Intel to Operate Foundry and Manufacturing More Like a Separate Business

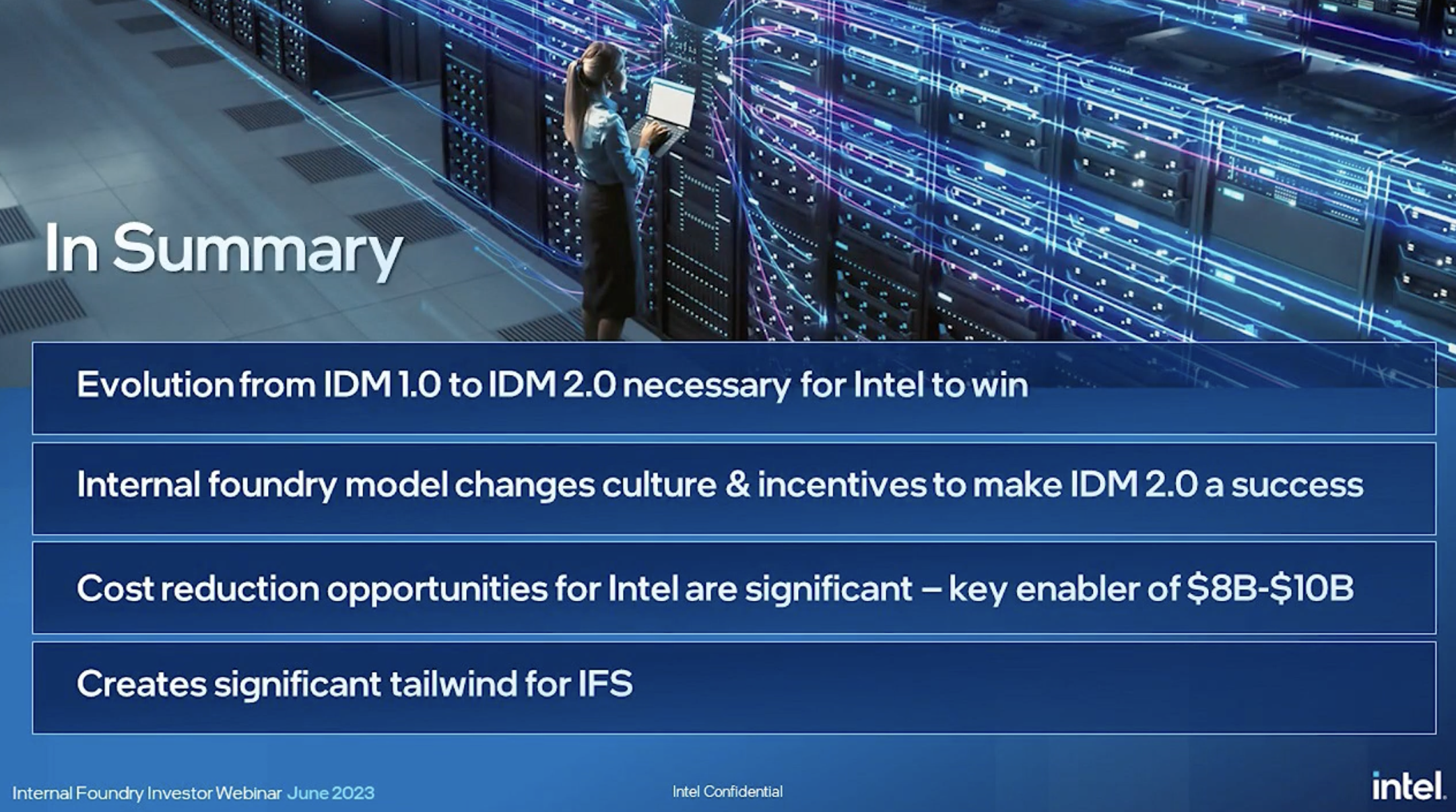

Intel is kicking off its in-house foundry model. On a conference call with investors today, Executive Vice President and Chief Financial Officer David Zinsner and Corporate Vice President and Director of Corporate Development Jason Grieve said that Intel’s manufacturing group, including Internal Foundry Services, will: announced that it will be split into its own group. A unique income statement (P&L) statement.

Zisner and Grebe said the new IDM 2.0 model will incorporate in-house foundry services into the reportable division, along with manufacturing and technology development, with external fabless customers using either Intel’s foundries or external competitors. He suggested that it would sell to both in-house business units that choose to do so. (Intel is already making some x86 chips at his TSMC, including the upcoming Meteor Lake processors.)

Intel said its IDM 1.0 strategy has worked for a long time, but the increased capital required to develop new cutting-edge nodes has left it lagging behind its rivals in a competitive business environment. However, Intel claims that the Intel 18A will come in his 2025 and regain process leadership.

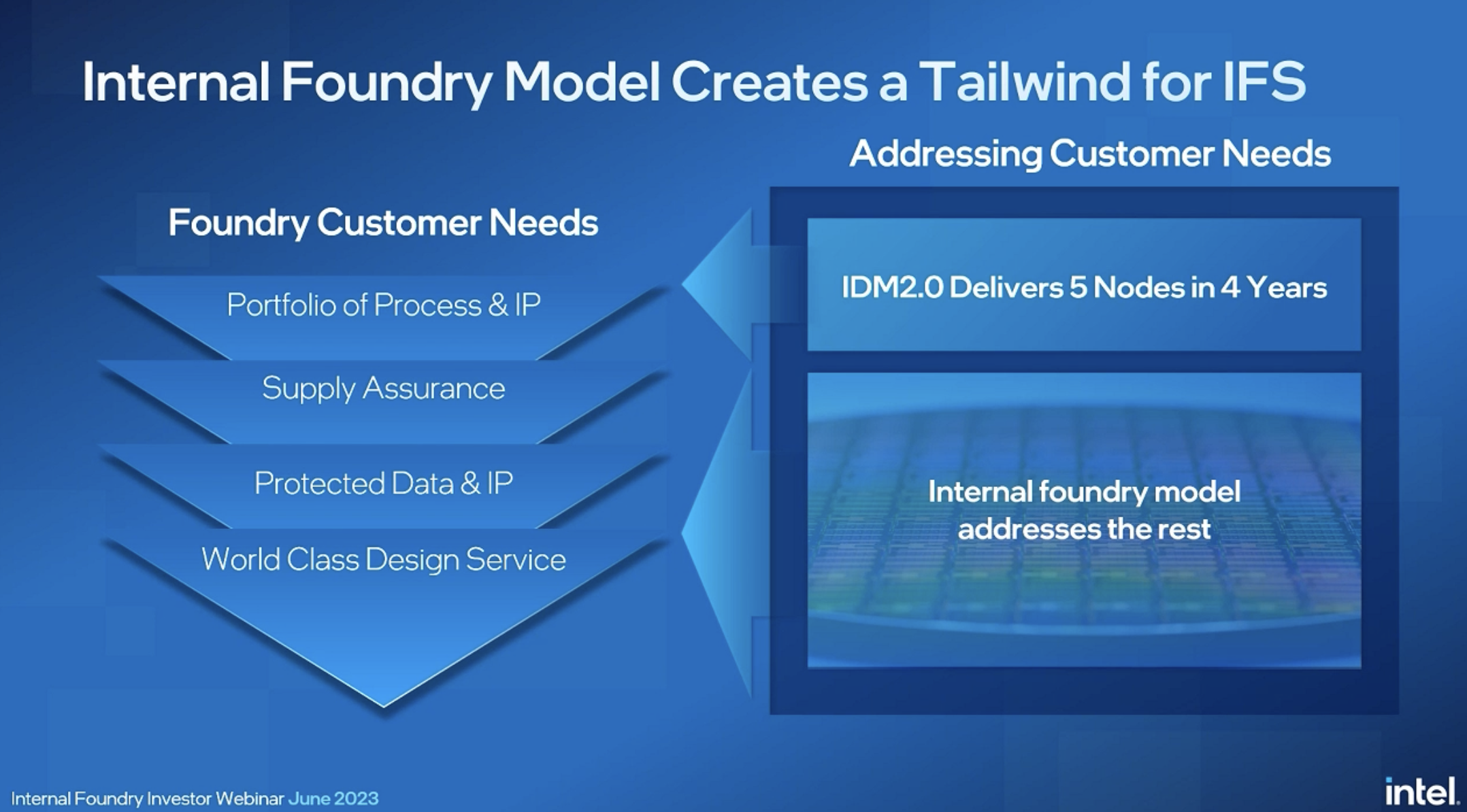

The company says its goal for its internal foundry model is to produce the industry’s second largest external foundry. Putting the group on the company’s income statement also provides an “opportunity for cost savings” of $8 billion to $10 billion, the company claims. This includes ramp rates based on “market-based” prices and testing and sorting times. However, it is highly likely that the operating profit margin will start negative.

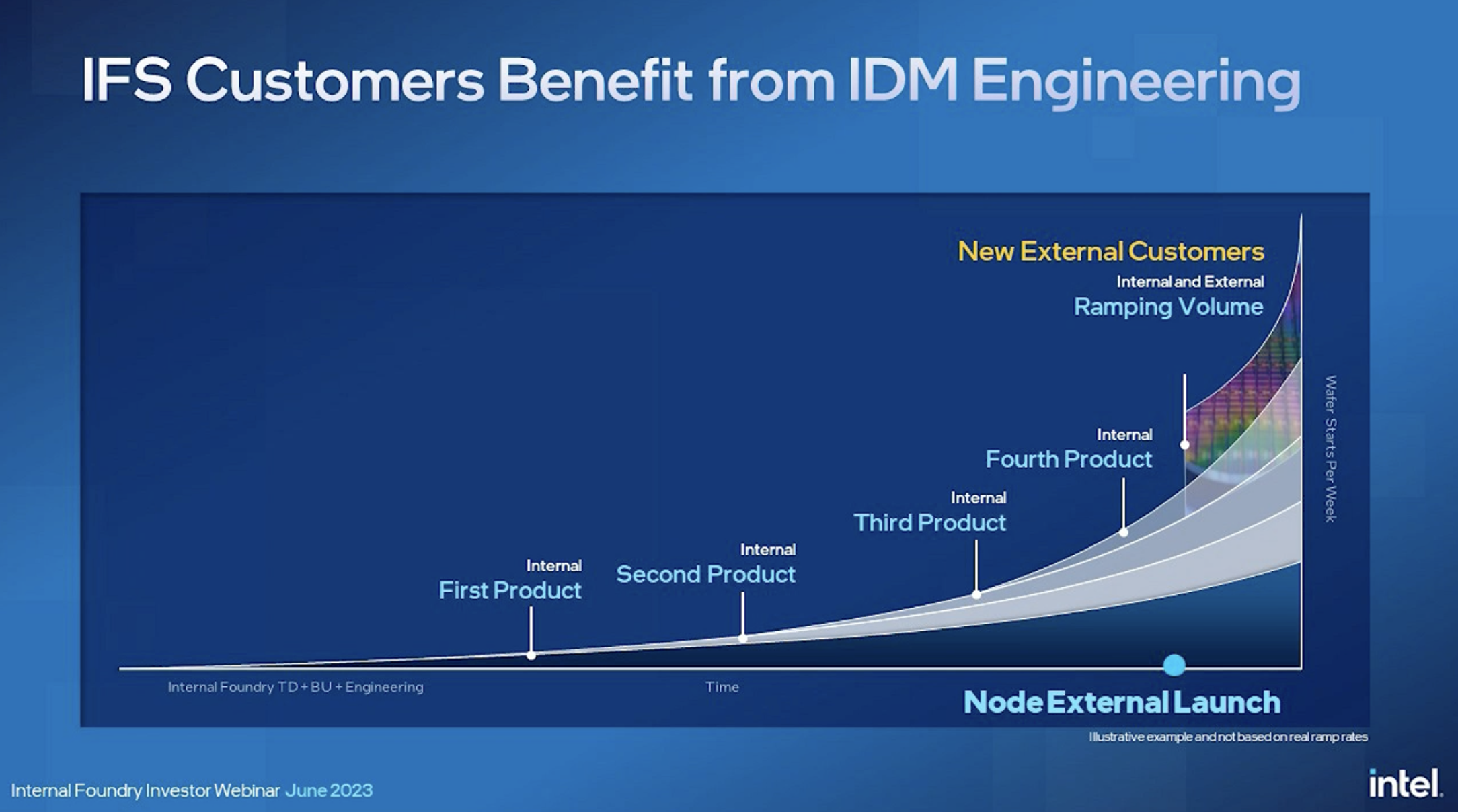

Intel also suggests that keeping the foundry in-house will benefit external customers. Intel said 18A will have five in-house products, creating multiple products on the node internally before releasing to external customers, allowing more wafer starts and pain relief to external partners suggests that it can “de-risk” nodes for process.

Mr. Grieve reiterated that there will be a “competitive separation” of customer data and intellectual property, as well as a “world-class” service and support, as well as a commitment to customers that there is available supply. rice field. Intel will have to compete with both TSMC and other fabs and external customers and Internally to ensure Intel’s success

Asked why Intel isn’t simply splitting into a fabless design business and a separate foundry business, Zissner said, “We see a lot of benefits in combining both the product business and the manufacturing business.” rice field. These benefits, he said, include process technology and product improvements from working with internal teams, as well as using internal teams as “customer zero” to increase the volume of new nodes. Zissner suggested there was no need to split the business in two. That said, it seems clear that Intel may spin out the foundry in the future.

Intel has announced big investment plans in recent weeks, including an assembly plant in Poland and a $25 billion factory in Israel. These include billions of dollars spent on new plants in Oregon and Arizona, and a plant in Magdeburg, Germany.

Intel shares fell about 4.9% on the news.