On-chain metrics continue signaling a Bitcoin bottom

Previous on-chain research suggested that the Bitcoin market had bottomed out. crypto slate We’ve reviewed some Glassnode indicators that continue to point to price bottoming.

However, macro factors that may not have been present in previous cycles are still at work and could affect the current cycle.

Bitcoin supply P/L band

Bitcoin’s supply P/L band shows a profit or loss circulating supply based on whether the token’s price is higher or lower than the current price at the time of the last move.

The market cycle bottom coincides with the convergence of the supply of profits (SP) and supply of losses (SL) lines that most recently occurred around Q4 2022. Subsequent acts of line divergence correspond to past price reversals.

The SP band is now sharply rising and deviating from the SL band, suggesting that a macro rise in price could be on the cards if this pattern holds.

Realized value from market value

Market Value to Realized Value (MVRV) refers to the ratio between market cap (or market value) and realized cap (or stored value). By collating this information, MVRV shows when the price of Bitcoin is trading above or below its “fair value.”

MVRV is further divided by long-term and short-term holders. Long-term holder MVRV (LTH-MVRV) refers to unused transaction output with an expiry of at least 155 days, and short-term holder MVRV (STH-MVRV) refers to unused transaction expiry of 154 days or less.

The previous cycle troughs marked the convergence of the STH-MVRV and LTH-MVRV lines, with the former outperforming the latter, signaling a bullish reversal in price.

Convergence occurred between the STH-MVRV and LTH-MVRV lines in Q4 2022. And in recent weeks, STH-MVRV has outperformed his LTH-MVRV, suggesting a possible price trend reversal.

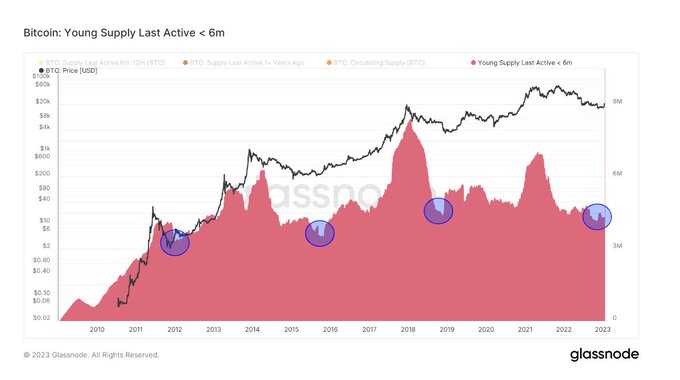

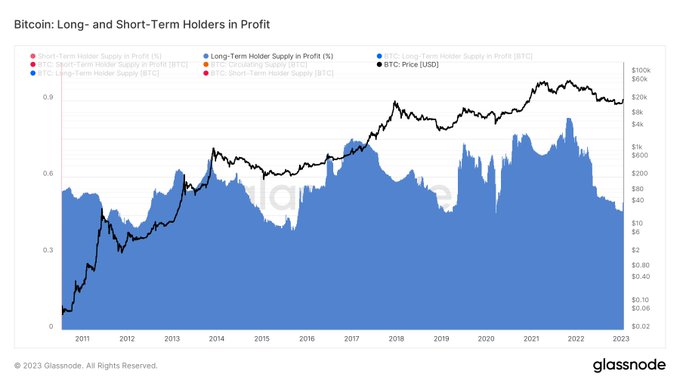

Young Supply Last Active < 6m & Holder Profit

Young Supply Last Active <6m (YSLA<6) refers to Bitcoin tokens that have traded within the last 6 months. The opposite scenario is holding the token for the long term and not actively participating in the Bitcoin ecosystem.

At the bottom of a bear market, YSLA<6 tokens account for less than 15% of the circulating supply. This is because disbelievers/hit-and-run speculators leave the market during price decline cycles.

The chart below shows that the YSLA<6 token hit the “below 15% threshold” late last year, suggesting a capitulation of speculative interest.

Similarly, the chart below shows long-term profit holders who are currently close to all-time lows (ATL). This confirms that long-term holders hold most of the supply and are unfazed by the -75% price drawdown from the top of the market.

Futures Perpetual Funding Rate

Futures Perpetual Funding Rate (FPFR) refers to periodic payments made to or by derivatives traders, both long and short, based on the difference between the perpetual contract market and the spot price.

During periods when the funding rate is positive, the perpetual contract price is higher than the mark price. In this case, long traders pay for short positions. In contrast, a negative funding rate indicates that the price of the perpetual contract is lower than the marked price and that short his traders pay for longs.

This mechanism matches the futures contract price with the spot price. FPFR can be used to measure trader sentiment. That is, willingness to pay a positive interest rate suggests a bullish belief and vice versa.

The chart below shows periods of negative FPFR, especially during black swan events, typically followed by price reversals. An exception is Terra Luna’s de-peg, which is believed to have caused a string of centralized platform bankruptcies, acting as a headwind against positive market sentiment.

After 2022, the magnitude of both positive and negative funding rates has decreased significantly. This suggests less certainty in either direction than before 2022.

Following the FTX scandal, the FPFR is mostly negative, indicating general market bearishness and a possible price bottom. Interestingly, the FTX scandal triggered the most extreme funding rate move since before 2022.