Realized Bitcoin losses spike as Grayscale GBTC trades at less than $10k BTC equivalent

Bitcoin investors have confirmed the fourth largest spike in realized losses in 2022 during the current market downturn. More than $1 billion has been locked in since November 9 as investors panic amid heightened market uncertainty.

Rapid increase in realized losses

A myriad of factors are influencing the situation, with the central one being the now announced bankruptcy of FTX.com, one of the world’s largest cryptocurrency exchanges. Bitcoin fell to $15,592 on Nov. 9 after rising to $21,414 four days earlier on Nov. 5.

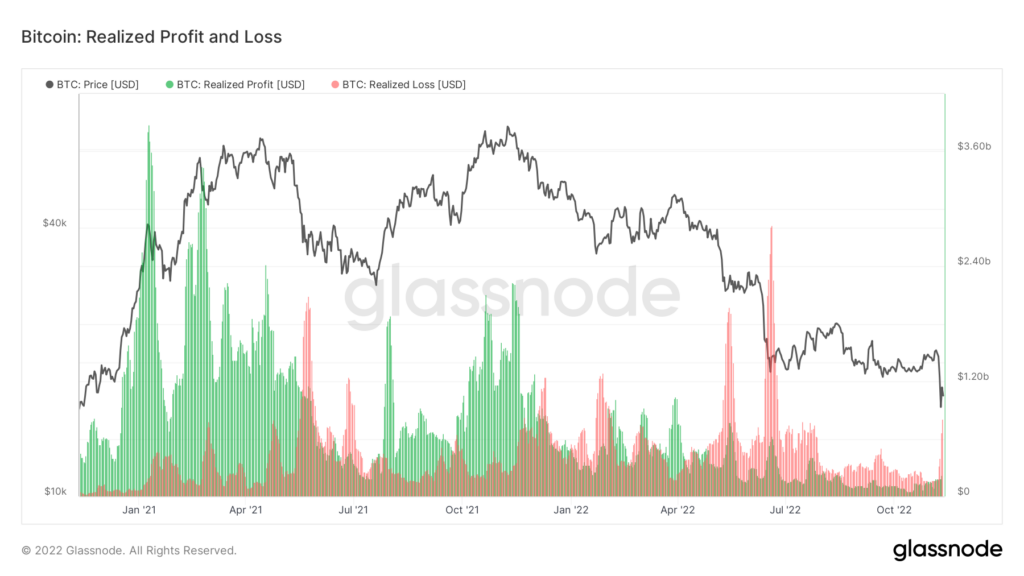

CryptoSlate analyzed on-chain data from Glassnode to identify the impact on profits and losses realized through the current market turmoil. The chart below shows the amount of return realized since the start of the 2021 bull market.

A higher value indicates a higher amount of realized gains or losses per day. Red sections represent losses and green sections represent gains. The chart focuses only on realized gains and losses, meaning coins bought at one price and sold at another price.

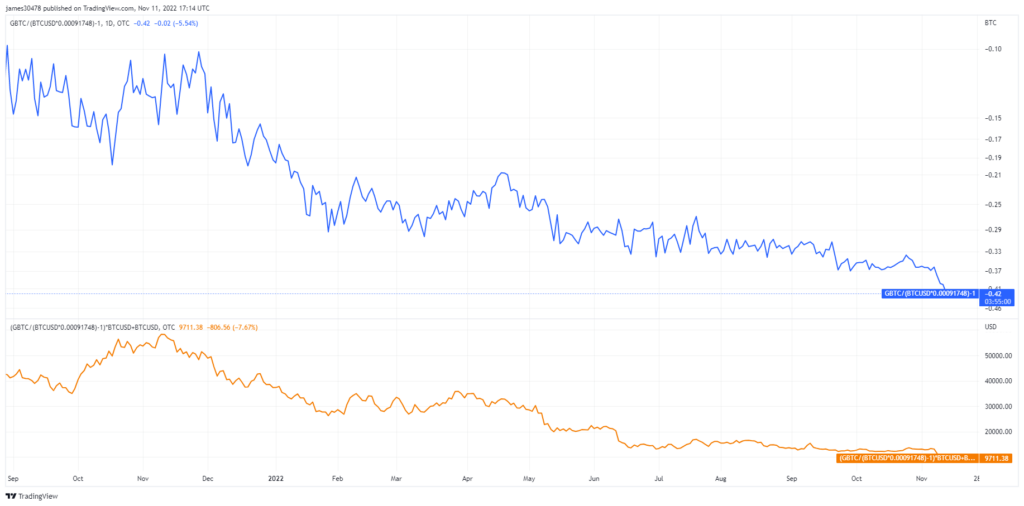

Grayscale Bitcoin Trust Discount Record

Grayscale Bitcoin Trust has also been hit hard by the recession, as GBTC is currently trading at a 41% discount to NAV (Net Asset Value). The investment vehicle started the year with a discount of just 17%, but is on a downward trend throughout 2022. At the time of writing, he said that buying GBTC shares is equivalent to buying Bitcoin for $9,771.

Historically, GBTC has traded at a premium as investors who were unable to buy Bitcoin flocked directly to investment vehicles to gain exposure to the world’s largest cryptocurrency by market capitalization. The premium he crossed 100% in December 2017 and finally he went negative for the first time in February 2021. Prices are now at all-time lows for the trust as interest in the product dwindles amid price surrenders.