MacroSlate Weekly: US inflation comes down, but Fed forecasts ‘mild recession’

US inflation is falling

The highlight of this week’s macro announcements is certainly the US inflation data. The Fed has been hiking rates for over a year now and we are starting to see signs of disinflation, but it is too early for the Fed to declare victory.

CPI inflation was below expectations in February. Over the course of the year, inflation slowed from 6% to 5%. At the same time, energy is in deflation for the first time since 2021 (-0.5%). Does this reflect OPEC+’s announced cuts that economic demand is deteriorating?

Meanwhile, oil prices (y/y) are down 32% and CPI inflation is just 5%. This is the first time oil has fallen more than 15% while the consumer price index remains above his 5%.

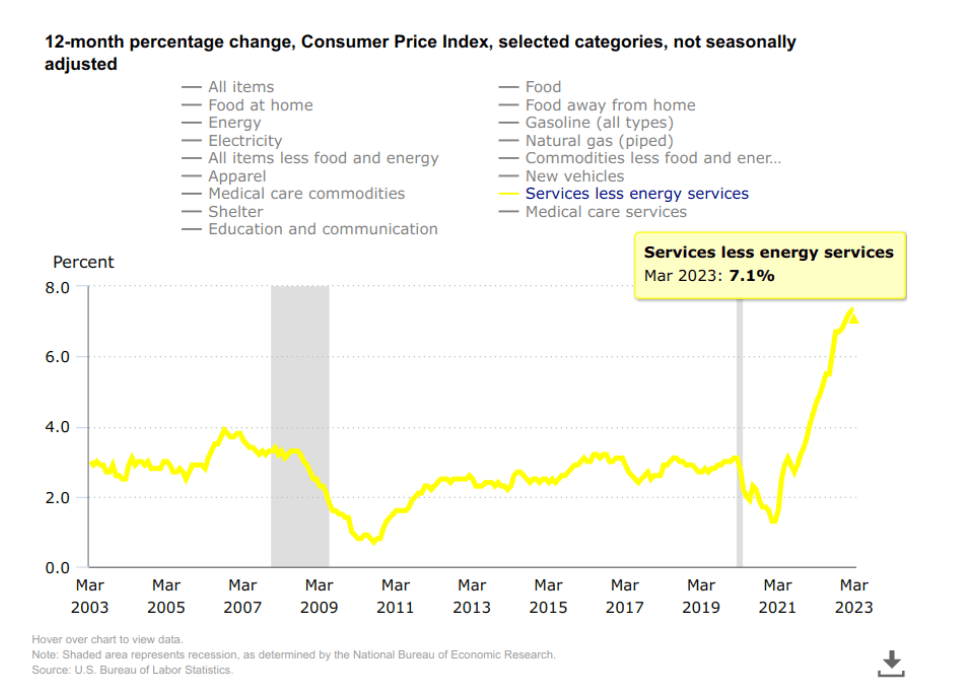

Moreover, core inflation remains strong and services inflation remains above 7%, too high for the Fed’s liking. Core CPI rose to 5.6% from +0.1% y/y. The Fed must continue on its hawkish route to avoid the mistakes of the 70’s and 80’s. However, credit uncertainty will be a major factor in the short to medium term.

minutes

The final FOMC minutes were released after CPI printing on Wednesday, revealing several factors. For one, staff are predicting a “moderate recession” later this year. Meanwhile, “all” officials backed last month’s 25bps rate hike. The FOMC keeps inflation low while monitoring monetary policy closely.

Inflation in China and Russia also fell

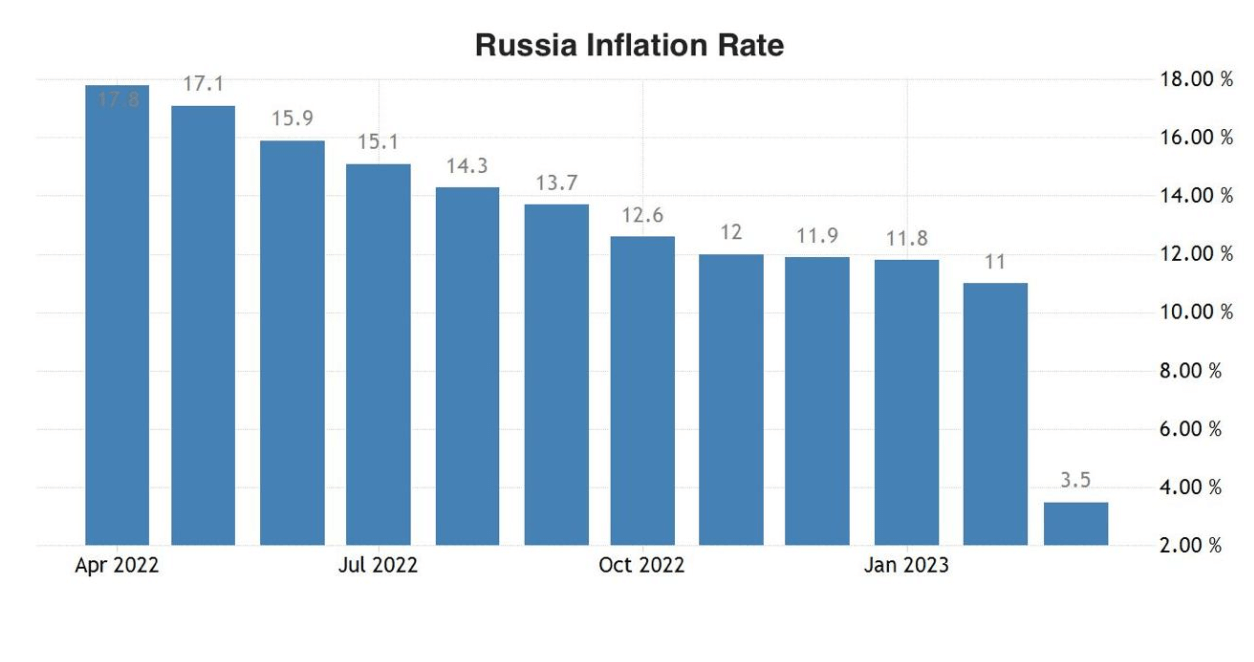

Inflation in Russia slowed to 3.5% from double digits of about 11% in February, reaching its lowest level in almost three years.

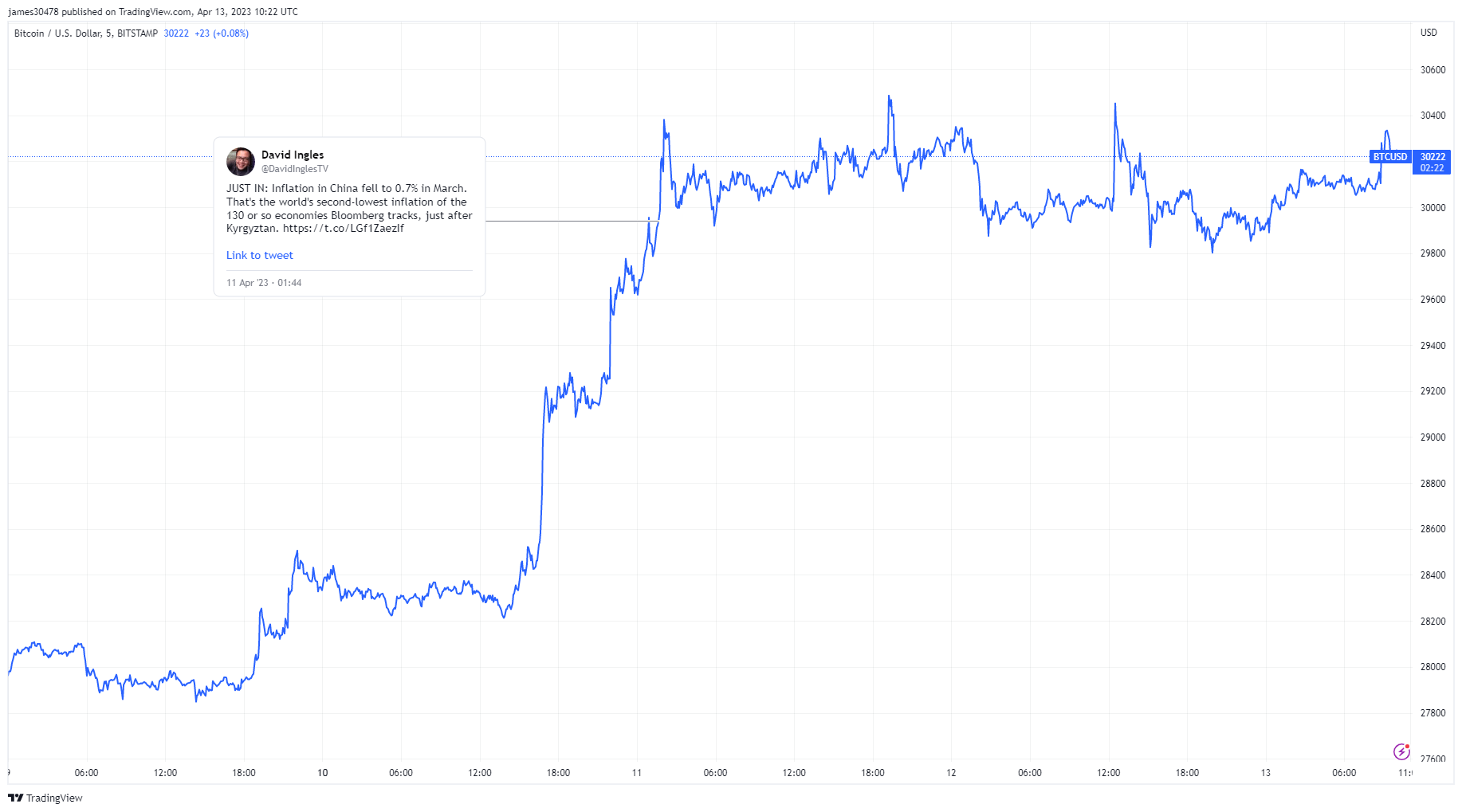

China’s inflation eased earlier this week, but the PPI showed deflation and the CPI fell to 0.7%. This happened around the same time as Bitcoin, where he crossed $30,000 during Asian trading hours.

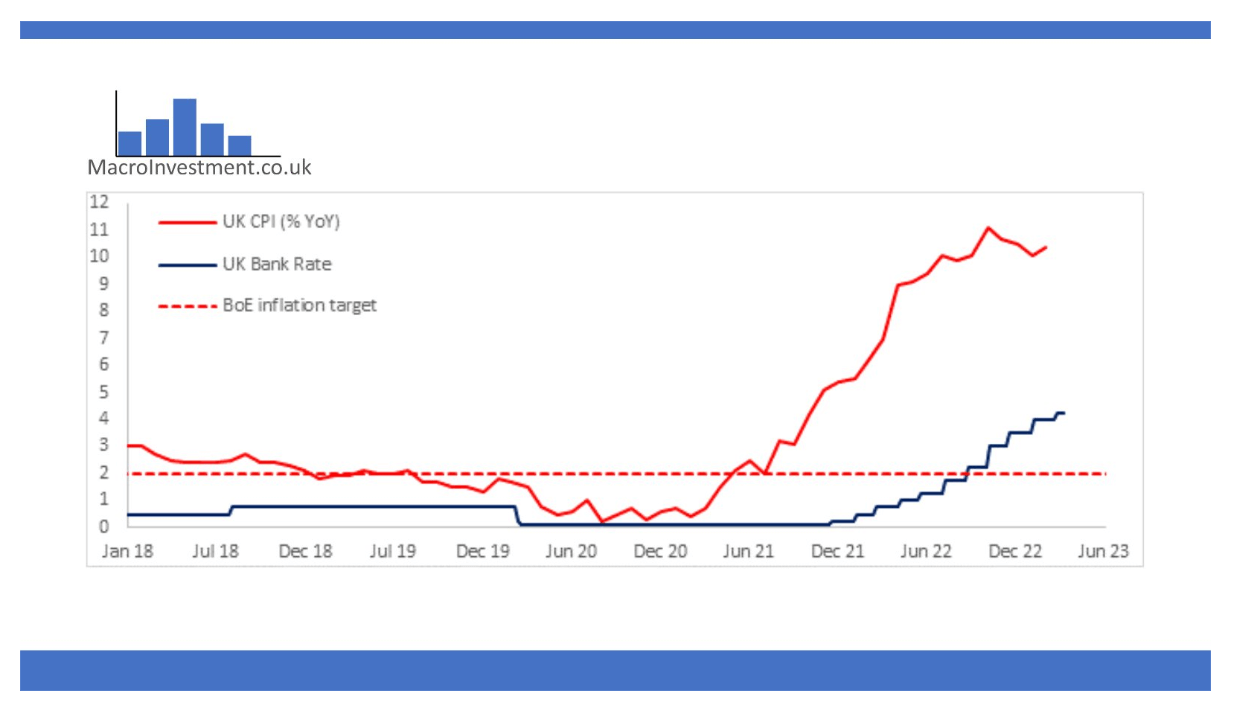

BOE tries and reigns hot inflation

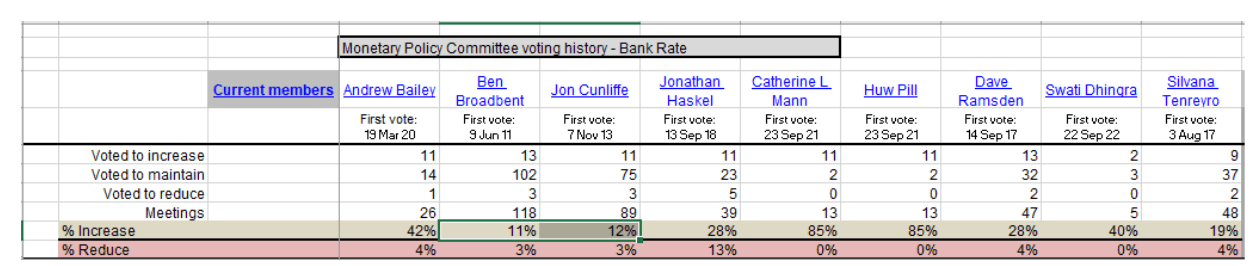

Andrew Bailey spoke at an IMF meeting about his prospects of prioritizing inflation. The BOE has raised bank interest rates to 4.25%, he said, and is expected to raise another 25bps on May 11. The UK now has the highest inflation rate of her G7, but changing circumstances have replaced Silvana Tenlero.

She is the most dovish MPC member and has voted against every rate hike since September. Megan Greene, who replaced her, later said, “The Bank of England will have to raise interest rates further to bring inflation back on target.”

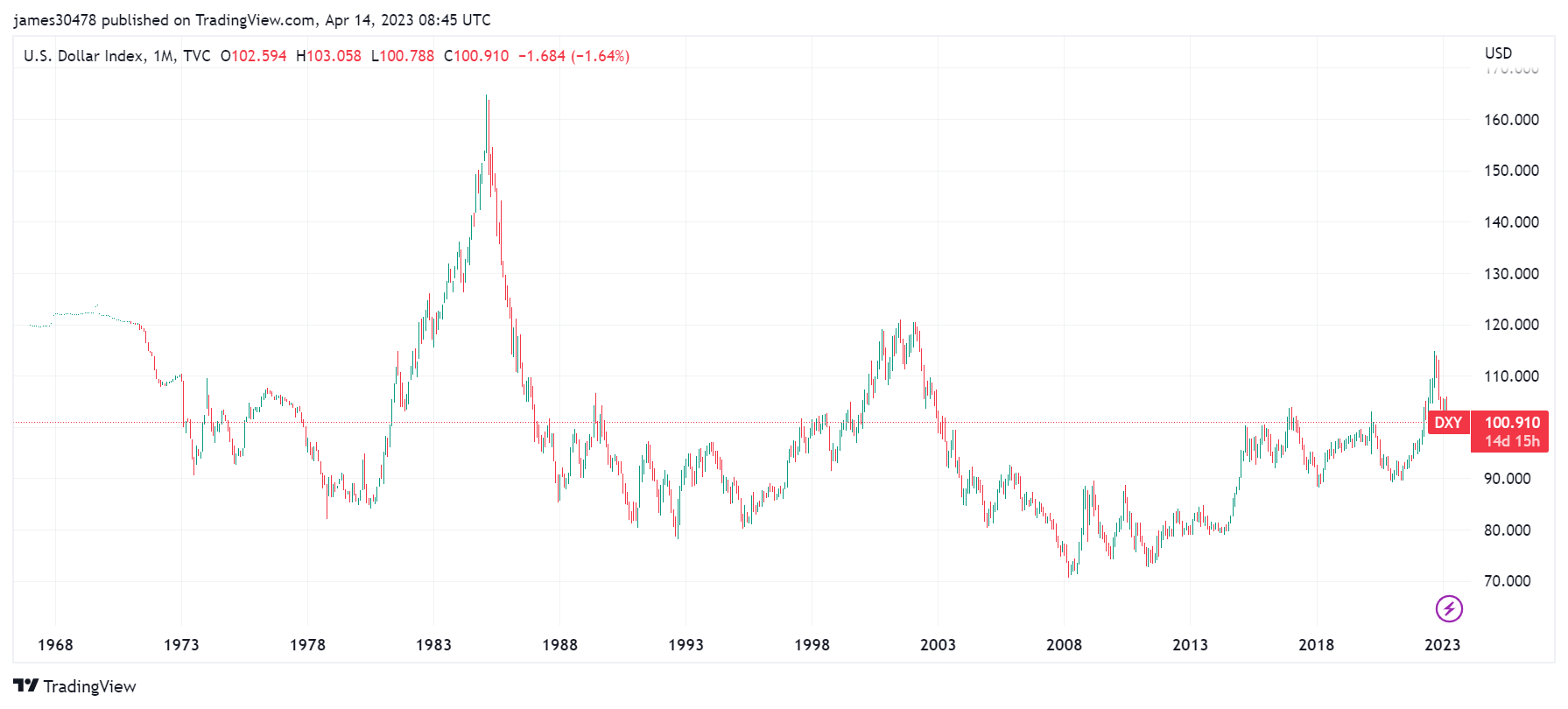

DXY Sinks, Bank Concerns Calm

The DXY index fell below 101, its lowest level in over a year, about the same level as it was almost a year ago. Usually, during a crisis, investors flock to the world’s reserve currency, the dollar. As you can see, during recessions, the DXY index surges as investors need to cover their dollar debt by selling it.

DXY index dropped from 114 to 100. In the past few weeks, as the banking crisis has subsided, the rate hike schedule is coming to an end and the possibility of further de-dollarization continues to reverberate. But this is definitely not the end of the dollar.

Defaults, outright deflation, and unemployment are likely as credit and M2 shrink further. Then DXY runs again and expects to squash the assets.

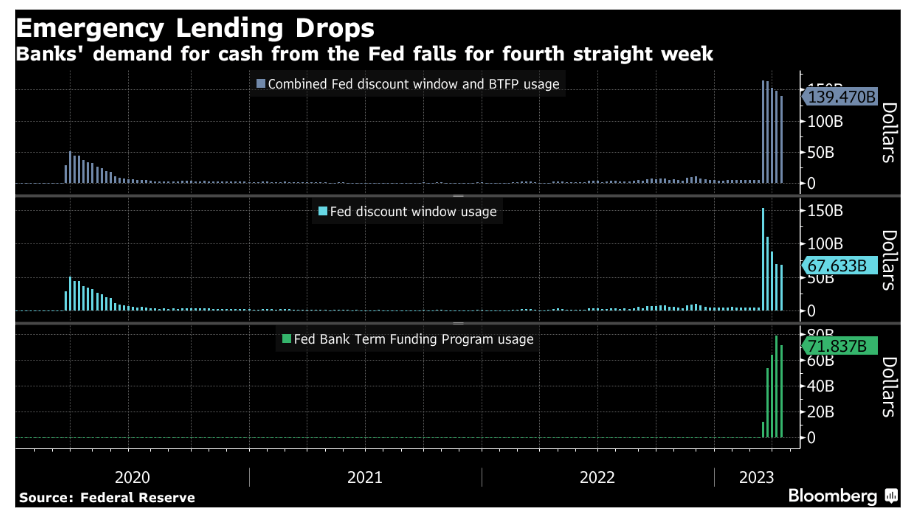

The banking crisis has subsided and the Fed’s emergency lending program has fallen to $139.5 billion from last week’s $148.7 billion. Breakdown; discount window: $67.6bn vs $69.7bn last week; BTFP: $71.8bn vs $79.0bn. As a result, the Federal Reserve’s balance sheet shrank slightly this week.

Post-MacroSlate Weekly: US Inflation Falls, But Fed Predicts “Moderate Recession,” First Appearing on CryptoSlate.