Is the UK heading towards a sovereign debt crisis?

quick take

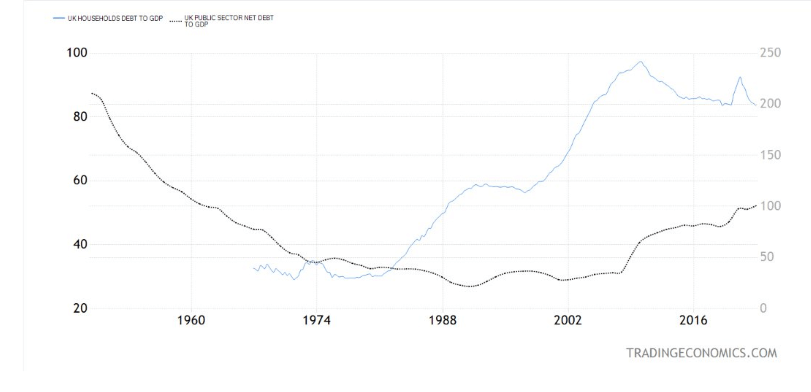

The UK is currently facing a tough financial environment with alarming levels of household and government debt. Household debt has soared, reaching 200% of gross domestic product (GDP), while government debt has risen as well, accounting for 100% of GDP. The imminent threat of rising interest rates has made such skyrocketing debt levels potentially unsustainable.

Currently, the Bank of England base rate is 5%. However, market analysts predict that the rate will likely jump to 6.75% (50% to be exact) by early 2024. Such a rise would push yields further along the yield curve and above those seen during the 2016 pension crisis. last year.

Fueling this volatility is the UK’s worrisome inflation rate. Consumer Price Index (CPI) inflation is currently at a remarkable 8.7%, with core inflation reaching 7.1%. These figures contrast sharply with the Bank of England’s previous interest rates of 1.75% and 0.25% a year ago and 18 months ago, respectively, and highlight just how slow the Bank of England has reacted. .

As this financial storm rages, Britain is at a critical economic crossroads. The effects of these economic stressors are likely to affect the fiscal health of countries for the foreseeable future. In this uncertain environment, the Bank of England’s future actions and their impact on the domestic economy will come under close scrutiny.

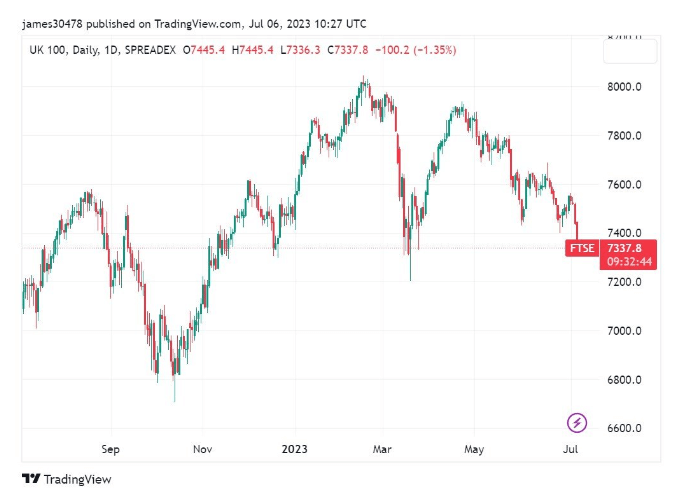

In addition, the FTSE 100 index, which represents the top 100 British stocks, hit a new low at the beginning of the year, dropping more than 2% from the previous day to 7286.

The post Is the UK headed for a sovereign debt crisis? First appeared on CryptoSlate.