Liquidations surpass $200M in 1 hour after SEC’s Binance lawsuit

The U.S. Securities Exchange (SEC) lawsuit against Binance wiped out more than $200 million in less than an hour from crypto traders who held positions in the market.

After receiving this news, of crypto slate The data show that the market capitalization of digital assets fell by 2.87% to $1.12 trillion.

Nearly $300 million in the last 24 hours

$298.51 million has been liquidated in the cryptocurrency market in the last 24 hours, affecting more than 110,000 traders.

According to Coinglass data, long traders lost $275.31 million, of which $130.46 million was accounted for by Bitcoin and Ethereum.

Meanwhile, short traders experienced liquidations of $23.2 million. The top two digital assets account for approximately 49.5% of these losses.

Other assets such as BNB, Chainlink, XRP, Litecoin and Solana had liquidations of less than $2 million each.

Across exchanges, most of the liquidations occurred on OKX, Binance and ByBit. These three exchanges accounted for 75% of his total liquidations and 92% were long positions. Other exchanges such as Huobi, Deribit and Bitmex also recorded significant amounts of total liquidation.

The most significant liquidation was on Bitmex – XBTUSD, valued at $9.94 million.

red market

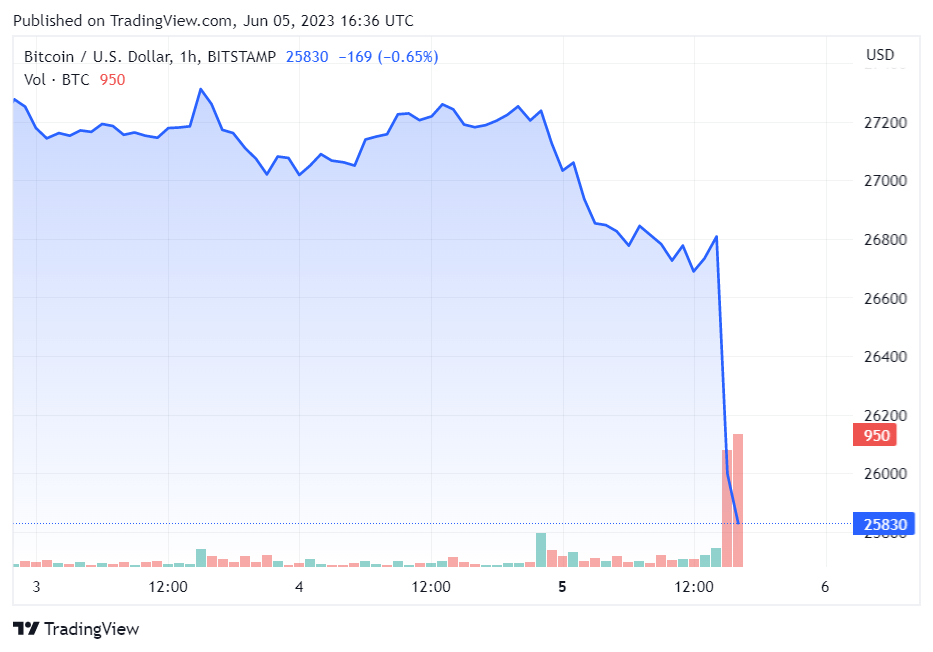

Bitcoin fell from over $27,000 to under $26,000 in less than an hour, trading at $25,859 at 16:36 UTC

Bitcoin’s price has overall fallen about 5% over the past 24 hours.

Binance-linked BNB suffered the biggest loss, dropping nearly 10% to $281, while Ethereum (ETH) dropped 3%. Other top digital assets such as XRP, Cardano (ADA) and Dogecoin (DOGE) also reported significant losses during the reporting period.

After the SEC’s Binance lawsuit first appeared on CryptoSlate, the post-liquidation amount surpassed $200 million in an hour.