SBF faces 8 criminal charges; Binance reportedly has billions in undisclosed reserves

Some of the biggest news in the cryptoverse on December 13th included the arrest of former FTX CEO Sam Bankman-Fried, the testimony of FTX’s new CEO John Ray about what led to the exchange’s failure, and Binance’s That includes reportedly keeping billions of dollars in secret reserves.

CryptoSlate Top Stories

Indictment filed by U.S. Attorney for the Southern District of New York (SDNY) Damien Williams in the arrest of FTX founder Sam Bankman-Fried include eight charges.

The charges include conspiracy to launder money, conspiracy to commit wire fraud against customers and lenders, conspiracy to commit commodity and security fraud, and separate wire fraud against customers and lenders.

The indictment also includes conspiracy to defraud the United States and campaign finance violations.

Additionally, both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have filed separate lawsuits against the former CEO.

Binance CEO Changpeng Zhao was unfazed after $1.4 billion worth of assets were withdrawn in a single day.

Despite the uncertainty, the CEO believes it would be a good idea to conduct a “withdrawal stress test” on a rotating basis at each centralized exchange.

However, Nansen, a Hong Kong-based blockchain analytics platform, has reported that $3 billion worth of assets have been removed from Binance in the past 24 hours.

Former FTX CEO Sam Bankman-Fried (SBF) was pressured by law firm Sullivan & Cromwell to file for bankruptcy of the FTX company during his scheduled testimony before the US House Financial Services Committee. I claim. Doing so was a potential legal and consultancy fee.

SBF was scheduled to testify before the US House Financial Services Committee on December 13, but was arrested in the Bahamas on December 12 at the request of the US government.

Forbes has obtained a draft of Bankman-Fried’s planned testimony, It was published It’s literally.

In the testimony, the SBF said under “Chapter 11” that shortly after John Ray signed the nomination to take over as CEO of FTX, he “offered billions of dollars to help complete customers.” claims to have received

Binance’s publicly disclosed reserves may only represent a fraction of all assets it holds, with the exchange having “more money than it is lending out,” the sources said. crypto slateciting people familiar with the matter, including former Binance employees.

source told crypto slate “Binance is safe” since exchange CEO Changpeng ‘CZ’ Zhao disclosed “probably half or just a fraction of what he actually owns.”

“In the early days of Binance, most of the funds went directly to CZ, which means reserves behind reserves.”

Regarding the potential lack of transparency around Binance’s reserves, the source said, “If there is no money behind CZ, we should be more concerned.”

FTX CEO John Ray III Dec 13 testimony A bankrupt exchange has revealed to the U.S. Congress that it had mixed up assets and kept private wallet keys unencrypted.

According to Ray, FTX’s collapse was caused by mismanagement of the company and was the worst it has handled bankruptcies in more than 40 years. He said FTX’s operations are concentrated in the hands of “a very small group of very inexperienced and unsophisticated individuals” who have failed to implement the form of control required for companies holding other people’s money. pointed out.

Earlier in the day, FTX co-founder Sam Bankman-Fried was arrested in the Bahamas on orders from the US government. His Dec. 12 press statement by the Attorney General of the Bahamas revealed that the U.S. government has filed criminal charges against his SBF and will likely demand extradition.

Damien Williams, U.S. Attorney for the Southern District of New York, confirmed the development. Williams said SBF was “arrested at the request of the U.S. government based on a sealed indictment filed by SDNY.”

According to Nansen data, Binance saw an outflow of more than $2 billion in Ethereum-based tokens since December 12th.

When Binance users withdrew their assets so aggressively in June, the cryptocurrency market was reeling from the Terra Luna collapse.

another Tweet From its blockchain intelligence platform, the exchange reported withdrawals of over $2.5 billion in the last 24 hours, with a negative net flow of $1.57 billion. Millions of dollars have flowed in.

research highlights

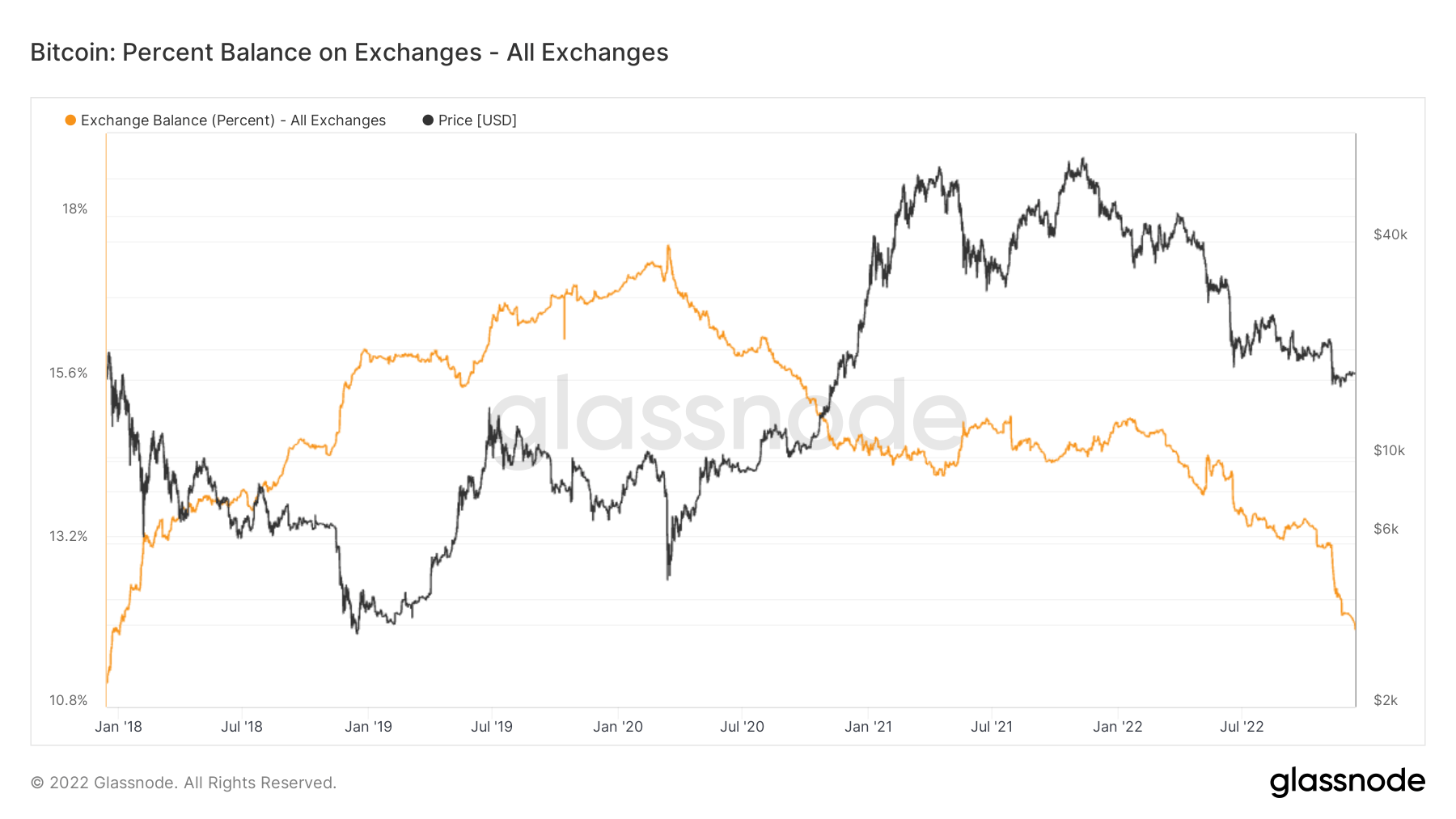

Less than 12% of the current Bitcoin (BTC) supply is held by exchanges, the lowest level since January 2018, according to data analyzed by Glassnode. crypto slate.

The chart below shows BTC balances held on exchanges by the orange line, starting in January 2018 when balances were just above 10.8%.

The exchange’s BTC reserves grew exponentially between January 2018 and January 2020, when the COVID-19 pandemic began. In January 2020, exchanges held nearly 18% of all BTC supply. After that peak, the amount of BTC held on exchanges began to shrink steadily, dropping to 12% of what it is today.

crypto market

Over the past 24 hours, Bitcoin (BTC) rose 4.01% to trade at $17,717.64 while Ethereum (ETH) rose 4.92% to trade at $1,316.80.

Biggest Gainers (24 hours)

- Siacoin (SC): +25.91%

- Tribe (Tribe): +15.32%

- Looks Rare (LOOKS): +11.95%

Biggest Loser (24h)

- ABBC Coin (ABBC): -14.69%

- Kaspa (KAS): -14.04%

- Neutrino US Dollar (USDN): -12.6%