In spite of FTX catastrophe, Bitcoin whales lead aggressive accumulation phase

The events of last week have brought significant selling pressure across the crypto market. Since rumors of FTX’s bankruptcy circulated on November 6th, the leak peaked at $270 billion leave the market.

Despite the bearish market conditions, on-chain data analyzed by CryptoSlate shows that all Bitcoin cohorts have switched to accumulation mode, with whales being the most active buyers.

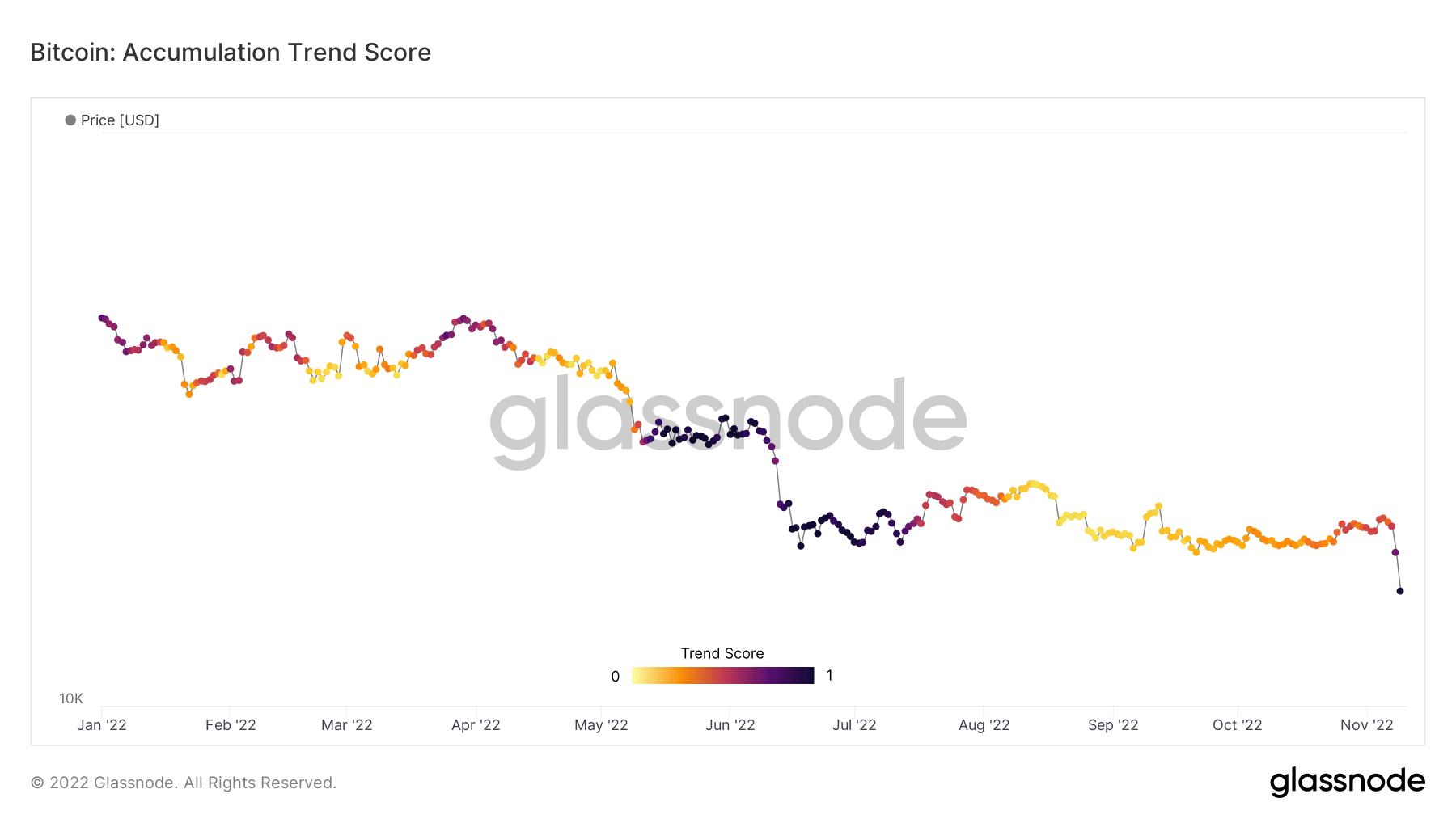

Bitcoin Cumulative Trend Score

The Accumulation Trend Score (ATS) looks at the relative size of entities actively accumulating or distributing in relation to Bitcoin holdings.

ATS works on a scale of 0 to 1. A reading close to 0 indicates distribution or sale. On the other hand, readings close to 1 indicate accumulation or purchases.

The chart below shows the whales accumulating for the first time since August. The current reading is 0.97, indicating an aggressive accumulation rate and the highest since 2019. For comparison, the previous day’s ATS reading was 0.74.

Despite the turmoil caused by the FTX demise, the market sees the value of Bitcoin at a teenage price.

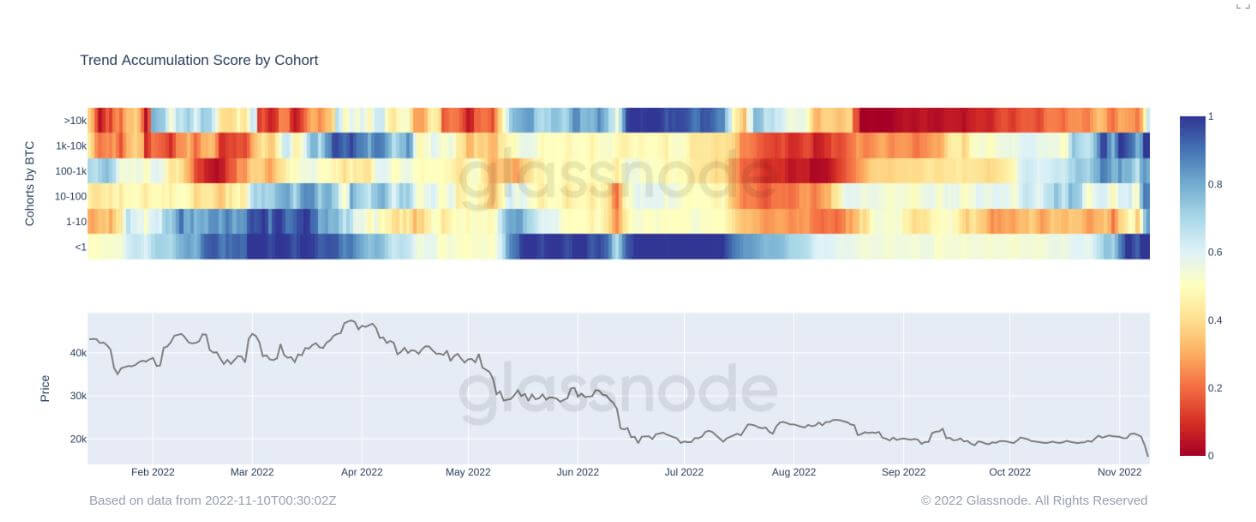

Cohort analysis

Entities holding between 1,000 and 9,999 Bitcoins are classified as whales. Holding more than 10,000 BTC refers to Super Whale status.

Over the past few days, all cohorts have been flashing bright or dark blue, indicating that all cohorts are accumulating in unison. This is an unprecedented pattern for 2022.

Whales and minnows in particular — entities holding less than 1 BTC — are the most actively accumulating cohorts.

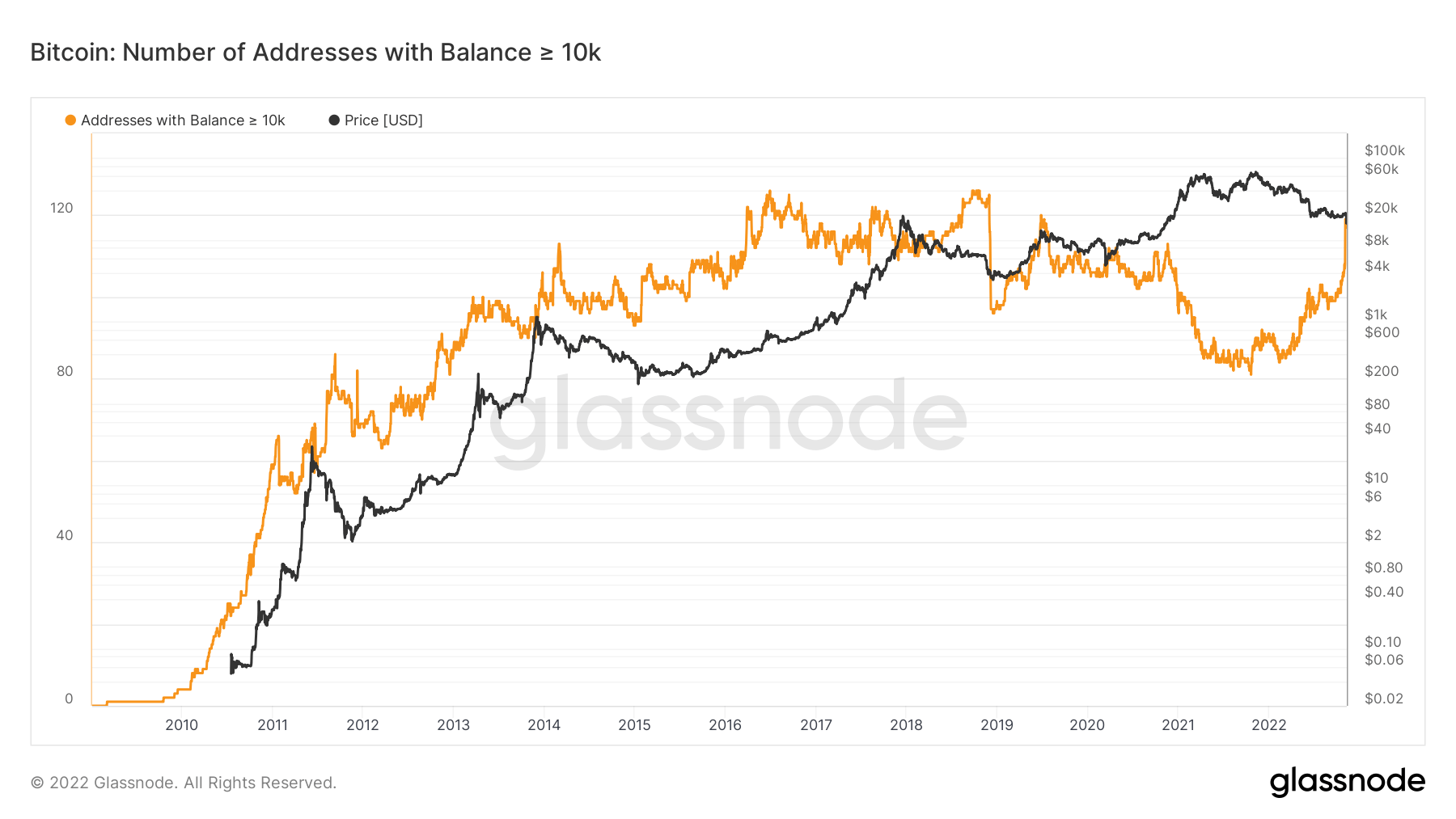

On-chain data shows the number of addresses bottoming out (up to whale status) around the top of the $69,000 market. Since then, the uptrend into 2022 has culminated in a sharp rally in recent days.

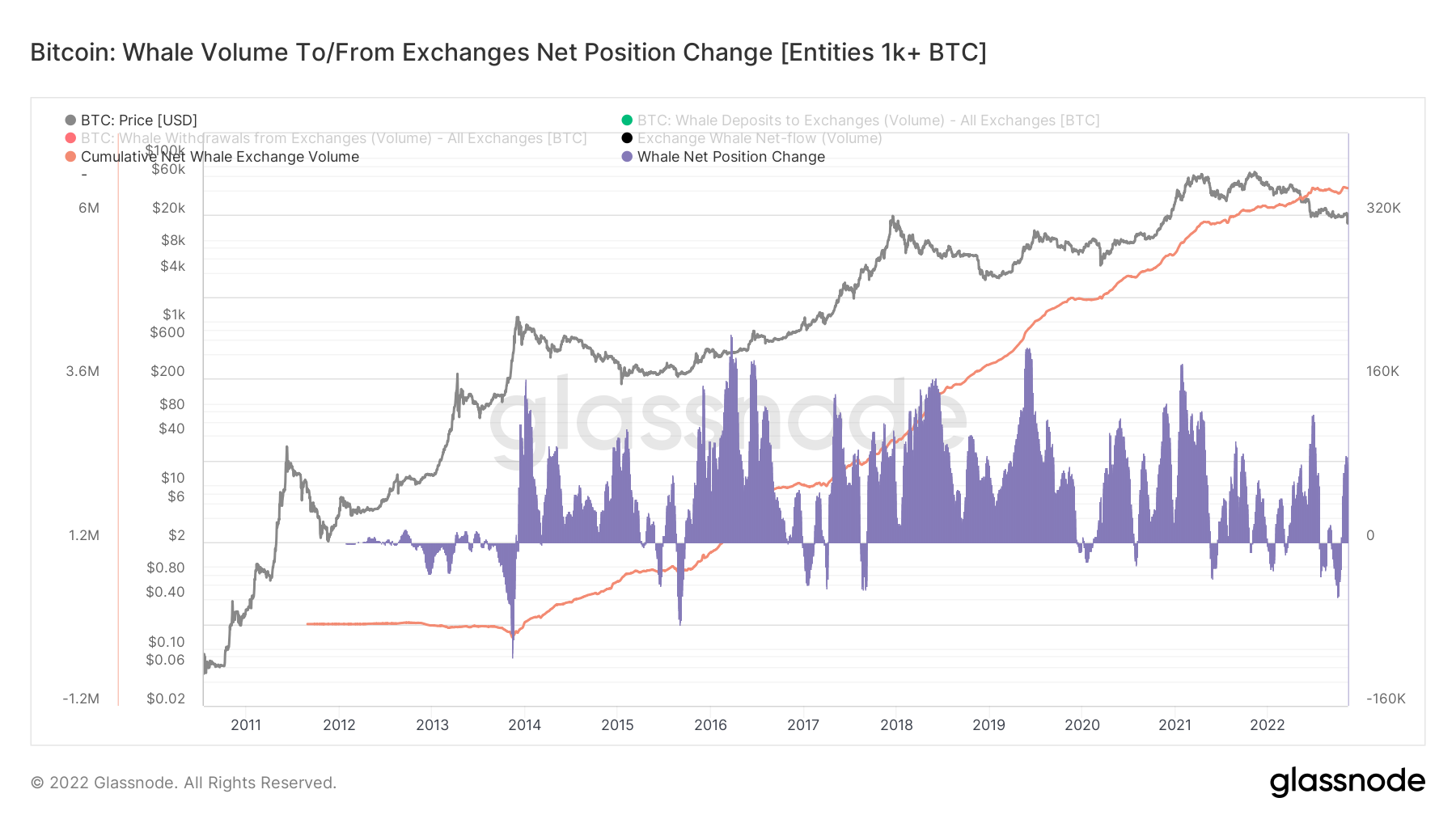

Whale exchange net position fluctuation

Exchange Net Position Change shows the 30-day change in Bitcoin supply from exchange wallets. A number above 0 indicates an inflow into the exchange wallet, and a number below 0 indicates that BTC has left the exchange wallet.

The chart below shows this data for whales and super whales. Recently, we have seen a surge in holdings of Exchange Whales and Super Whales. The last time this happened, with equal severity, was in August.

Cashing out is the main reason entities send their tokens to exchanges. Cumulative net whale exchange shows a macro increase over time, indicating that this is not the case for whale owners.