Top 4 stablecoins gaining market dominance despite stagnant growth since May

Top 4 stablecoins — USDT, USDC, BUSD, DAI — experienced exponential growth throughout 2021 and the first three months of 2022, reaching a peak market cap of $160 billion . However, growth hit a wall in his May when Terra LUNA collapsed and the market capitalization of the top four companies dropped significantly.

Top 4

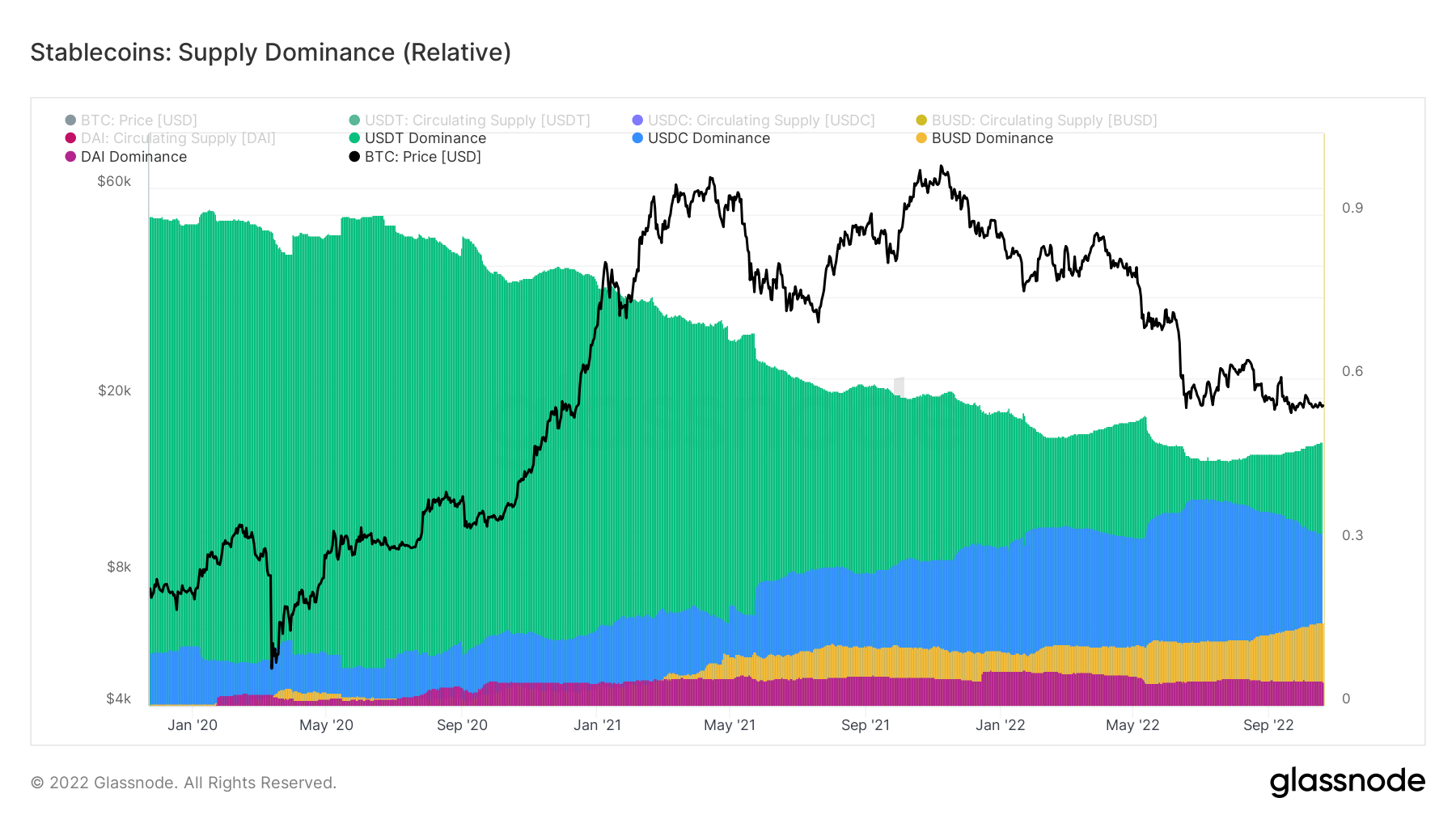

Tether (USDT) had a 90% market share in 2020, but has since climbed to around 50% as other stablecoins gained ground in the industry. The chart below shows the top four stablecoins by market share since early January 2020.

In early 2020, USDT held over 90% of the stablecoin market share, with Circle’s USD Coin (USDC) making up the majority of the remaining 10%.

However, as of October, USDT’s market share has dropped to around 50%, with USDC and Binance USD (BUSD) making up most of the rest.

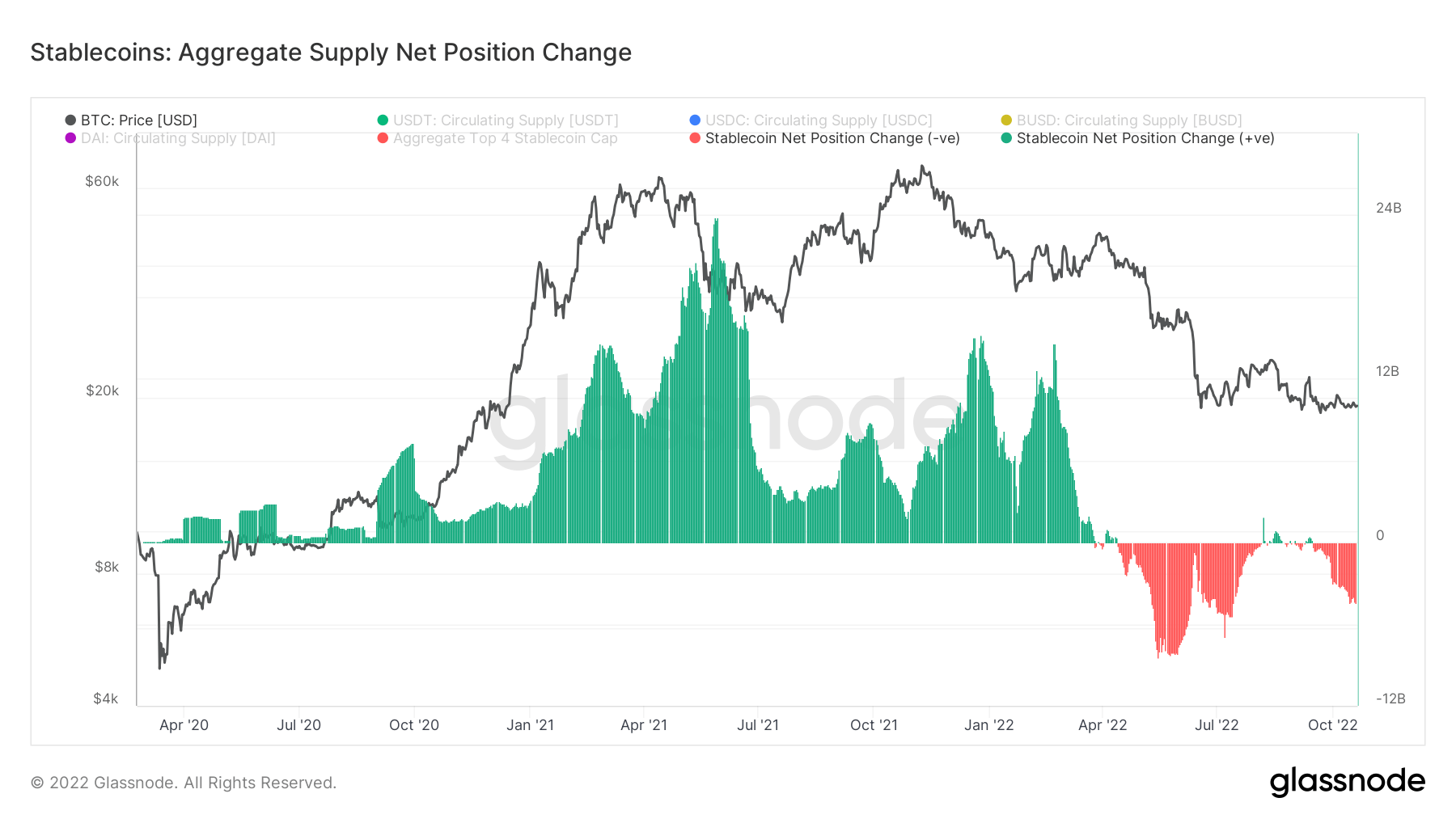

Stablecoin supply

Stablecoins have been steadily leaving exchanges since May, with only a short period of rest from August to September.

When a stablecoin leaves an exchange, it usually means it is either sold as fiat currency to pay off debt or moved to another asset class as investors lose confidence in the cryptocurrency. .

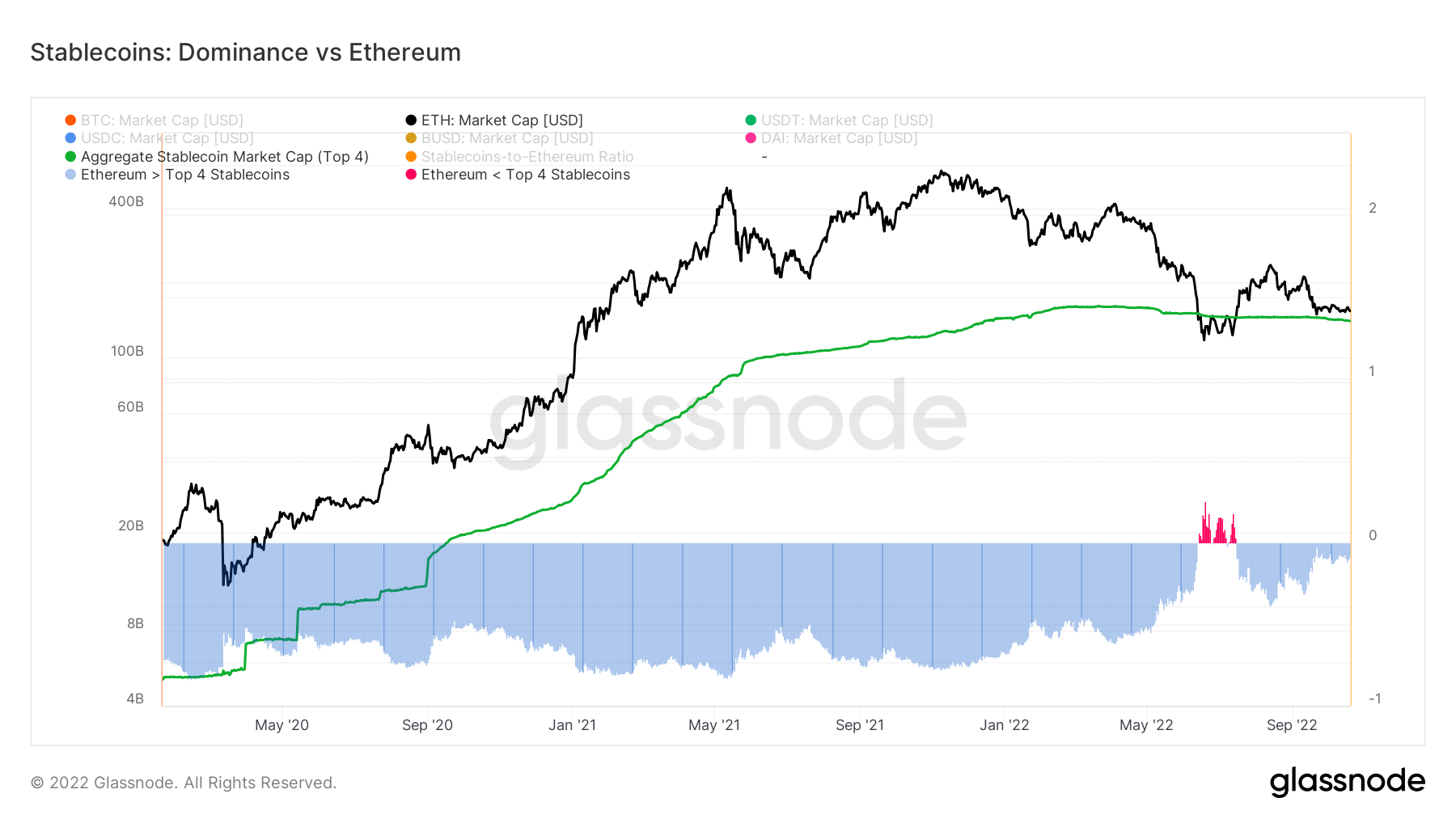

Top 4 Stablecoins vs. Ethereum

Ethereum (ETH)’s dominance over the top four stablecoins has been on a downward trend since May, with the stablecoin gaining dominance in June, when ETH hit its lowest price of the year.

The top four stablecoins claiming to be dominant during such times show that investors tend to trade Ethereum for stablecoins to protect themselves.

After the loss of trust caused by the collapse of Terra’s algorithmic stablecoin, this conversion to a stablecoin is a positive development in restoring trust.