Navigating the Bitcoin surge: A deep dive into Implied Volatility

quick take

Glassnode describes “implied volatility” as the prediction of market price movements. Knowing the cost of an option allows us to calculate the expected volatility of the asset it represents. Formally, implied volatility (IV) describes the expected range of price changes for an asset over a one-year period to within one standard deviation.

Tracking at-the-money (ATM) implied volatility (IV) over time provides a standardized view of expected volatility. Expected volatility usually depends on actual volatility and market mood. This measure displays the ATM IV for option contracts that expire one month from the current date.

Over the past few weeks, there has been a wave of positivity within the Bitcoin community, largely due to the introduction of spot exchange traded funds (ETFs). Importantly, Bitcoin ended the second quarter with a 7% gain to end above $30,000.

According to data analysis by Deribit, the volatility experienced in June revealed important details about the individual volatility of Bitcoin and Ethereum. Since Glassnode began monitoring derivatives data, Ethereum has consistently displayed higher beta values than Bitcoin, suggesting higher levels of volatility.

However, an interesting change has occurred in the last two weeks. Bitcoin’s implied volatility has unexpectedly overtaken Ethereum. This surprising turn of events can be traced back to the reasons explained earlier.

Volatility rose slightly, but Deribit noted that the rise was offset by trading volume. Moreover, most stayed within the lower bounds even when market conditions were volatile. According to Deribit, this phase of increased Bitcoin volatility is the longest observed so far, suggesting it may be an emerging trend.

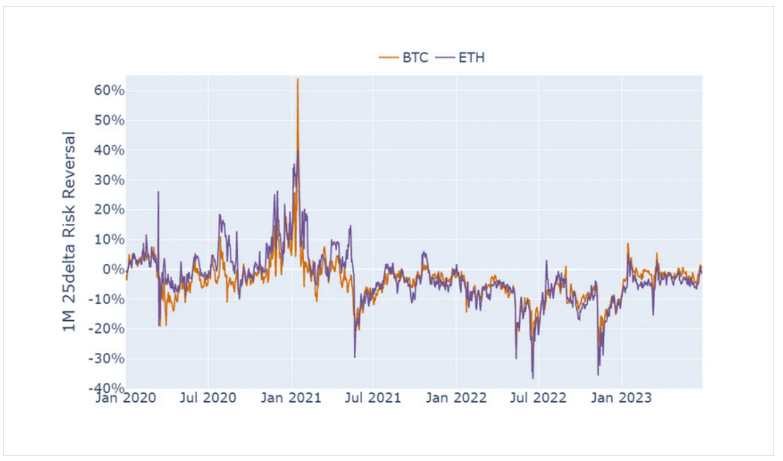

Since the beginning of the year, Bitcoin has posted an impressive 82% gain, fueled by multiple encouraging factors. Deribit produced a month-long 25 delta risk reversal chart showing that skew remains relatively stable despite the upward price trend.

The post, Navigating Bitcoin’s Rise: Deep Insights into Implicit Volatility, first appeared on CryptoSlate.