, and Alameda Research all filing for bankruptcy protection, it could be months before the public finds out what happened to Sam Bankman-Fried’s crumbling trading empire.

Until that happens, all we are left with is on-chain data that can tell us where the money is going.

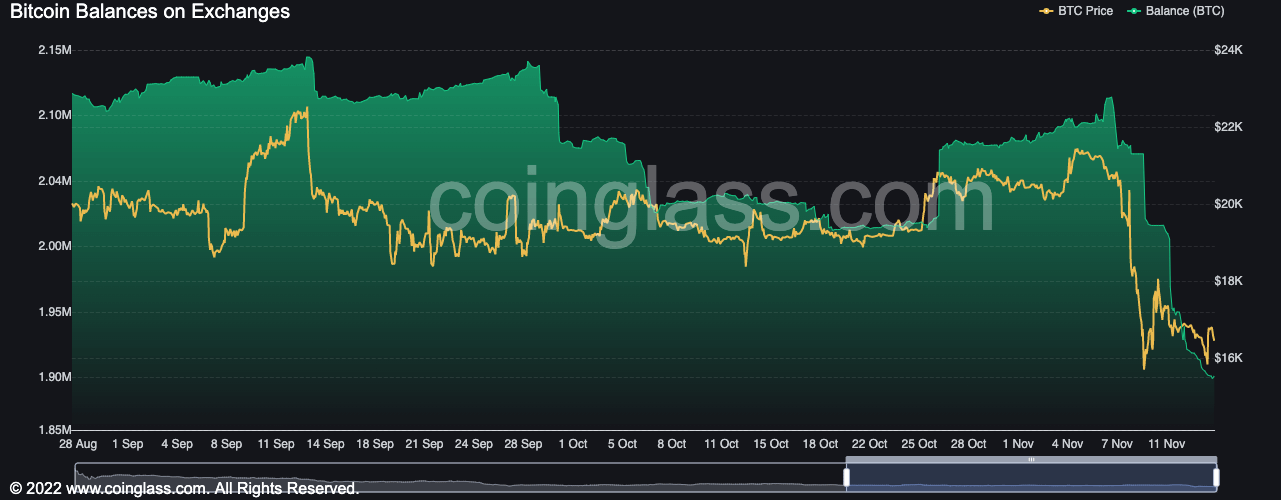

Centralized exchanges saw significant fluctuations in Bitcoin balances in September and October. These fluctuations included jumps and drops in the range of 10,000 BTC to 40,000 BTC, leaving a large dent in total FX balances across the market.

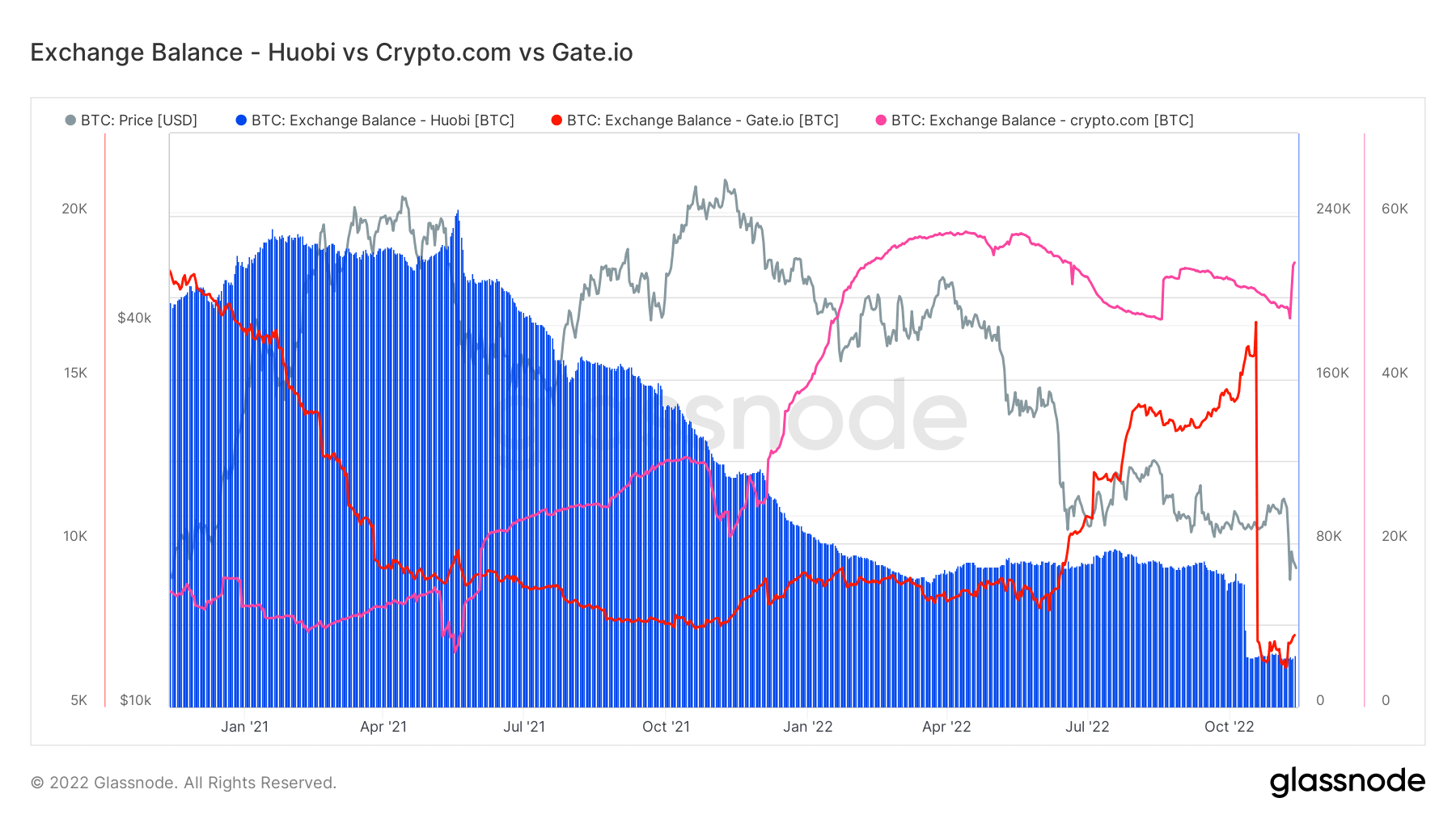

The sharp drop in Bitcoin balances seen over the past week can be attributed to FTX, but three exchanges stand out in particular – Huobi, Gate.io and Crypto.com.

Looking at Bitcoin balances on all three exchanges, we can see that there was quite a bit of anomalous activity in the month before FTX fell.

Alameda’s reckless trading strategy came to light last week, prompting many to investigate whether the trading firm is using exchanges other than FTX.

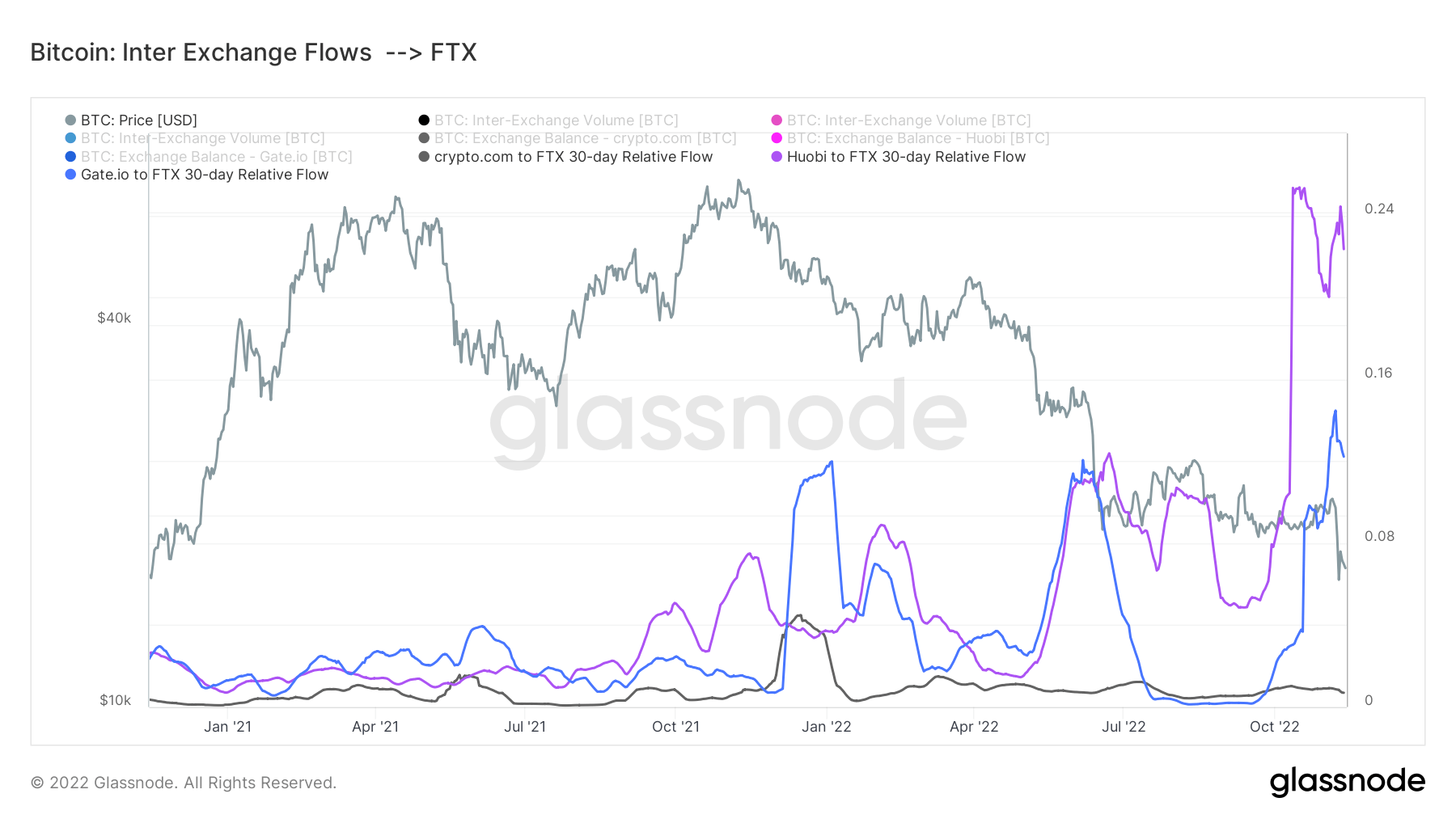

Data analyzed by CryptoSlate showed a surge in inter-exchange flows to FTX, most notably from Huobi. Bitcoin flow from exchanges to FTX tripled in early October. Flow from Gate.io also saw a vertical spike in October that continued through November.

Similar spikes were seen in January 2021 and early July 2022. The former follows his fall from ATH, which he reached in November 2021, and the latter coincides with Luna’s collapse. The spike seen last month is smaller than the previous one in both size and severity.