U.S. Treasury yields soar and Bitcoin stumbles amid debt ceiling, rate hike concerns

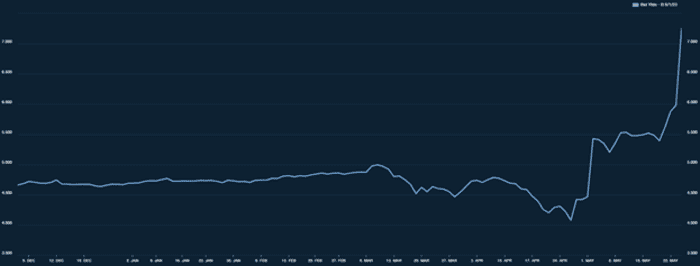

US Treasury yields rose notably this week, fueling market fears. There were notable gains on Wednesday and Thursday as debt ceiling concerns and rate hike speculation pushed yields to all-time highs.

In the early hours of Thursday, May 25, 12-month treasury bills yielded 5.18% and six-month treasury bills yielded 5.41%. Three-month yields reached 5.33%. 10-year Treasuries reached 3.76%, while 2-year bonds rose 7 basis points to 4.46%.

“Treasury Bonds” means U.S. government securities that represent the obligations of the U.S. government to borrow money to fund its business. Government bond yields are the return on investment that investors get from holding these securities. They are important benchmarks in financial markets and serve as key indicators of market sentiment, inflation expectations and overall economic conditions across the country.

Several factors contribute to the rate of return on government bond yields, but the most important is demand. When investors show higher demand, prices rise and yields fall as a result. Conversely, when demand weakens, prices fall and yields rise.

Additionally, market expectations regarding interest rates and inflation can have a significant impact on US Treasury yields. When investors anticipate rising interest rates and inflation, yields tend to rise, reflecting the increased risk associated with holding bonds.

The recent decline in demand for Treasuries can be attributed to two main factors: concerns over the debt ceiling and speculation that a rate hike is imminent.

As the US approaches its debt ceiling, uncertainty grows over whether the government will be able to meet its fiscal obligations. This uncertainty drives investors to demand higher yields to compensate for perceived risk. Moreover, the possibility of an interest rate hike introduced by the Federal Reserve is adding to market unease, as higher interest rates will affect the value of existing bond investments.

Market concerns about the debt ceiling become apparent when analyzing one-month Treasury bills. On Wednesday, May 24, the one-month interest rate due June 1 hit a multi-decade high of 7.226%. This shows investors are dumping short-maturity notes for fear of a possible technical default on June 1 if the debt ceiling negotiations fail.

A sharp rise in government bond yields has a significant impact on the financial markets as a whole. It increases borrowing costs, triggers higher interest rates on all types of borrowing, and restrains private consumption and business investment. Rising government bond yields can also create downward pressure on equity markets, as high yields on fixed income investments are relatively more attractive than stocks.

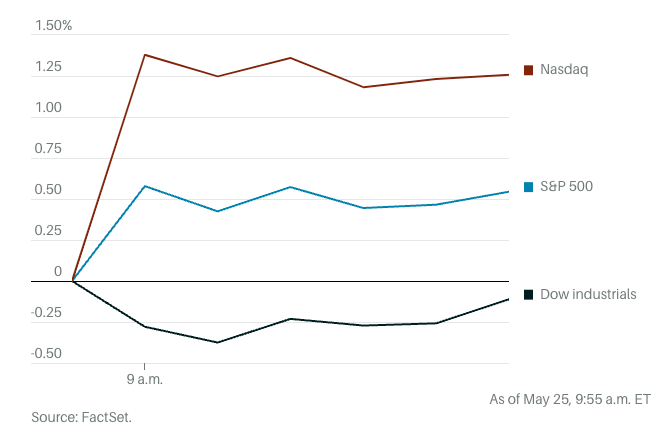

Equity market volatility has increased as investors weigh the economic health of the market amid debt ceiling negotiations. All three major US indices fell late Wednesday after Fitch Ratings put the US AAA long-term rating on negative watch. Dow Jones Industrial Average futures fell 86 points, or 0.3%, early Thursday. S&P 500 futures were up 0.6% and Nasdaq 100 futures were up 1.4%. However, the positive moves seen in the S&P 500 and Nasdaq 100 futures are likely due to exceptional circumstances. performance It came from Nvidia (NVDA), which led to a rise in tech stocks.

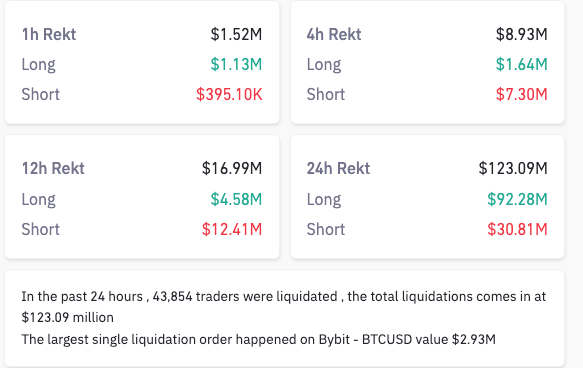

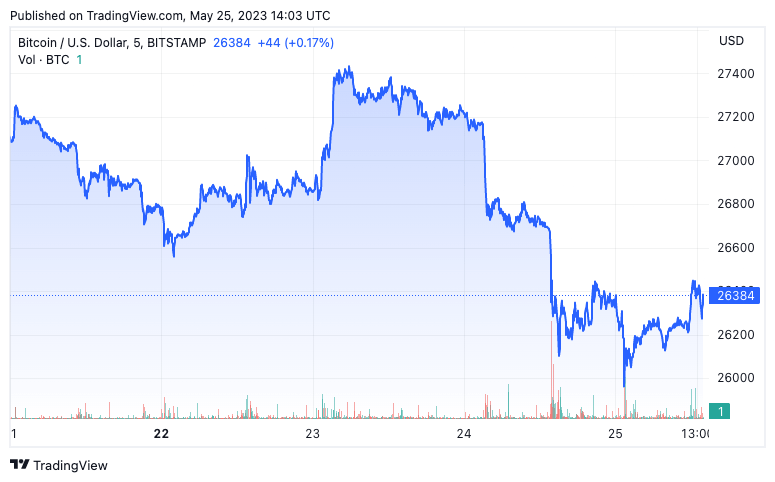

The cryptocurrency market is also affected by rising US Treasury yields. Bitcoin fell below $26,000, triggering a liquidation storm of $120 million, mostly long positions.

The surge in liquidations suggests an inverse relationship between government bond yields and BTC. When yields rise, investments typically turn away from riskier assets such as Bitcoin. And while institutional investors may be shifting their money to higher-profit bond investments, retail investors may be concerned about the price volatility that further rate hikes may bring.

Fears of a rate hike first appeared on CryptoSlate as US Treasury yields surged and Bitcoin stumbled amid the debt ceiling.