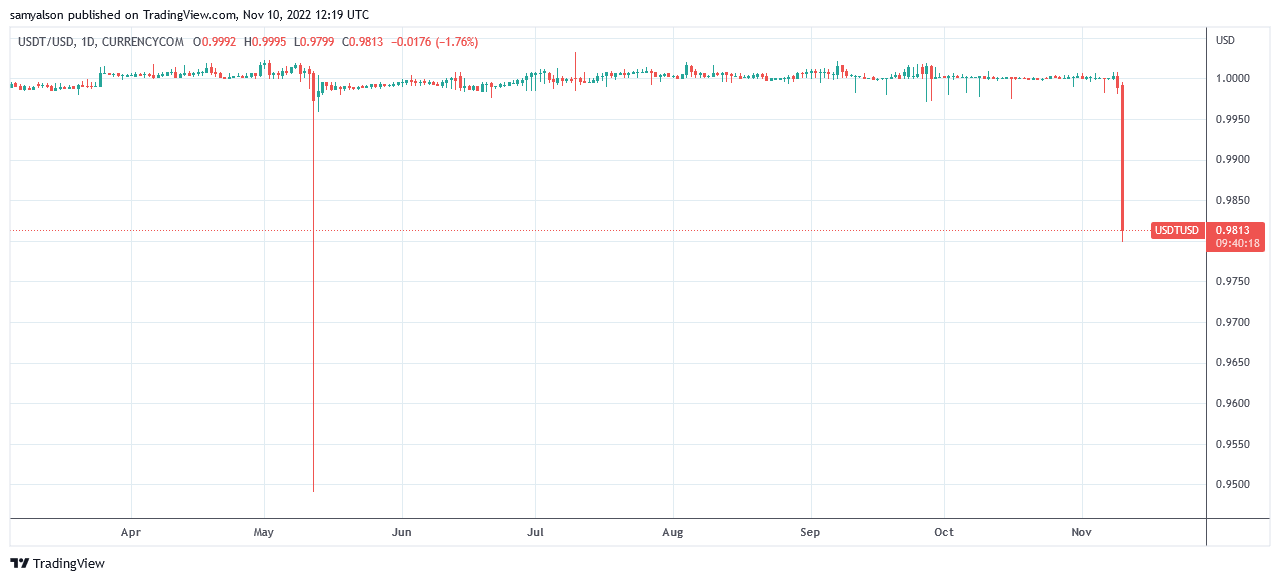

Tether dollar peg sinks 1.7% as FTX-induced turmoil persists

The Tether (USDT) stablecoin showed signs of wobble on Nov. 10, dropping to $0.9806 as market uncertainty continues to dominate.

The aftermath of the FTX bankruptcy is building selling pressure across the cryptocurrency market. His 7-day performance of the top 100 tokens is his double-digit loss overall. Exceptions are some stablecoins — PAX Gold and OKB.

Unsurprisingly, FTT leads the losses, down 88% over the past week.

In another twist to the sages, on-chain analysis showed that Alameda, the trading arm of FTX, borrowed 250,000 USDT from Aave early on November 10th.

Twitter user @Moncasaro We speculated that Alameda may be shorting assets in hopes of further declines.

Since 2017, Tether has dropped its dollar peg nine times, with the worst falling to $0.92 in April 2017.

Tweet from @celestius_eth Alameda is known to have held a large amount of Tether.

#Alameda received approximately $36.6 billion #tether the past year. That’s about 38% of all outbound he volume to date.

just imagine #Alameda We still have a large amount of Tether and need to liquidate all remaining assets. Can Tether cover it?

sauce: https://t.co/feqe6oVOMF#FTX #SBF #CZ Binance pic.twitter.com/rXE2WymiRZ

— celestius.eth (@celestius_eth) November 10, 2022

Commenting on the situation, Paolo Ardoino, CTO of Bitfinex and Tether, noted the aftermath of the Celsius collapse that also rocked Tether, adding that sufficient reserves are being held.

“This time, Tether is about to prove once again that its reserves are liquid and stable. We are ready to redeem any amount that comes our way.”

The TRON DAO Reserve has spoken out, saying that buying 1 billion USDT tokens will help protect the peg.

To protect the entire blockchain industry and crypto market, the TRON DAO Reserve will purchase a total of 1 billion USDT.You may see a change in balance https://t.co/L52UWqhmkR All reserves will be CEX.

— TRON DAO Reserve (@trondaoreserve) November 10, 2022