U.S. CHIPS Funding Terms Will Severely Restrict Chinese Chips Industry

As more details emerge about the requirements for companies to receive the funding made possible by the CHIPS and Science Act, the law could not only boost the U.S. semiconductor sector, but severely limit investment in China’s chip industry. It’s becoming clear. US government. trend force This will have a big impact on Chinese foundries and memory makers, and they will lose a large market share.

U.S. wafer fab manufacturers are no longer able to provide tools that can be used to manufacture logic chips with non-planar transistors at the 14/16nm node and below, 3D NAND with 128 layers and above, and 18nm half-pitch DRAM memory chips. . the following. But the requirement for companies to get funding under his CHIPS and science laws in the US means these companies will not be allowed to invest in Chinese fabs. This will have dramatic implications for multinationals such as Samsung, SK Hynix, and TSMC. All of these companies have large fabs in China and may apply for funding under the CHIPS and Science Act.

Currently, only SK Hynix manufactures DRAM in China, but it is unclear which production node it uses in China. According to TrendForce, Samsung and SK Hynix are manufacturing 3D NAND in China using 128-layer process technology. This node is pretty competitive now, but as the manufacturer ramps up his 3D NAND with more advanced nodes, his 3D NAND with 128 layers will be pretty uncompetitive in terms of cost. These companies have permission to set up new tools in their Chinese fabs for now, but they can’t upgrade their Chinese fabs if they receive funding from the U.S. government. This means that memory production must be scaled down.

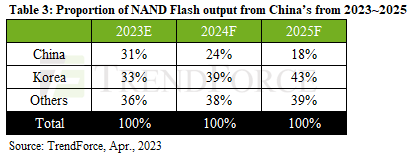

As a result, China’s share of the DRAM market will drop from 14% in 2023 to 12% in 2025, while China’s share of the 3D NAND market will drop from 31% in 2023 to 18% in 2025, according to TrendForce. drops to

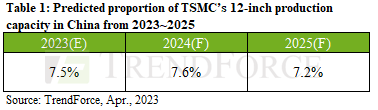

TSMC has a large fab in China that produces chips in 28nm class technology. The company has upgraded this fab so he can’t manufacture 16nm FinFET chips. In addition, funding under the CHIPS and Science Act cannot expand Fab 16 capacity.

Meanwhile, the U.S. government plans to further tighten regulations on China’s semiconductor sector, banning imports of equipment that could be used to make chips at the 28nm node. It also affects SMIC.

Additionally, TrendForce claims that some fabless chip designers move existing and new orders to Taiwanese foundries to minimize client pressure and risk. According to TrendForce, foundries focused on mature production nodes such as VIS and PSMC have already benefited greatly from this trend. Market research firms predict that this shift will result in a significant recovery for foundries currently affected by IC designer inventory destocking.

TrendForce claims that many U.S. companies are restricting the production of memory and storage products in order to avoid geopolitical issues, urging foundries to move manufacturing plants away from China. TrendForce anticipates a scenario in which two distinct production areas emerge. One consists mainly of Chinese fabs serving local demand, and the other consists of non-Chinese fabs serving other markets.