NFTs accounted for 28% of the ETH gas usage in January

crypto slate Analysts have studied gas usage for various transaction categories on the Ethereum (ETH) network and found that the NFT category accounted for 28% in the first month of the year.

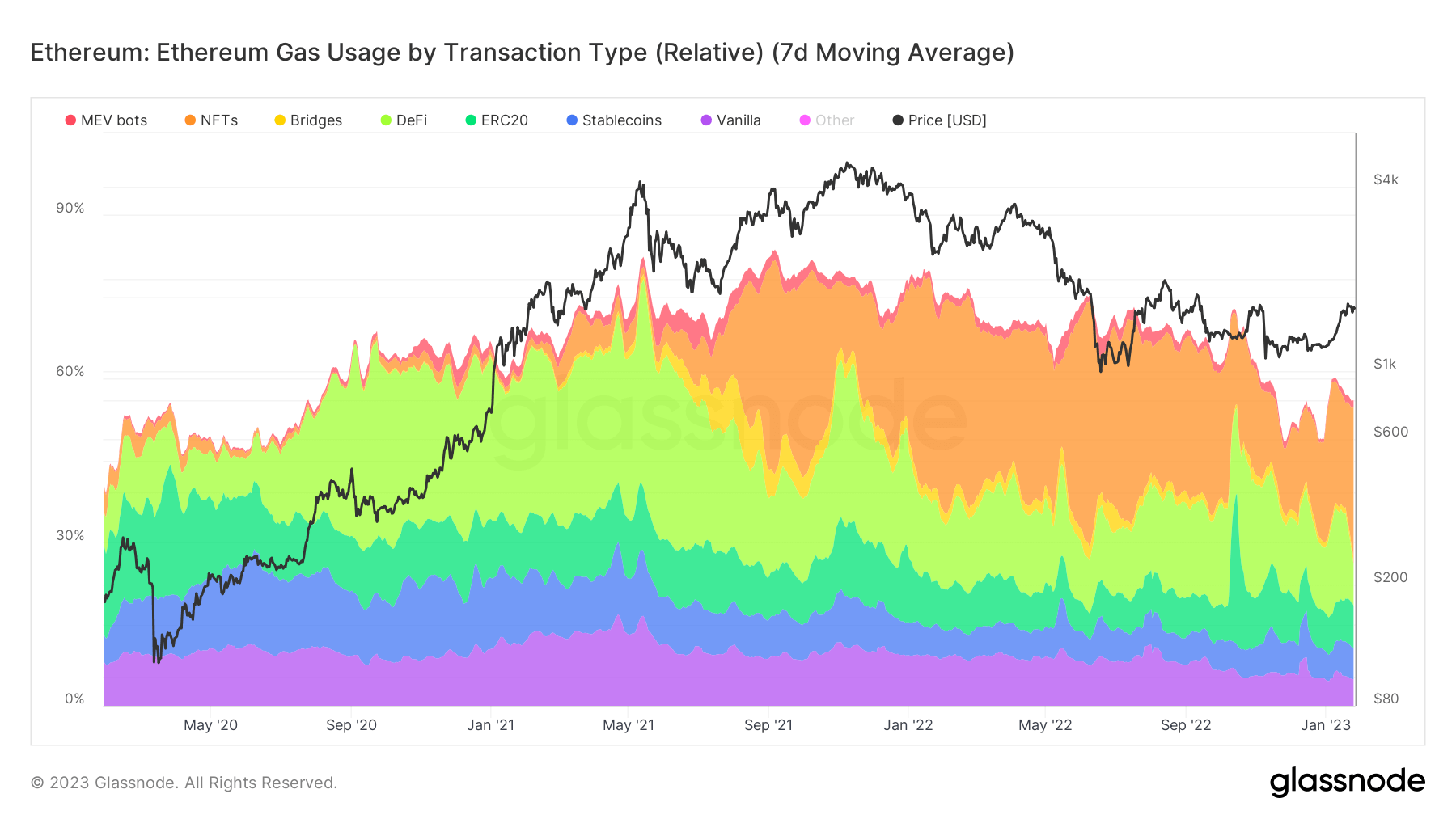

This analysis classifies all transactions on the ETH network into eight categories, including Vanilla, ERC20, Stablecoins, DeFi, Bridges, NFTs, and MEV bots.

Defi, ERC20, and stablecoins accounted for the largest share and gas usage in the 2nd, 3rd, and 4th categories, with Defi and ERC20 at 8% and stablecoins at 6%. .

Category

The Vanilla category includes pure ETH transfers between Externally Owned Accounts (EOAs) issued without invoking a contract. The ERC20 class counts all transactions that invoke ERC20 contracts, excluding stablecoin transactions.

The Stablecoin category represents all fungible tokens with value locked into off-chain assets by the issuer or algorithm. This category includes over 150 stablecoins, with Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and DAI (DAI) being the most prominent.

The Defi category covers all on-chain financial instruments and protocols implemented as smart contracts. Decentralized exchanges (DEX) also fall into this category. Over 90 Defi protocols are listed in this section, including Uniswap (UNI), Etherdelta, 1 inch (1INCH), Sushiswap (SUSHI), Aave (AAVE).

A bridge represents any contract that allows the transfer of tokens between different blockchains and includes over 50 bridges such as Ronin, Polygon (MATIC), Optimism (OP) and Arbitrum (ARBI).

All transactions that interact with non-fungible tokens fall under the NFT category. This section contains both ERC721 and ERC1155 token contract standards and NFT marketplaces for trading them.

MEV bots (Miner Extractable Value bots) represent bots that automatically execute transactions for profit by sorting, inserting, and censoring transactions within blocks.

All remaining ETH transactions are grouped under the Miscellaneous category.

Gas usage by category

The graph below shows the relative amount of gas consumed in each category of the ETH network. The chat started in January 2020 and shows the gas usage share for each category in a different color.

At first glance, the NFT, Defi, ERC20, Stablecoins and Vanilla categories stand out, having the most visible share of total gas prices.

At first glance, the NFT, Defi, ERC20, Stablecoins and Vanilla categories stand out, having the most visible share of total gas prices.According to the data, the NFT category currently accounts for 28% of total gas prices on the ETH network represented by the orange zone. His share in this category was just around 4% in early May, before the pandemic started.

Defi has the second largest share with 8% represented by the light green area. Both the NFT and Defi categories have registered an increase in gas tariff share since the pandemic began. The ERC20 category accounts for 8% of total gas share. The share of the category represented by the dark green area has halved from 16% in October 2022.

On the other hand, the share of stablecoins has remained flat at around 5-6%, as can be seen from the dark blue zone. Finally, the vanilla category continues to account for about 5% of total gas prices.

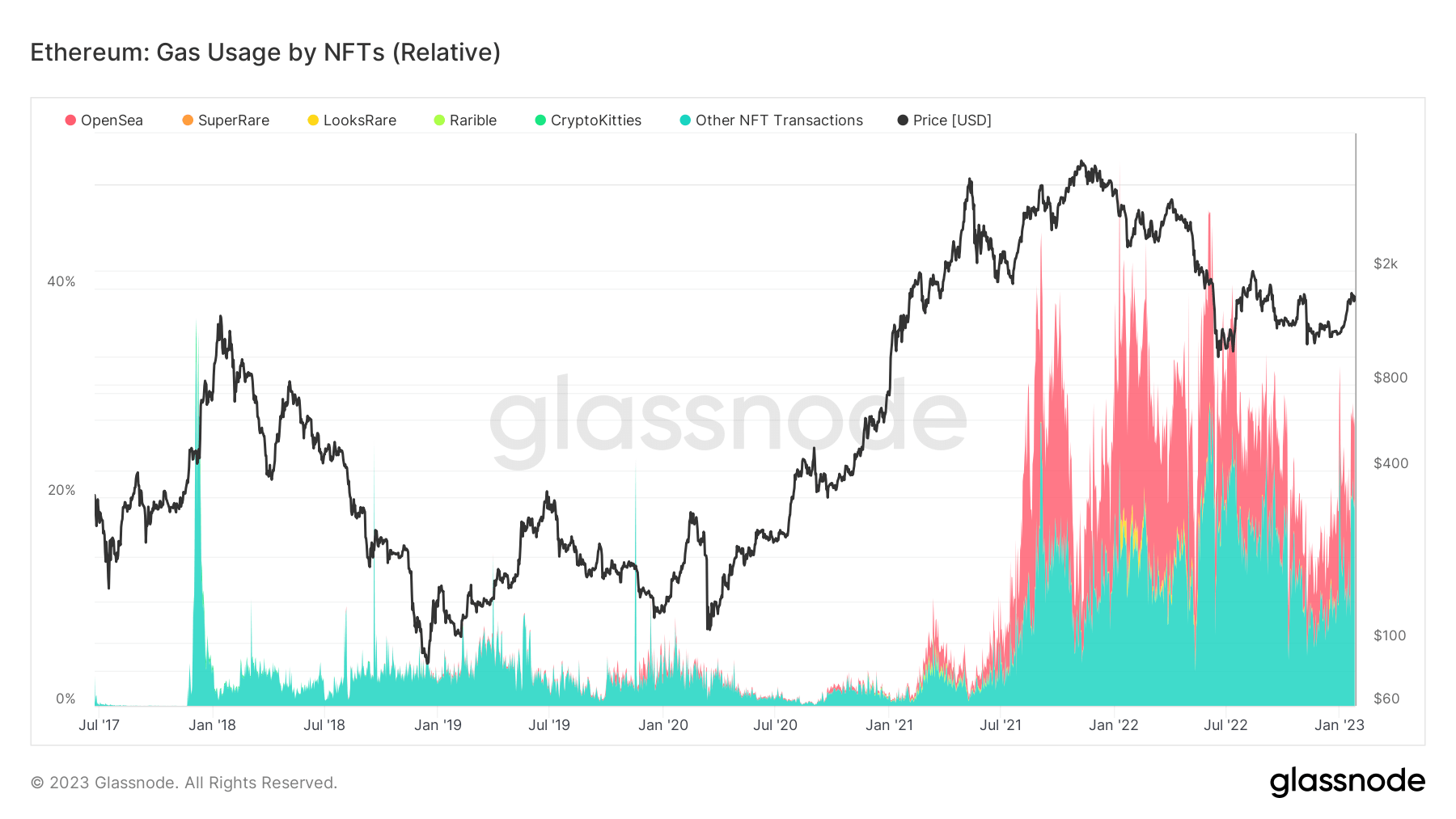

Gas consumption by NFT

A closer look at gas usage in the NFT category shows OpenSea in the lead. The graph below shows the NFT marketplace share of gas usage since early 2018.

OpenSea emerged in early 2020 and has significantly increased its share of gas usage since mid-2021. With the exception of a brief period in January 2022, it remains the dominant NFT marketplace accounting for enough gas usage to leave its mark on the overall charts.LooksRare has been next to OpenSea for a short time. It accounted for enough gas usage to be displayed.

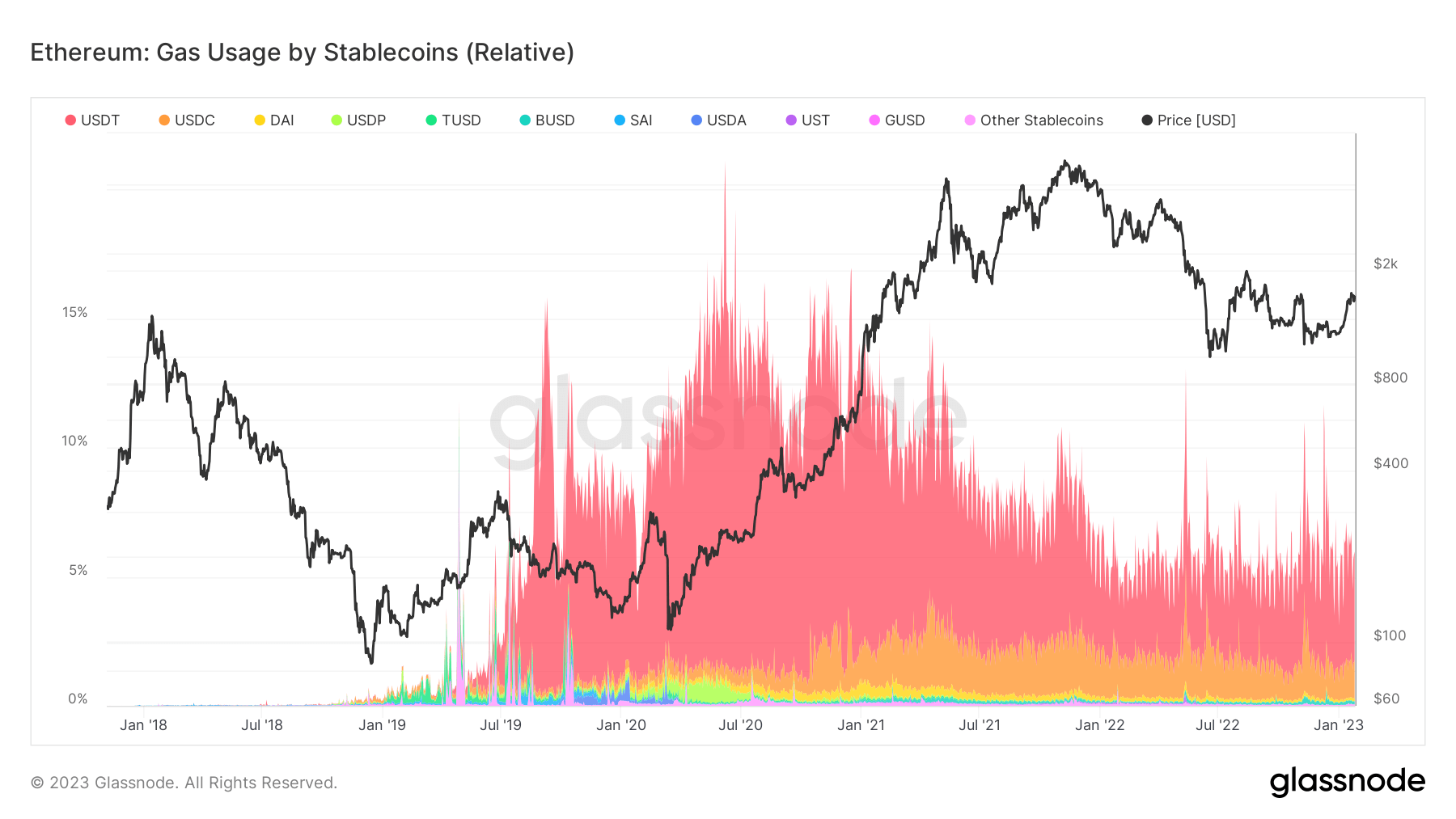

Gas usage by stablecoin

A breakdown of gas usage share for stablecoins also highlights USDT’s dominance. The chart below shows the gas usage share of major stablecoins since early 2018.

USDT maintains its dominant position among stablecoins, but its share still registered a significant decline from 11% to 4%. USDC, on the other hand, began to chart in his early 2020 and has been slowly but steadily gaining share of gas usage ever since.