Indicators point to Bitcoin bottom formation but recovery unlikely so soon – Glassnode

According to the latest information from Glassnode, Bitcoin (BTC) is likely to form a substantial bottom after trading below the realized price for a month. Weekly report..

The report suggests that current market conditions are nearing the bottom of the market.

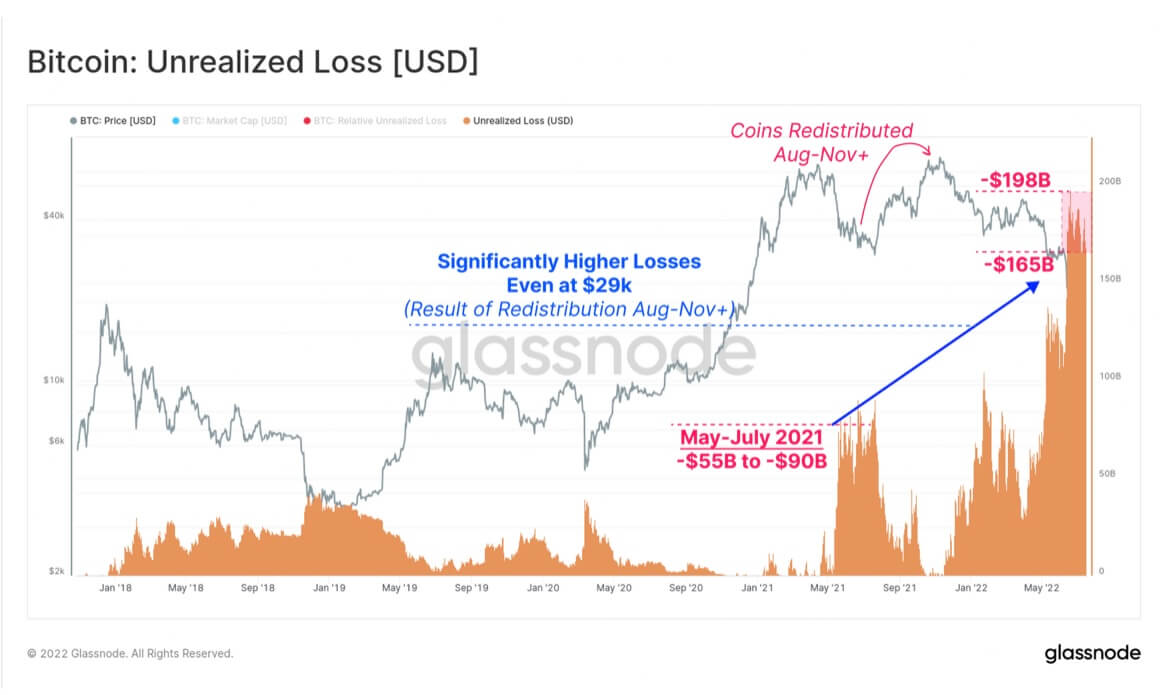

Bottom formation usually occurs when there is a “large positive fluctuation in unrealized gains and losses” due to surrender and redistribution of coins.

Unrealized loss

Since Bitcoin trades in the range of $ 17,600 to $ 21,800, the total unrealized loss is between $ 165 billion and $ 198 billion. At that rate, it’s about 55% of market capitalization, similar to the size of the bear market in 2018.

However, there may be some hope in the cryptocurrency industry after a slight revival causes market capitalization to exceed $ 1 trillion for the first time in a few weeks.

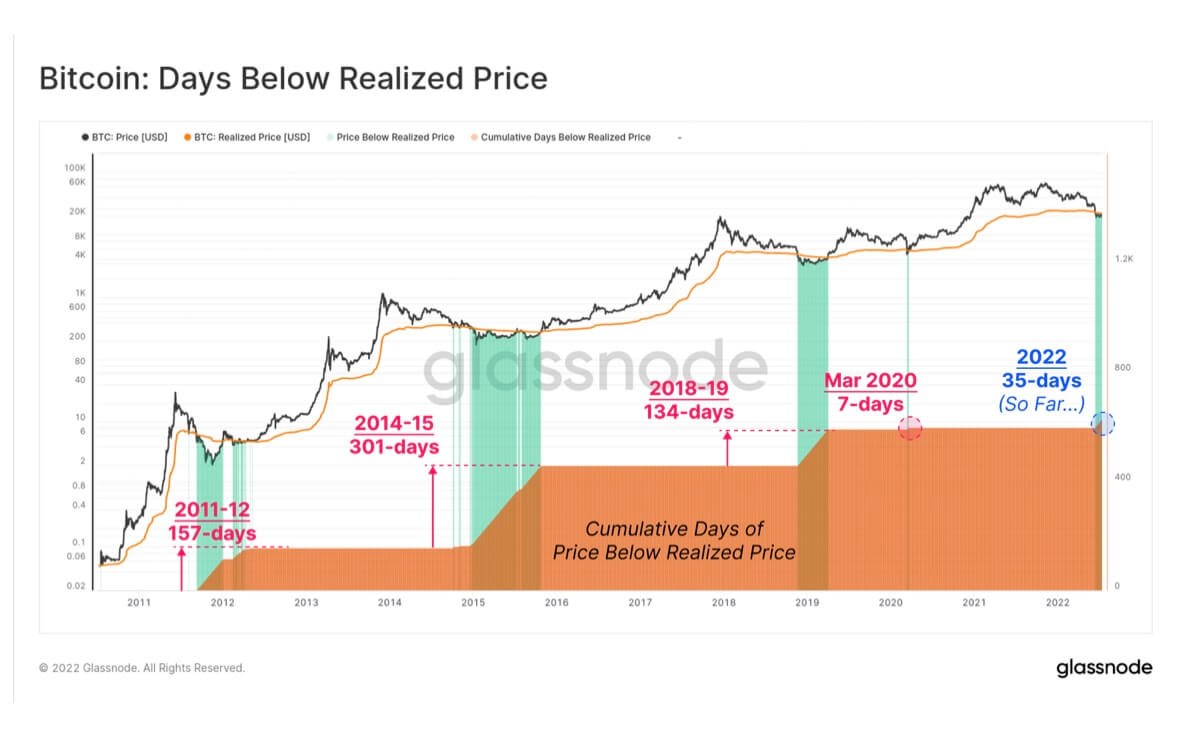

Bitcoin has also slightly exceeded its realized price of $ 21,963 after being temporarily traded above $ 22,000 for the first time in the last 35 days.

The price then fell 1.7% and then returned to $ 21,908. This means that the holder is doing so with an unrealized loss.

Current bear market days are below average

Glassnode writes that the average bear market is 197 days, while the current bear market is only 35 days. The bear market can last longer and the value of Bitcoin etc. can be even lower.

Grayscale, on the other hand, believes that the current cryptocurrency winter could last about 250 days.

Glassnode also pointed out that all on-chain metrics show signs of price bottom formation, except for the length of time it takes for a real bottom to form.

Macroeconomics

Macroeconomic conditions remain largely bearish, recent market recovery could be dead cat bounce, and cryptocurrency prices could still fall.

A major headwind for the industry is inflation and the Federal Reserve plan to tackle it. US consumer inflation reached 9.1% in June for the first time in 40 years.

according to ReutersAt the next meeting, the federal government has an 86% chance of raising interest rates by 100 points. If that happens, it could push the market down further.

On the other hand, the effects of the current recession are visible in the crypto industry as some crypto companies have declared bankruptcy and more conversations about bankruptcy of others.