Litecoin bucks market downtrend, posting 19% gains to pass Shiba Inu

Litecoin bucked the market’s downtrend, leading the top 100 with a 19% gain over the past week.

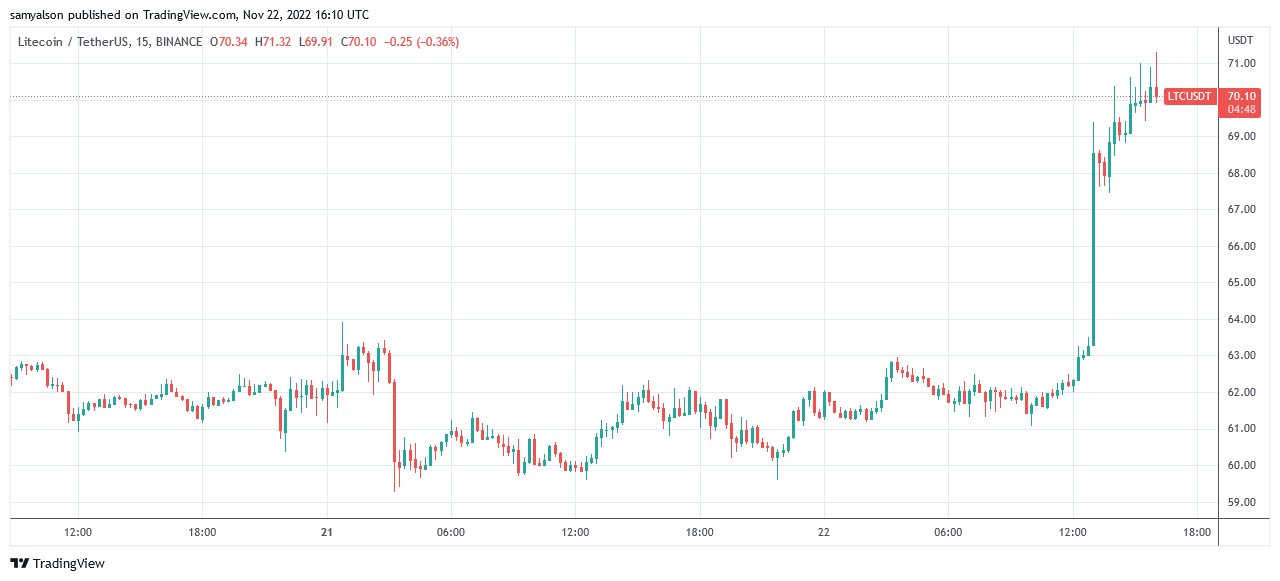

In the last 24 hours price performance, LTC is up 13.7% to $70.10 from $61.53 at the time of writing. Most of today’s gain is due to the candle’s 9.6% upside at 13:00 (UTC).

As a result, Litecoin continues to rise in the market capitalization rankings. Excluding stablecoins, LTC ranks in the top 10 and he is ninth, overtaking Shiba Inu in the process.

“Boring” Litecoin Offers Stability

CryptoSlate reported that Litecoin’s resurgence is likely due to the market seeking stability amid the impact of FTX.

Since FTX started showing signs of bankruptcy, the total market cap outflow has reached $228 billion, leading to a crash in token prices. Especially when it comes to his FTX-related projects, including FTT and SOL, the former currently fading outside the top 200.

Commenting on the recent chaotic market conditions, Litecoin Foundation Managing Director Alan Austin recently asked, “Are you guys excited enough yet?”

Austin referred to Litecoin’s “boring” reputation, which is less attractive, but in return it offers a high degree of stability to its holders.

Aside from Bitcoin, Litecoin is probably the most solid cryptocurrency in terms of longevity, with 11 years of history in and around big caps to back this up.

On-chain metrics show users holding LTC

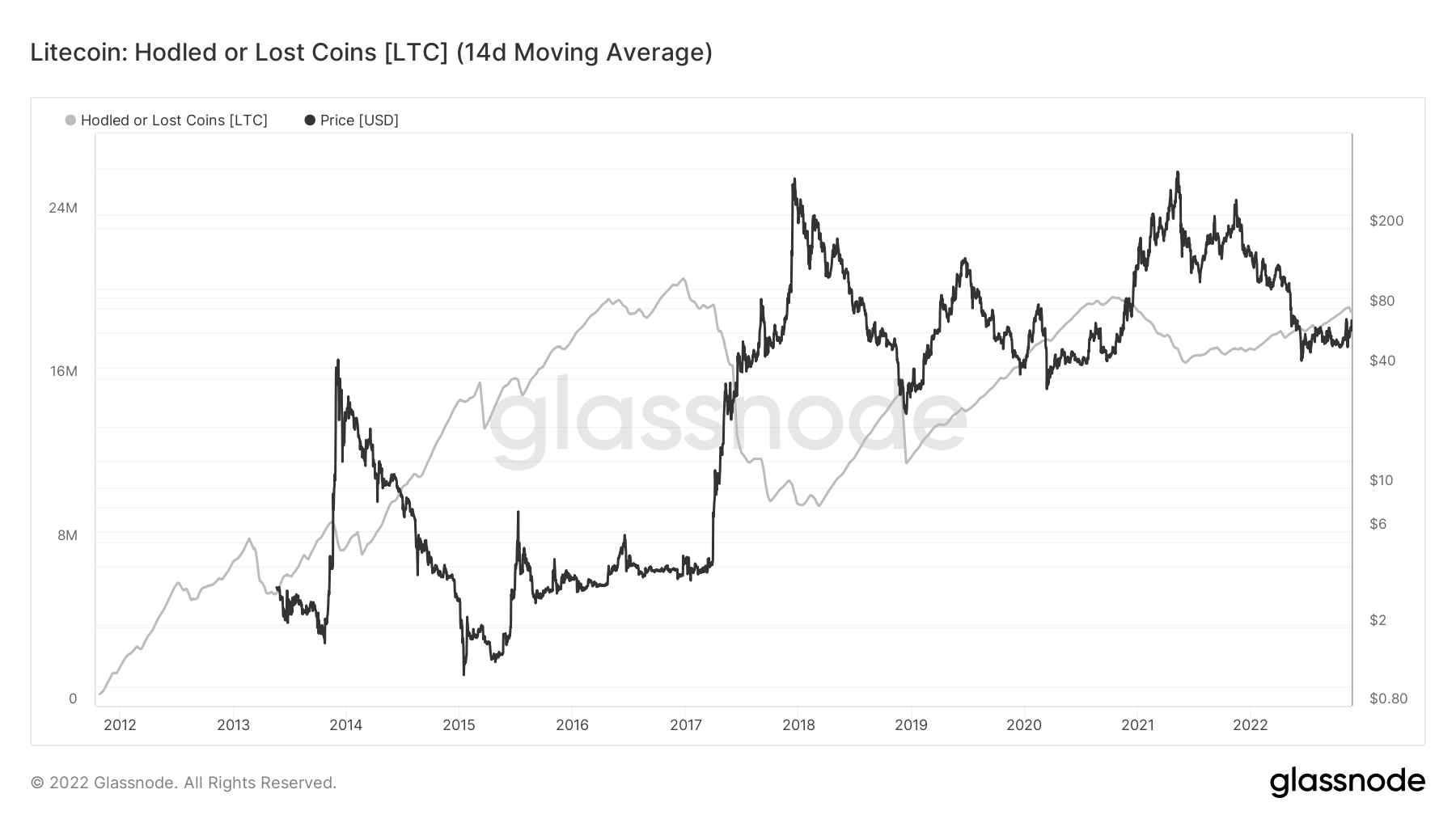

Analysis of Glassnode data suggests that users are increasingly viewing Litecoin as a store of value rather than a payment token. This is the main use case.

Since Q1 2021, the amount of Litecoin held or lost has continued to grow steadily over time. The chart below shows that about 20 million LTC currently fall into this category.

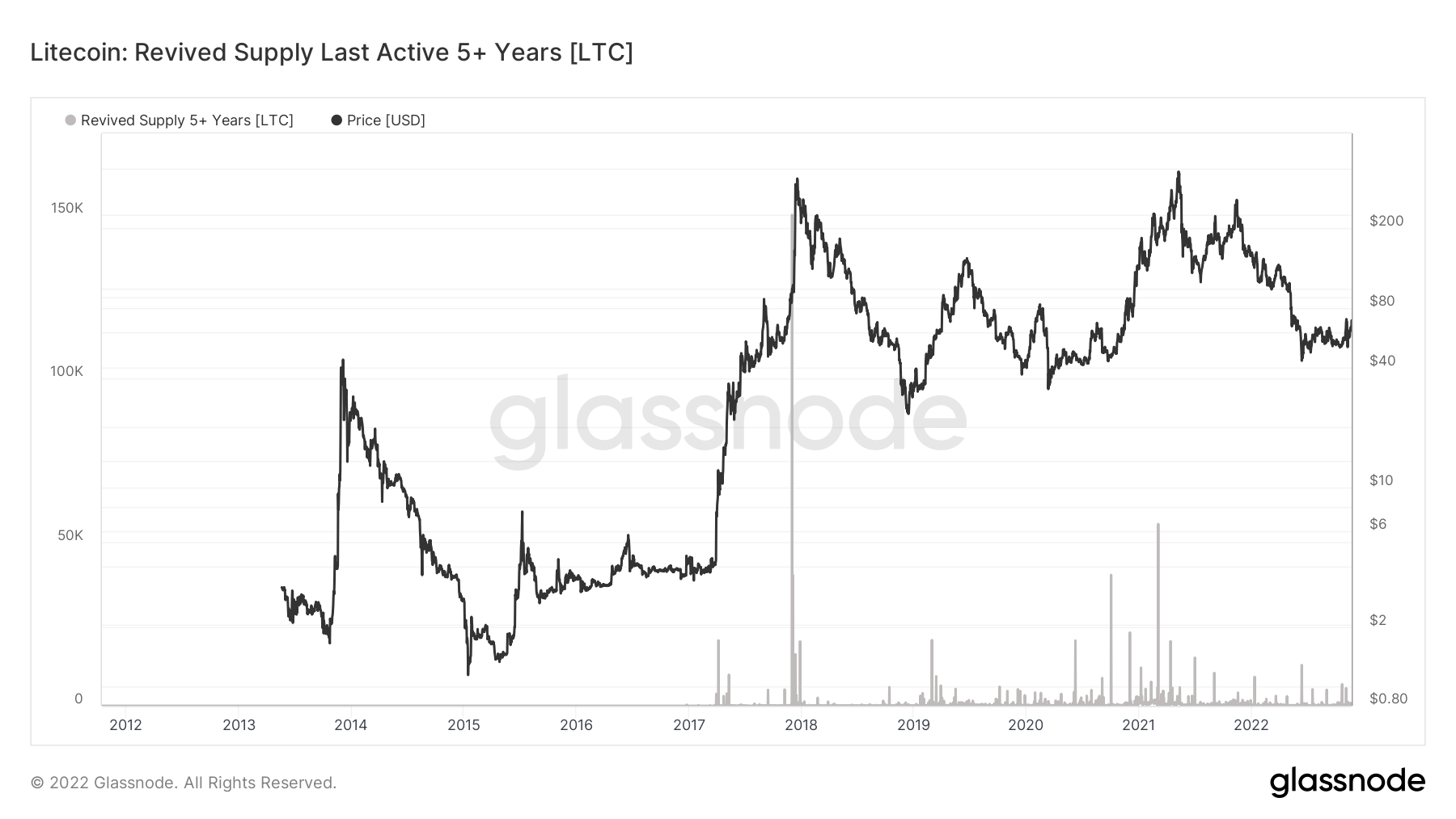

Revived Supply Last Active 5+ Years refers to the amount of Litecoin that was inactive 5 years before the data point. The chart below shows a peak of inactive supply of around 150,000 LTC in the second half of 2017.

Since then, the LTC token has become more active. However, recent trends show that LTC holders are starting to hold tokens again, although not as much as in late 2017.

The above suggests that long-term holders are not selling Litecoin.