November 2022 GameFi Report

Despite one of the worst things that could happen in November, the complete collapse of the world’s largest cryptocurrency company, the GameFi market did not drop significantly compared to October.

This could indicate that the market’s downside risks have reached their limits, barring a systemic collapse.

Nevertheless, the decline in space investment continues, with the amount of investment and the number of funds reaching historic lows.

Despite the recession, Polygon is doing relatively well as a game chain, with several major titles gaining users in November.

Overall, November was a relatively quiet month for GameFi, especially given what happened in the CEX sector.

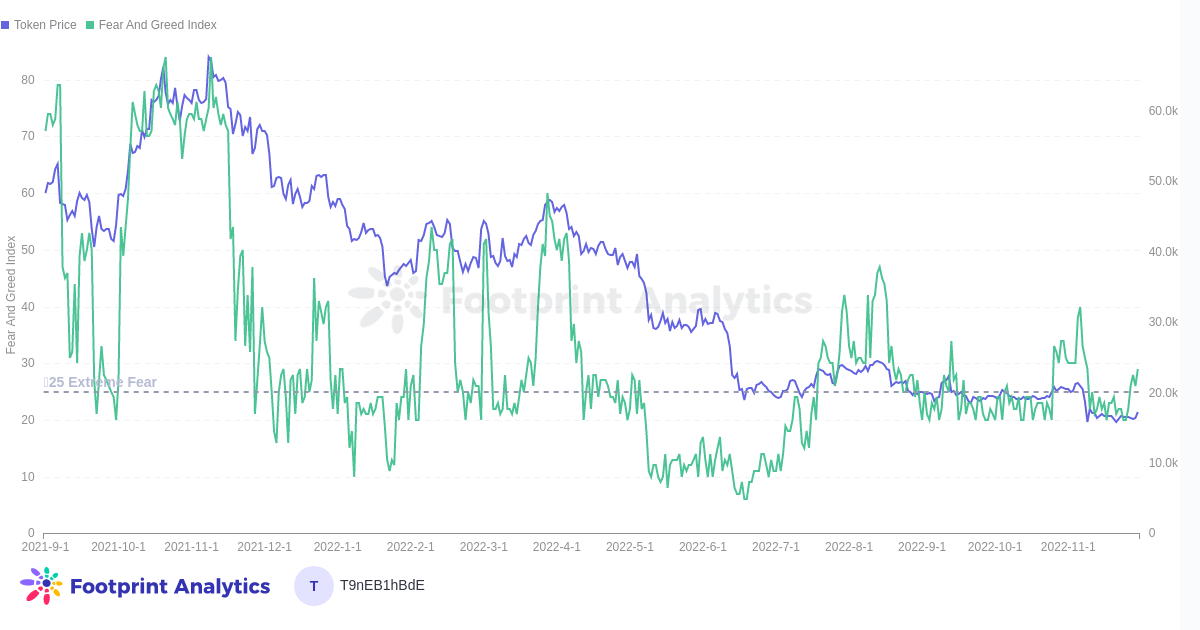

Overview of Crypto Macros

- At the end of November, the F&G index closed higher than at the end of October.

- The FTX crash halted the recovery of the F&G index, dropping from 40 to 20.

- Ethereum hit $1,091 on November 9 and tried to break below $1,000, but it didn’t.

While the FTX crash did not drive ETH price below June lows, this event was arguably more significant than the Terra Luna crash that happened.

Interestingly, BTC has broken below June lows, which is unexpected.

One possible explanation is that news of this seemingly minor price move is the first evidence of something big. That’s where Merge’s tokenonomic effect comes to fruition. For the first time, Ethereum is less volatile than his BTC.

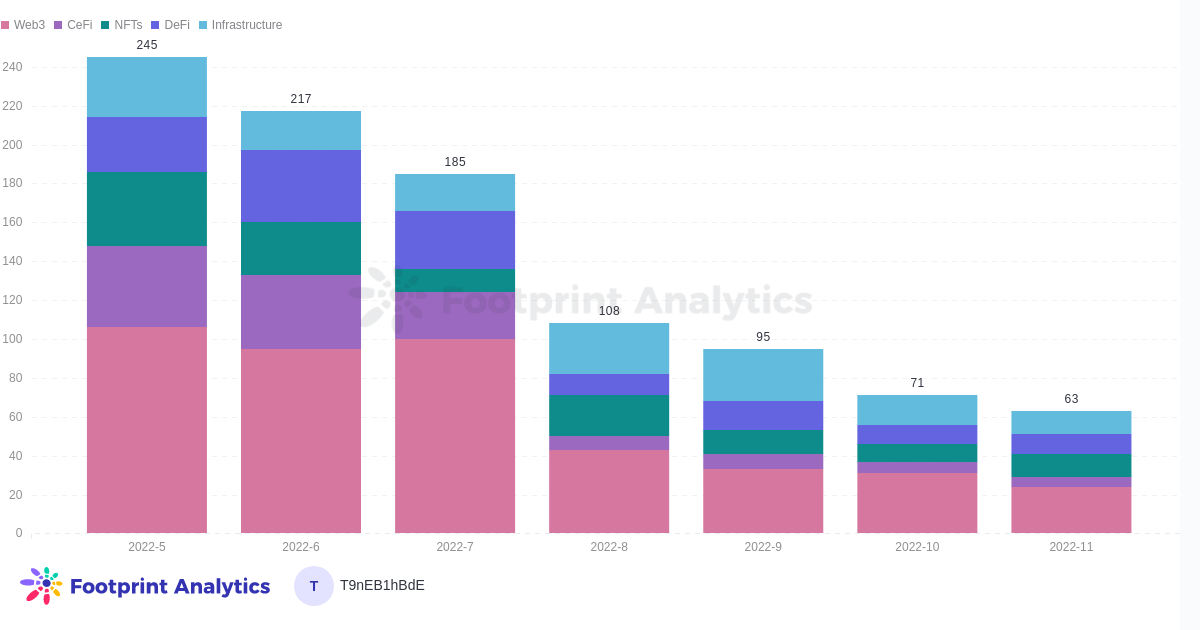

GameFi Funding and Investments

- GameFi’s funding continued to decline, with November’s ATL dropping to $60 million, down 69% month-on-month.

- It was just nine rounds in the GameFi industry, led by Roboto Games and Thirdverse.

- Thirdverse is a Tokyo-based development studio focused on Web3 and VR games. Earned his $15 million round led by MZ Web3 Fund.

- A16z was the lead investor in Roboto Games’ $15 million Series A. Traditional game studio wants to expand into Web3 and blockchain.

GameFi funding has dried up a fraction of what it once was. Funds were invested in a few projects, mostly game developers and studios. Most of these rounds were for established developers with a track record of successfully publishing projects on Web3 or Web2.

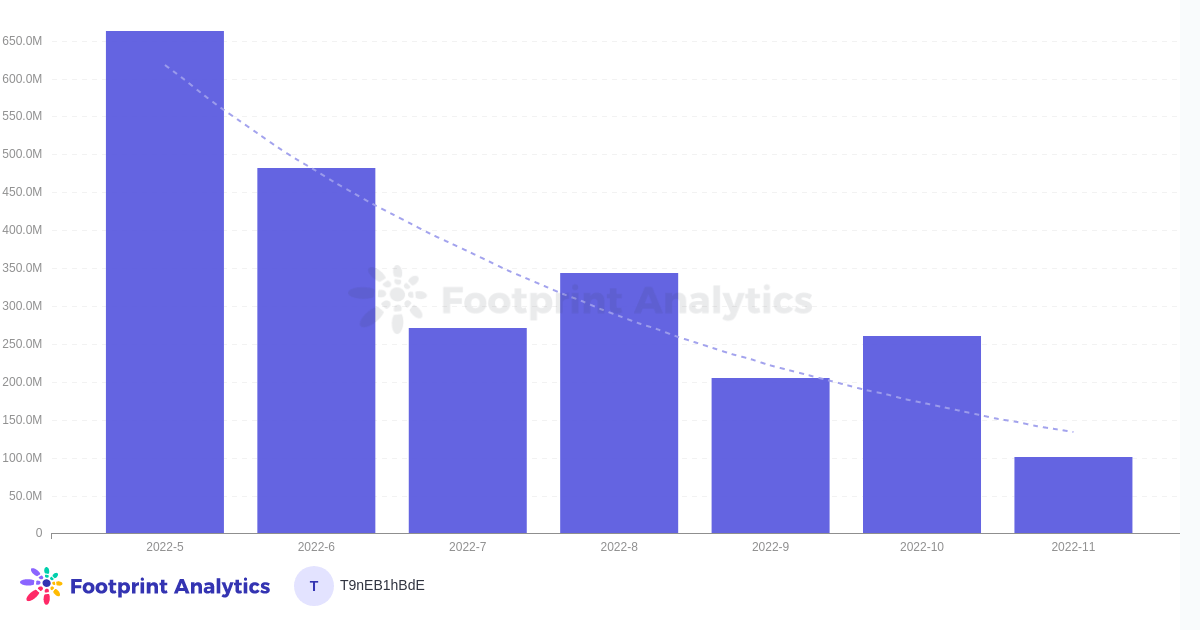

GameFi Market Overview

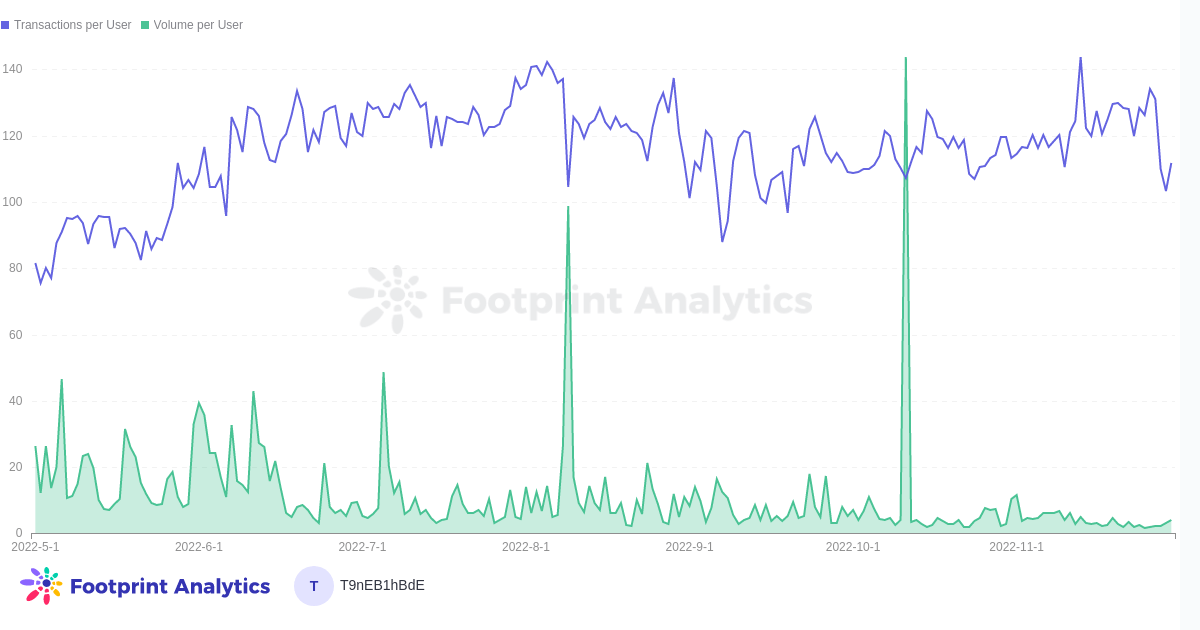

- GameFi’s total volume has declined since October, dropping from $260 million to $100 million.

- Transactions per user also dropped sharply at the end of November, but are still higher than they were six months ago.

- In October, the Axie Infinity unlock event generated an unusually high amount of traffic on the Ronin. In November, the breakdown between chains returned to a more regular distribution.

GameFi’s total volume has more than halved. A large part of this was his October volume anomaly driven by the Axie Infinity unlock event. The market is now back to normal.

GameFi User Overview

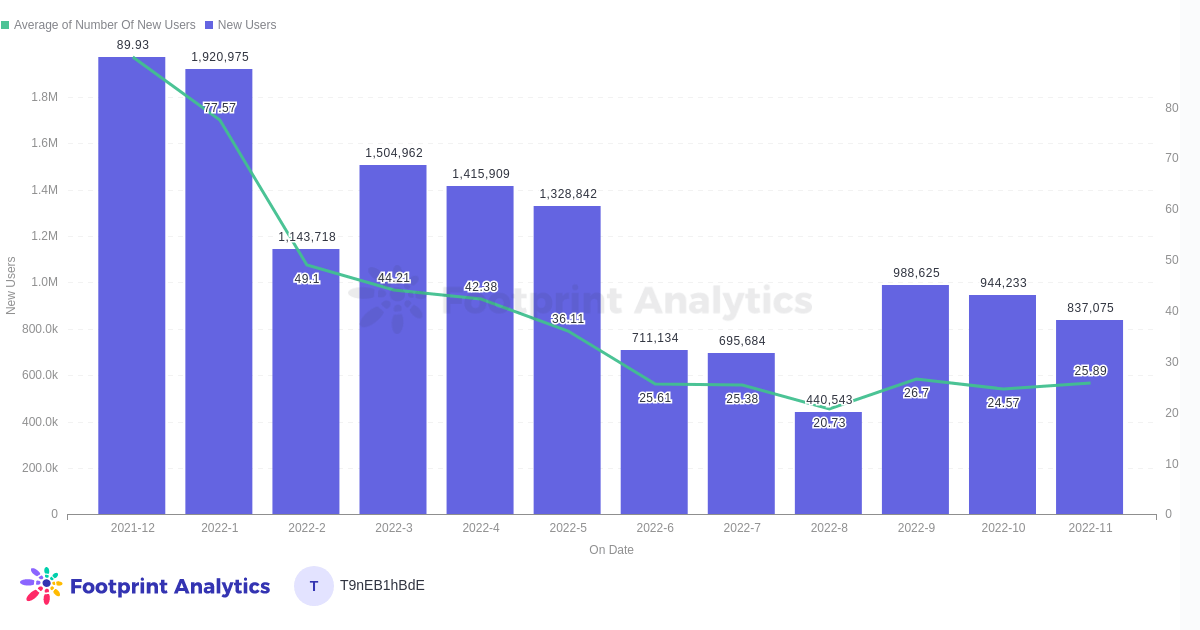

- MAU fell to 2 million percent from 2.2 million percent in October, and new users fell by just over 100,000.

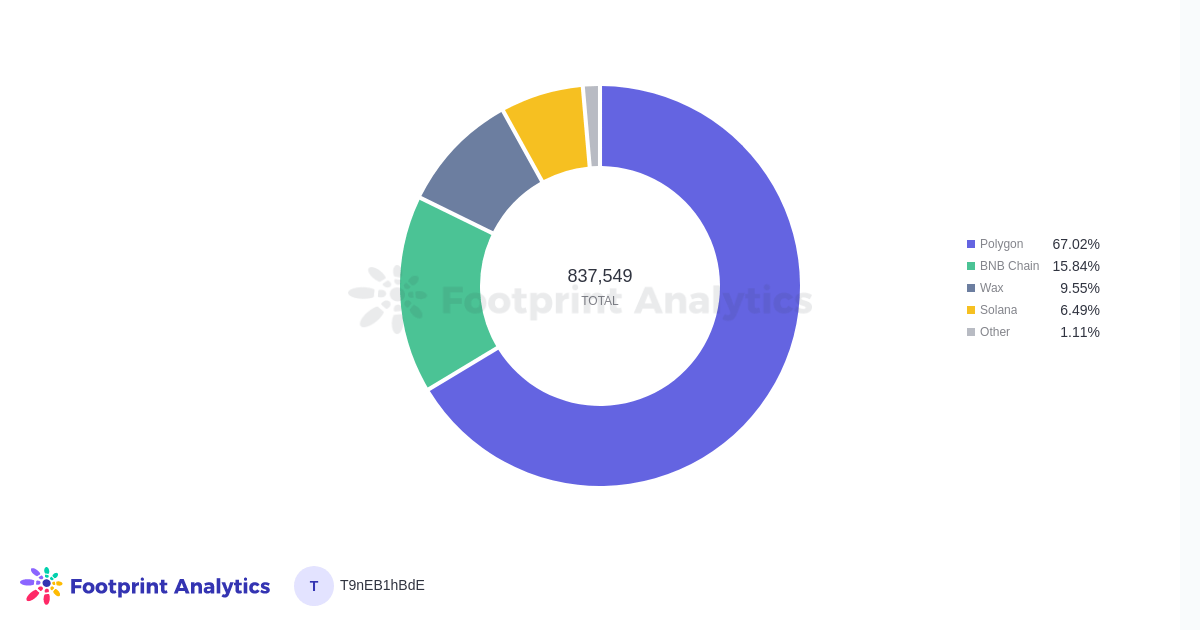

- Polygon gained the most new users thanks to several titles that are gaining popularity (Benji Bananas and Planet IX).

Polygon has established itself as a potential winner in the GameFi space if it can continue to attract solid projects. Notable Polygon-based titles that have seen rapid growth over the past few months include Benji Bananas, Arc8 by GAMEE, and Planet IX.

GameFi project overview

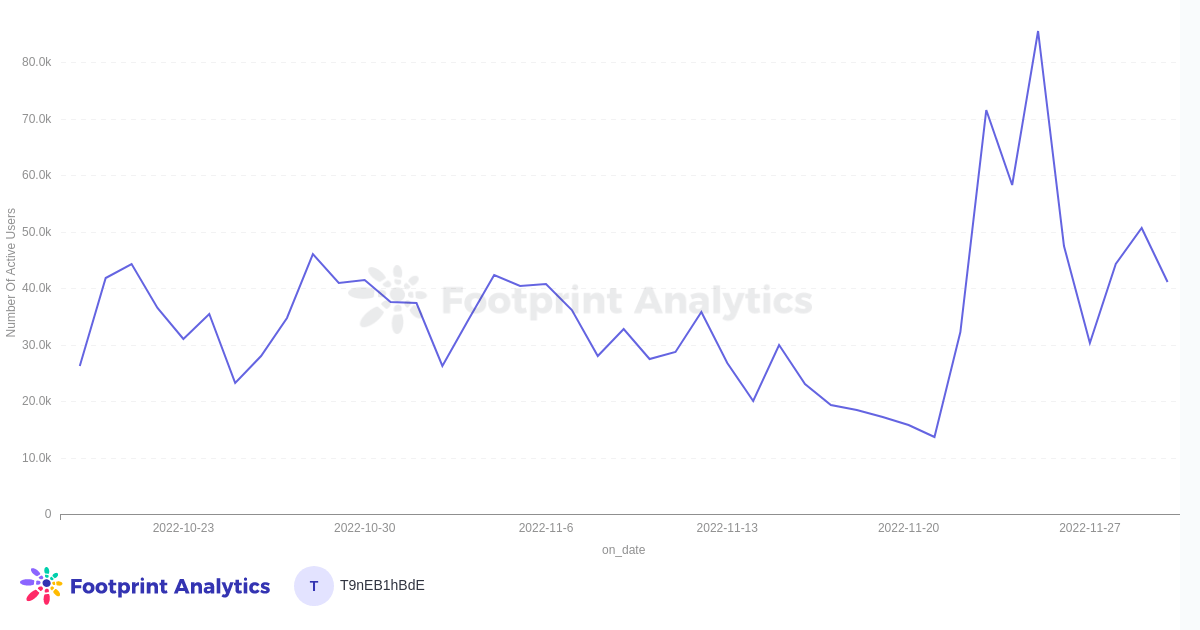

- The exponential growth in volume at Polygon was attributed to Benji Bananas gaining users and volume. The number of users he has exceeded 80,000.

- Space-themed strategy game Planet IX more than tripled its users in November. Note that the game’s token IXT has not increased in price.

Benji Bananas saw a significant increase in user numbers in November, which was reflected in the token price. On the other hand, Planet IX also saw a surge in players, but his token, IXT, continued to decline, indicating the project’s low sustainability.