The bullish case for Bitcoin as 2022 comes to an end

Bitcoin (BTC) price has fallen significantly throughout 2022, trading at $16,877.39 at the time of writing. That’s down more than 66% from his November 2021 high of over $68,000.

Most investors consider price to be the most important indicator of growth. While there is little reason for Bitcoin’s price to be bullish, evaluations of other growth indicators strongly support BTC’s growth over the next few years.

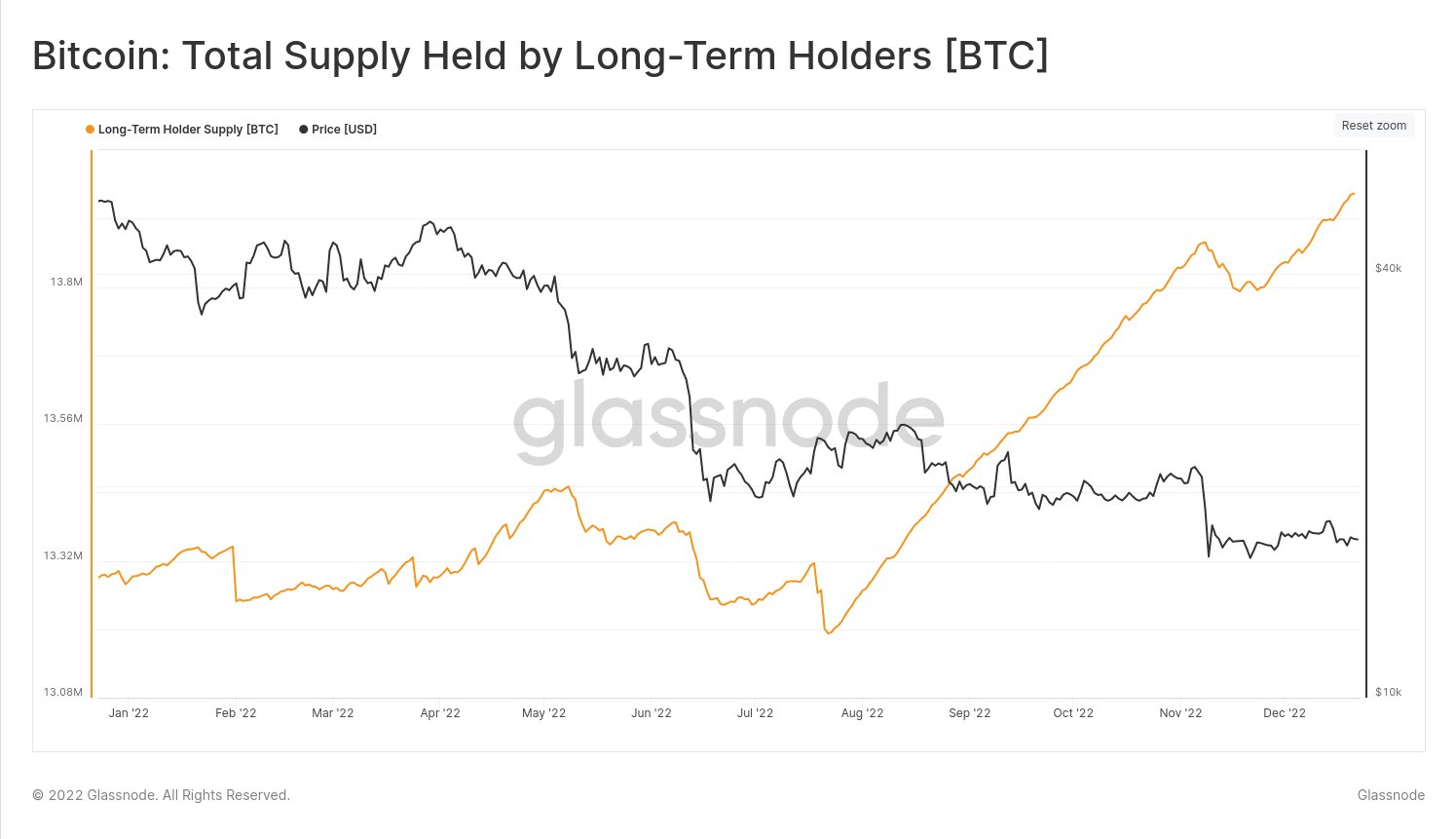

Record number of long-term holders

The total supply of Bitcoin held by long-term users will continue to increase throughout 2022. However, it is worth noting that Bitcoin fluctuated during major events such as his Terra-LUNA debacle in May and the bankruptcy of hedge fund his Three Arrows Capital (3AC). Crypto lender Celsius fell in June and his FTX in July. These events caused a short-term panic, causing long-term holders to give up their BTC holdings.

Total supply of long-term holders hits all-time high of over 13.9 million BTC despite drop, according to Glassnode data analyzed by crypto slateThis shows that long-term investors hold about 72.7% of Bitcoin’s circulating supply of 19.24 million coins, a record high. A long-term holder is someone who has held Bitcoin for more than 155 days.

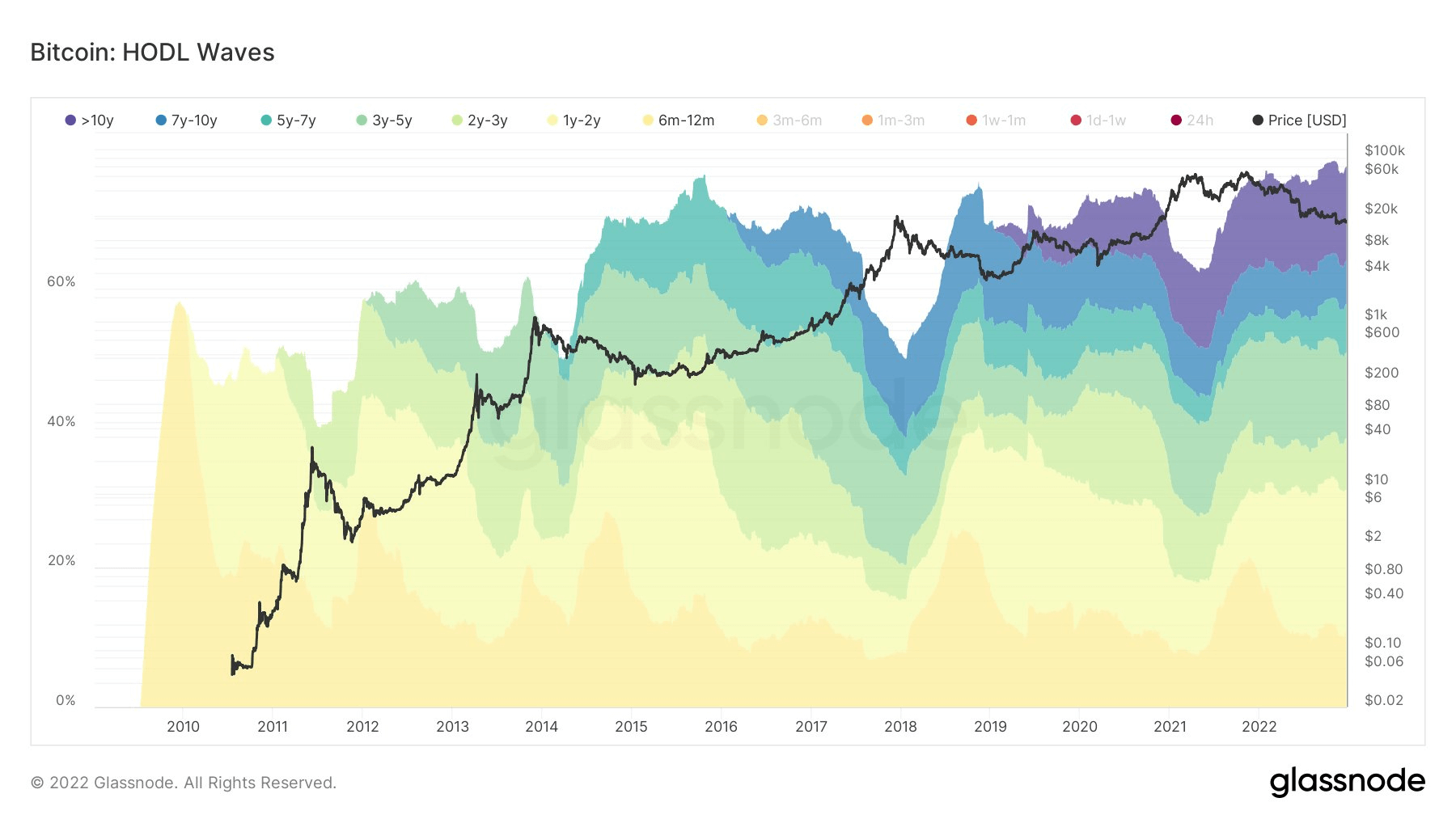

Additionally, the BTC HODL Waves chart shows a high number of early BTC enthusiasts (purple) who have held onto the coin for over a decade, despite the post-FTX collapse dip. The HODL Waves chart shows the amount of BTC held by different age groups.

Percentage of investors holding BTC for 7-10 years has remained largely stable despite market volatility throughout 2022, indicating long-term holders maintain their faith in BTC. I’m here.

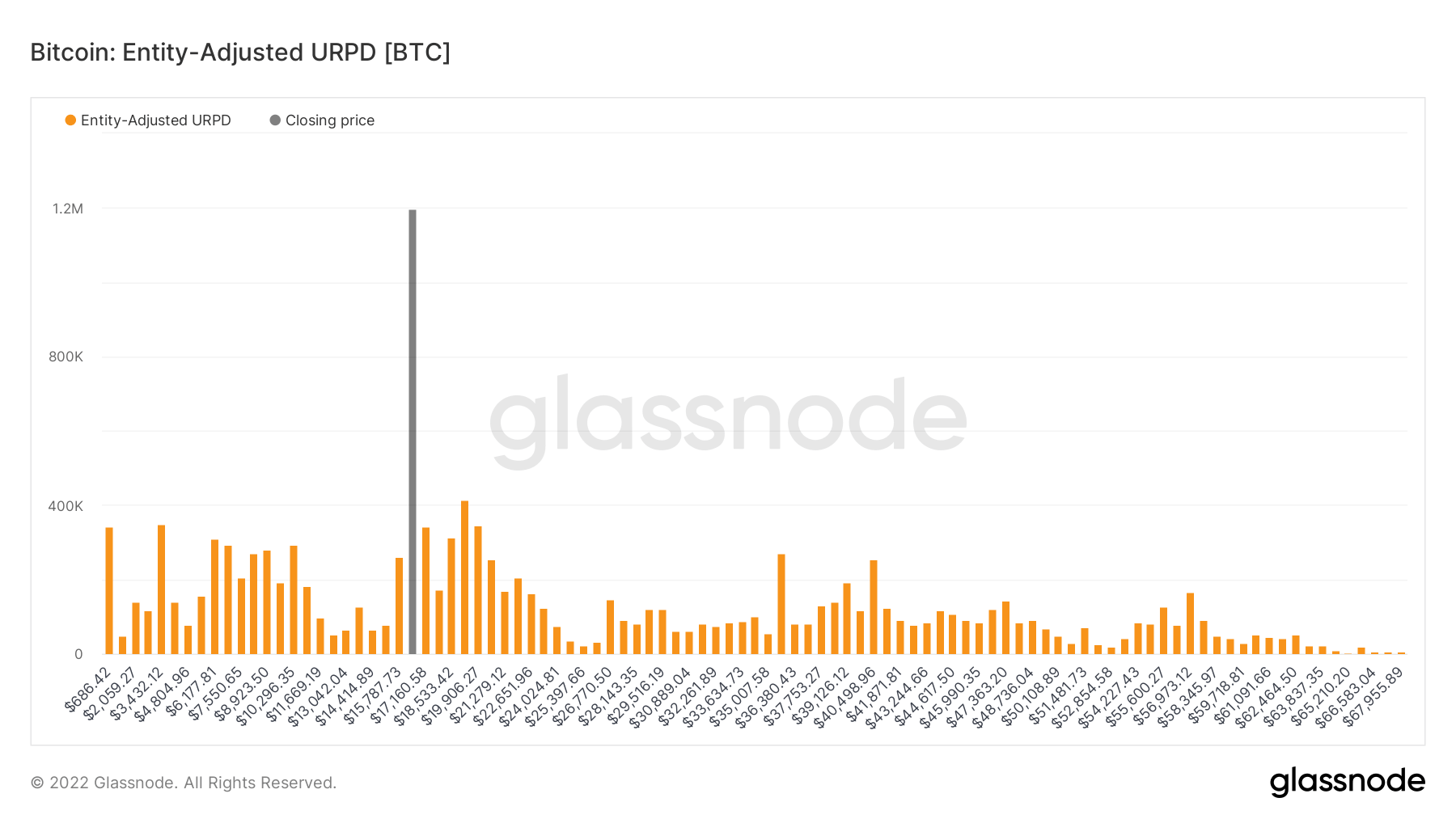

Around 1.8 million BTC were bought between $15,700 and $17,100

According to Glassnode data, about 1.8 million BTC (more than 9% of the circulating supply) was bought in the price range of $15,787.73 to $17,160.58. BTC has only traded in this price range since November 2020 and this year, November 2022.

The 9% volume suggests more redistribution is likely, but Bitcoin consolidation suggests long-term holders dominate.

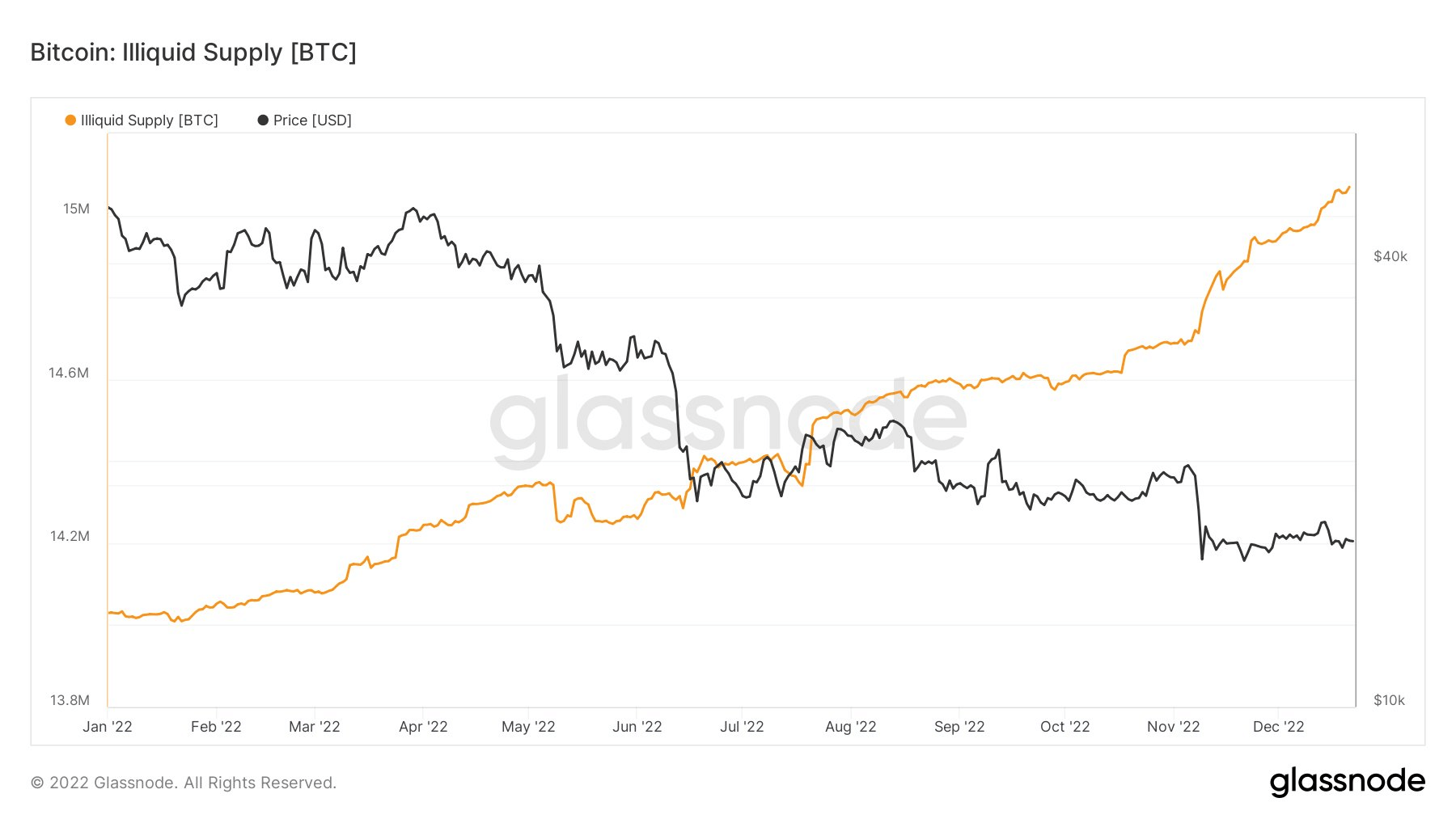

78% of Bitcoin’s circulating supply is self-managed

The bankruptcies of a string of prominent crypto lenders and centralized exchanges such as Celsius and FTX have unearthed important lessons among investors. The phrase has been around for years, but with millions of investors collectively losing tens of billions of dollars in 2022, the message is finally understood.

Large numbers of investors continued to control assets throughout the year as confidence in centralized exchanges waned. Over 15 million coins, or about 78% of the circulating supply of 19.24 million BTC, were illiquid as of December 27th.

The illiquid supply of BTC has increased from about 14.8 million coins in August, or 76% of the circulating supply. Additionally, the illiquid supply of Bitcoin has increased by about 7.4% from his just over 14 million coins at the beginning of the year.