Return of Bitcoin leverage signals impending market volatility

quick take

- In the last 24 hours, Bitcoin has seen a spectacular surge, breaking through the $28,000 level and pushing Bitcoin’s market capitalization dominance past the 50% threshold.

- Spot buying has returned and over $150 million worth of Bitcoin has been withdrawn from exchanges, as you can see below.

- according to coin glassopen interest also rose significantly.

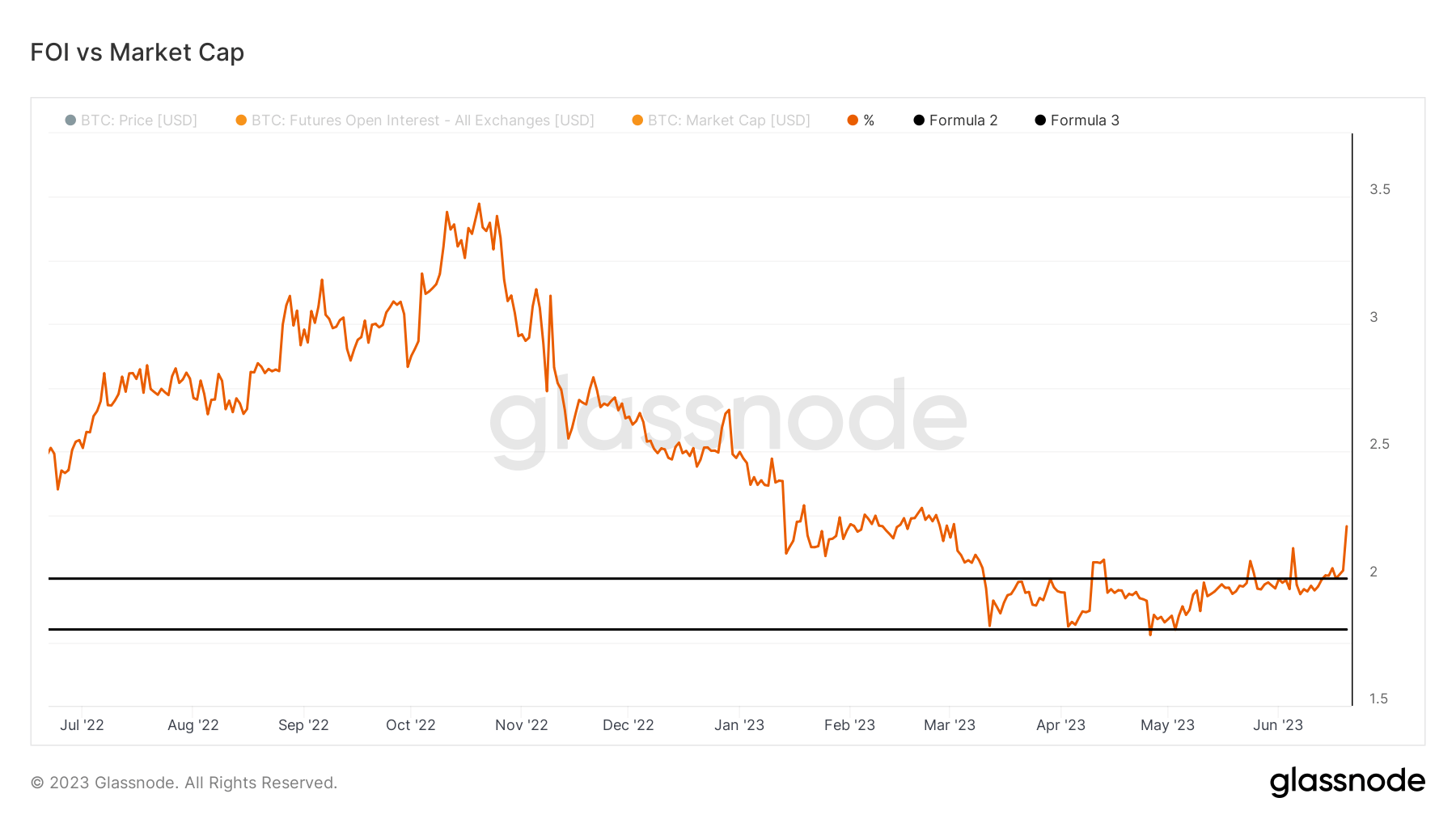

- “Open Interest” means a contract that has been traded but has not yet been liquidated by a set-off transaction or related exercise or transfer. It provides an indicator of the liquidity and activity of a particular market.

- The amount of bitcoin in the open interest contract has reached a substantial amount 475,000 unitsa peak not observed since March.

- Open interest now accounts for more than 2.2% of Bitcoin market cap, nearing its all-time high.

- This suggests an increase in futures contracts, potentially suggesting an increase in volatility and trading volume.

An imminent sign of market volatility after the resurgence of Bitcoin leverage first appeared on CryptoSlate.