Institutional appetite for Bitcoin has evaporated as OTC trades approach YTD low

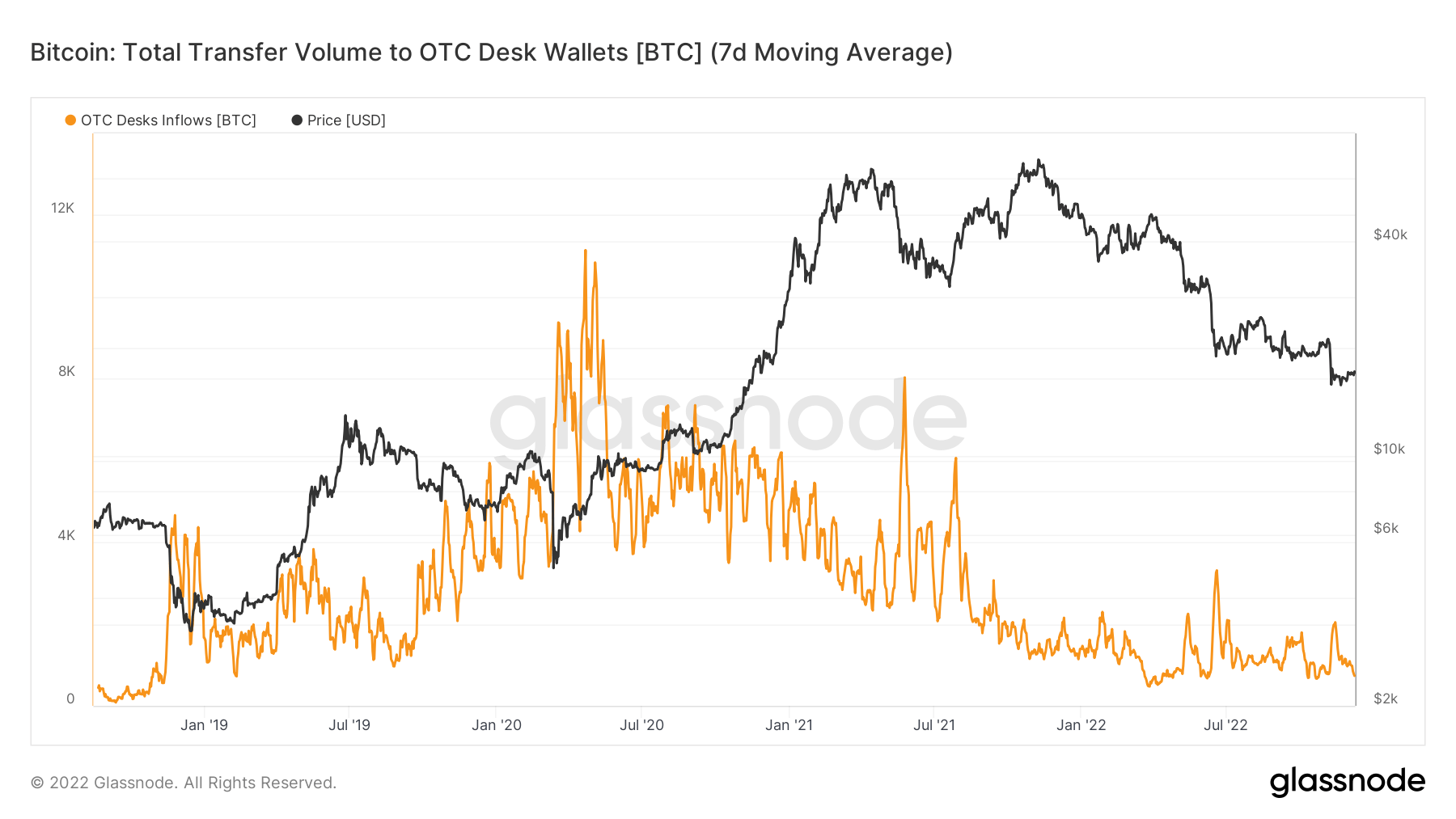

Due to the current bear market conditions, institutional appetite for Bitcoin (BTC) is slowly evaporating, reflected in a significant decline in over-the-counter (OTC) trading, according to CryptoSlate’s analysis of Glassnode data. .

Several institutional investors flocked to the flagship digital asset during the 2021 bull market, but that interest faded as prices plummeted to new lows in 2022. Data showed that the flow of funds from this group slowly evaporated.

according to river financial, OTC desks act as dealers for traders looking to trade specific assets such as securities, currencies, etc. It is usually used when a particular trade is not possible on a centralized exchange.

According to CryptoSlate’s analysis, the 7-day moving average of total remittances to OTC desk wallets is now nearing its 2018 lows. OTC trading peaked during the covid 19 pandemic when BTC was trading around $3000.

Since then, the market has witnessed a sizeable surge throughout 2021, but slowed down towards the end of the year. His OTC trading for 2022 saw a significant surge in July when investors were still reeling from the collapse of the Terra ecosystem.

Since then, the 7-day moving average of OTC desk inflows has fallen and is now approaching year-to-date (YTD) lows.

Purpose ETFs have seen no activity since early August

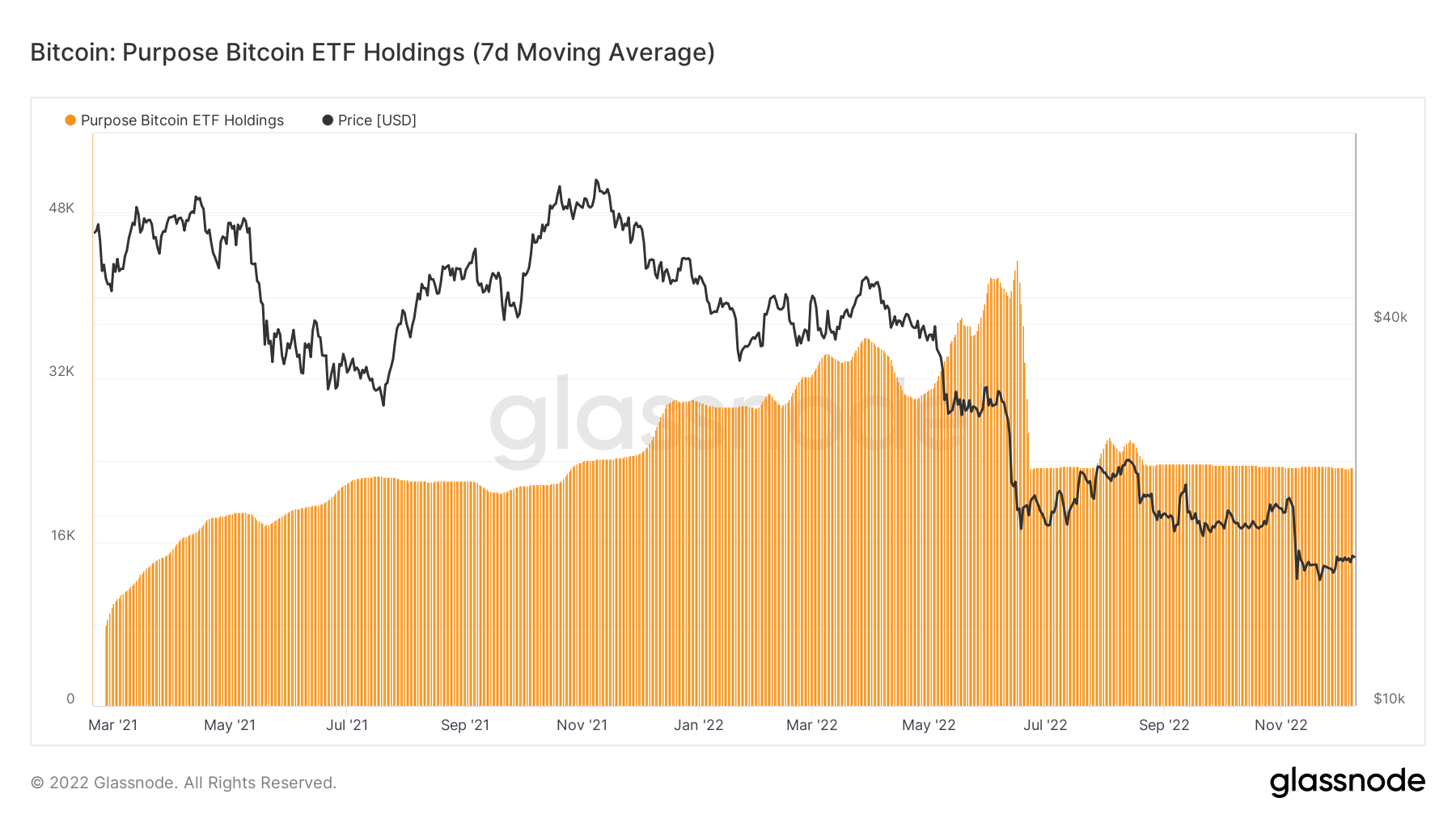

The Purpose Spot Bitcoin ETF, the world’s first Bitcoin ETF, had a fairly quiet year.

According to CryptoSlate’s analysis, the ETF hasn’t seen much movement since late July/early August. His BTC holdings in the objective ETF peaked in June-July 2022, according to his 7-day moving average data from Glassnode.

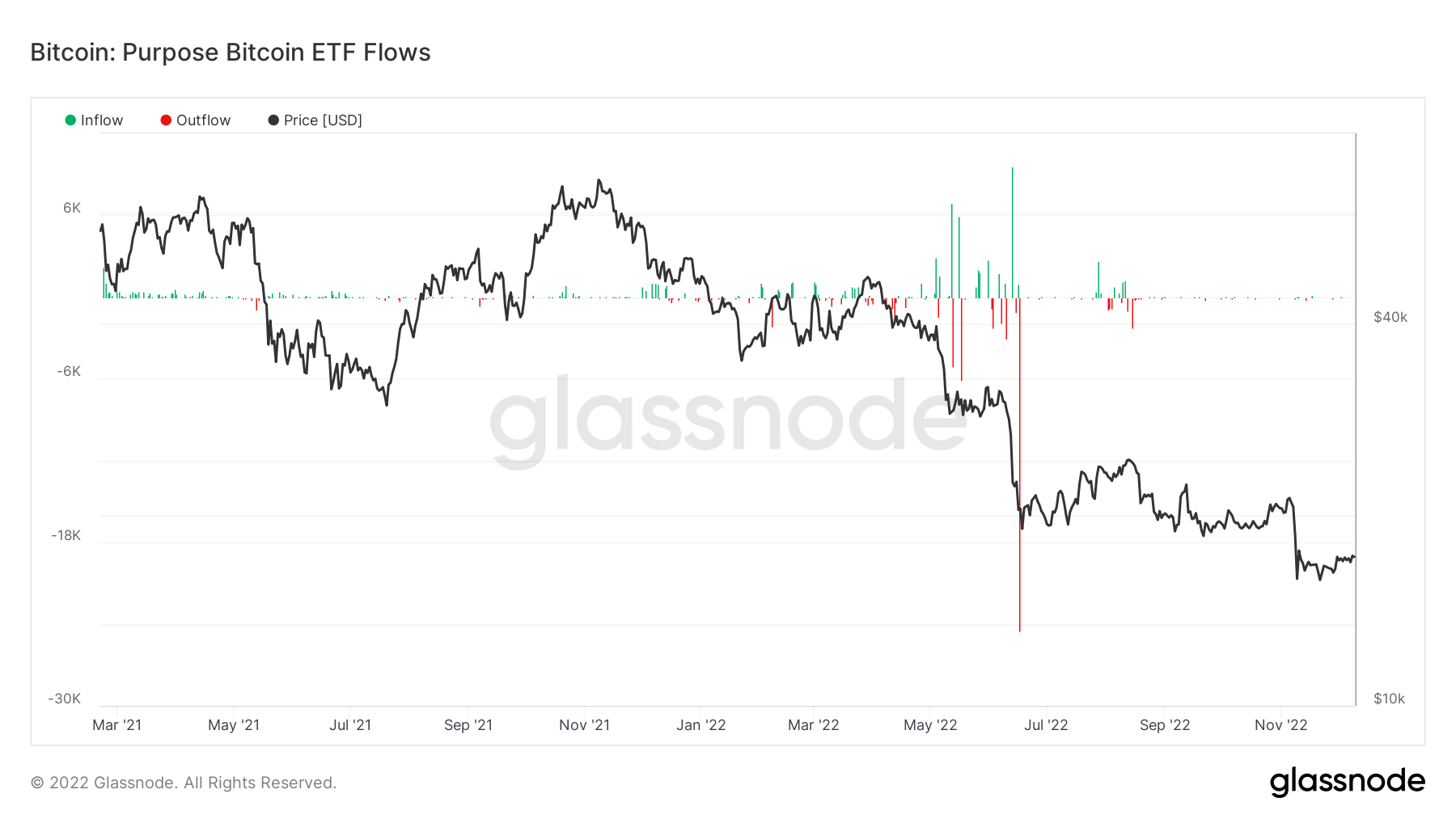

A Glassnode chart of its inflows and outflows shows that the ETF experienced massive outflows between May and July 2022, coinciding with a 40% drop in BTC’s value. Mainly in July, the Purpose ETF recorded the largest outflows.

There is some inflow and outflow in early August, and little to no activity since then.

Despite months of inactivity, ETF holdings are still well above where they started in March 2021.according to purpose investmentETF assets under management are $396.7 million (23,240 BTC).