Regulatory compliant pricing oracles to allow new institutional investment opportunities

As the demand for tighter regulation in the crypto industry grows, it’s interesting to see how this impacts Web3’s core fundamentals. One area that is often overlooked is the source of data used to power DeFi and the industry as a whole.

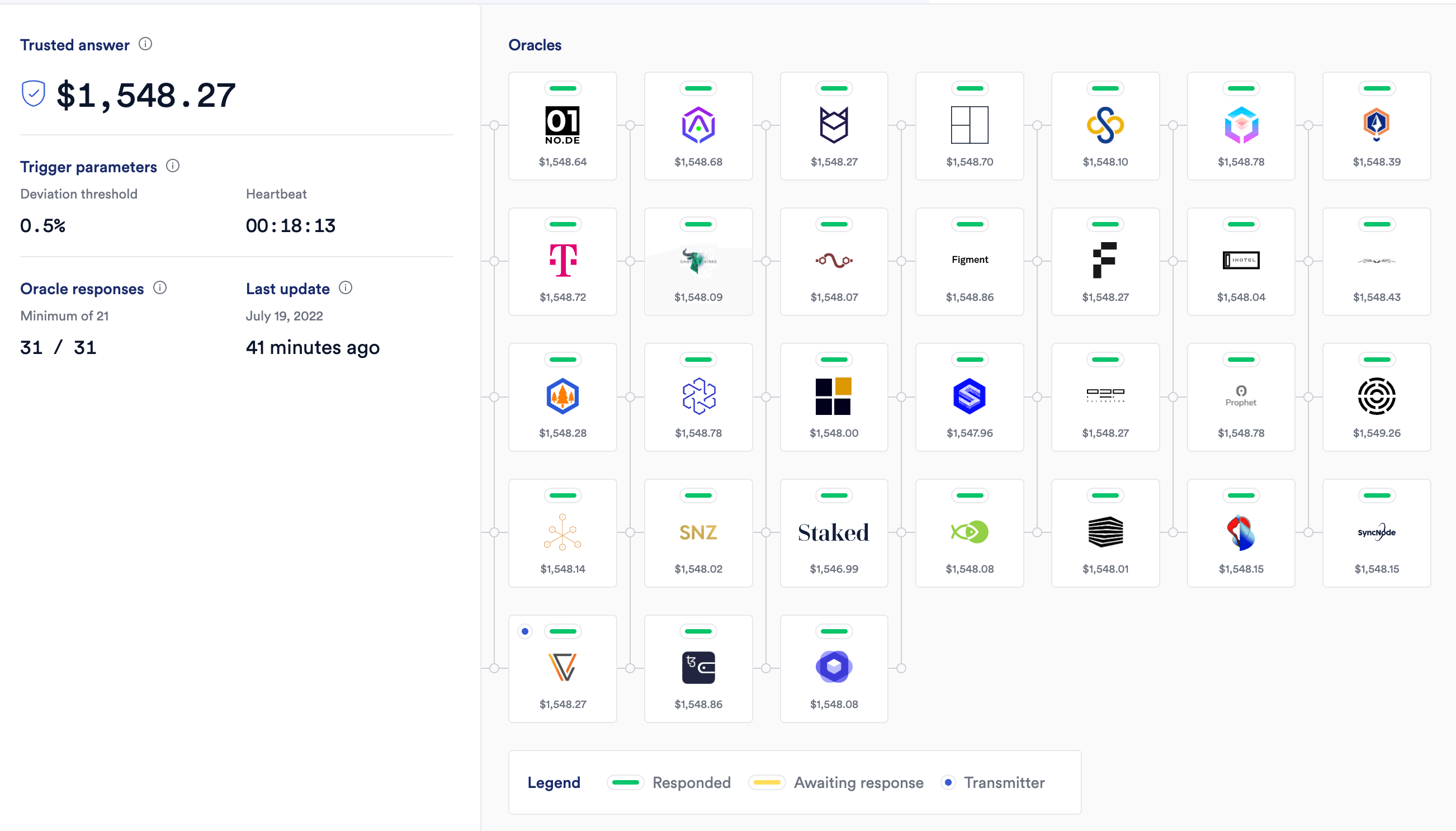

Data streams such as Oracle Wide range Combine price data into a single source and present it as reliable.Methodology depends Trust aggregation As a benchmark for the authenticity of information.

Chainlink, one of the largest oracles in the world, said:Validated feedUse to add a layer of security to the aggregation process. However, feeds may not comply with the requirements of institutions regulated by organizations such as the SEC and ESMA.

However, Oracle price fixing has become a major issue in creating costly exploits on platforms such as Miller Protocol, Inverse Finance, and Deus Finance. This issue occurs when sufficient data streams are available and the price of Oracle does not represent its actual value. This exploit could use a flash loan to drain funds to take advantage of price inequality.

At EthCC, Kaiko’s founder Alexander Coenegrachts cast Challenges offered

“Prize up to € 150,000 for startups and the opportunity for each winner to participate in the actual transaction of security tokens with international organizations”

Kaiko offers “enterprise-grade” solutions for “regulatory” data streams, opening the door for traditional institutional investors to leverage the crypto market. law For example, the US GAAP Framework and its AIFMD in the EU require data streams that are compliant with the stakeholders of a particular institution.

Fully compliant pricing Oracle availability could open the door to crypto indexes where sourcing such data is part of the cause of the lack of Spot Bitcoin ETFs in the United States. The ability to take advantage of such oracles may also enable basket ETFs that cover the top 10 cryptocurrencies after surpassing other regulatory hurdles.

Product data providers that need to be GAAP or AIFMD compliant must also be compliant.The latest license agreement for silk moth is

“The total citation of the silk moth is the first one Securities price solution Available on the market for buy-side procurement of Mark-to-Matrix or Mark-to-Model digital assets in accordance with US GAAP and EU AIFMD. “

This is a major step forward for the crypto industry in the traditional move to justify itself within the financial sector. Kaiko’s data is already used by cryptocurrency native companies such as Ledger, Messari and CoinShares, as well as S & P Global, Dow Jones and GBBC.