Research: Ordinals, BRC-20 drive financial boon for Bitcoin miners

The Ordinal Protocol enabled NFTs and BRC-20 tokens on the Bitcoin network, previously a single-asset network.

However, the issue has sparked controversy, with critics pointing to skyrocketing transaction fees and bloated chains. It also claims to include

Glassnode data analyzed by crypto slate The Ordinals Protocol has revealed that the good times are back for miners.

bitcoin miner hash price

Minor Hash Price refers to the ratio of daily earnings to mining hashrate, showing the earnings generated on an Exahash (EH/s) basis. A minor’s “comfort” in relation to other minors can be measured as a going concern.

The chart below shows that Minor Hash prices have surged since May and are approaching the one-year high last seen in June 2022. Prior to this, the Minor Hash price was in his two-year downtrend. Downtrend after about 4 months.

Miners are benefiting from the lower average production cost of Bitcoin as their daily income increases relative to their contribution to mining.

Consumption rate of mined supply for miners

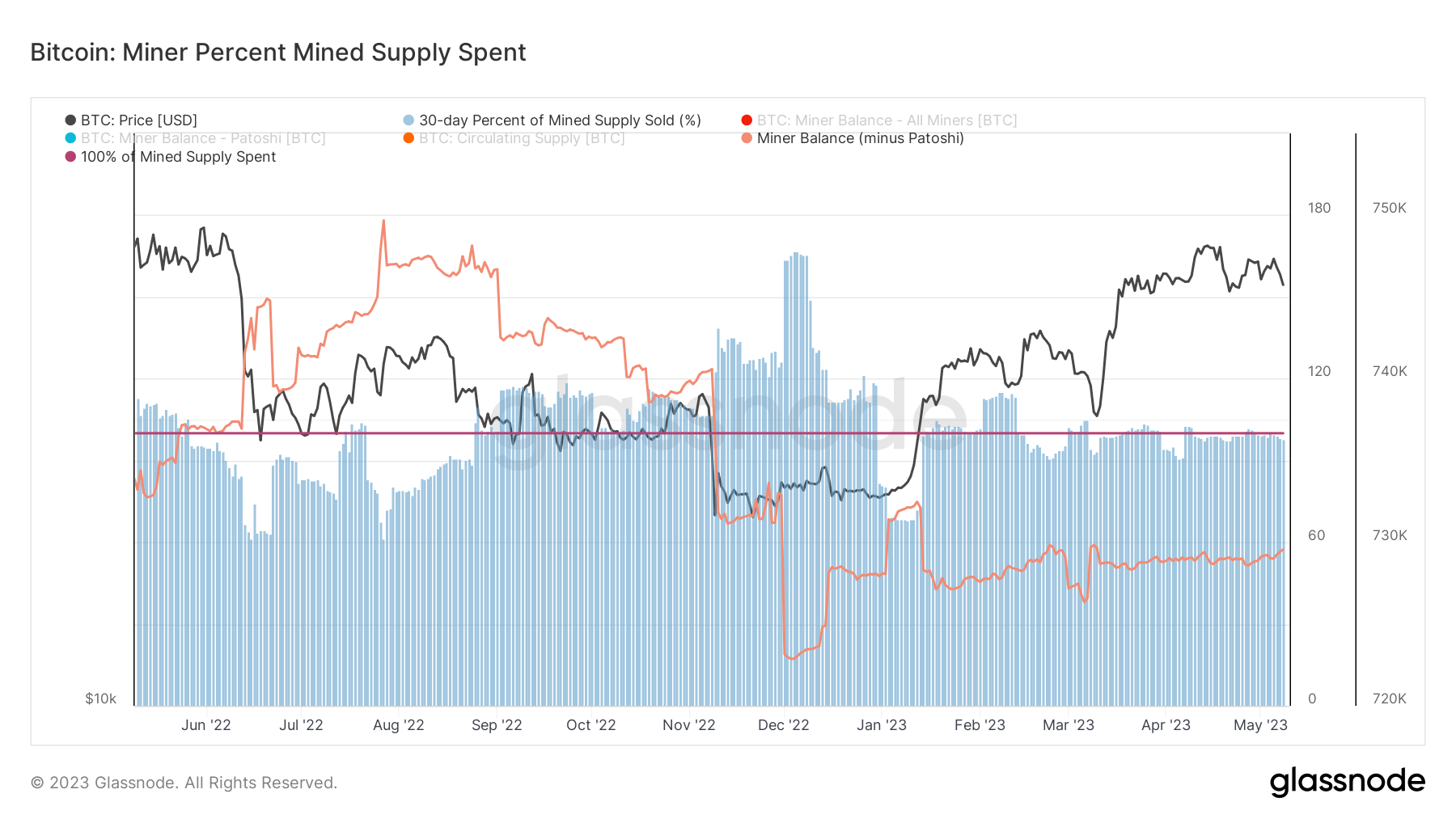

Miner Percent Mined Supply Spent refers to an estimate of the percentage of mined supply consumed by miners over a 30-day window.

The model compares the 30-day change in miner balances with the 30-day total issuance to determine the percentage of mined coins consumed given the following three variables at a given point in time:

- 100% – indicates that the amount of coins mined is equal to the total mined supply spent in aggregate.

- Less than 100% – Miners keep a portion of mined supply in financial reserves.

- Over 100% – Miners are distributing coins in excess of their mined supply, thus depleting their financial reserves.

The chart below shows that the miner balance (excluding Patoshi) is currently at 729,554 BTC. This is well below his July 2022 peak of 750,000 BTC, but marks a significant uptick from his December 2022 low, which bottomed out at 722,000 BTC.

Additionally, the year-to-date pattern shows an overall upward trend, indicating that miners are confident about future price increases, and rather than sell mined coins as assets on their balance sheets. I have come to prefer to keep it.

Patoshi is a coin mined by Satoshi Nakamoto when he was actively involved in the development of Bitcoin. On-chain data shows that he holds his 1.096 million coins.

Combined with analysis suggesting that miner capitulation occurred last year, CryptoSlate expects the upward trend in miner balances to continue and anticipates a continuation of favorable times for miners.

Ordinal impact summary for the past week

Earlier this week, meme coin mania confirmed that the BRC-20 token caused transaction fees to soar for the first time in 24 months.

this meaning block 788695was written on May 7 and earned a transaction fee of 6.701 BTC. first ever block If the transaction fee exceeds the mining reward (currently 6.25 BTC).

Similarly, meme coin FOMO pushed BRC-20’s market cap above $1 billion on May 8th.As a result, the current BRC-20 market cap is $735.6 million.

The number of Inscriptions, digital artifacts inscribed on the Bitcoin blockchain, has approached 5 million, resulting in miners earning a cumulative fee of 904 BTC.

Post Survey: Ordinal, The Economic Bounty Of BRC-20 Drives For Bitcoin Miners First Appeared On CryptoSlate.