Micron Loses $2.312 Billion as Demand for DRAM and 3D NAND Nosedives

Q2 2023 Micron Posted Revenue is down about 53% year-over-year, and continued weak demand for 3D NAND and DRAM will further reduce revenue in the current quarter, the company said. The company will have to write down billions of dollars worth of inventory and will maintain conservative spending, but said it will have to lay off more people than planned this year. We believe memory demand will skyrocket by 2025 as the world embraces more computing.

Worst recession in years

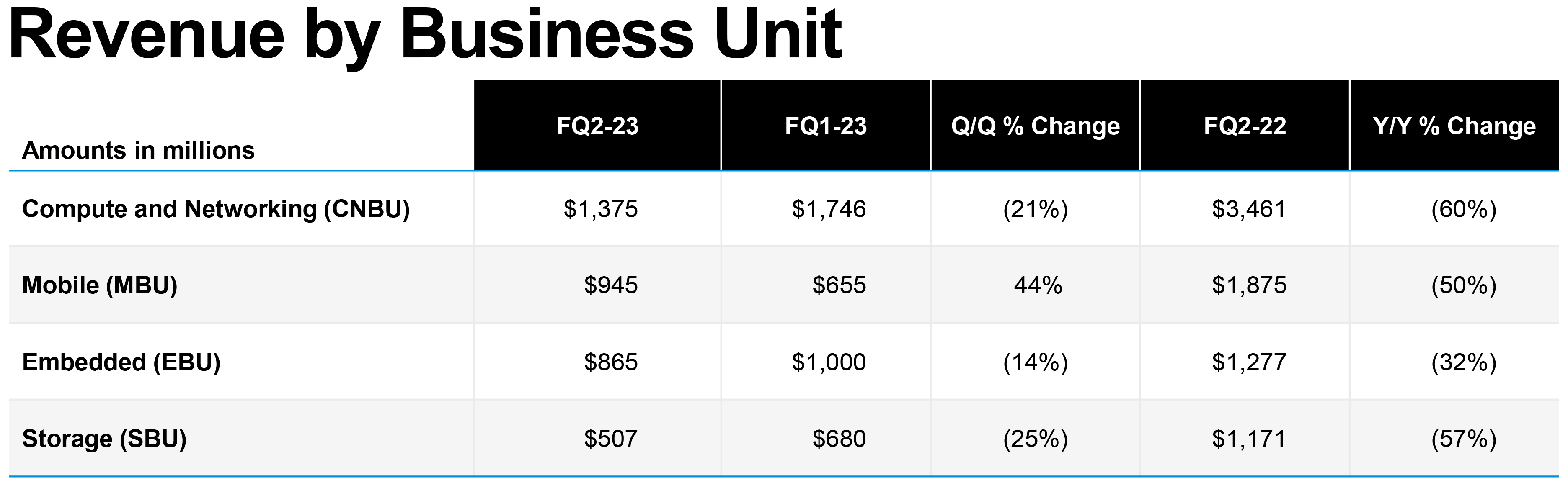

Micron earned $3,693 million in the second quarter of fiscal 2023 (ending March 2, 2023). That’s down from $786 million in the same period last year, but within the guidance the company set in the previous quarter. Micron reported a whopping $2.312 billion GAAP net loss as it had to write down $1.43 billion worth of 3D NAND and DRAM inventory, and gross margin fell to 20% in the second quarter of fiscal 2022. Decreased from 47.2% to 47.2%.

Despite a total loss of $2.12 per share, Micron declared a quarterly dividend of $0.115 per share, payable in cash on April 25, 2023.

Low Average Selling Price (ASP) due to oversupply continues to be a major challenge in the 3D NAND and DRAM industry. To somehow slow down the bit output growth, Microsoft said it has cut its starting number of DRAM and NAND wafers by about 25% year-over-year.

“The semiconductor memory and storage industry is facing its worst recession in 13 years, with a very weak pricing environment having a significant impact on our financial performance.” Said Sanjay Melotra, CEO of Micron. “We have taken significant supply cuts and austerity measures, including implementing company-wide workforce reductions. We believe that the balance between supply and demand will gradually improve over the next few months.”

Due to the uncertainty regarding DRAM and Flash memory demand in the near and medium term, the company will continue to conservatively invest in capacity expansion and accelerate headcount reductions. Micron has announced that it will maintain its CapEx at about $7 billion for FY2023 (down over 40% from FY2022 and down over 50% for Fab Tools). This is the lower end of the previously predicted range. Micron also plans to reduce headcount by 15% this year, up from a previous target of 10%.

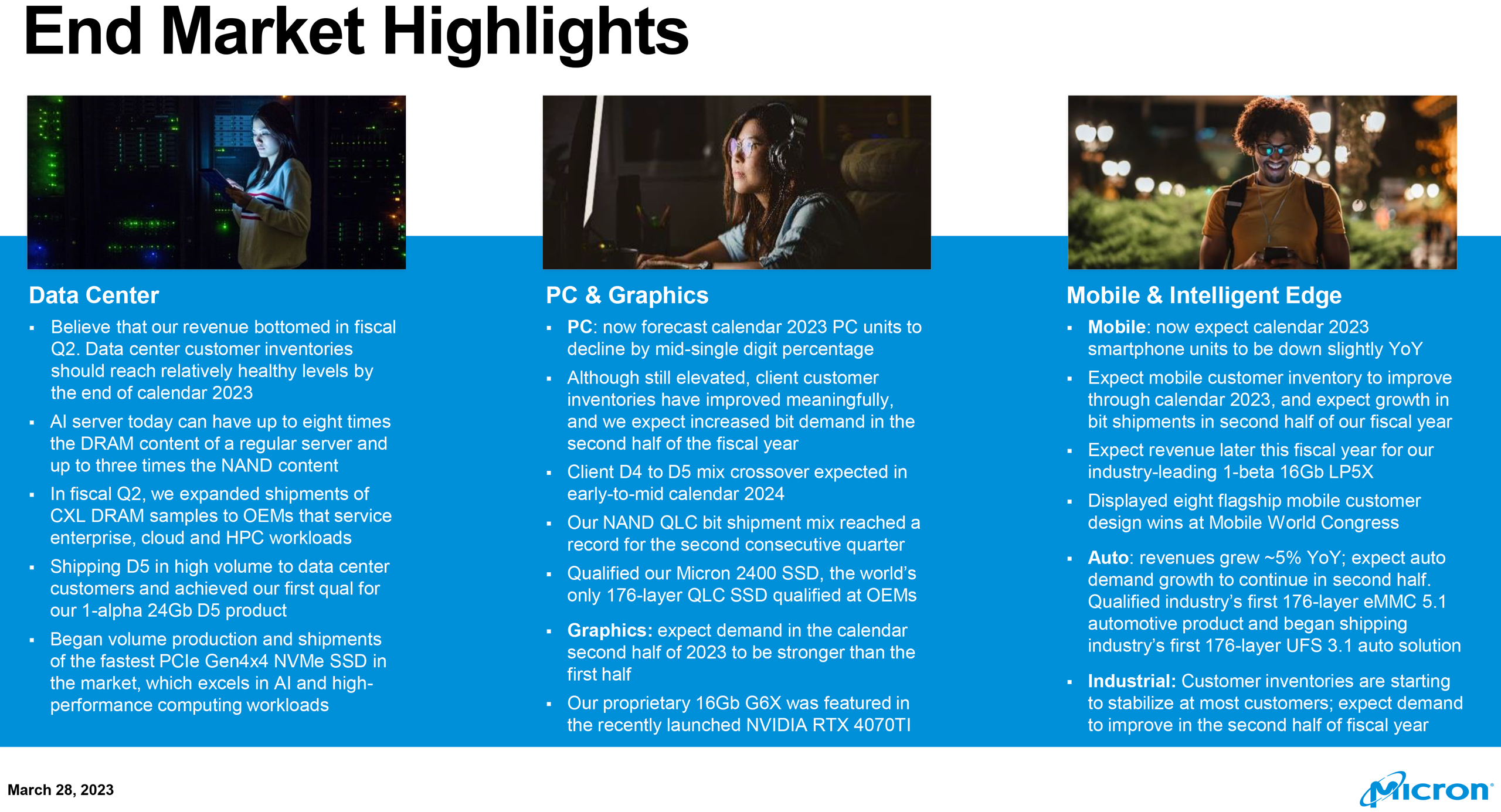

PC business remains a cause for concern

Micron’s PC business is cause for concern. The company expects PC sales to drop by his mid-single digits in 2023, which will bring sales back to his pre-COVID levels. While the client’s customer inventory remains high, it has deteriorated significantly, with Micron predicting a surge in bit demand in the second half of his 2023 fiscal year.

Micron is much more optimistic about its data center business, forecasting revenue growth in the third quarter of the fiscal year (DC revenue bottomed out in the second quarter of 2023). The company expects data center customer inventories to return to relatively healthy levels by the end of his 2023.

As for the mobile business, Micron seems to see this as a mixed bag. On the one hand, smartphone shipments in 2023 are expected to decline compared to the previous year. Meanwhile, some of his smartphone suppliers’ inventories have returned to normal levels, while others of his OEM’s remain high. Micron expects overall mobile customer inventories to improve throughout the remainder of calendar year 2023. We also expect mobile DRAM and NAND bit shipments to increase in the first half of 2023 compared to the first half of 2023.

In contrast, Micron’s graphics and automotive memory businesses continue to be profitable and look set to continue doing so.

On the graphics side, Micron says customer inventory destocking is progressing well and the company expects demand to pick up in the second half of 2023 (which is consistent with the annual trend in discrete graphics card sales). Memory makers expect the total addressable market (TAM) for graphics DRAM to grow at a higher compound annual rate than the general market, owing to applications in both client and data center domains. Quoting analysts.

Micron also expects demand for automotive memory to grow sustainably in the second half of the year as non-memory supply constraints gradually decrease and memory capacity per vehicle increases.

High yield of 3D NAND and DRAM

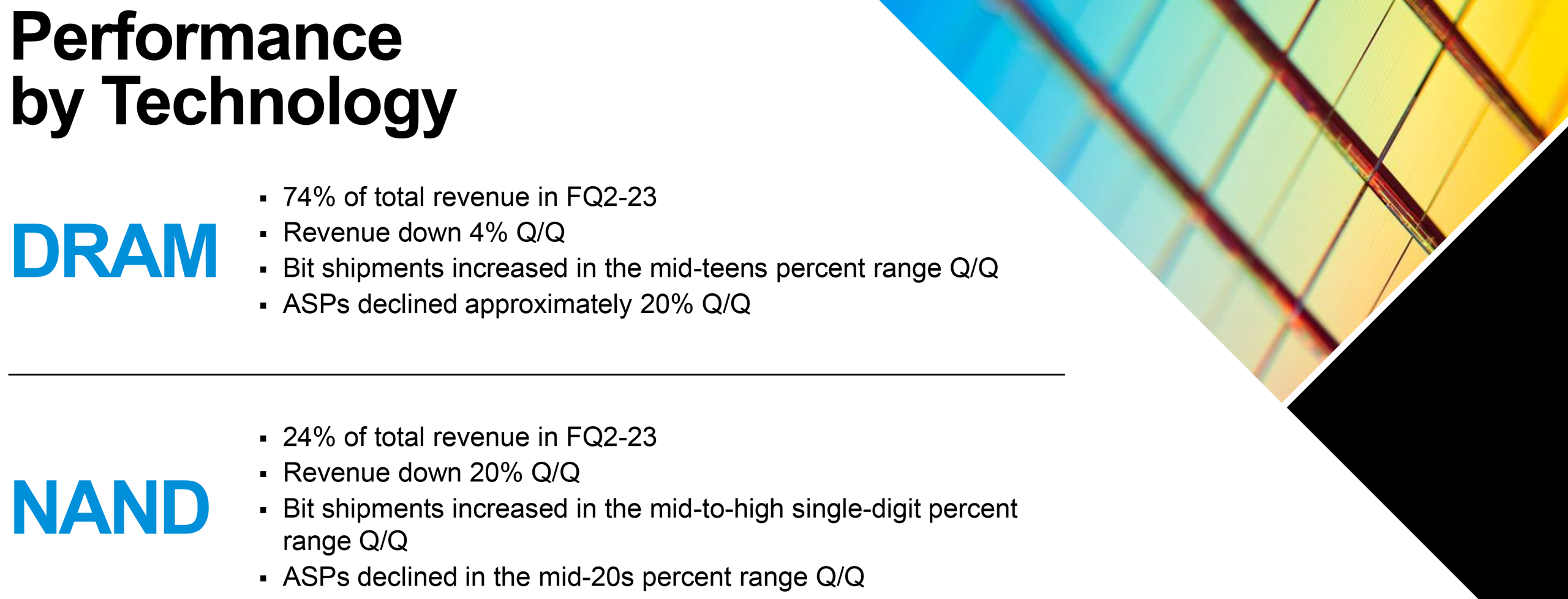

DRAM accounts for 74% of Micron’s revenue, and while the company has tried to cut computer memory output, bit shipments have increased quarterly in the mid-teens.

Micron has achieved record-breaking yields with its 1α DRAM, beating yields at other nodes in its history. Additionally, the yield targets for the 1β (1-Beta) fabrication node, which increases DRAM bit density by 35% and improves power efficiency by 15%, was achieved ahead of schedule and faster than any of Micron’s previous nodes, the company said. said. In any case, the DRAM business still resulted in heavy losses for the company as the average selling price of DRAM fell by 20% in his QoQ.

NAND memory accounted for 24% of Micron’s Q2 2023 revenue, despite efforts to cut flash memory production as the company accelerated its transition to more sophisticated 176- and 232-layer nodes. , bit shipments also increased during the quarter.

Over 90% of Micron’s NAND bit production in the second quarter of fiscal year 2023 was represented by the 176-layer and 232-layer production nodes, while 3D QLC NAND represented 20% of the company’s flash memory bit production and shipments. occupied more than Micron says it has achieved record yields for its 176-layer NAND, surpassing yields at other nodes in Micron’s history. Additionally, the target yield for 232-layer 3D NAND memory was not only achieved ahead of schedule, but faster than any of the company’s previous nodes.

High Yields Limit Micron’s Losses somewhat. However, 3D NAND and DRAM ASPs continue to decline, so the company will continue to lose money in the next quarter (or quarters).

2025 will be a record year

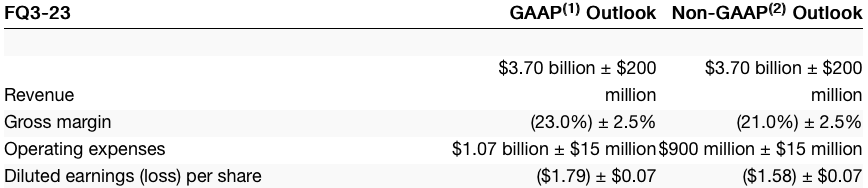

Micron currently forecasts third quarter 2023 GAAP revenue of $3.7 billion ± $200 million. This would be the biggest year-over-year profit decline since the dot-com bankruptcy in 2001. The company projects a loss of $1.79±0.07 per share for him in the current quarter.

Micron is optimistic about future demand for DRAM and 3D NAND as the industry embraces applications that use more memory and storage, such as Large Language Models (LLMs) like ChatGPT.

“Our industry faces significant short-term challenges, but the total addressable market (TAM) for memory and storage will reach a new record in calendar year 2025, and the semiconductor industry will continue to grow,” Mehrotra said. We believe that we will continue to outpace our growth.” “Recent advances in artificial intelligence (AI) provide an exciting prelude to the transformational capabilities of large language models (LLMs such as ChatGPT). LLMs require large amounts of memory and storage to operate. need it.”