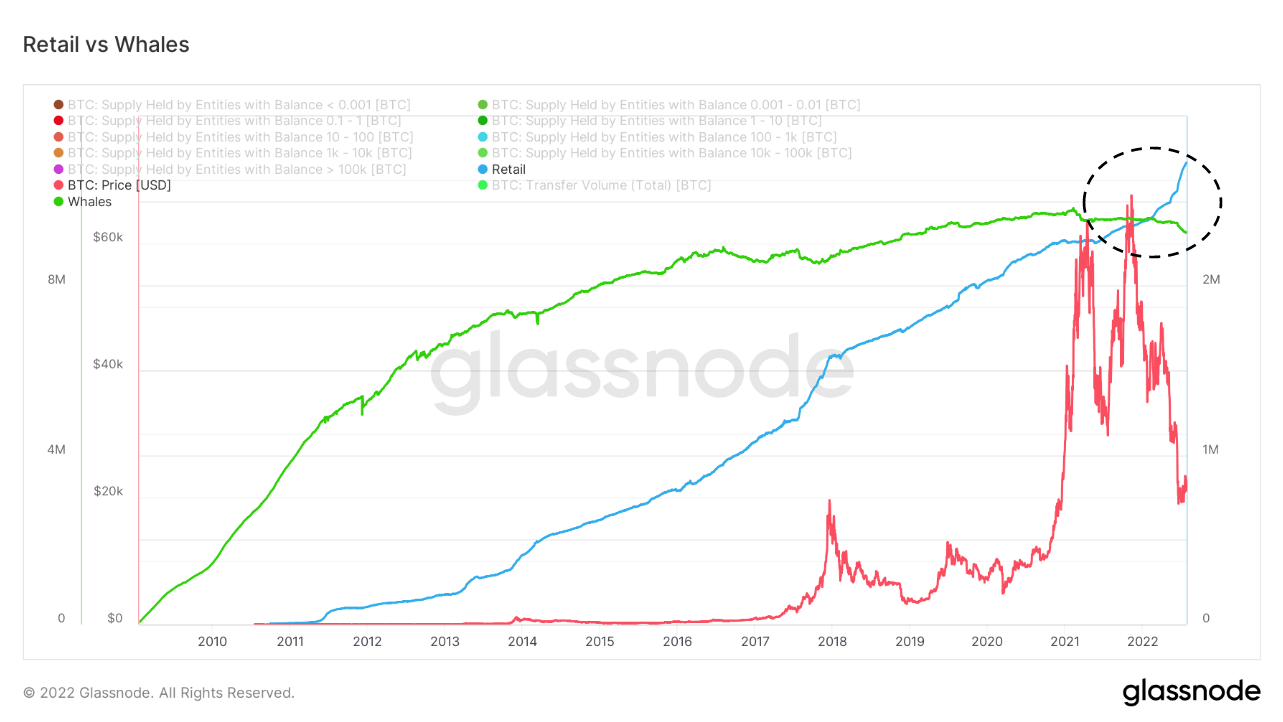

Shrimps vs. Whales — Small holders accumulate Bitcoin as whales dump

CryptoSlate’s new study using Glassnode data reveals that small or retail Bitcoin (BTC) holders are accumulating major digital assets while whales are dumping their holdings became.

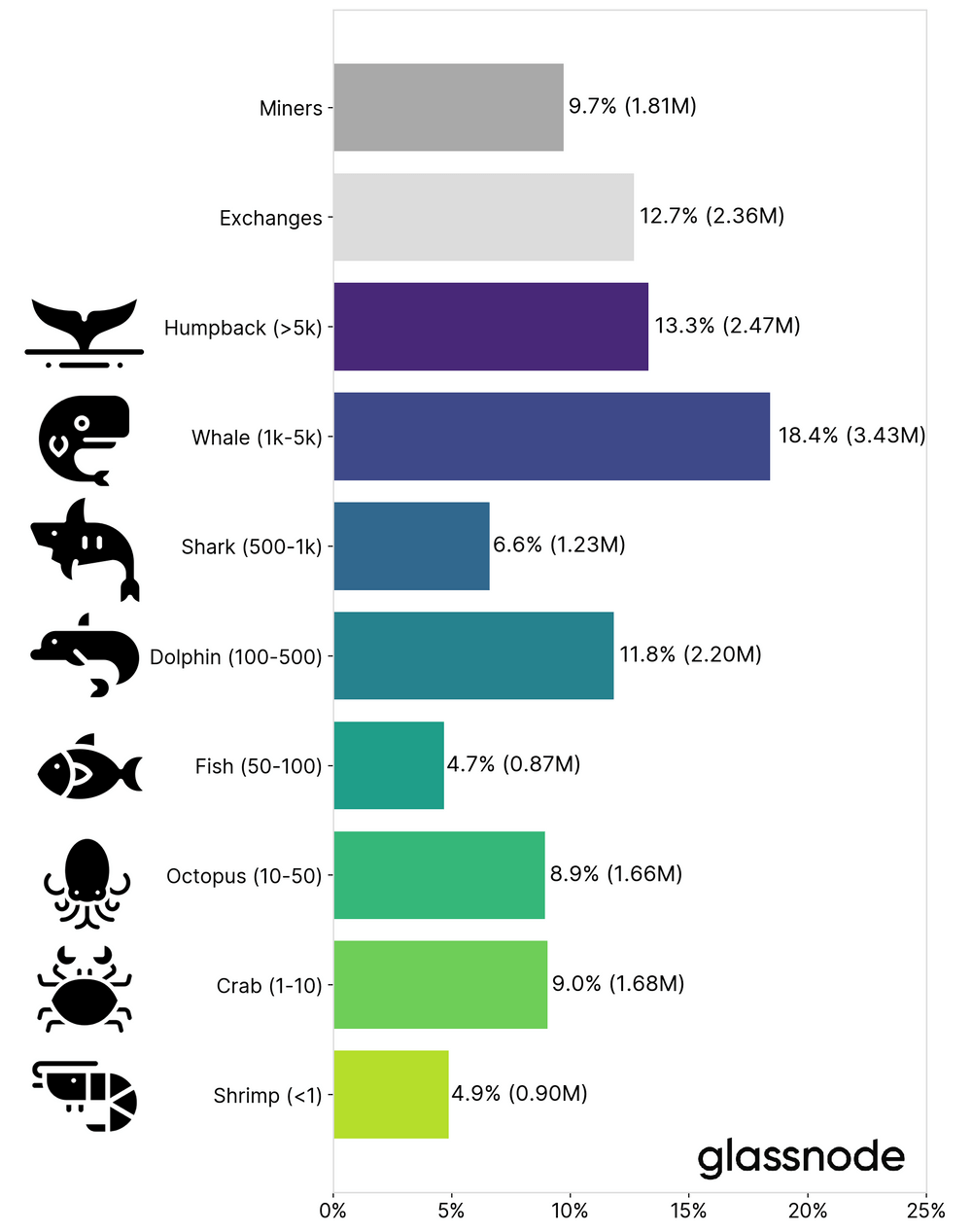

Retailers own less than 10 BTCs in their portfolios, also known as “crabs” or “shrimp”, but whales have more than 1000 Bitcoins in their portfolios.

Retailers accumulated by market implosion

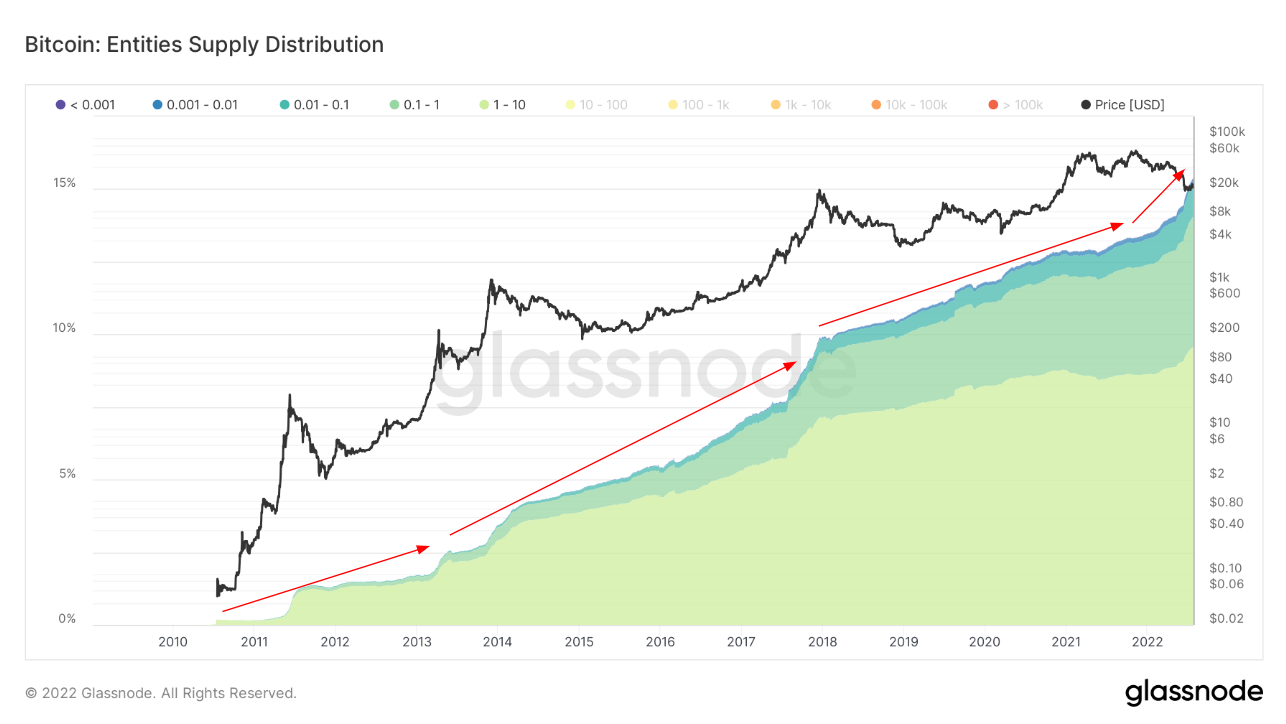

According to a CryptoSlate study, retailers’ control of Bitcoin supply increased from 14% to 15.3% in the bear market, an additional 1.3% unaffected by recent price behavior.

Bitcoin’s crash into the $ 20,000 range has reportedly made assets “attractive and affordable” for investors in this class, with retailers at the most aggressive rates in market history, around 60,500 per month. I bought it at BTC.

Meanwhile, throughout Bitcoin’s history, the group has continued to grow and is the backbone of asset bottoming in the bear market cycle.

In recent months, its growth has accelerated despite the uncertain economic and geopolitical issues that have plagued the world. In addition, growth is seen when Bitcoin prices fall 66% from record highs.

The data show that not only retailers are involved, but they are also contributing to the rapid growth of the network. It also shows that Bitcoin adoption continues to grow despite the impact of the bear market.

Whale is littering

A CryptoSlate study found that whales have been littering Bitcoin since the beginning of the year.

Evidence of this is a recent mysterious study. clearly Institutional investors sold 236,237 BTC when Terra’s ecosystem collapsed. Tesla, a Bitcoin whale known as an institutional investor, said it sold 75% of its holdings during this period.

A recent tweet from Edris also added credibility to our study of whales selling their property. “Large companies now hold coins in losses and are forced to sell some of them before they lose a lot of money in their portfolio,” Edris said.

#Bitcoin Whales sell at a high rate ⚠️

1. The final stage of the bear market is where even the strongest hands panic and start selling undervalued ones. #BTC Withdraw from the market as soon as possible.

Keep reading below … 👇🏼 pic.twitter.com/JZyqCDcFcp

— Edris 💀 (@TradingRage) July 13, 2022

Despite sales, whales still hold nearly 10 million BTC, more than four times more than retailers.

The graph below shows that private investors may overtake whale owners if the dumping trend continues. This is a net plus for the network as more coins are distributed fairly and volatility is reduced in the long run.