Traditional hedge funds consider regulatory uncertainty biggest barrier to entry in crypto

No traditional hedge fund has ever invested in cryptocurrencies, but about two-thirds are still hesitant to enter the market. PwC 2022 Global Cryptographic Hedge Fund Report.. People at the fence said they were waiting for the market to mature and more regulations to come into force.

The report provides insights into the growing interest that traditional hedge funds have shown in the crypto market. Created in collaboration with the Alternative Investment Management Association (AIMA), it analyzes the approaches these funds take when assessing whether to invest in digital assets and explores the key barriers they face.

Who and why to invest in crypto

The AIMA survey, conducted in the first quarter of 2022, included 89 hedge funds managing approximately $ 436 billion in assets. More than half of the funds that participated in the survey had over $ 1 billion in assets under management (AUM).

About one-third of traditional hedge funds say they are investing in digital assets. This is a significant increase compared to last year when only one in five people was exposed to the crypto market. This significant increase in interest is supported by findings from last year’s survey, which showed that about 25% of funds plan to invest in cryptocurrencies next year.

The increase in the number of funds investing in cryptocurrencies is not proportional to the increase in overall exposure to cryptocurrencies. Of these funds investing in cryptocurrencies, more than half have only toe positions and less than 1% of AUM is allocated to digital assets. Only one in five respondents said that cryptocurrencies have more than 5% of AUM.

Two-thirds of funds investing in cryptocurrencies say they plan to invest more capital in their asset classes by the end of the year. However, this is a significant decrease from 2021, when 86% of funds said they would increase crypto investment. The majority of funds planning to expand their capital into cryptocurrencies are less than 1% of the asset class AUM.

Regarding the motivation for investing in cryptocurrencies, more than half of the respondents said they invested to diversify their portfolio. About one-third said they were “market-neutral alpha opportunities,” but only 18% cited “long-term outperformance.”

Investing in crypto

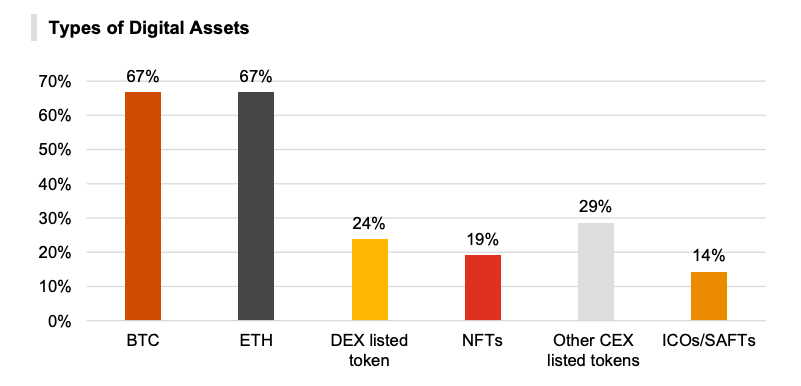

Survey data show that the majority of funds have their portfolios diversified into Bitcoin (BTC) and Ethereum (ETH). One-third invested in tokens listed on centralized exchanges, and one-quarter said they traded tokens listed on decentralized exchanges.

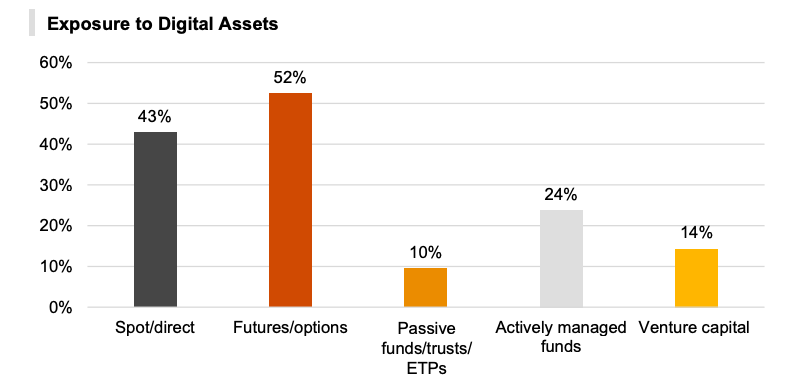

Unlike specialized cryptocurrencies, traditional hedge funds are usually not directly exposed to cryptocurrencies. However, the situation seems to change in 2022, and the report shows that the number of funds with direct market exposure has increased significantly.

More than half of PwC’s survey respondents said they invested in cryptocurrencies through derivatives such as futures and options. This is a slight decrease from last year, when about two-thirds of respondents said they invested only through derivatives. Traditional hedge funds investing in cryptocurrencies using direct and spot trading increased from 33% in 2021 to 43% in 2022. From 29% in 2021 to 10% in 2022, the passive approach of investing in crypto through passive funds, trusts and EPs.

Of all hedge funds investing in cryptocurrencies, 43% say they used leverage when trading. Approximately 78% of leveraged people manage assets under $ 1 billion, indicating that smaller hedgers are more likely to use riskier investment strategies.

However, this lack of risk aversion was not translated into other crypto categories. Despite significant growth in GameFi, Metaverse, and Web3 platforms this year, hedge funds appear to be uninterested in investing in these areas. More than half of hedge funds say they have seen the biggest growth opportunities on DeFi.

Increased interest suppressed by lack of clarity

Rising interest rate hedge funds in the crypto market only exacerbate some of the major problems facing the industry. More than 90% of hedge funds investing in cryptocurrencies said the lack of regulation and taxation was the most serious problem they faced. About 78% also cited the lack of deeply fluid synthetic and indirect commodities, storage issues, lack of prime broker services, and the withdrawal of complex fiat money on exchanges.

Hedge funds are also not happy with the current market infrastructure.

On average, less than a tenth of hedge funds said their crypto market infrastructure was “appropriate”. Meanwhile, 95% of respondents say auditing and accounting are segments that need serious improvement. Another staggering 94% of the fund said risk management and compliance needed substantial improvements, as well as the ability to use digital assets as collateral.

Those who did not invest in the crypto market also had a lot of thought about it.

The study reported a slight decrease in the number of hedge funds that did not invest in cryptocurrencies. It increased from 79% in 2021 to 63% in 2022. Of those 63%, about one-third said they were in the “late stage.” “Plan to invest” or are actively considering investing. This is an increase from last year, but 41% of funds say they are unlikely to enter the crypto market over the next three years. Another 31% said they were interested in the market but were waiting for the market to mature.

Most hedge funds, whether or not they have invested in cryptocurrencies, seem to agree on what the barriers to entry are. According to PwC, the majority of funds said that regulatory and tax uncertainty was the biggest problem they had to overcome before they could enter the market. An interesting finding from the survey was the fact that 79% of respondents said that the reaction from clients and the danger to their reputation kept them away from the market.

It’s no wonder that the risk of exposure to cryptocurrencies outweighs the benefits, as the majority of funds do not invest in crypto that manages assets in excess of $ 1 billion. Managing assets in excess of $ 1 billion requires a significant amount of trust built on conservative and successful strategies over decades, if not decades.

About one-third of respondents said they would aggressively accelerate their involvement in the crypto market if these barriers were removed, but most of the money went beyond that to convince them. I need it.

“45% of respondents said that removing barriers probably wouldn’t affect their current approach, as investing in digital assets is out of duty or remains skeptical.” The book states.

PwC’s report shows a clear trend in traditional hedge funds. The more assets you manage, the less likely you are to invest in the crypto market. Relatively small institutions seem willing to take on the risks and volatility that are synonymous with cryptocurrencies and address the barriers associated with such young and relatively unregulated markets.