Cryptocurrency

UK yields skyrocket to levels echoing last year’s pension crisis

quick take

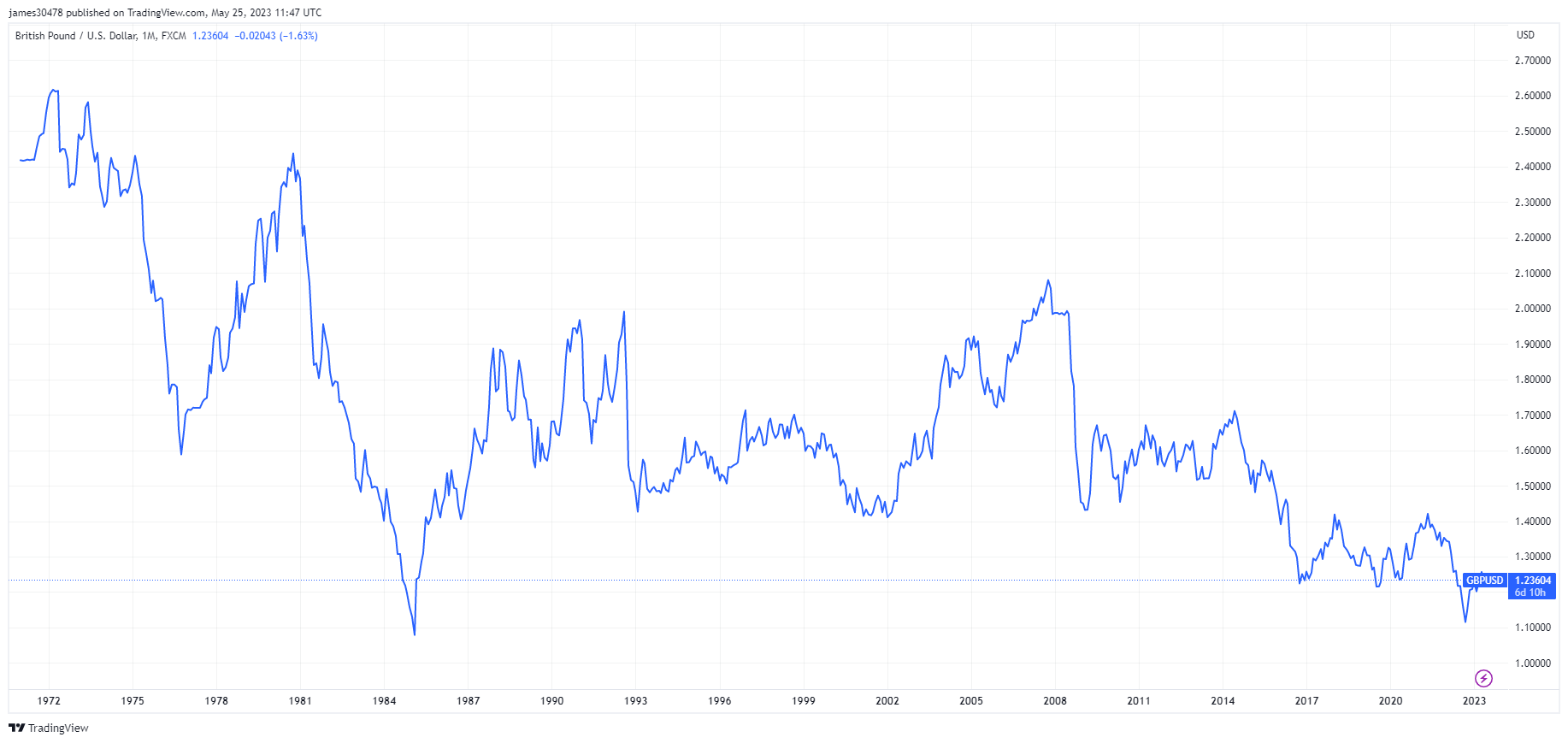

- In October last year, British Prime Minister Liz Truss introduced the following “mini-budget”: triggered Pension fund crisis. This mini-budget episode shocked the UK market, with the pound rising to 1.11 against the US dollar.

- In the wake of new inflation figures UK government yields rose further yesterday.

- Pension funds fell as yields spiked across the curve, especially at the long end (30 years).

- according to bloombergPension funds use leverage to balance assets and liabilities.

- Pension funds allocate so much to long-term, highly leveraged bonds that they need to post collateral to avoid being called on margin if bond prices fall.

- As gold (government bond) prices continued to fall, the threat of margin calls loomed, forcing pensioners to seek immediate financing.

UK yields surged to levels reflecting last year’s pension crisis, first published on CryptoSlate.