Machine money gains traction among EU regulators; stablecoins under consideration

In recent years, as the cryptocurrency market has expanded dramatically, stablecoins have also achieved remarkable growth.

In response, the Digital Euro Association (DEA) report We analyze use cases for European Union-denominated stablecoins and examine trends such as machine-to-machine (M2M) payments and other aspects of decentralized finance impacting the broader sector of the stablecoin market.

The report, entitled “The Future of Machine Money – Opportunities for Stablecoins in Europe,” shows that once regulation is established, Europe can leverage stablecoins to facilitate the development of the Internet of Things (IoT). suggesting.

Europe’s DEA believes that automated micropayments enabled by stablecoins could be a means for Europe to remain digitally competitive.

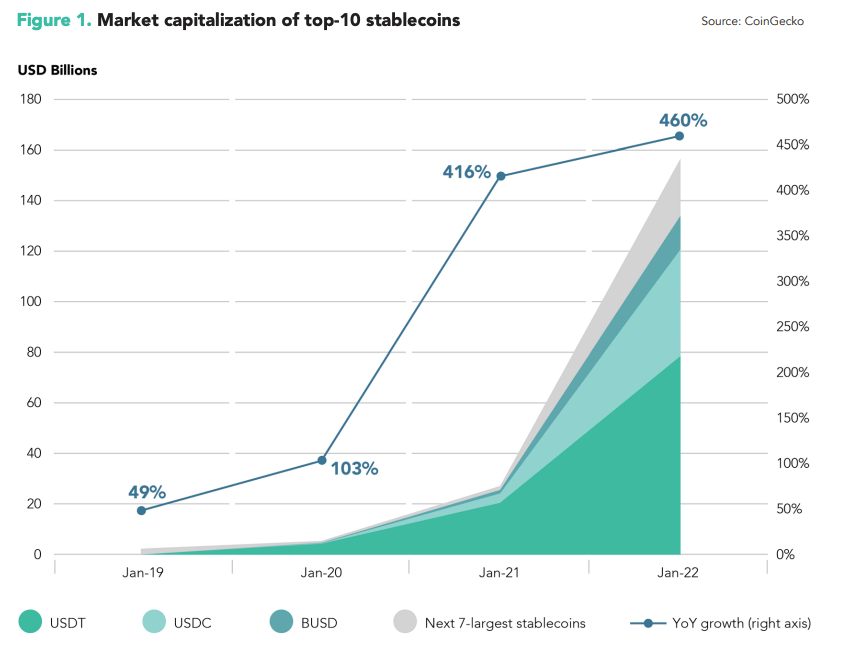

Top 10 Stablecoins Market Cap

As of March 2022, before TerraUSD’s collapse, the total value of the top 10 stablecoins was approximately US$164 billion, a 460% increase from the previous year.

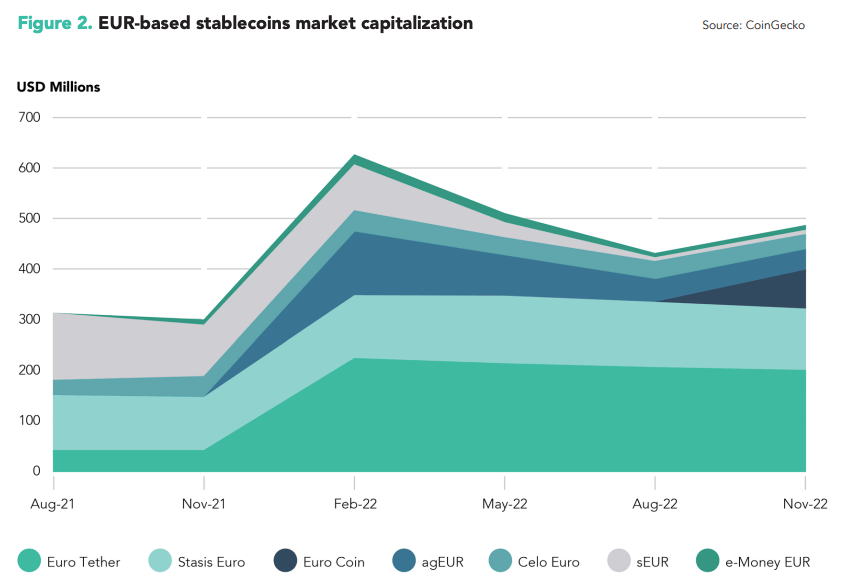

The two largest stablecoin issuers, Tether and Circle, have both introduced euro-backed stablecoins. Tether’s Euro Tether (EURT) is worth $220 million and currently has over 200 million tokens in circulation. Meanwhile, the USD pegged stablecoin USDT has a market capitalization of $71 billion. Circle’s Eurocoin (EUROC) has a market cap of $33 million, while USDC, a USD-pegged stablecoin, has a market cap of $43 billion.

As of November 2022, EUR-based stablecoins have a market capitalization of less than US$500 million, representing approximately 0.2% of the total stablecoin market.

Europe’s Potential Stablecoin Future

Stablecoins not only provide a gateway to cryptocurrency trading, a safe haven from market volatility, and access to decentralized finance (DeFi) markets, but they also enhance financial inclusion and provide a well-served market. It has also been used to facilitate cross-border payments for non-resident communities. claim.

Trading, cross-border remittances, inflation hedging, decentralized finance, and tokenized securities settlement are all reasons for stablecoin adoption.

Internet of Things (IoT) The difference between IoT and Machine-to-Machine (M2M) payments is starting to become apparent, with over 11.3 billion IoT devices in operation worldwide by 2021 leading the way. Experts believe it will surge to 30 billion by 2021. 2030. This burgeoning trend is expected to affect all sectors of the economy and is expected to unlock economic value in the range of US$5.5 trillion to US$12.6 trillion, which will also affect global finance. bring economic benefits.

Main findings

European policymakers and regulators should encourage the implementation of industry-wide or EU-level standards that incorporate established best practices and global standards, the report says.

- “EUR-based stablecoins for M2M payments could be issued on different types of blockchains or distributed ledgers (e.g. permissionless, permissioned, hybrid, even consortium).”

- “The digital euro is likely not to be issued until late 2026 at the earliest, so alternatives are needed for the growth of the M2M space to truly flourish. It could play a role.”