Investors lost over $100M after Invictus Capital moved funds into UST, Celsius against their wishes

Invictus Capital, a crypto investment company based in South Africa, said:No downside risk expectedWas put into TerraUSD and held tokens throughout the UST Depeg event, citing “quite amazing interest” as a valid reason to stop the crash.

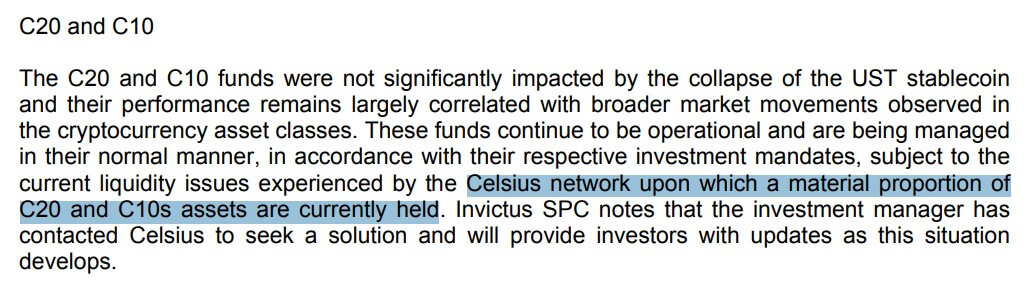

highlight

- Invictus Capital has invested millions of dollars in investor funds in the Terra ecosystem to harness the massive profits within its “regulated” funds.

- The fund manager rejected the investor’s call to sell the UST before the pegs fell below $ 0.93.

- Investor crypto assets were supposed to be refrigerated, but Invictus invested in Celsius instead.

- The founder of the company was evacuated after making a bad deal with the company at a cost of $ 4 million.

- Employees of Invictus Capital threatened to report the founder of the scam as a leverage in selling one of the funds.

- Employees have shut down all social media channels and suspended their withdrawal.

- Invictus’ board members allegedly threatened the founder and chased him home.

- Invictus allegedly created a smear campaign against founder and former CEO Daniel Schwartzkopff.

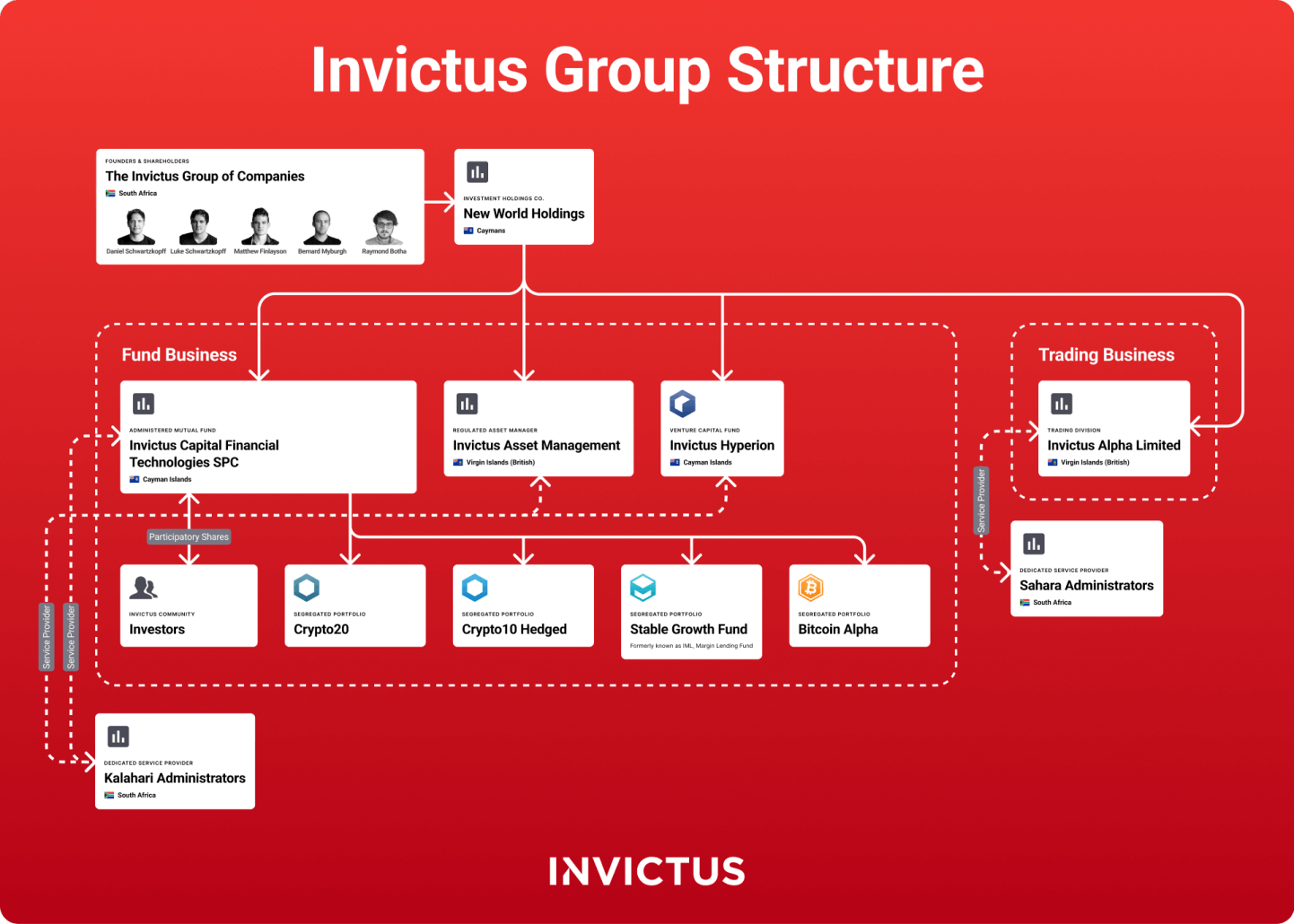

- Invictus Capital is currently conducting a voluntary liquidation in the Cayman Islands through its holding company, New World Holdings.

- The CEO of restructuring tried to use his influence to keep the story private.

Invictus Capital

Invictus Capital had approximately $ 135 million in assets under management at the time of the collapse of Terraruna. Some of these funds are held in UST and can be considered to be acting against the original terms. White paper See “US $ Equivalent with Little Expected Drawdown Risk”.

Around the same time, it became clear that 50% of the refrigerated nominated assets were held in degrees Celsius. Funds are currently locked and Invictus Capital is on the verge of bankruptcy and is applying for voluntary liquidation.

The company suspended its withdrawal and closed all social media channels amid internal disputes and protests seeking information on holdings from investors.

Contact from Invictus has been restricted since early June, and restructuring CEO Haydn Hammond was appointed after founder and former CEO Daniel Schwartzkopff resigned.

Invictus Capital is a public institution that represents several separate portfolio companies in the Cayman Islands. The offering is designed to allow investors an easy way to invest in cryptocurrencies while minimizing downside risk.

One product, Invictus MarginLending (IML), actually provides the ability to “take advantage of the volatility of the cryptocurrency market to attract attention. No downside risk expected..“”

CEO dismissal

In April 2022, the situation at Invictus began to collapse after a dispute between Schwartzkopff and a member of one of its service providers, Kalahari. According to submissions by Kalahari and Sahara’s director Steven Williams, Kalahari and another company, Sahara, provided all employee services to companies in the Invictus Capital Group.

CryptoSlate contacted several Invictus employees, but all requests for comment were rejected.The only comment available is letter After Schwartzkopff’s dismissal, the Invictus staff told us, “It’s serious enough that the business could be shut down or significantly reorganized.”

However, I was able to talk to several investors, including Schwartzkopff and Lev Mazur.

Mazur, the founder of the blockchain trading platform Quantfury, has become involved in Invictus through its investment product, the Hyperion Investment Fund. Investors were able to touch a basket of potential blockchain unicorns by purchasing IHF tokens.

Quantfury was launched through an IHF investment, but Mazur confirms that the company does not have a direct business relationship with Invictus Capital. However, that experience gave me insights into how the company works through interacting with employees.

Mazur and Schwartzkopff became closer with Quantfury funding, and Mazur said the launch was “all him” in connection with Schwartzkopff’s support in securing investment. Mazur praises Schwarzkopf, saying, “He’s a kind of genius type … similar to SBF.”

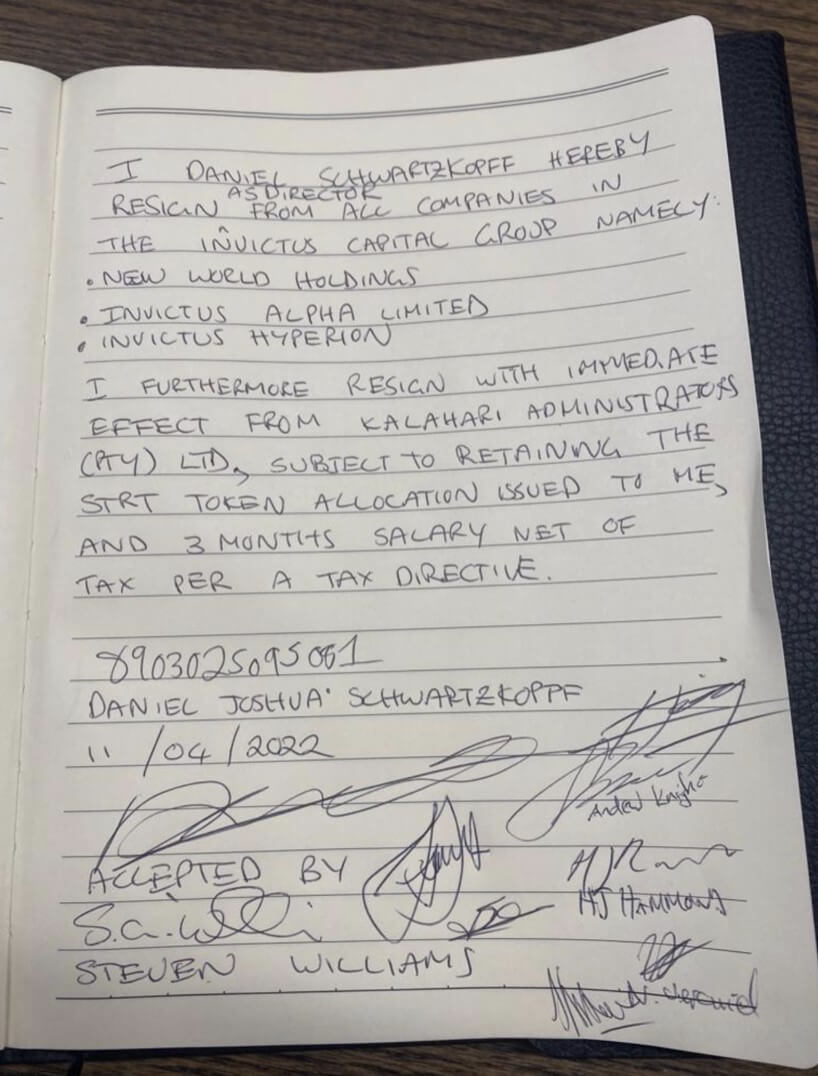

In mid-April, Schwarzkopf was expelled from Invictus and offered to resign at the board of directors.

The image below is a leaked copy of a resignation signed by Schwartzkopff and a board member written in Notepad.

It is extremely rare for companies with over $ 100 million in assets to use Notepad for such important documents. Those familiar with the matter told CryptoSlate that Schwarzkopf was “literally extruded, mentally abused, and extruded to sign.”

Schwartzkopff founded Invictus Capital and is well known to be the brain behind surgery. Many members of the community objected to him, but few claim he wasn’t very talented.

Schwartzkopff has created several ETF-like products that leverage smart contracts to hedge crypto investments and distribute them across crypto assets. His work made the company very informative, but the consensus was that he wasn’t the right person to be CEO.

Schwarzkopf reportedly rarely came to the office and was more interested in code than running a company. He was always coming up with new ideas for investment strategies. In one of these strategies, he lost a $ 4 million Invictus Capital fund.

Schwartzkopff told CryptoSlate that the money he lost was due to the company’s profits. However, many community members claim that Schwartzkopff used client funds loaned from the Invictus Alpha Fund. No evidence was found to confirm these claims.

Schwartzkopff believes the allegations were made by an employee of Invictus Capital “posting in a discordant troll pseudonym.”

He further claims that they threatened him and chased him to his parents’ house, and

“”[Did] Some are pretty malicious, such as logging in to private Whatsapp or Telegram on the company laptop I gave you. We also refused to send emails or Slack messages to protect ourselves from allegations. “

After Schwartzkopff was expelled from the company, Invictus Capital sent a letter to the community refusing to provide specific details about the circumstances surrounding Schwartzkopff’s dismissal. However, it said, “The board has agreed to request management to resign Daniel accordingly, and he submitted it.”

UST Depeg Event

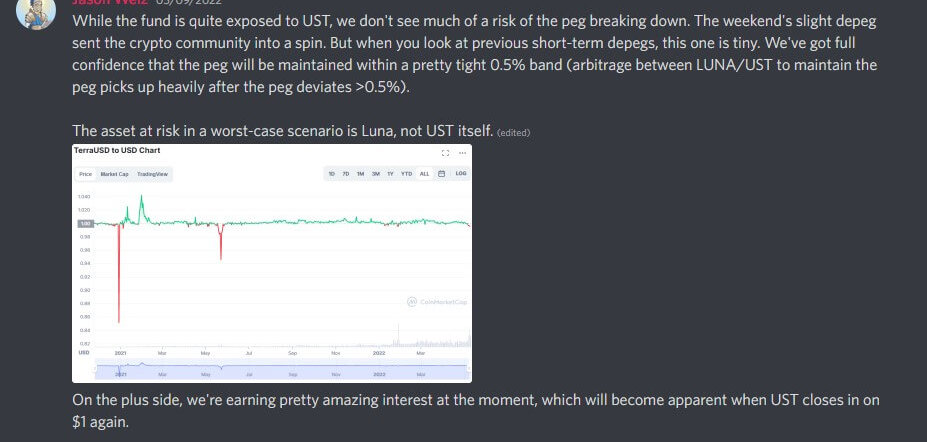

As Schwartzkopff disappeared, Invictus Capital increased its exposure to the UST of the Invictus Margin Lending Fund, as shown in the email sent to some investors.The update was leaked to CryptoSlate by a former employee, which explained:

“Unfortunately, before the de-pegging, the majority of ISG funds (98%), the majority of IBA funds (48%), and some of the C10 cash hedges (40%) were exposed to UST. Stablecoin. “

Percentages indicate that Invictus Capital had approximately $ 22.5 million directly detained by UST.

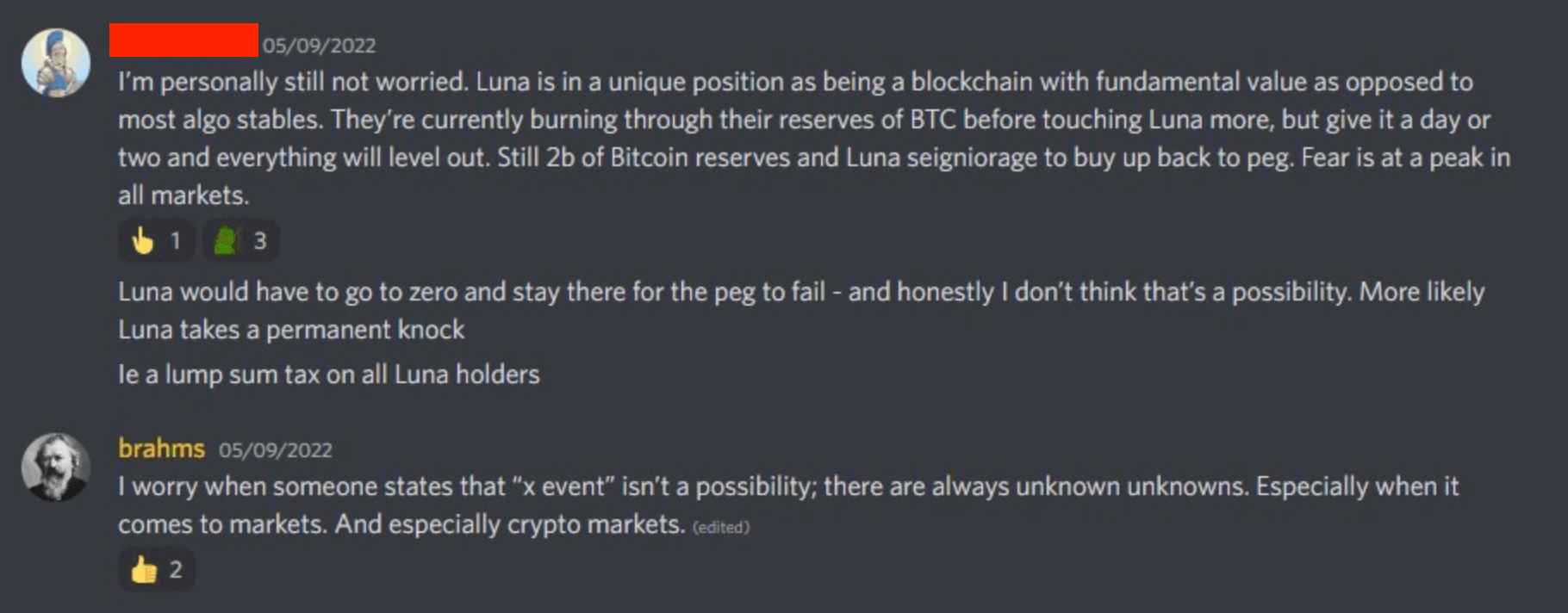

Prior to this information being released, investors contacted Invictus via the official Discord server and instructed them to close their position. However, Invictus representatives downplayed concerns that Depeg might have long-term implications.

During the week of Terra’s collapse, a validated Invictus fund analyst quoted Discord investors as his rationale for UST’s past performance: “There is less risk of pegs collapsing. “. “I’m completely confident that the pegs will be maintained,” he added.

Invictus analysts later added, “We’re getting pretty amazing interest … over 30%,” and “not worried yet.” He further declared that he believes that LUNA will be zero and there is no possibility of “staying there”.

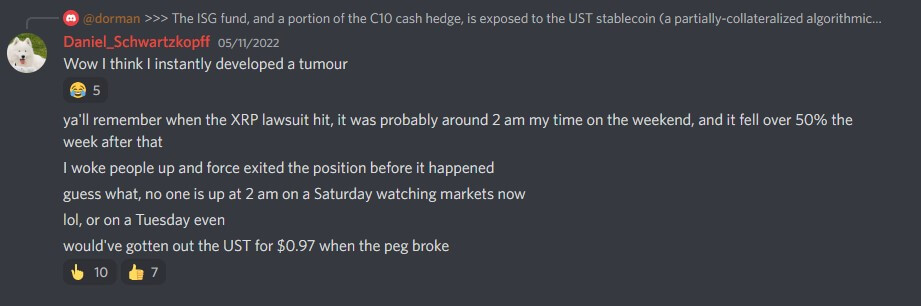

In several conversations about the event, Schwarzkopf claimed to have escaped from a position of about $ 0.97, citing a late-night move to sell XRP when “a proceeding” occurred. Schwartzkopff is no longer involved in the company during this period. But when the peg finally broke, he tried to call Invictus, but told us that no one answered.

Investors sought proof of risk management strategies because of Invictus’ belief that UST would re-peg. Nothing was offered, but one investor contacted via the Invictus website received a reply on May 11 that “the dollar should slowly recover to equality.”

At this point, the UST was below $ 0.65 and recovered to around $ 0.86. Invictus remains bullish, saying “ISF funds will maintain their UST position.” An email notified to investors “unfortunately” sent the following day, May 12, that USTs in excess of $ 22.5 million were held in multiple funds.

Refrigerate in Celsius

Two of Invictus’ core products were crypto index funds called C20 and C10. The C20 was sold as a way to invest in “regulated and tokenized funds”, allowing investors to be exposed to the “top 20 crypto assets” through a single token. The C10, on the other hand, was a hedged “smart index fund” designed to limit capital losses using a “dynamic cash hedging mechanism.”

Of the portfolio White paper.. However, Invictus later revealed that 50% of the C20 fund and the majority of C10 are instead held in Celsius.

“Both C20 and C10 have considerable exposure to the Celsius network, which has recently stopped withdrawing. Most of C10’s assets are held in the Celsius network, and about 50% of C20’s assets are also held in the Celsius network. It has been.”

Another letter to investors confirmed the exposure to Celsius, but interestingly contradicted the earlier statement regarding C10 exposure to UST:

The total reserves held in Celsius are estimated to be $ 49 million before the collapse of Terra and $ 23 million after the collapse. The fund accounted for about 55% of total assets under management. At the time of Celsius ” Bankruptcy filingIf Invictus Capital is listed as one of the largest creditors, the value of the asset has reached $ 17.7 million.

Impact on investors

Of the $ 135 million managed by Invictus, about $ 80 million was invested in Terra or Celsius. These investments have been lost due to the collapse of Terra or remain trapped inside Celsius. Investors have been unable to withdraw funds for more than a month and Invictus has disabled all means of communication.

Investors have grouped together to create a private Discord community with hundreds of members and thousands of messages. A server named “Independent Invictus Tokenholders” helped CryptoSlate in procuring the original document from Invictus to validate the claim.

Several active members spoke directly to CryptoSlate to facilitate this investigation, revealing that many private investors involved in Invictus lost their entire net worth in the disaster.

Alvarez & Marsal, the same company that represents Celsius, represents Invictus. “In the event of bankruptcy, customers may appear to be prejudiced and should not communicate with them,” Celsius said. Invictus Capital is similarly silent on voluntary post-issues. Clearing declaration.

CryptoSlate contacted several members of Invictus Capital and Kalahari, including restructuring CEO Haydn Hammond, but no one was willing to comment. However, Hammond contacted CryptoSlate in June and asked journalists to stop investigating the story.

CryptoSlate will publish a follow-up story as Invictus research progresses and more information becomes available.

Blocklight is the research division of CryptoSlate. If you have lost money through Invictus Capital, have more information, or have other tips on malicious persons in the crypto, please contact us by email.

Initial Survey: Orwa Permia de Jumo