Lobbying Group for U.S Semiconductor Industry: Government Assistance Necessary to Maintain Global Leadership

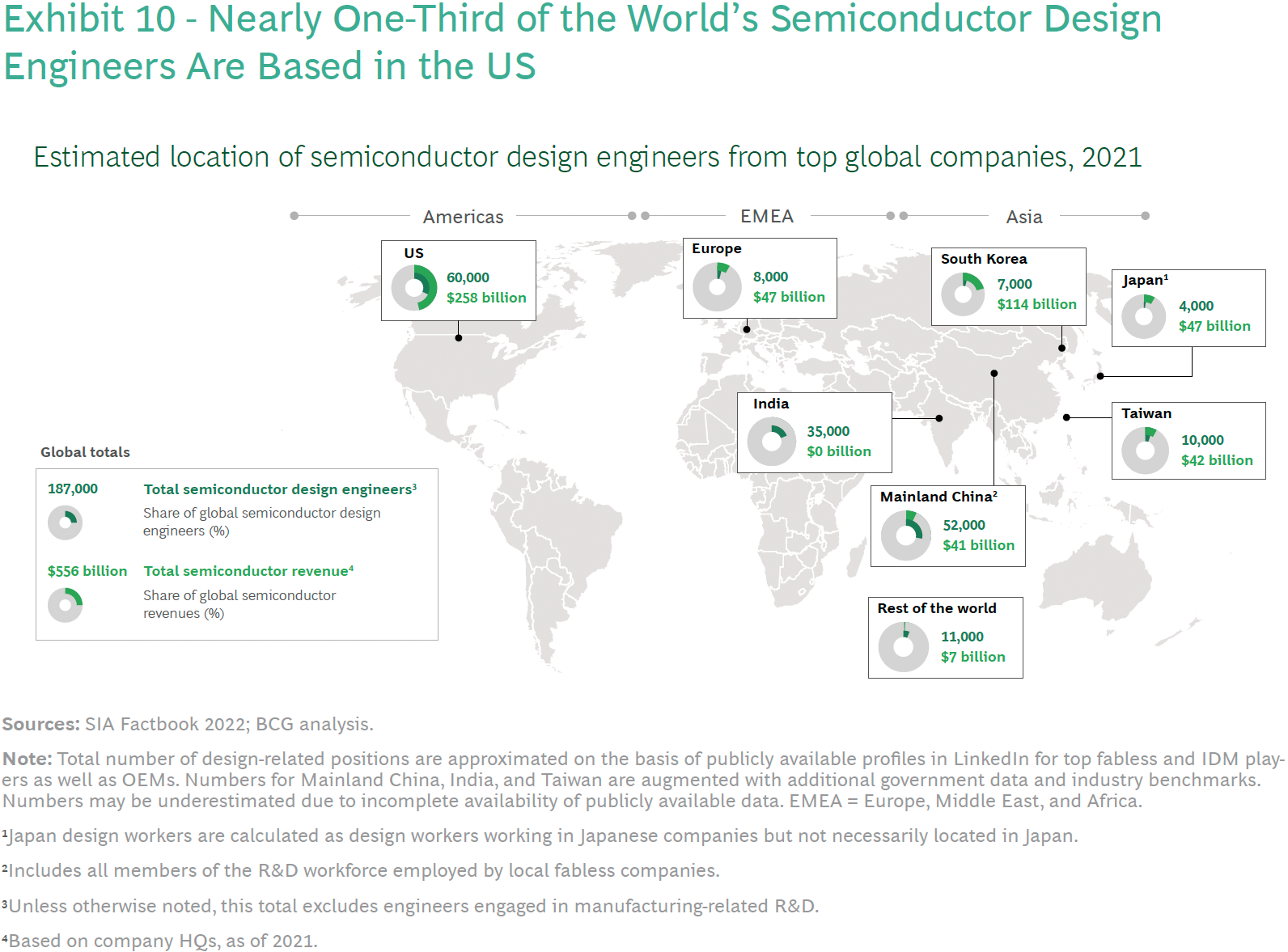

The United States is the world’s largest chip developer. But as semiconductors become more ubiquitous and important, other countries are gaining chip design prowess and market share.

If the U.S. wants to maintain its status as the world’s largest chip developer, the U.S. government must help fund local semiconductor research and development. according to reports From Semiconductor Industry Association and Boston Consulting Group.

Chip development is expensive

US companies account for approximately 46% of global semiconductor design revenue. That’s about 2.5 times more than our closest competitor. With companies like AMD, Apple, Intel, Nvidia, and Qualcomm dominating the processor, graphics card, and mobile SoC markets, the US is particularly strong in logic chips such as CPUs, GPUs, and various other complex SoCs.

However, it has decreased by 46%. According to SIA, the US controlled more than 50% of the market in 2015. This loss comes as countries such as China, South Korea, and Taiwan have captured design-related shares over the years thanks to federal and local government-backed semiconductor R&D activities and domestic talent development. . For example, in 2021 South Korea approved her $450 billion plan to develop the local semiconductor industry over the next decade. That figure included her $1.3 billion in designing AI and power chips.

If nothing changes and the US continues its current downward trajectory, the US share of chip design revenue could drop to as low as 36% by the end of the decade. according to reports.

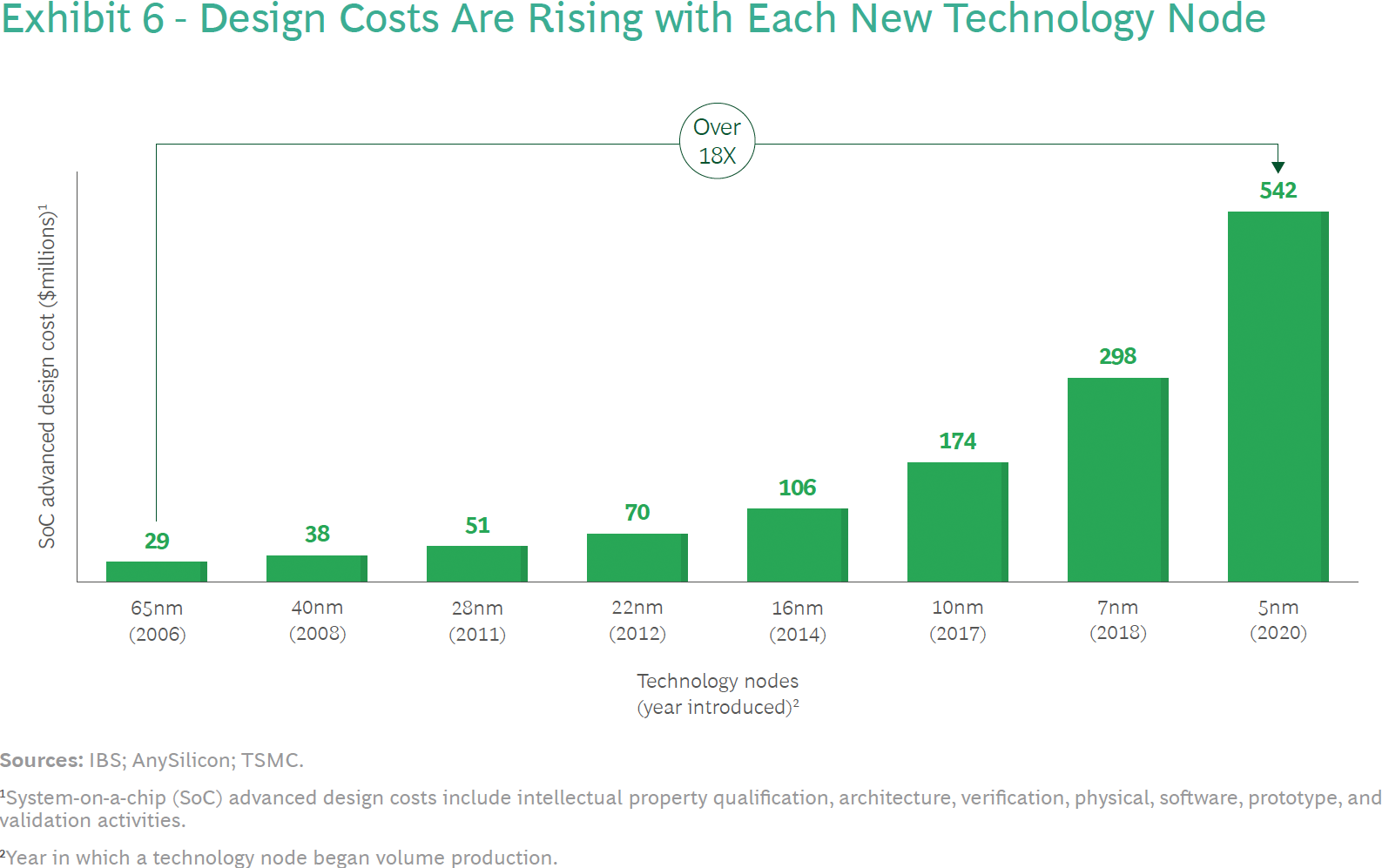

As logic and memory chips become more complex, they require more R&D investment and more engineering talent. The cost of designing a fairly complex chip (including the design of both the physical integrated circuit and the associated software) for a 5nm-class process technology is estimated at over $540 million. international business studiesAmerican companies spend billions of dollars on design-related R&D to produce dozens of such systems-on-chips each year. In 2021 alone, US companies poured about $40 billion into chip design.

Semiconductor Industry Association analysts estimate that the US public sector will invest $400 billion to $500 billion in R&D and workforce development over the next decade. But they believe this alone is not enough to maintain chip design leadership across the country.

SIA and BCG experts say the U.S. semiconductor design industry is already facing a shortage of skilled workers and that by 2030, as science, technology, engineering and math (STEM) graduates leave the industry, its It warns that the shortage could rise to 23,000.

Plus, top-of-the-line processors for growing artificial intelligence and high-performance computing applications, including AMD’s Instinct MI250X, Intel’s Ponte Vecchio, and Nvidia’s A100 and H100 computing GPUs, all of which sell for $10,000 or more apiece. export restrictions, etc. ) further threatens the ability of US companies to invest in R&D.

Large OEMs rely on chips

Chip design prowess not only ensures the prosperity of American chip developers, but also the success of neighboring OEM manufacturers. In the US, this includes 34 world-class companies such as Apple, Dell, HP and HPE. By contrast, China has 27 large companies, including Huawei, Lenovo, BKK, and Xiaomi, all consuming chips made by the People’s Republic of China.

The Chinese government understands how important it is to develop chips domestically, and for years it has fostered a local design industry, even if it is produced elsewhere. Revenue for China’s top 25 fabless companies doubled from $12.2 billion in 2017 to $24.4 billion in 2020, according to SIA data.

Public Sector Chip Development Fund Needed

The CHIPS & Science Act, passed earlier this year, focuses on new semiconductor manufacturing methods (i.e., new basic manufacturing techniques), advanced semiconductor research (transistor structures, materials), metrology research, and innovative chip packaging. $11 billion is spent on various R&D projects focused on

But this act does not fund chip designers. Micron and Western Digital will get some money to do pre-competitive research and development on materials, transistors, fabrication methods, analytics, and metrology, but not money to design actual products to compete with them. not available. Developed elsewhere.

Developing a real product ahead of your competitors is very important. This allows the first entrants to set new market standards that other entrants must follow. Companies that set their own standards also tend to benefit directly. For example, Nvidia’s own CUDA parallel computing platform and development environment is far superior to its competitors, which is why the company has dominated in some areas of his AI and HPC for years. increase.

About 13% of US semiconductor design research and development is currently funded by public investment. About 20% to 30% of such R&D is funded by governments, local governments, or tax incentives in Europe, Taiwan, South Korea, and Japan. In China, a whopping 45% of chip design-related R&D is funded using direct public funds (government, municipalities, public universities, etc.), tax incentives, and other initiatives.

Experts from the Semiconductor Industry Association and the Boston Consulting Group believe public sector investment is needed to secure US leadership in chip design going forward.

The good news, according to analysts, is that public money invested in design and research and development will provoke additional private sector investment, thus boosting actual chip sales significantly.

They found that if the U.S. public sector invested $20-30 billion in design and R&D by 2030 (including $15-20 billion in design tax incentives), it would ultimately save about It is estimated to generate $450 billion in design-related sales. It will also help train and hire 23,000 semiconductor design engineers, creating 130,000 indirect jobs.

Overview

The US still leads in advanced logic processors and other logic, but lags in memory, sensors and optoelectronics. This isn’t going to change anytime soon, but if ongoing trends continue, the chip design-related revenue share dominated by American companies could also decline in the years to come.

Industry experts believe that public sector funding of chip design and R&D in Europe and Asia will allow non-U.S. companies to increase their share of chip design-related revenues if the U.S. does not take action. increase.

Public investment in chip design R&D in the US need not be prohibitively expensive as the chip development ecosystem already exists. And there are dozens of competitive chip designers in the US.

According to SIA and BCG reports, US public sector investment of $20 billion to $30 billion in design and R&D (including tax incentives) by 2030 will boost private sector investment and Increase related sales by approximately $450 billion. Decade. This is more than enough for the US to maintain its position as the world’s leading chip developer.