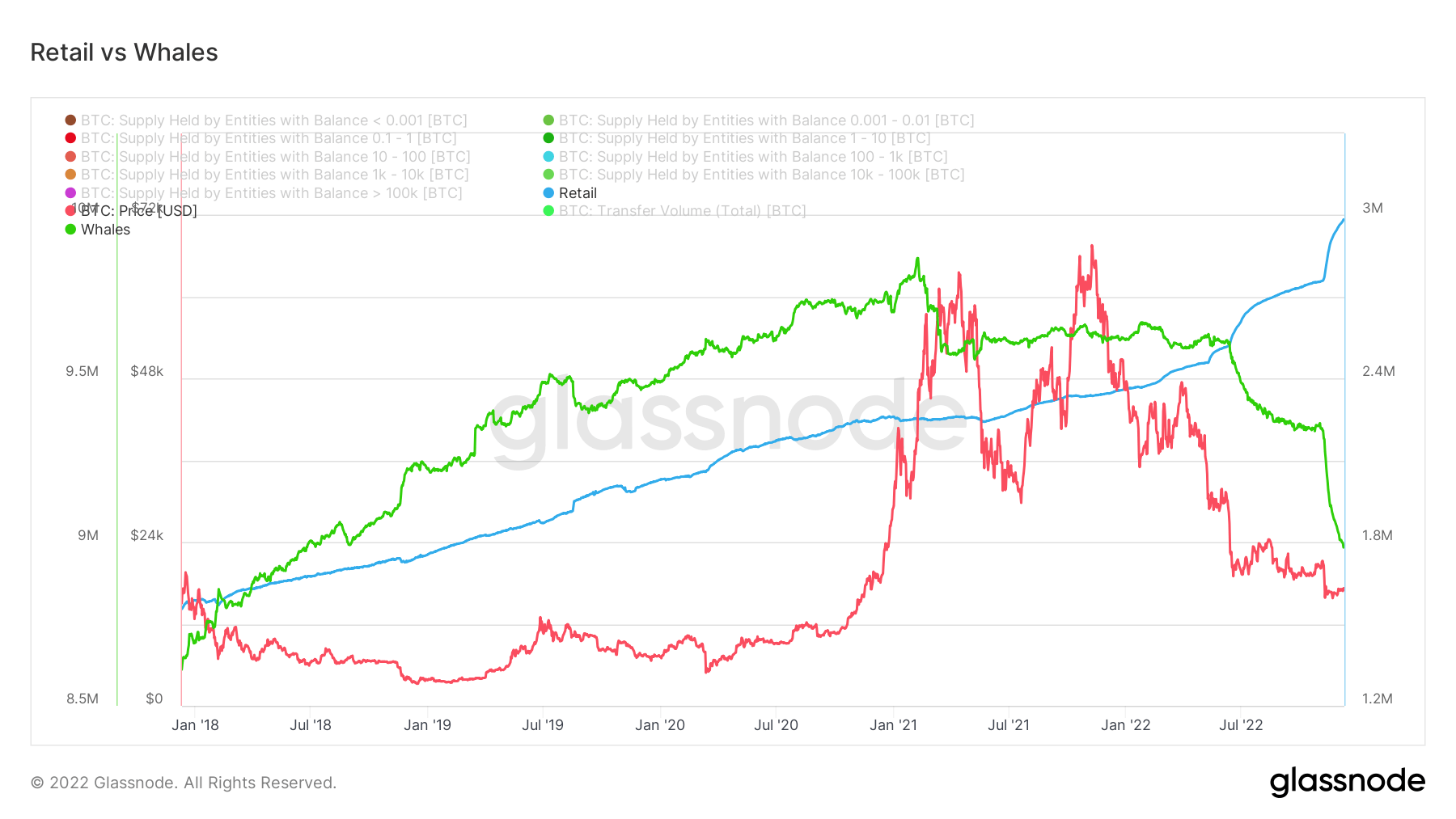

Retail investors are growing their BTC stack; whales’ holdings falling

According to Glassnode data analyzed by CryptoSlate, bitcoin ownership is still on the rise among retail investors, who now hold 3 million bitcoins, but whale accumulation is declining. , the recent number is about 9 million.

Individual investors are those who hold less than 1 bitcoin, while whales are those who hold more than 1000 bitcoins. Bitcoin holdings by individual investors have doubled since he held 1.5 million in 2018 compared to 10 million held by institutional investors. .

However, this space has been hacked, the collapse of Terra Luna, FTX downturnwhich was accompanied by a number of bankruptcies.

Even during the recession triggered by Terra Luna’s bankruptcy in May, investors continuation save bitcoins. Nevertheless, Bitcoin traded flat throughout the third quarter as sentiment turned bearish in his August.

Furthermore, Bitcoin holders with less than 1 BTC and 1,000 BTC to 10,000 BTC entered the accumulation phase in late October. However, since mid-July, those over 10,000 BTC have continued to sell.

This appears to be the third largest whale dump of Bitcoin in history, based on transactions and accumulation, as outlined in a previous article. Cryptoslate Report,

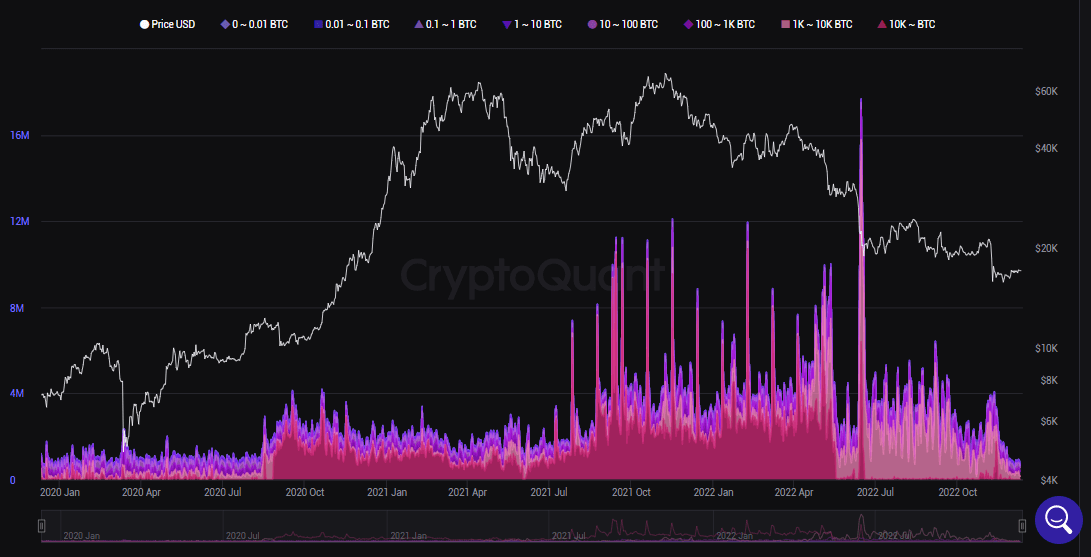

Nearly 80% of Bitcoin losses are due to whales

In response to the Terra-LUNA and FTX crises, Bitcoin whales have sold around 365,000 BTC according to on-chain data from CryptoQuant.

Additionally, on-chain data shows that whales that held between 1,000 and 10,000 BTC disposed of their BTC holdings during the miner’s surrender phase by November. Whales account for nearly 80% of Bitcoin sales since June.

BTC is priced at $17,004, but small investors are still accumulating. As of Nov. 28, retail holds 96.2k BTC of him since FTX collapsed. This is the best ever.

#bitcoin Shrimp (< 1$BTC) added 96.2k $BTC Their holdings have increased to an all-time high since FTX collapsed.

This cohort now exceeds 1.21 million $BTCcorresponding to 6.3% of the circulating supply.

Pro Dashboard: https://t.co/HpXwoav6wO pic.twitter.com/7U4oPAAakD

— Glassnode (@glassnode) November 28, 2022

Bitcoin exchange outflow has reached historic levels

According to Glassnode, the number of Bitcoin addresses has recently surged to its highest level.

Following the collapse of FTX, #bitcoin Investors are withdrawing coins for self-custody at the historic rate of 106,000 $BTC/Moon.

It is only compared with the other three times.

– April 2020

– November 2020

– June-July 2022https://t.co/92aYVYU4Yt pic.twitter.com/em7CsDBWUf— Glassnode (@glassnode) November 13, 2022

The demise of FTX, the world’s second-largest cryptocurrency exchange, has eroded trust in the exchange, prompting more Bitcoin investors to gradually shift their holdings to self-custody solutions.

Bitcoin exchange outflows hit 106,000 BTC per month, approaching historical levels, according to analytics platform.

Bitcoin exchange outflows usually indicate that cryptocurrencies are held for a long time. This also appears to be the result of a decline in trust in centralized cryptocurrency exchanges.

Bitcoin is currently trading at $16,971, down 1.16% over the past 24 hours, according to the report. coin market cap.