Seven key points from the SEC’s charges against Binance and Binance.US

On June 5, the U.S. Securities and Exchange Commission (SEC) filed broad charges against major cryptocurrency exchange Binance and its affiliates for allegedly violating securities laws.

of filing This is one of the most comprehensive series of charges the SEC has brought against cryptocurrency companies to date. Below are the most important claims and facts.

1. BNB and BUSD are securities

The SEC has declared Binance’s cryptocurrencies, including the BNB Exchange Token (BNB) and the Binance USD Stablecoin (BUSD), as securities.

The regulator said Binance’s BNB Vault, Binance’s Simple Earn program and Binance.US’s staking service are also securities. All of the company’s offerings and sales were illegal and unregistered.

More broadly, the SEC said that Binance and its U.S. peers failed to register as exchanges, broker-clearing firms and clearing houses, even though they were required to do so.

2. Some third party tokens are securities

Some of the tokens Binance has listed are Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND) and Descent. Lalando (MANA), Algorand said it is a securities containing. (ALGO), Axie Infinity (AXS), and Coti (COTI).

These tokens were “sold as investment contracts, [were] The SEC said it was a “securities” from the first sale. Binance did not issue the above tokens, but the SEC complained that Binance did not restrict the trading of assets on its platform.

3. SEC seeks jail time for Zhao et al.

The SEC permanently states that Binance CEO Zhao Changpeng, Binance, Binance.US’s parent company BAM Company Trading, and related parties have violated the Securities Act and relevant provisions of the Securities Exchange Act. said it should be banned or blocked. It also said those parties should be ordered to pay disgorgement and civil penalties.

The regulator added that Zhao should be barred from certain leadership roles. Binance and its affiliates should be banned from trading securities and cryptocurrency securities and engaging in related businesses, he said.

4. Binance Bypassed US Regulations

The SEC said Binance secretly and explicitly sold its service to U.S. customers after its launch in 2017 and nominally restricted U.S. access in 2019.

One consultant instructed Binance to create a “Tai Chi” organization in the United States tasked with issuing reports and liaising with the SEC “only to suspend potential enforcement activity.” The consultant also encouraged Binance to block U.S. users on major exchanges while privately teaching some users how to circumvent the restrictions.

Binance and its executives have not fully embraced Tai Chi’s plans, but many have expressed interest in continuing to work with consultants.

5. Executives were aware of the situation

Binance’s CCO (anonymous to the SEC) has issued a statement indicating that it is aware of the fraudulent activity. In 2018, the CCO said, “We operate as an unlicensed stock exchange in the United States.” In 2020, he said of Binance:[does] don’t want [Binance].com will continue to be regulated,” he said, adding that this led to the creation of local bodies.

Mr. Zhao and others also participated in discussions on the Tai Chi plan. Mr. Zhao knew there were “safer” alternatives, but went ahead with much of the plan nonetheless. Zhao personally instructed Binance to develop a plan to advise users to avoid geo-blocked VPNs. He also instructed Binance to encourage VIP users to bypass KYC checks.

The SEC said Zhao and Binance were aware of the exchange’s large number of US users, as evidenced by an internal presentation estimating that the company had 1.47 million US users in 2019. Stated.

6. CZ Owned Company, US Fund Management

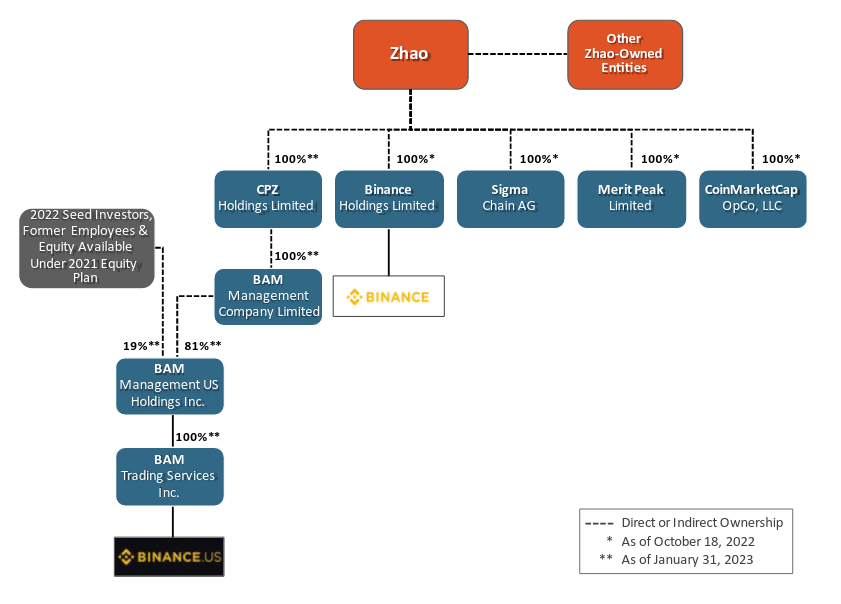

The SEC said it has 100% ownership of several Binance-affiliated companies, along with Binance CEO Zhao Changpeng and other entities owned by Zhao.

Although Zhao did not have 100% ownership of the US company under BAM, he and Binance had significant control over bank accounts and users’ crypto deposits. Additionally, Zhao’s Merit Peak and Sigma Chain were “used to transfer tens of billions of US dollars” between Binance and US peers, the SEC said.

Zhao and Binance were also involved in designing, launching, hiring, trading activities and operating the US-based company, according to the regulator.

7. Wash trading was rampant

Finally, the SEC said that Binance’s US company misled users To Protection against wash trading and exaggerating the accuracy of trading volumes.

Sigma Chain’s role as a market maker led to a large wash trade, the SEC said. At one point, SigmaChain accounts wash traded 48 of the 51 newly listed assets. At another point in time, these accounts were wash trading 51 of the 58 listed assets.

D.Despite earlier promises that this feature exists, Binance US companies have Trade surveillance mechanisms are at least February 2022. Executives were reportedly aware of the wash trading, but took no action to stop its activity.

The SEC said trading data is important information for users and equity investors, and that Binance’s U.S. company benefits from such misleading statements. The regulator therefore declared the company’s conduct to be fraud and deception.