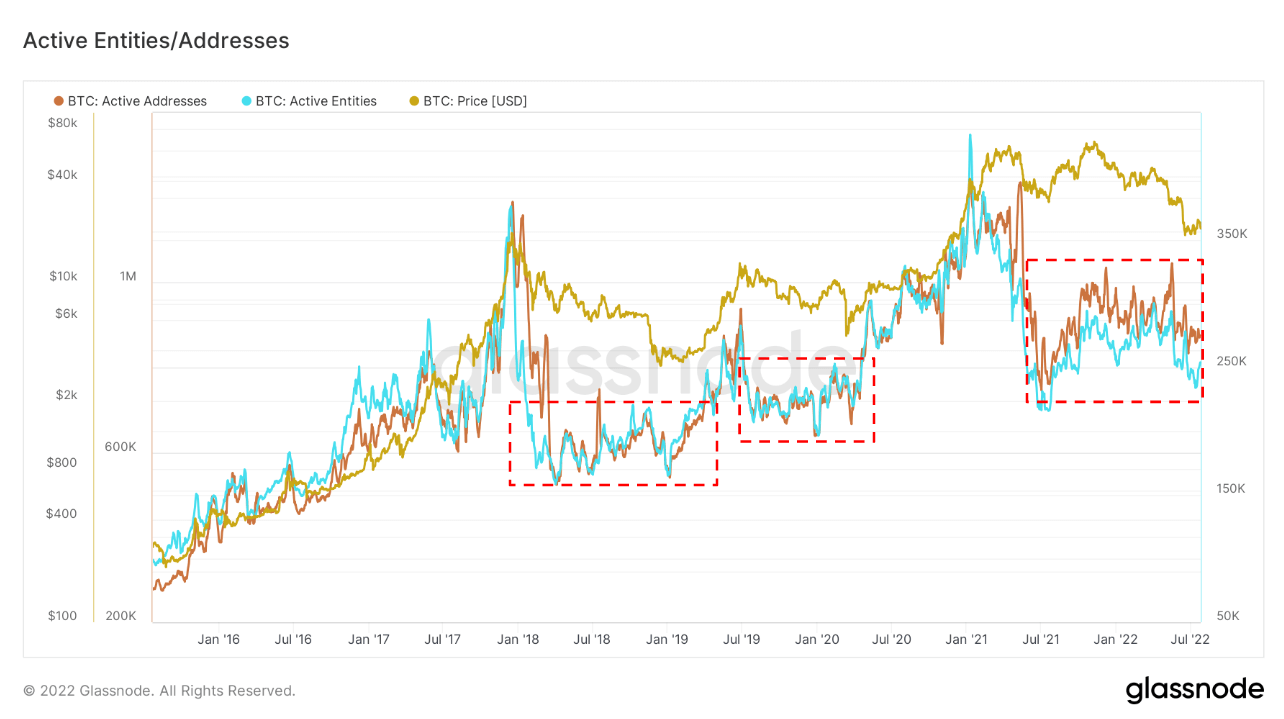

Stagnating active addresses and entities show we’re in a typical bear market

Determining the length of an ongoing bear market is very difficult to do with a single indicator, especially when looking at shorter timeframes. Zoom out to better understand an ongoing bear market. and consider how different market fundamentals have performed in previous cycles.

An often overlooked but solid market performance indicator is active addresses and entities. Active addresses represent the number of unique Bitcoin addresses that have sent or received transactions. Active entities, on the other hand, are clusters of addresses controlled by the same network entity that was active as a sender or receiver.

CryptoSlate uses advanced heuristics and of the glass node Proprietary clustering algorithm to estimate the number of active entities.

These two metrics are solid indicators for determining if the market has entered a bear phase and show the number of users interacting with the network.

Analyzing the relationship between Bitcoin price and the network’s active addresses and entities reveals three distinct bear market cycles over the past five years. The first is from 2018-2019, the second is from 2019-2020, and the third is from 2020-2021.

In 2017, the Bitcoin network had 1.19 million active addresses. By 2021, that number has increased to 1.24 million. This means that 50,000 new active addresses have been added to the network. While this may seem like a low number compared to the overall increase in Bitcoin adoption, it is important to note that there were only 523,000 active addresses in the 2018 cycle. In the 2020 cycle there were 640,000, but in the 2021 cycle there were 746,000 active addresses. Only during bull market peaks, such as those seen in 2017 and 2020, did we see a modest 4% increase in on-chain activity.

Analysis of Glassnode’s data reveals an interesting phenomenon in the market. With each bear market, the number of active addresses and entities hit new highs. This shows that users who were pulled into the bull market are weathering the bear market and resuming activity when conditions improve.

However, the current bear cycle does not see a significant influx of new users. This suggests that this bearish cycle will continue until macro conditions turn around.