Is MicroStrategy undervalued? | CryptoSlate

prologue

Founded in 1989, MicroStrategy is an American company providing business intelligence, mobile software and cloud-based services. Led by Michael Saylor, one of his three co-founders, the company saw its first major success in 1992 when McDonald’s signed his $10 million deal.

Throughout the 1990s, MicroStrategy established itself as a leader in data analytics software, with revenue growing by more than 100% each year. The dot-com boom that began in the late 1990s accelerated the company’s growth and culminated in 1998 when it went public.

And while the company has been a staple in the global business landscape for decades, it didn’t catch the attention of the cryptocurrency industry until it acquired its first bitcoin in August 2020. bottom.

Thaler made news by making MicroStrategy one of the few publicly traded companies to hold Bitcoin as part of its financial reserve policy. At the time, MicroStrategy said that a $250 million investment in BTC could provide a reasonable hedge against inflation and yield high returns in the future.

Since August 2020, the company has regularly purchased large amounts of Bitcoin, impacting both its stock price and BTC.

When MicroStrategy first bought Bitcoin, BTC was trading around $11,700 while MSTR was trading around $144. Bitcoin price hovered around $22,300 at the time of writing, with MSTR ending the previous trading day at $252.5.

This is a decrease of 75.6% from the MSTR’s July 2021 high of $1,304. The sharp drop in the company’s stock price over the past two years, coupled with Bitcoin’s price volatility, has led many to criticize his MicroStrategy financial management strategy and even aggressively short-sell him.

In this report, CryptoSlate takes a deep dive into MicroStrategy and its holdings to determine if its ambitious bet on Bitcoin is undervaluing its current stock price.

MicroStrategy’s bitcoin holdings

As of March 1, 2023, MicroStrategy hold 132,500 BTC were acquired at a total purchase price of $3,992 million, with an average purchase price per BTC of approximately $30,137. Bitcoin’s current market price of $22,300 puts his BTC holdings in MicroStrategy at $2,954 million.

The company’s bitcoin was acquired through 25 different purchases, including the largest on February 24, 2021. At the time, the company bought 19,452 BTC for him for $1.26 billion when BTC was trading just under $45,000 for him. The second largest purchase took place on December 21, 2020, when he acquired 29,646 BTC for $650 million.

At Bitcoin’s ATH in early November 2021, 114,042 BTC held by MicroStrategy was worth well over $7.86 billion. With Bitcoin plummeting to his $15,500 mark in early November 2022, the company’s holdings were valued at just over his $2.05 billion. At the time, the market cap of all his MSTR stocks had reached his $1.9 billion.

As CryptoSlate’s analysis showed, it wasn’t until the end of February 2023 that MicroStrategy’s market capitalization matched the market value of its Bitcoin holdings. The difference between the two is why many wondered if MSTR could be underestimated.

However, looking at MicroStrategy’s market capitalization is not enough to determine if it is overvalued or undervalued.

MicroStrategy’s debt

The company has issued $2.4 billion in debt to finance the purchase of Bitcoin. As of December 31, 2022, MicroStrategy’s liabilities are as follows:

- $650 million 0.750% convertible senior notes due 2025

- $1.05 billion 0% convertible senior notes due 2027

- $500M 6.125% Senior Secured Notes due 2028

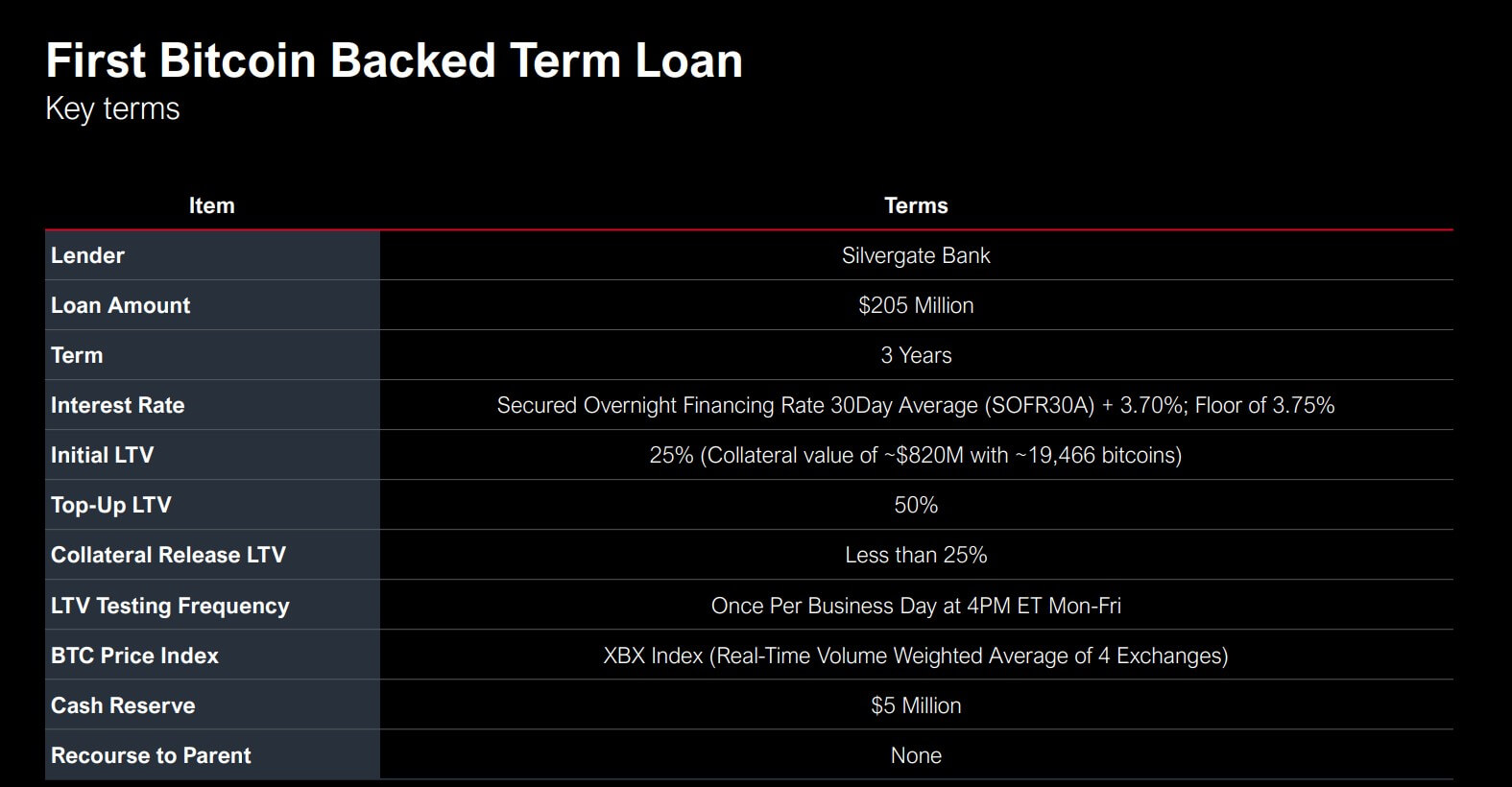

- $205 million in secured term loans

- $10.9 million of other long-term debt

The interest rates the company secured on its 2025 and 2027 convertible bonds have proven to be very profitable, especially in light of the recent rise in interest rates. However, any gain MicroStrategy makes on the convertible bond will be offset by the risk he took on his $205 secured term loan from Silvergate Bank in March 2022.

The loan was backed by 19,466 BTC and was valued at $820 million at the time, with an LTV ratio of 25%. The loan must remain collateralized at his LTV ratio of up to 50% until maturity in March 2025. If the LTV exceeds 50%, the firm must replenish collateral to bring the ratio back below 25%.

Terra’s crash in June 2022 triggered market volatility, requiring MicroStrategy to pledge an additional 10,585 BTC. In addition to the volatile bitcoin price, Silvergate’s variable rate loan resulted in an annual interest rate of 7.19%, putting a heavy strain on the company.

The recent controversy over Silvergate covered by CryptoSlate has made many worry about the future of MicroStrategy’s loans.However, the company said the future of the loan did not depend on Silvergate and the company would. Continue Pay off the loan even if the bank goes bankrupt.

Of the 132,500 BTC held by the company, only 87,559 BTC are unrestricted. MicroStrategy has pledged 14,890 BTC as collateral for his 2028 senior secured bond, apart from his 30,051 BTC used as collateral for Silvergate’s secured term loan. If the Silvergate loan needs to be replenished with collateral, the company can invest 87,559 unencumbered BTC.

Thaler also said the company could post additional collateral should the price of Bitcoin fall below $3,530 and a margin call on the loan occurs.

MSTR vs BTC

MicroStrategy, one of the biggest stars of the dot-com boom, has experienced intense share price volatility during its expansion period.

Following its IPO in 1998, MSTR’s price increased by over 1,500%, peaking at over $1,300 in February 2000. It took him more than a decade for the company to recoup his $120 stock price, which it marked in 1998, after a spectacular share price drop that marked the beginning of the dot-com crash.

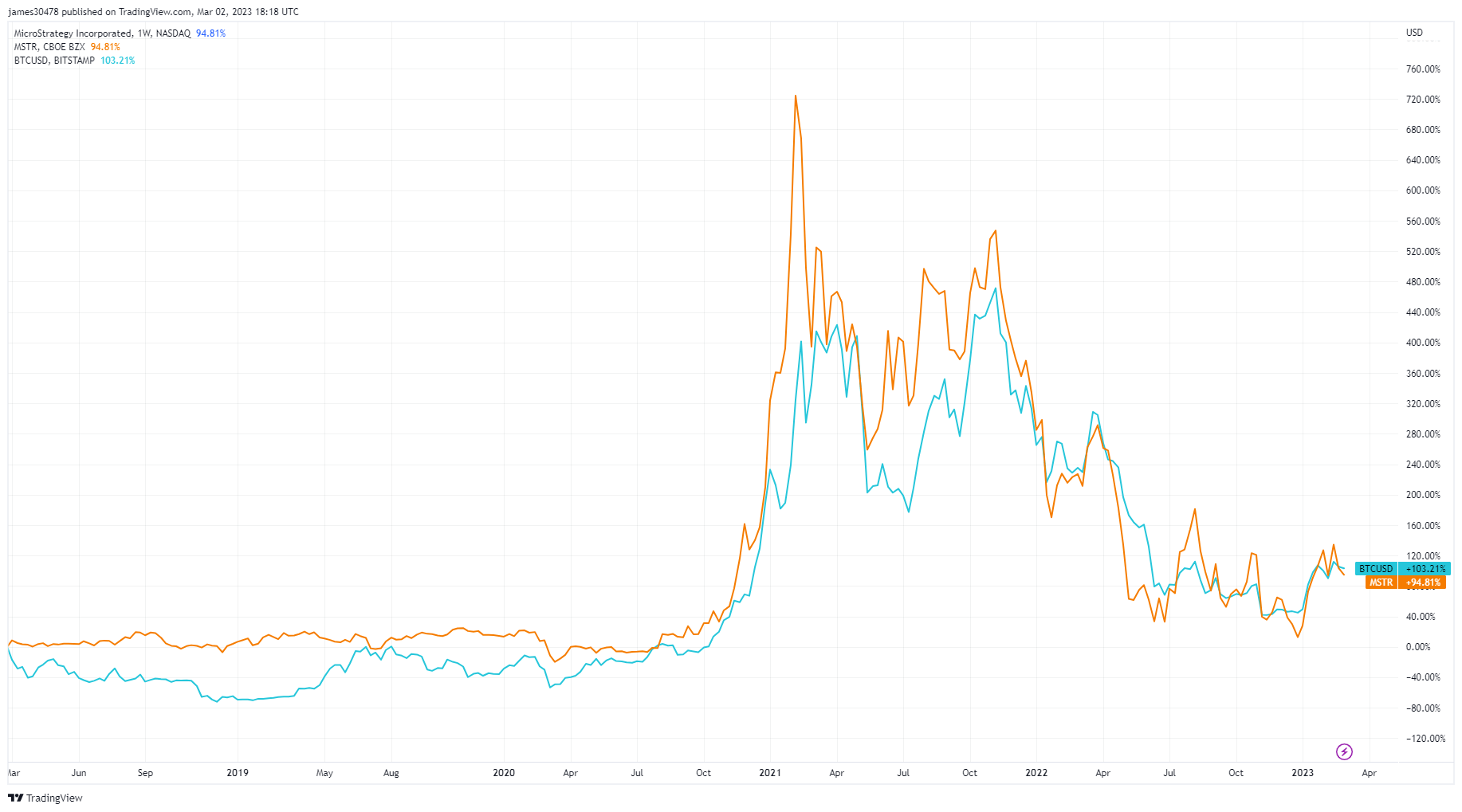

MicroStrategy stock was trading at $160 before the first bitcoin purchase in August 2020. September saw a notable rise, with the price hitting a new peak of his $1,300 in February 2021.

Since then, MSTR has shown a remarkable correlation with Bitcoin price volatility, and the company’s performance is now tied to the cryptocurrency market.

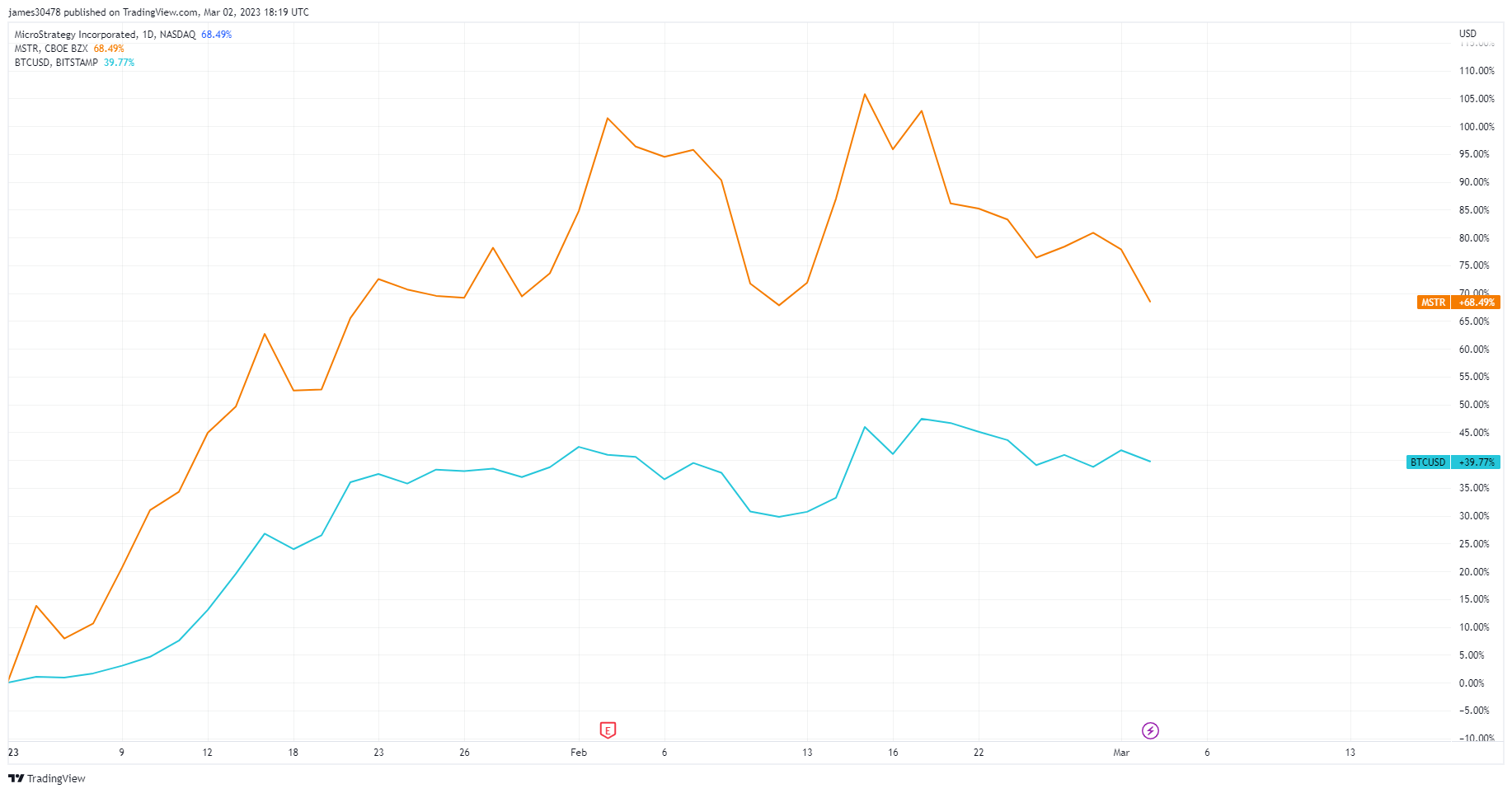

MSTR is up more than 68% year-to-date, outperforming BTC, whose price has risen just under 40%.

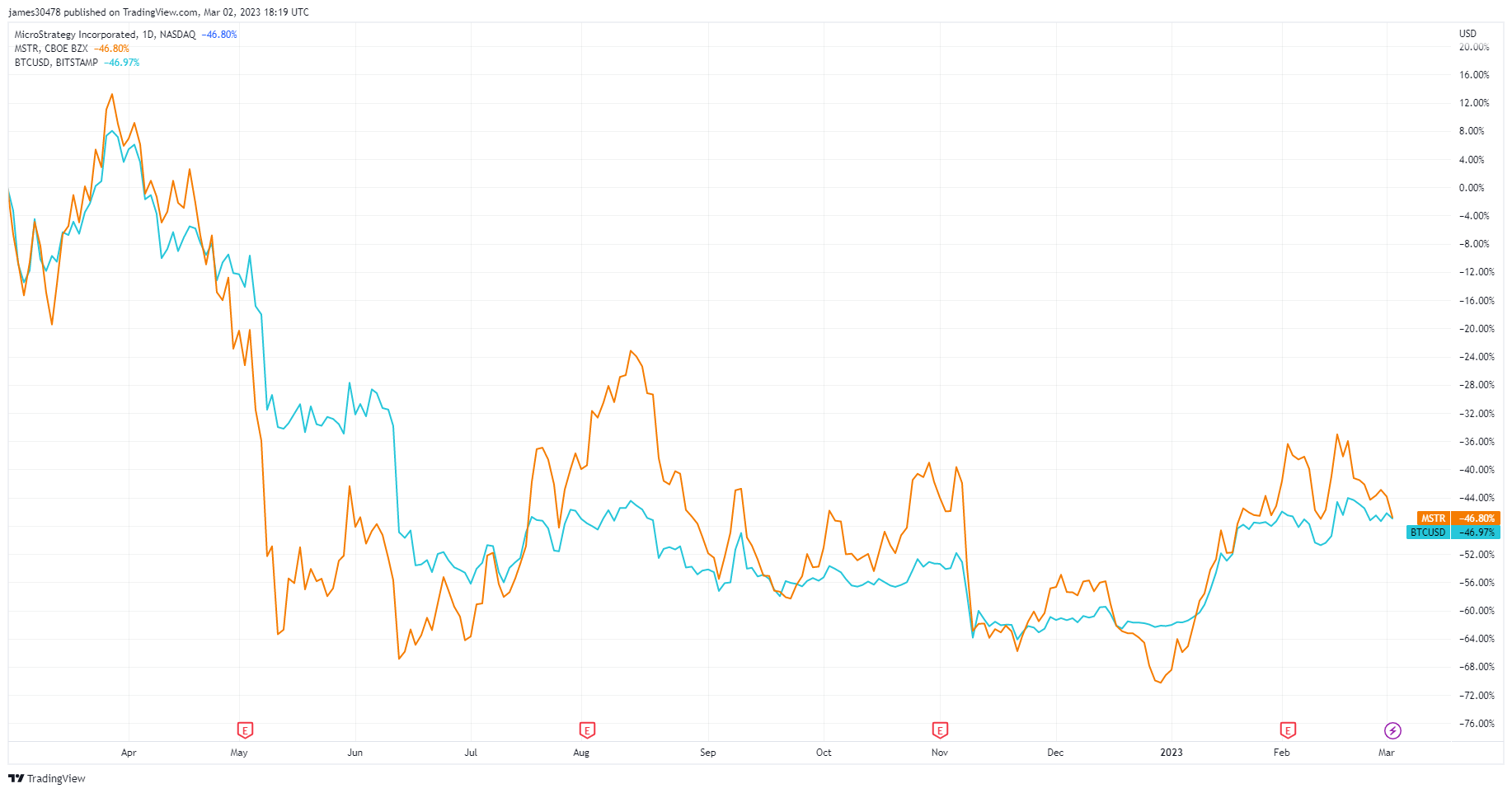

MSTR tracked Bitcoin’s performance on a one-year scale, both recording losses of 46%.

Zooming out to the 5-year timeframe, we see a striking correlation in performance, with BTC slightly outperforming MSTR with a 103% increase.

However, MSTR’s market performance has often been overshadowed by MicroStrategy’s deteriorating financial statements. At the end of the fourth quarter of 2022, the company will report An operating loss of $249.6 million, down from $89.9 million in the fourth quarter of 2021.This brings the company’s total operating loss to his $1.46 billion in 2022

accounting conundrum

With a $1.46 billion operating loss in 2022, risky loans that need to be repledged, and a volatile crypto market behind it, MicroStrategy certainly doesn’t look overvalued.

However, the company’s reported operating loss may cloud its profitability. In other words, the SEC requires companies to report unrealized losses in bitcoin they hold as impairment losses. According to MicroStrategy’s Bitcoin Accounting Treatment, the company’s impairment losses will add to its operating loss. This means that any negative change in Bitcoin’s market price will show up as a large loss in MicroStrategy’s quarterly results. Even if the company has not sold any assets.

On December 31, 2022, the company reported an impairment loss of $2.15 billion on its one-year bitcoin holdings. It reported a pre-tax operating loss of $1.32 billion.

Conclusion

Given the correlation between MSTR and Bitcoin’s performance, a bull market rally could push the stock back to 2021 highs.

Traditional financial markets have historically struggled to keep up with the rapid pace of growth seen in the cryptocurrency industry. The kind of volatility that cryptocurrency markets have grown accustomed to, both positive and negative, is still rare in stock markets. In a bull market similar to the one that lifted Bitcoin to ATH, MSTR could significantly outperform other tech stocks, including the large-cap FAANG giant.

However, while MSTR’s growth may mimic the growth seen in the crypto market, the company’s stock price is unlikely to fluctuate significantly over the next few years. If MicroStrategy continues to pay off its debt, it will be very well positioned to profit from the crypto-heavy market over the next decade.

Its long-standing reputation could make it the go-to agency for institutional investors to gain exposure to Bitcoin, creating demand that sustains high buying pressure.