Tech giants’ and Bitcoin’s dominance skew S&P 500, crypto market growth rates

The S&P 500 Index, a key barometer of U.S. stocks, reached 4,151 points at close May 29, showing year-to-date growth of 9.15%, indicating rising inflation and a potential recession. The situation is the opposite. .

In parallel, the cryptocurrency market, as measured by market capitalization, witnessed significant volatility, ending the month with a massive $1.16 trillion. Despite periodic economic downturns, the overall cryptocurrency market has grown by a staggering 45.3% year-to-date.

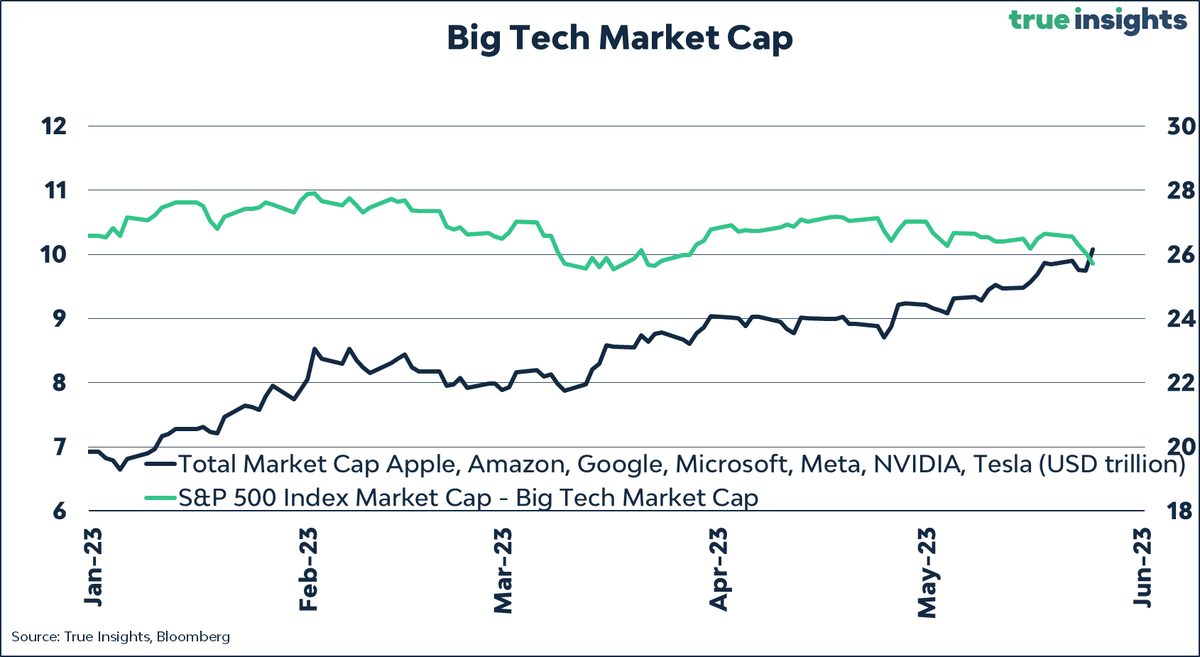

However, the performance of the S&P 500 is not indicative of real market conditions. A closer look reveals that technology giants Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla, which account for a significant portion of the index’s market capitalization, disproportionately impact overall index performance. .

Together, these stocks added $3.16 trillion in market capitalization, representing a year-to-date growth of 46%.

When these companies are excluded from year-to-date performance calculations, the S&P 500 Index paints a different picture, with year-to-date growth slowing to just 3% and its strong performance heavily dependent on these companies. indicates that you are

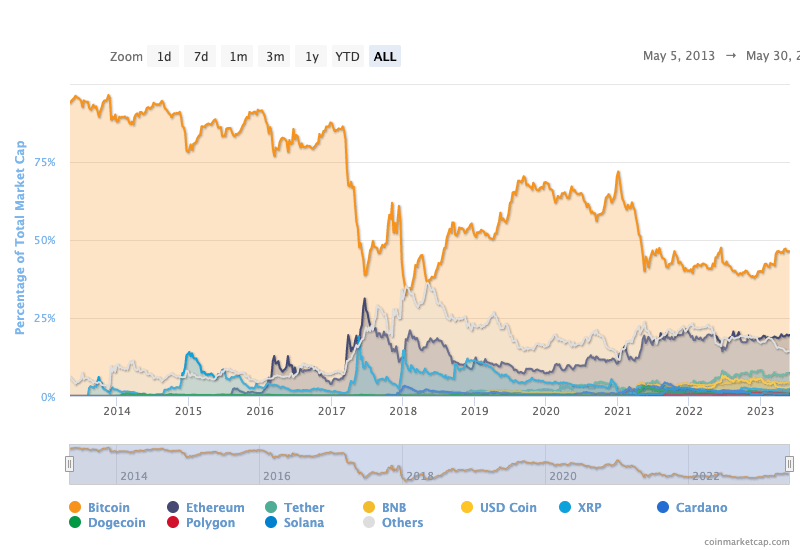

However, the cryptocurrency market is also dominated by a significant player, Bitcoin. As of May 23, 2023, Bitcoin alone accounts for $542.7 billion of the cryptocurrency market capitalization. Its sheer size and influence often overshadows the performance of other cryptocurrencies in the market.

In fact, Bitcoin’s dominance has reached approximately 46% of the total cryptocurrency market capitalization, reflecting its status as the original most widely adopted cryptocurrency. This number has been a major driver of cryptocurrency market trends, demonstrating the resilience and growing popularity of Bitcoin.

Excluding Bitcoin’s market cap from the total, the remaining cryptocurrency market cap was $617.3 billion, indicating a low year-to-date growth rate of 29.1% for the rest of the market, with Bitcoin becoming the largest share of the overall cryptocurrency market. It was found to have a significant impact on growth.

Comparing the performance of the S&P 500 and the cryptocurrency markets yields insightful parallels. Both are highly concentrated, with selected companies having a significant impact on their respective market caps. This disproportionate influence presents interesting considerations regarding the diversity and resilience of these markets.

However, the resilience exhibited by the cryptocurrency market even in the midst of a global crisis highlights its potential as a formidable competitor to traditional markets.

As we continue our research into 2023, these market developments will undoubtedly remain under our lens and will be an interesting observation for market watchers and participants.

The growth rate of the cryptocurrency market was first displayed on CryptoSlate after tech giants and Bitcoin’s dominance distorted the S&P 500.