Intel Posts $500 Million Loss for the First Time in Decades as Sales Drop 17%

Thursday Intel Post Processor sales for client PCs and data centers are second due to what Intel calls the “rapid decline in economic activity” caused by inflation, geopolitical tensions, and the ongoing war between Russia and Ukraine. The sharp decline in the quarter caused the first loss in decades.

Intel revenue in the second quarter of 2022 totaled $ 15.3 billion, down 17% year-on-year (YoY) and down 22% from the previous quarter. In addition, the company’s gross margin fell 36.5% from 57.1% in the year-ago quarter. The company also posted a loss of $ 500 million. This is the first loss in decades. Intel’s quarterly losses may seem shocking, but it should be noted that the company needs to keep inventory in preparation for future product launches and incurs losses in accordance with GAAP.

Intel CEO Pat Gelsinger said: “We have to do better. The sudden and rapid decline in economic activity was the biggest factor, but the shortage also reflects our own execution problems.”

Core and Xeon shipments decline for the first time in years

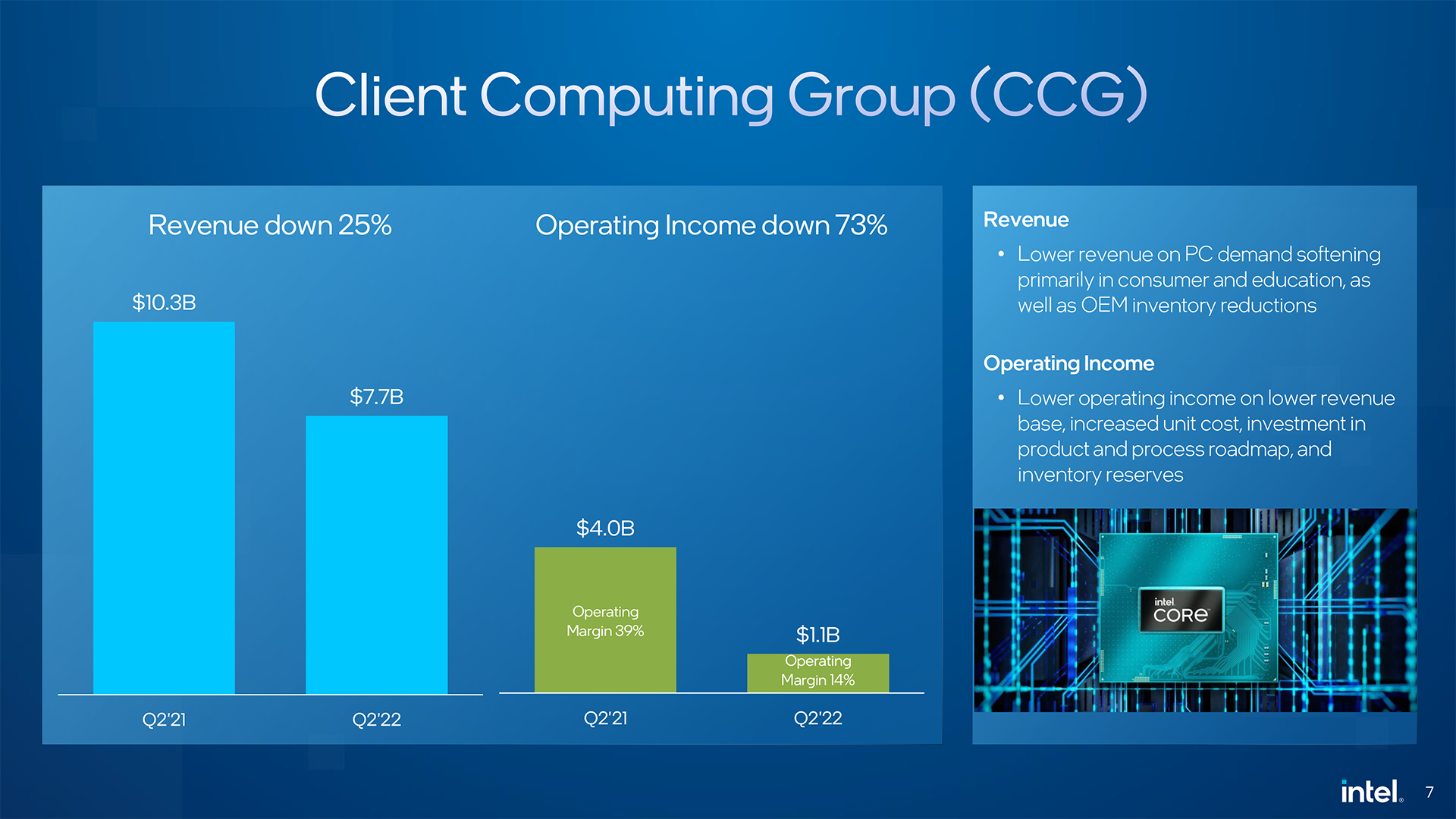

Intel’s leading cash cow, Client Computing Group (CCG), generated $ 7.7 billion in revenue in the second quarter of 2022, down 25% from the year-ago quarter. There are several reasons why Intel’s client CPU and chipset sales have fallen significantly. First, PC demand declined sequentially and year-over-year in the second quarter. Second, PC OEMs are uncertain about demand in the coming quarter, so they buy less CPU than they consume, use their existing inventory, and run out of their existing inventory. That means they will increase their purchases from Intel as soon as their stash is gone.

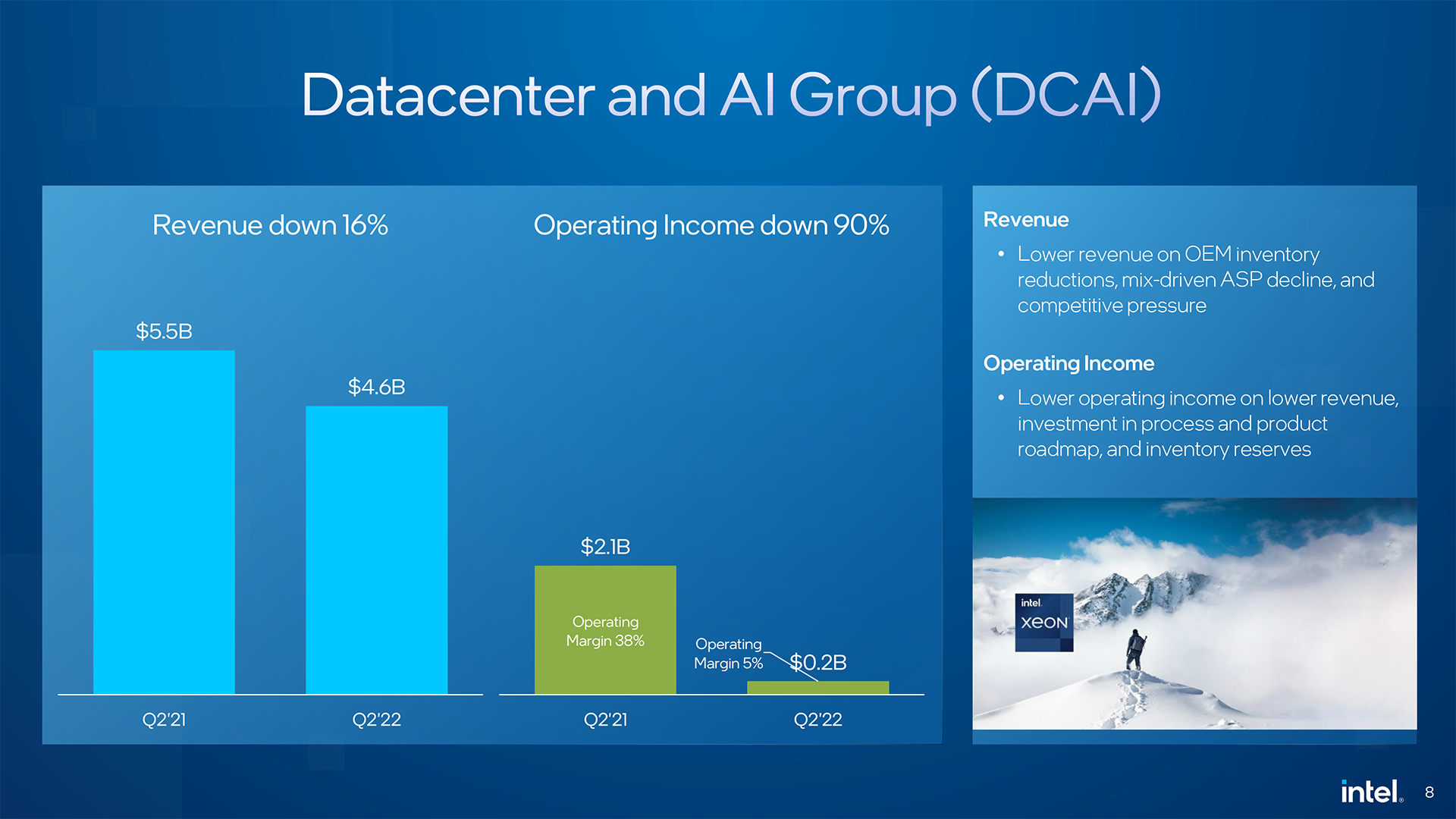

Intel data center and AI Group (DCAI) data center hardware sales fell from $ 5.5 billion in the second quarter of 2021 to $ 4.6 billion in the second quarter of 2022, 16% year-over-year. It has decreased. Intel is under competitive pressure from AMD, lower mix-driven average selling prices (ASPs) (because they need to adjust prices and adjust products to keep up with the competition), and reduce OEM inventories. I gave two reasons.

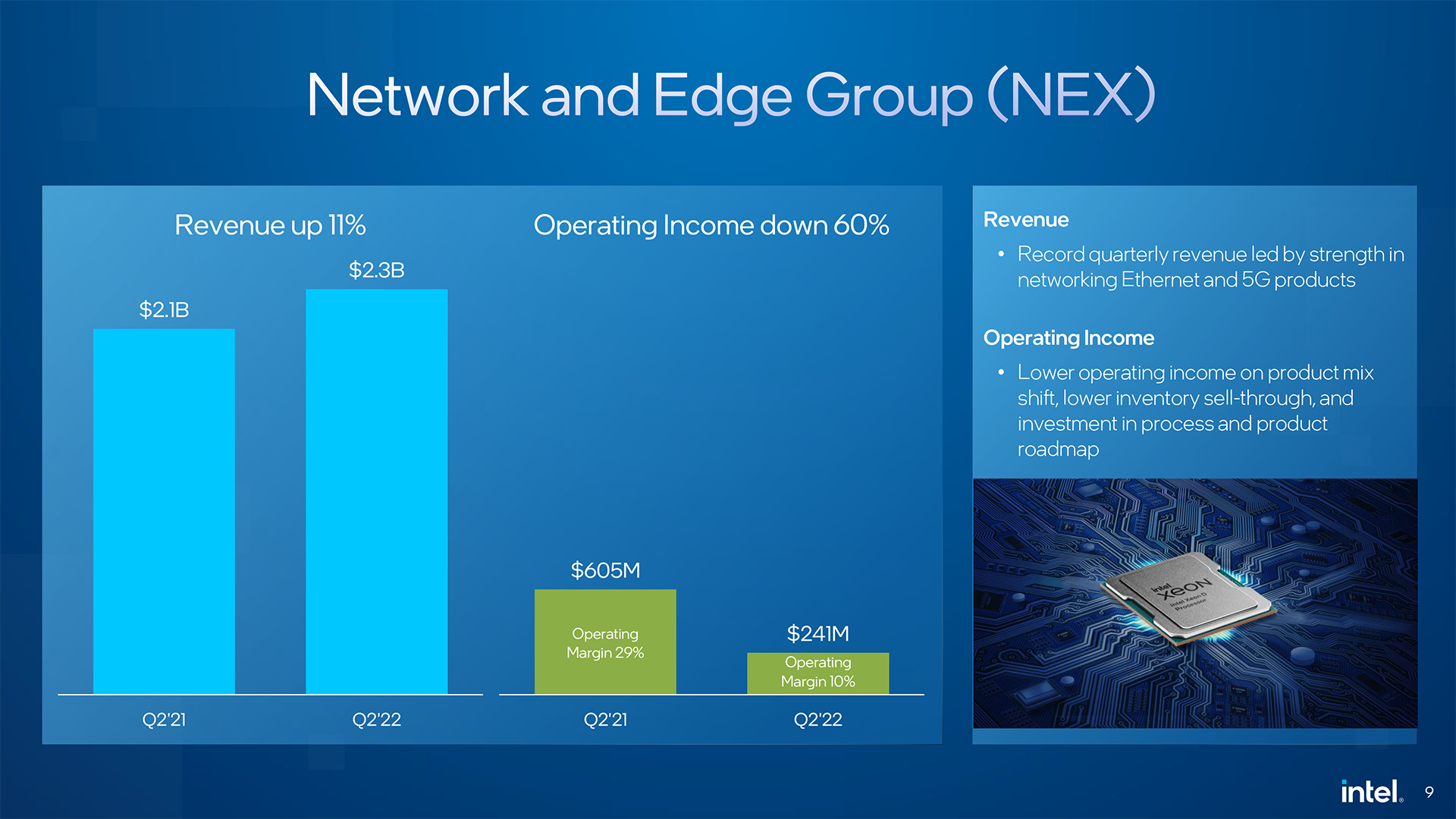

Intel’s Network and Edge Group (NEX) revenue was probably the light of the company’s pessimistic revenue report, as business units grew 11% year-on-year to $ 2.3 billion. According to Intel, NEX’s strong performance was driven by strong sales of 5G (probably meaning computing solutions for infrastructure equipment) and Ethernet products.Meanwhile, Intel’s NEX has also started shipping codenames. Mount Evans 200GbS IPPU We have begun to increase shipments of the latest Xeon D-1700 / 2700 parts based on the Ice Lake-D microarchitecture.

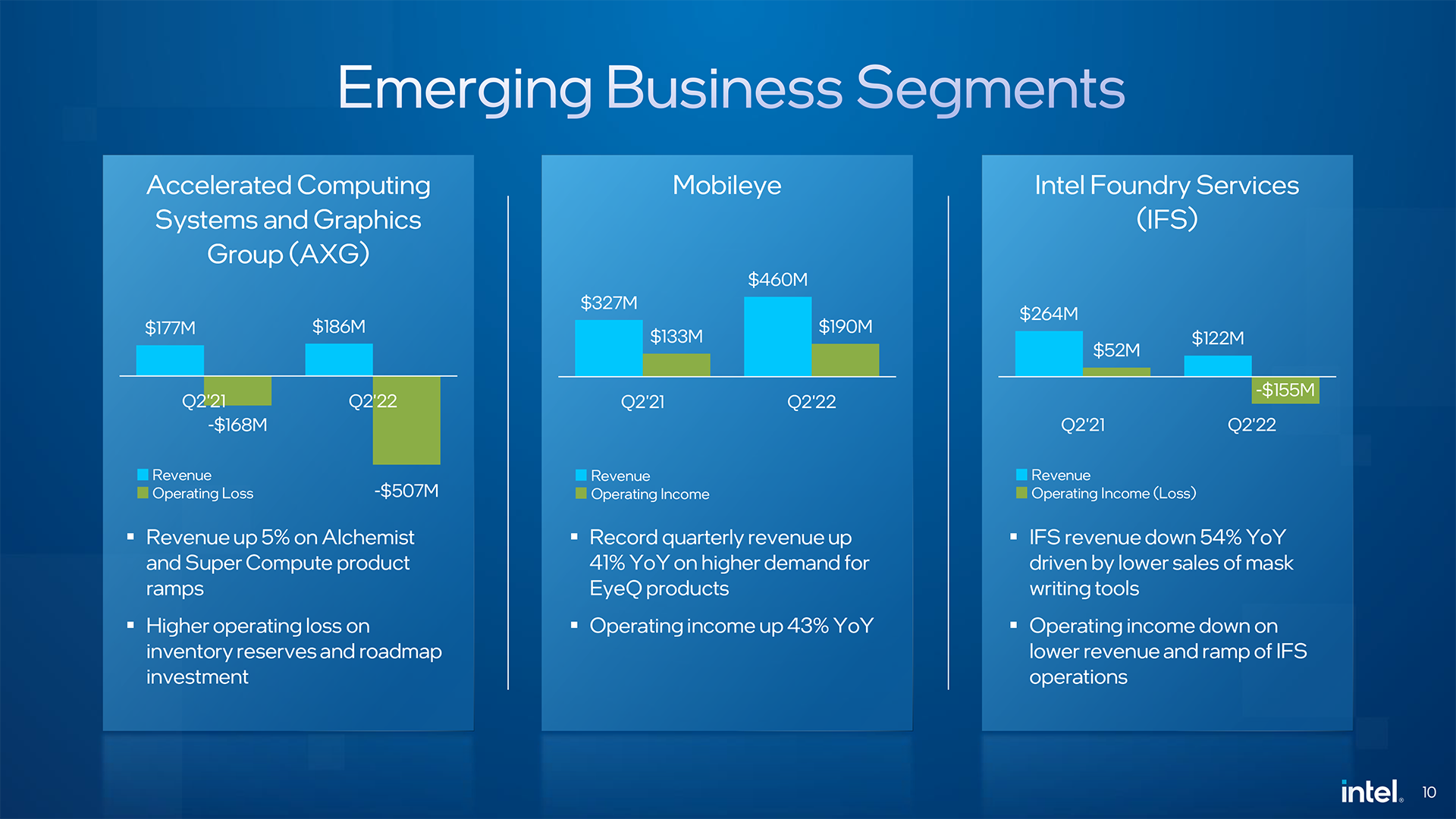

One of Intel’s most ambitious projects in recent years is arguably Raja Koduri-led client and data center GPU efforts. However, entering the GPU market is expensive. As a result, Intel is increasing shipments, and its Accelerated Computing Systems and Graphics Group (AXG) was $ 186 million in the second quarter of 2022 (up from $ 177 million in the second quarter of 2021). Lost $ 507 million in sales. We have shipped Ark Alchemist blockscale mining ASICs and have begun shipping supercomputing products. Losses are primarily due to additional investments in R & D, prototyping and inventory reserves to launch large volumes of Arc in the third quarter.

Intel Foundry Services has received orders from Qualcomm and Mediatek, two major fabless developers of chips that sell hundreds of millions of chips annually. But IFS still has to be a big business for the blue giant. As a result, Intel’s foundry business unit sales fell to $ 122 million and lost $ 155 million in the second quarter of 2022. In addition, according to Intel, demand for photomask writing tools declined in the second quarter, but the company had to continue investing in IFS. ..

Another bright spot in Intel’s second-quarter financial report is Mobileye’s $ 460 million revenue. This is up 40% year-on-year due to high demand for EyeQ products. In addition, the unit’s operating profit totaled $ 190 million, an increase of 43% over the previous year.

Pessimistic expectations

Intel currently forecasts revenue in the third quarter of 2022 to range from $ 15 billion to $ 16 billion, a significant decrease from $ 19.2 billion in the year-ago quarter. In addition, the company’s gross profit is expected to be 43.2%, down from 56% in the third quarter of 2021, but significantly up from the second quarter of 2022.

Due to catastrophic second quarter results and macroeconomic uncertainties, Intel expects 2022 sales to fall 9% to 13% from initial expectations, to $ 8 billion to $ 11 billion. .. As a result, the chip giant expects a total margin of 44.8% in 2022.

“We are working closely with our customers to respond to changing business conditions, focusing our lasers on strategies and long-term opportunities,” Gelsinger said. “We are embracing this difficult environment to accelerate change.”

Intel will cut short-term spending and consider ways to reduce production costs in response to the market downturn. In particular, the company has reduced its capital investment budget for 2022 from $ 27 billion to $ 23 billion. Intel, on the other hand, doesn’t sacrifice long-term spending or big projects like the new fabs in the US and Europe.

“While accelerating the rollout of our smart capital strategy, we will repeat the adjusted free cash flow guidance of the previous year and take the necessary steps to manage the current environment, such as returning gross profit to the target range by the fourth quarter. I’m taking it. ” David Jinsner, Intel CFO. “We continue to focus on our business strategy, the long-term financial model presented at the Investor Conference, and our strong and growing dividends.”